TradeLandFX Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MetaTrader4

- 2017

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MetaTrader4

- 2017

Our Evaluation of TradeLandFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TradeLandFX is a high-risk broker with the TU Overall Score of 2.41 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TradeLandFX clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. TradeLandFX ranks 369 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

TradeLandFX offers generally favorable trading conditions. It has many accounts to choose from, a wide pool of CFDs, high leverage, tight spreads, and no fees on most accounts. There are no withdrawal fees, and traders can use bank cards or e-wallets. Opportunities to open MAM accounts or use the copy trading service allow traders to receive passive income. Unfortunately, the broker does not have a regular referral program and you can trade only through MetaTrader 4.

Brief Look at TradeLandFX

The broker has been operating in the market for 10 years. It is registered in South Africa and is regulated by the Financial Services Conduct Authority (FSCA). It offers six account types, which range from Nano (cent) accounts to Pro accounts with a 0.2 spread and no trading fee. Among the trading instruments, TradeLandFX provides CFDs on currency pairs, cryptocurrencies, stocks, indices, metals, and commodities. The minimum deposit is $10 for cent accounts and $100 for Standard accounts. The maximum leverage is 1:1000. There are no restrictions on trading strategies, so you can use bots and advisors, scalp, hedge, trade news, and work on weekends. Trading is carried out through the MetaTrader 4 (MT4) trading platform. The broker has many services on its website, such as indicators, robots, and calculators. There are MAM accounts and its own copy trading service for passive income. There is no standard referral program, only a partnership program for businesses.

- You can start with $10, trading is carried out through classic MT4, and the interface of the website and user account is intuitive;

- More than 200 assets from 6 groups of trading instruments are available, also there is large leverage and low spreads, which range from 0.2 pips to 1.6 pips depending on the account type;

- There are no trading fees on all accounts, except for ECN (Electronic Communication Network) Pro and ECN VIP accounts. TradeLandFX does not charge withdrawal fees;

- 10 most popular channels are available for deposits and withdrawals, including MasterCard and VISA cards, Skrill, Perfect Money, Neteller, PayTrust88, and others;

- There are no regional or other restrictions for traders, users who are residents of any country worldwide can trade with TradeLandFX;

- MAM accounts are integrated with MetaTrader 4, you can connect any number of sub-accounts, and profits are distributed proportionally to the capital;

- The broker's technical support is multilingual, its managers are available 24/7 via phone, email, and live chat.

- Many traders are used to working with MetaTrader 5, NinjaTrader, cTrader, or other solutions, but TradeLandFX allows trading only through MT4;

- The broker does not implement a standard referral program for individuals, like most of its competitors;

- Withdrawal process sometimes takes up to several days.

TU Expert Advice

Financial expert and analyst at Traders Union

TradeLandFX is registered as a financial institution in South Africa and is regulated by FSCA with the confirmed license number FSP 51303. The company does not set regional restrictions; thus, users from all over the world can trade with it. Expert assessment and retrospective analysis showed that the broker fulfills its obligations to clients, it works transparently and provides timely reports to regulatory authorities.

TradeLandFX provides competitive trading conditions for CFDs. The pool has CFDs on currency pairs, cryptocurrencies, stocks, indices, precious metals, and commodities. The list is impressive, which allows traders to implement various trading strategies, and diversify risks due to the variety of their trading portfolio. Also, traders receive leverage up to 1:1000 and rather tight spreads, which depend on the account type. The minimum spread starts from 0.2 pips.

TradeLandFX offers six accounts, including a cent account, which is used to get to know the platform and test strategies. A cent account requires a deposit of at least $10. You need $100 minimum to open a Standard account. The minimum deposit is determined by the account, as are most trading parameters. In this sense, TradeLandFX has no conceptual differences from its competitors, although it surpasses them in a number of characteristics. For example, there are no trading fees on most accounts, and withdrawals through any channel are also free of charge.

Users work through MetaTrader 4. MAM accounts are also integrated with this trading platform. By the way, TradeLandFX’s multiple accounts are highly appreciated by experts, as traders can connect any number of subaccounts, and profit is automatically distributed in accordance with the deposited capital. Trade sizes are standard and start from 0.01 lots; also, there are no restrictions (for example, the use of advisors is allowed). The copy trading service is distinguished by flexible conditions, low fees, and simple functionality. Even if traders have never worked as signal providers or investors, they will understand how to do it within minutes.

TradeLandFX Summary

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Nano, Standard, ECN, ECN Pro, ECN VIP, and Pro VIP |

| 💰 Account currency: | USD and INR |

| 💵 Replenishment / Withdrawal: | Bank cards and e-wallets |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:1000, subject to the account type and the asset selected |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.2 pips |

| 🔧 Instruments: | CFDs on currencies, cryptocurrencies, stocks, indices, precious metals, and commodities |

| 💹 Margin Call / Stop Out: | Subject to the account type |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

six account types including cent account; integrated copy trading service; MAM accounts; tight spreads; no trading fees on most accounts; no restrictions on strategies; only MetaTrader 4 is available |

| 🎁 Contests and bonuses: | Yes |

The minimum deposit with brokers depends on the account type. For TradeLandFX, this rule also works. $10 is the minimum for cent accounts. To consider Standard accounts, traders need to deposit at least $100. Pro accounts require much more investment. The highest leverage is on cent accounts, the lowest (1:200) is on ECN Pro accounts. Note that leverage is also determined by the asset you are trading. Currency pairs always have the highest leverage. Finally, the broker's technical support is a conceptually important point that clearly demonstrates the quality of service and client-oriented approach. TradeLandFX has these parameters at their best, because technical support is available 24/7.

TradeLandFX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start trading with this broker, register on its official website, verify (confirm) your personal information, select an account type, and make a deposit. Below is a step-by-step registration guide.

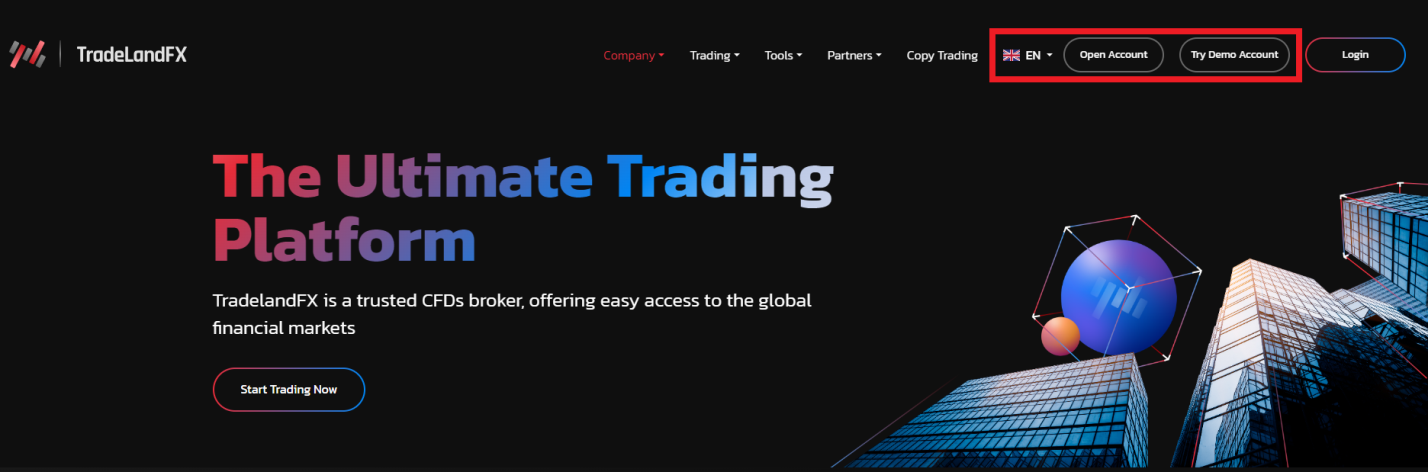

Go to the TradeLandFX official website. Select the interface language in the upper right corner. Click the "Open Account" or "Try Demo Account" button. In this guide, TU will show how to open a live account.

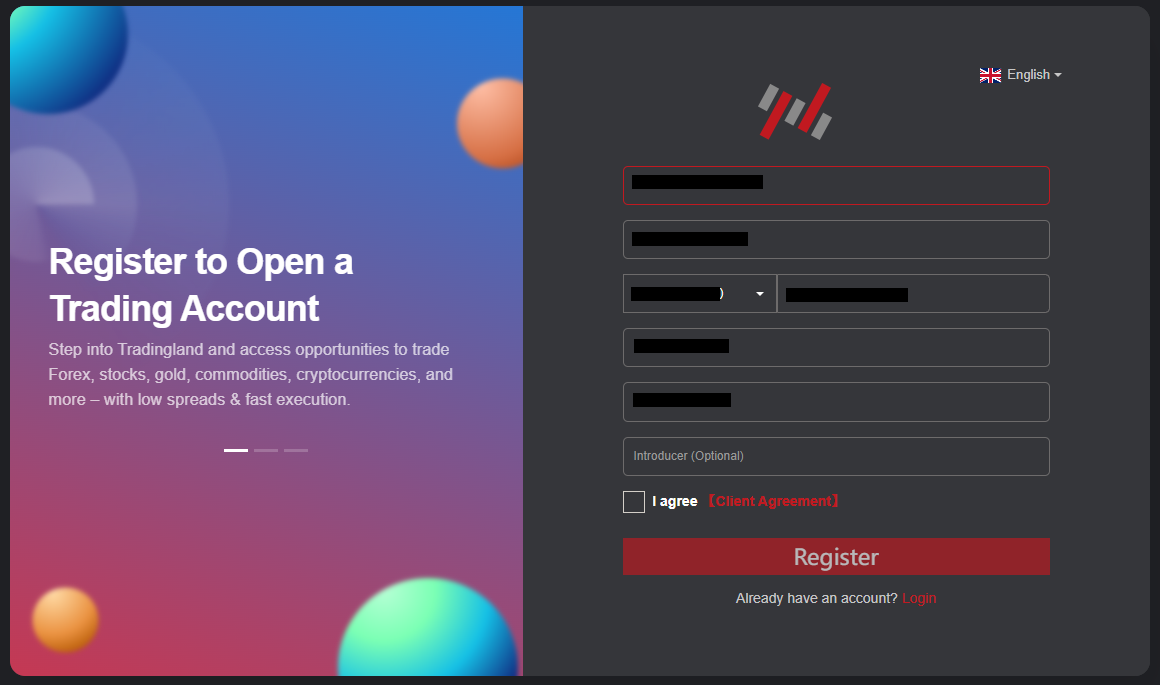

Enter your email address, name, country of residence, and phone number. Make a password and confirm it. Agree to the terms of service by ticking the appropriate box. Click the "Register" button.

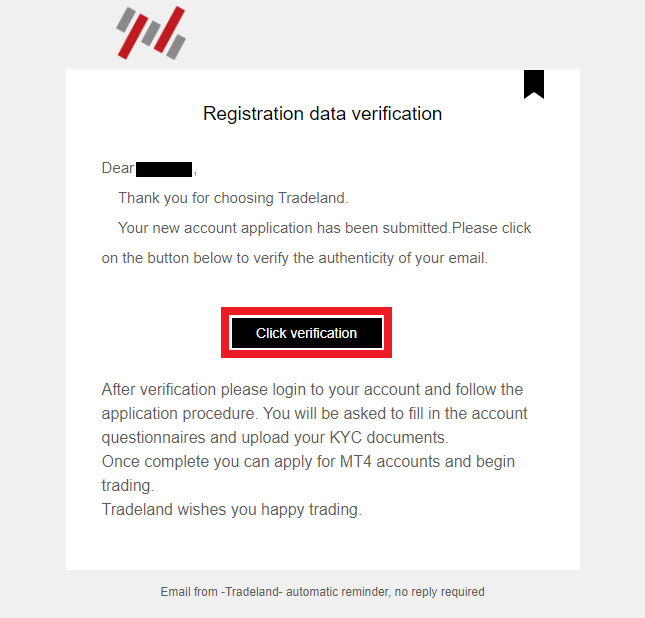

Wait a few seconds until a pop-up message appears on the screen informing you that an email has been sent to the specified address to activate your user account. Go to your mailbox, open the email, and click the "Click verification" button.

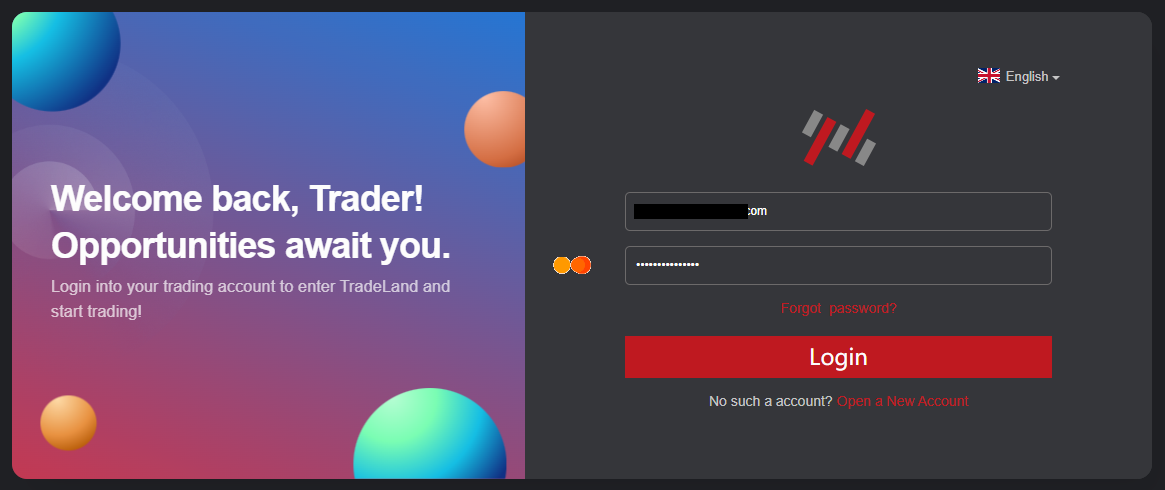

You will automatically return to the registration screen and see a message stating that the user account activation was successful. Enter your registration information (email and password), then click the "Login" button.

After authorization, you will be logged into your user account. The system will prompt you to open your first trading account. Specify the account type and the leverage will be determined automatically. Click the “Submit" button. A confirmation code will be sent to your email. Enter it in the appropriate field and click the "Confirm" button.

Go to the "My Profile" section. Next, go to the "Banking Information" and "Personal Identification" sections. Complete the information in both sections by following the on-screen instructions. You will also need to provide scans or photos of your ID documents, as this is a legal requirement.

Go to the “Deposit/Withdrawal” section. Select the "Online Deposit", "Bank Transfer", or "Funds Transfer" subsection, depending on which deposit channel is more convenient for you. Enter the required details and follow the instructions on the screen to replenish your balance. After the successful completion of the operation, you can download MT4 and start trading.

Services of TradeLandFX’s user account:

My profile. Here traders enter and change personal data, banking information, and account security settings;

Client area. This section provides information on active accounts and on the partnership program;

Signals. This section offers three subsections, namely Broker’s signals, Provider’s signals, and Trader’s signals (if traders are providers themselves);

History. This is an archive that stores information on all transactions, including deposits, withdrawals, and internal transfers;

Report Center. This section allows traders to generate a report of the selected type, for example, on closed positions;

Deposit/Withdrawal. Here requests for depositing and withdrawing traders’ funds are processed;

Download MT4. This section contains a link that allows traders to get the official distributive of MetaTrader 4.

Regulation and safety

Traders can get confirmation of brokers’ reliability only by checking their licenses from regulators. Note that the official registration of a financial organization is not the same as regulation by an official financial regulatory body. It is prescribed by the law that all legitimate brokers must be registered. To submit to the control and conditions of a specialized organization that checks the broker for compliance with its declared parameters and with its own rules is voluntary. TradeLandFX is regulated by the Financial Services Conduct Authority (FSCA), so traders receive security guarantees.

Advantages

- Traders can contact the broker’s technical support

- The broker’s clients can apply to FSCA

Disadvantages

- Clients cannot address the regulatory authorities at the place of their residence or registration

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Nano | $1.6 | No |

| Standard | $1.6 | No |

| ECN | $1.2 | No |

| ECN Pro | $0.2 | No |

| ECN VIP | $0.2 | No |

| Pro VIP | $0.2 | No |

Trading fees are indicated for a full lot. For ECN Pro accounts, the fee is $6 and for ECN VIP it is $4. The minimum trade size for a trader is 0.01 lots. Accordingly, the fees for these accounts are low, but more importantly, they are lower than those of many of this broker’s competitors. To help you visualize this, the comparative table below shows the average fees for TradeLandFX and two other well-known brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$1.2 | |

|

$1 | |

|

$8.5 |

Account types

In most cases, the first thing a trader does after getting acquainted with the trading conditions of the platform is to choose the account type. TradeLandFX offers quite an extensive choice. There are six options that differ in available assets. They are leverage, spread, trading fees, and stop-out levels. Obviously, a cent account is designed to evaluate the possibilities of the platform and for training (it is similar to a demo account). Standard accounts are the most universal. ECN accounts — ECN, ECN Pro, and ECN VIP — differ in that each subsequent one offers an expanded list of features and more flexible conditions that only experienced market participants can use with the greatest potential. Finally, the Pro VIP account is designed for ambitious traders.

Account types and trading conditions:

Regardless of the account type, the hedge margin is 0. All accounts are connected to MetaTrader 4. Technical support works equally for each account type.

Deposit and Withdrawal

-

Traders make profit when they choose one of the six account types and start trading successfully;

-

All traders’ profits are accumulated on their accounts, access to which is possible through MetaTrader 4 or the user account on the broker's website;

-

Traders can at any time submit a withdrawal request by sending it to technical support through the user account;

-

Available withdrawal channels are bank cards, Perfect Money, PayTrust88, Neteller, and Skrill;

-

You can withdraw funds in USD or INR. If the card or e-wallet does not support these currencies, an automatic conversion will be performed;

-

Usually, withdrawal applications are processed within 1-2 days, but in some cases, this period may increase due to delays in clearing.

Investment Options

Some brokers offer investment programs like cryptocurrency staking or buying dividend stocks. But most of them focus on active trading, as users come mainly for this. TradeLandFX provides such investment options as the copy trading service and joint accounts.

MAM accounts are smart solutions for investors

This is a multi-currency account, which is managed by an experienced trader. Such traders have their own accounts, and they can connect other users to themselves as subaccounts. Managers fully control only their own assets, and not the funds on subaccounts. Subaccounts copy trades from managers’ accounts, but not in full. The ratio is determined by investors. For example, a manager bets $1,000. Investors on subaccounts do not have to invest the same amount, they can invest, for example, $100. If the trade is unprofitable, a manager and owners of subaccounts lose their bets. If the trade is profitable, the income is distributed in proportion to the contribution and a manager charges a small fee from investors.

Copy trading is a simple investment with high potential

The copy trading service allows traders to register as signal providers or investors. Signal providers trade at their own pace, without being distracted by anything. Investors can connect to providers and automatically copy their trades to their own accounts. The difference from MAM accounts is that signal providers have no connection with investors, they do not interact directly, and subaccounts are not connected to providers’ accounts. Investors can copy trades in full or in part, for example, they can specify a different amount. In case of nonprofitable trades, all participants lose their funds, and in case of success, everyone receives profit from their own trade. As for MAM accounts, there is the signal provider reward system in the form of a small fee, which is known in advance and is automatically deducted from traders.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program for businesses from TradeLandFX

If you own an exchange-related company, you can use TradeLandFX's ready-made solutions. The broker offers a streamlined, fully operational infrastructure that allows it to bring your clients' transactions to the interbank market on favorable conditions. All levels from integration with MT4 to a selection of marketing materials for advertising are presented. Fees are transparent and are paid based on CPA (Cost Per Acquisition) and Revenue Share. Traders get dedicated managers, flexible payouts, and low fees. This program is unlikely to be of interest to ordinary users, but representatives of small and medium-sized businesses often work with TradeLandFX to increase their profits.

Customer support

A broker's technical support is an important element of its infrastructure and should provide high-quality and prompt service. All traders sometimes face situations that they cannot resolve on their own. Client support is designed to help them, which is why it is important that users can get qualified advice at any time. This is a powerful competitive advantage. TradeLandFX’s technical support is available 24/7 via phone, email, and live chat.

Advantages

- Non-clients of the broker can contact technical support

- Call center and live chat are available at any time and are prompt

- You can ask for advice or help from experts even at night

Disadvantages

- Email is not as fast as other communication channels

If you want to work with TradeLandFX or are already its client, and you have a question that requires competent assistance, you can contact its technical support in the following ways:

-

multichannel call center;

-

email;

-

live chat on the website and in the user account.

TradeLandFX has its official profiles on such social platforms as Facebook, Instagram, Twitter, TikTok, and LinkedIn. It is worth subscribing to them to stay up-to-date with the latest news of the company.

Contacts

| Foundation date | 2017 |

|---|---|

| Registration address | Griffith Corporate Center 305 |

| Official site | https://www.tradelandfx.com/ |

| Contacts |

+173283526

|

Education

Traders cannot be successful if they do not progress. Progress includes regular trading and communication with colleagues. It is necessary to constantly explore new areas, work with different assets, study best practices and alternative methods, and adapt to the market. TradeLandFX helps its clients by providing a wide range of educational materials, which are presented by guides and universal programs. Also, there is a newsfeed in the "Tools" section. All this allows traders to constantly learn something new because the broker regularly adds new materials.

In general, educational materials of the broker are universal, they will suit traders of various levels. Even professionals will find a lot of useful information there. Experts rate TradeLandFX education programs with a high score.

Comparison of TradeLandFX with other Brokers

| TradeLandFX | RoboForex | Pocket Option | Exness | FxGlory | 4XC | |

| Trading platform |

MetaTrader4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 | MT5, MT4, WebTrader |

| Min deposit | $10 | $10 | $5 | $10 | $1 | $50 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | 8.00% | No |

| Spread | From 0.2 points | From 0 points | From 1.2 point | From 1 point | From 2 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 20% / 10% | 100% / 50% |

| Execution of orders | No | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Instant Execution, Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of TradeLandFX

TradeLandFX has been in the market for a long time and has established itself as a reliable partner. Thousands of traders globally, who are attracted by favorable conditions, work with the company. First, traders have a large number of CFDs, the ability to choose one of six accounts, impressive leverage, and low fees. All these advantages are sure to attract the attention of novice traders. Professionals also evaluate brokers by integrated services and technical indicators. TradeLandFX offers MAM accounts and its own copy trading platform. The execution takes place within 0.02 seconds, which is one of the highest rates in the segment.

TradeLandFX by the numbers:

-

The minimum deposit is $10;

-

The maximum leverage is 1:1000;

-

Over 200 assets;

-

The minimum spread is 0.2 pips;

-

Fees for the traded lot are $4 and $6.

TradeLandFX is a convenient broker for working with CFDs

CFDs are very popular and have a lot of potential. TradeLandFX offers only CFDs, but on different assets. The broker’s pool includes currency pairs, cryptocurrencies, stocks, indices, commodities, and precious metals. The list is regularly updated in response to the wishes of traders. A large choice is an advantage in any case. The diversity of assets allows traders to use the widest possible range of strategies without limiting themselves. Also, hundreds of instruments provide excellent risk diversification through a balanced portfolio, which can include CFDs on currencies, cryptocurrencies, indices, and etc. Given the favorable fee policy and other advantages of the platform, it allows you to work with CFDs at the most comfortable level.

Useful services offered by TradeLandFX:

-

Indicators. The broker offers a set of indicators for MetaTrader 4. These tools enhance faster and more accurate technical analysis of charts;

-

Calculator and converter. To facilitate routine tasks and automatically calculate objectives, TradeLandFX provides a profit and margin calculator, as well as a currency converter;

-

Robots. The broker's own robots perform quite well in trading, regardless of the strategy chosen by a trader. However, these are not individualized solutions.

Advantages:

Low entry threshold, intuitive interface, and classic trading platform;

Fast registration and verification, also there are transparent requirements and conditions;

Traders choose from six account types in accordance with their goals;

Extensive pool of CFDs and high leverage;

MAM accounts and copy trading for passive income;

The platform is proven and reliable, and it has a valid license;

Technical support works 24/7.

User Satisfaction