Review of FxPro Direct

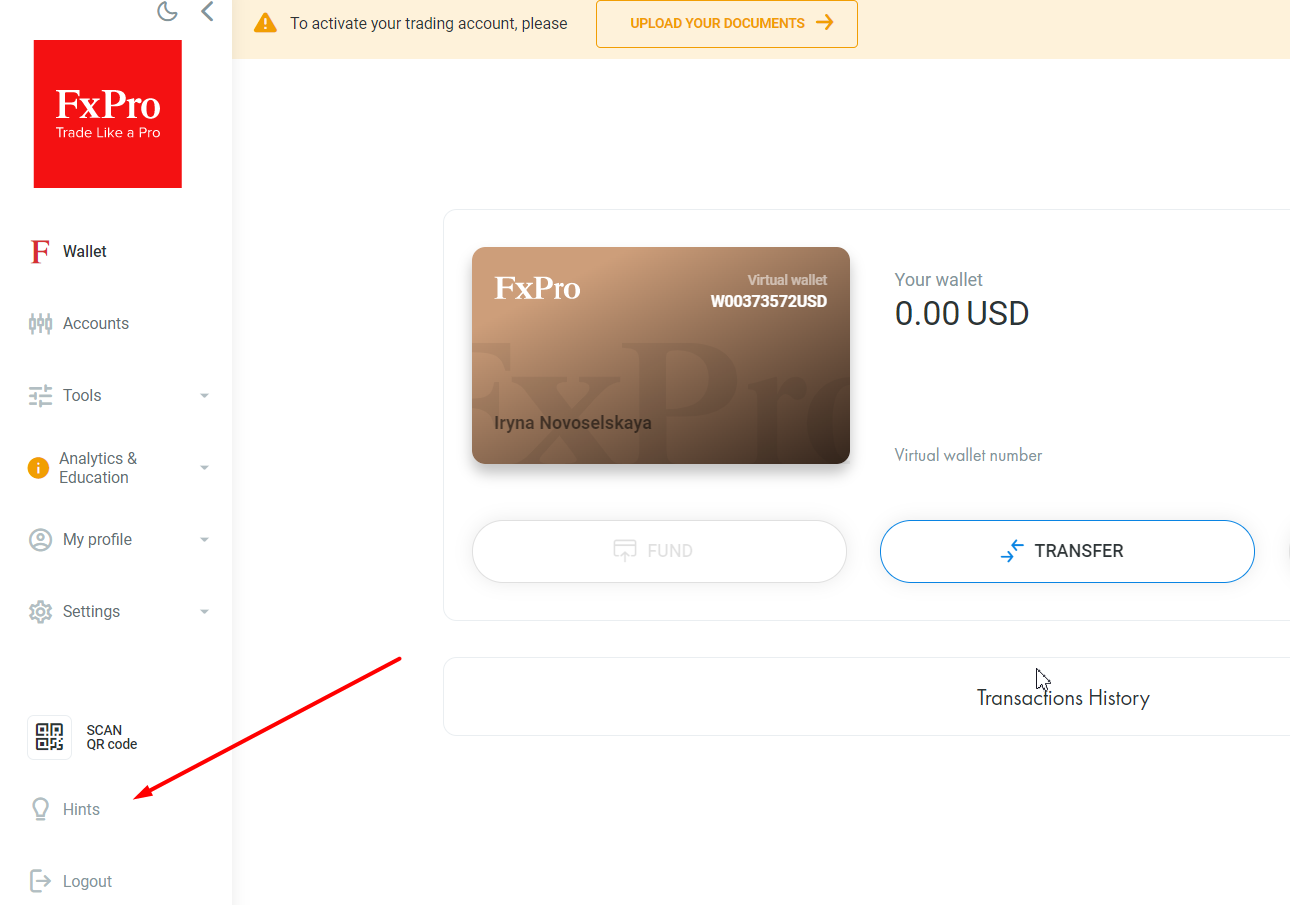

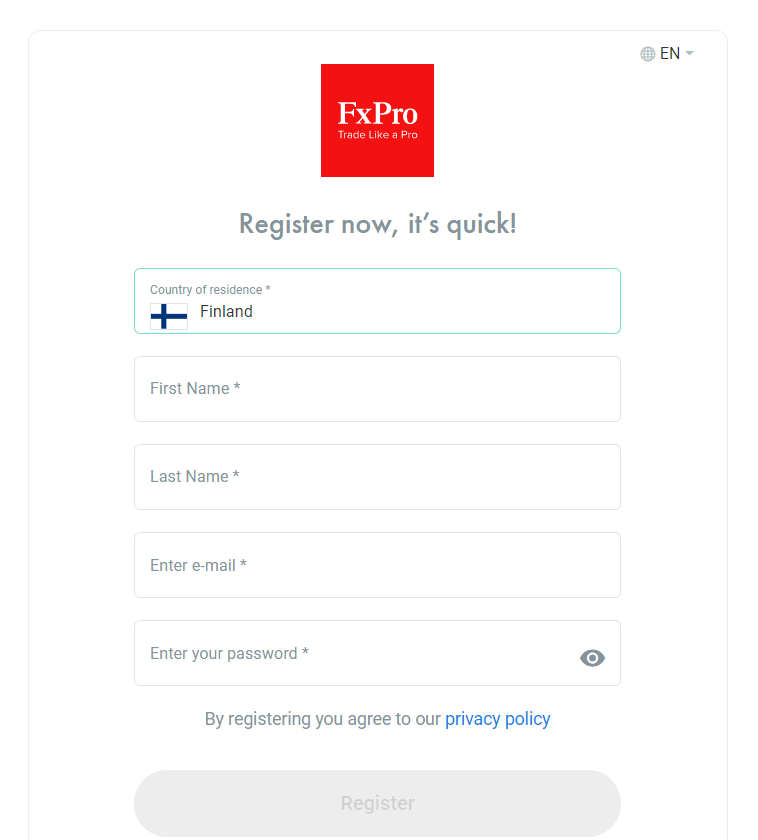

After registration, your FxPro Direct will open. It is easy to use and has a minimum of required features.

Photo: FxPro Direct – Review of features

The menu can be provisionally divided into three parts:

1

Main menu with the sections of all available features.

2

Data display window with information on the menu’s tabs. The link to verification is above it. You can pass verification also by going to account settings.

3

Quick help. Feedback, live chat and call.

Let’s review the features of the main menu in more detail.

FxPro Direct Features

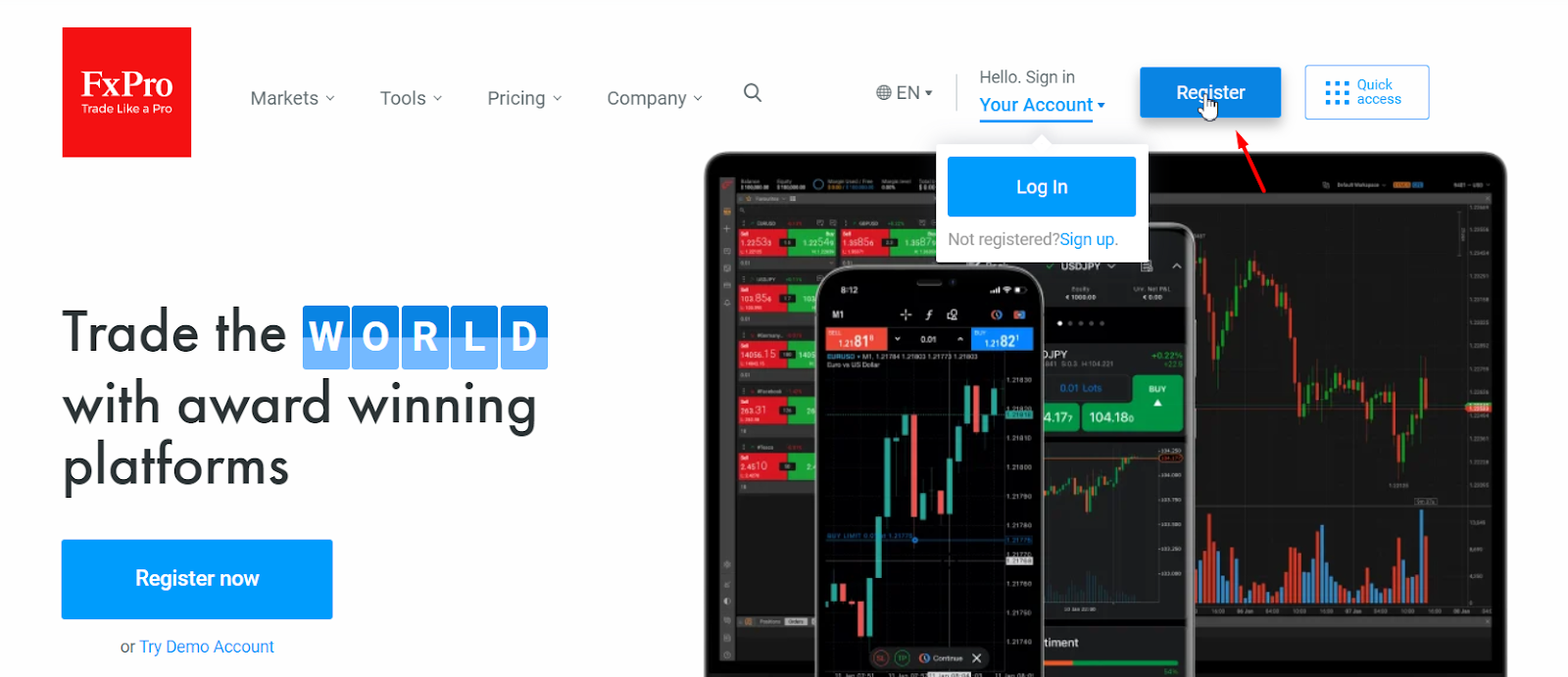

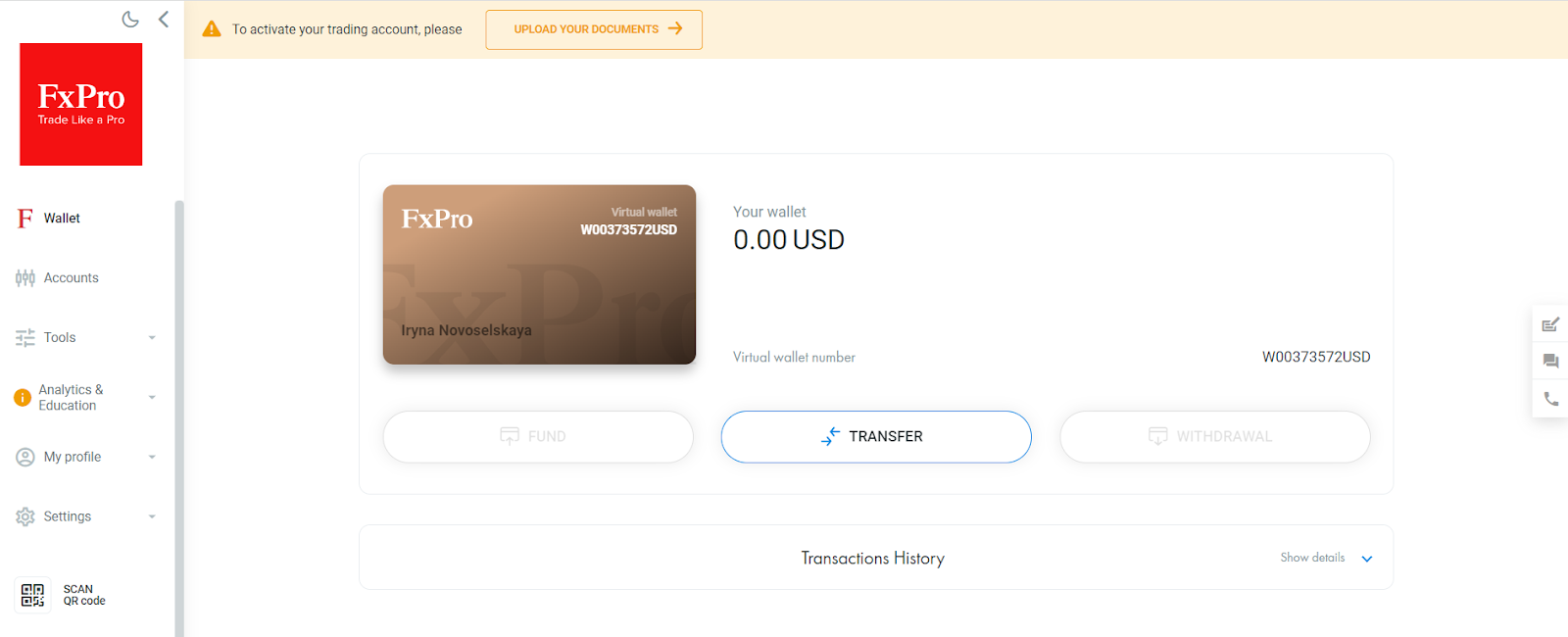

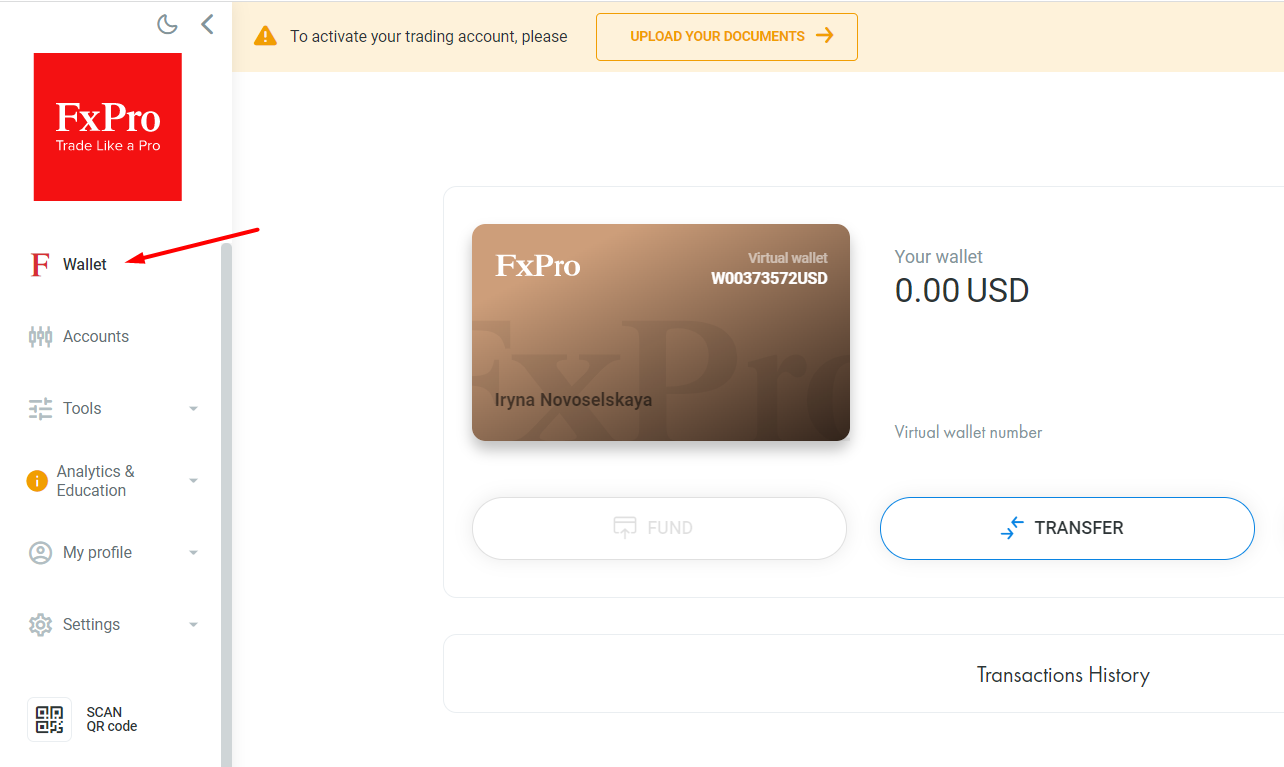

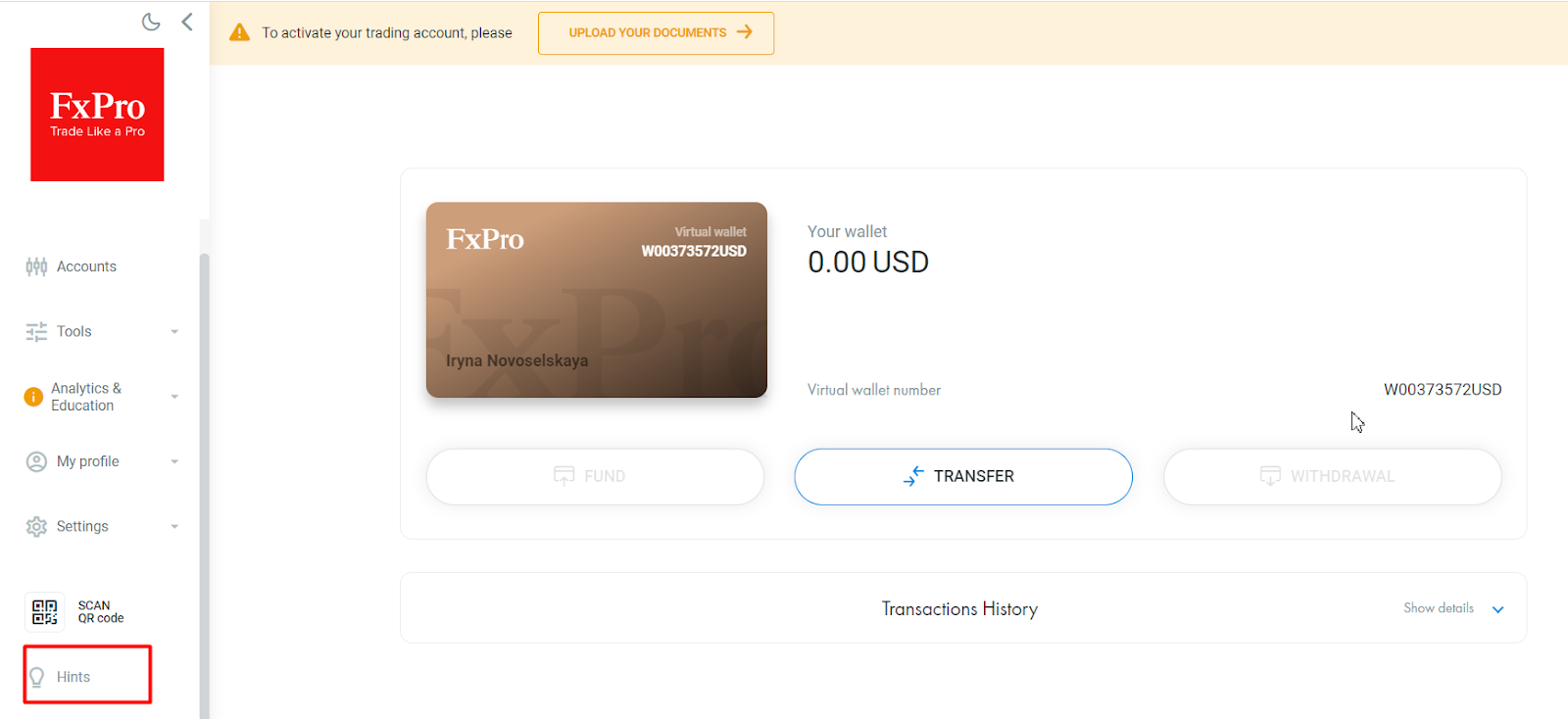

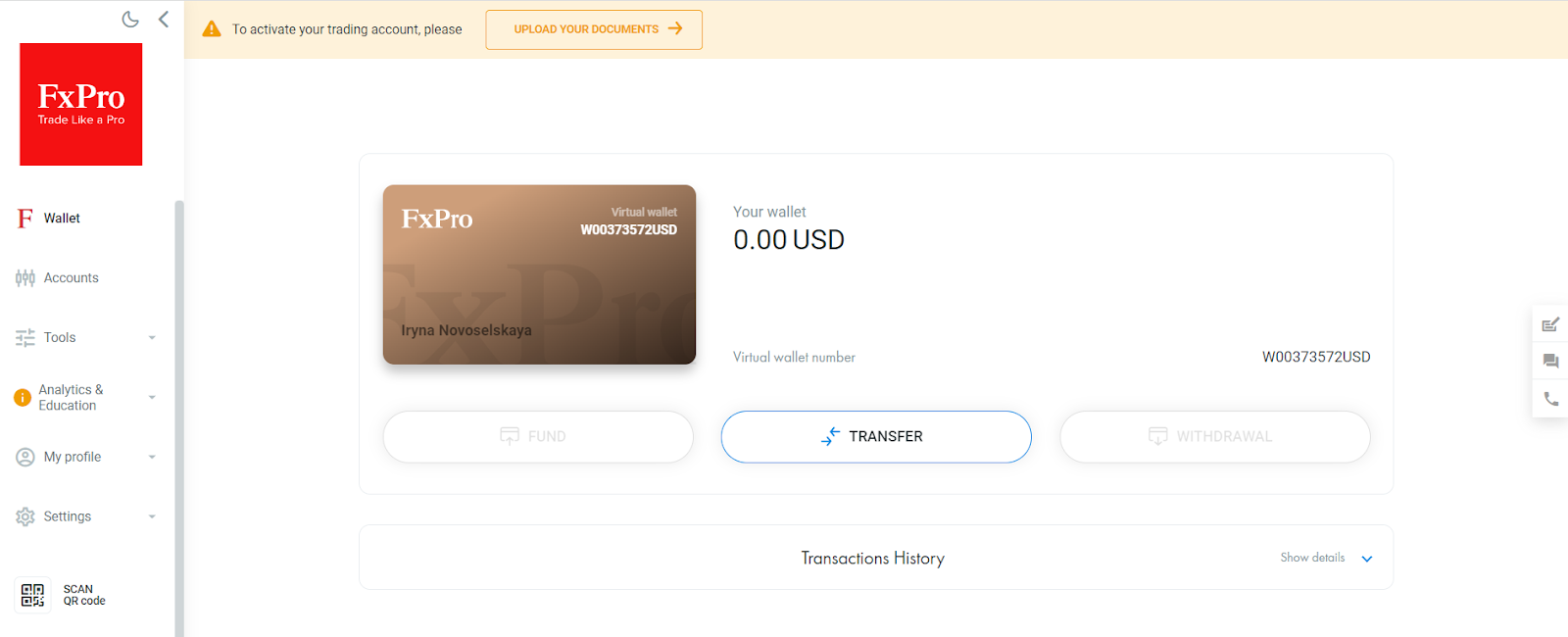

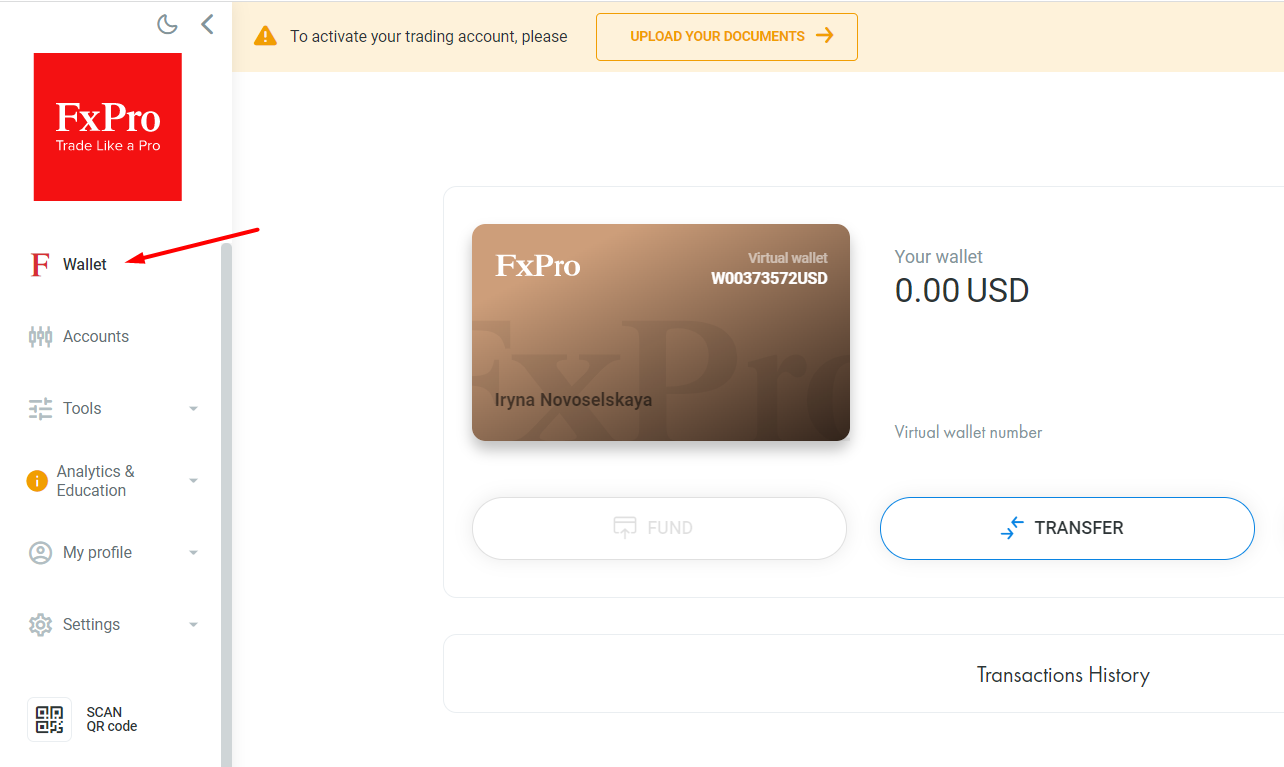

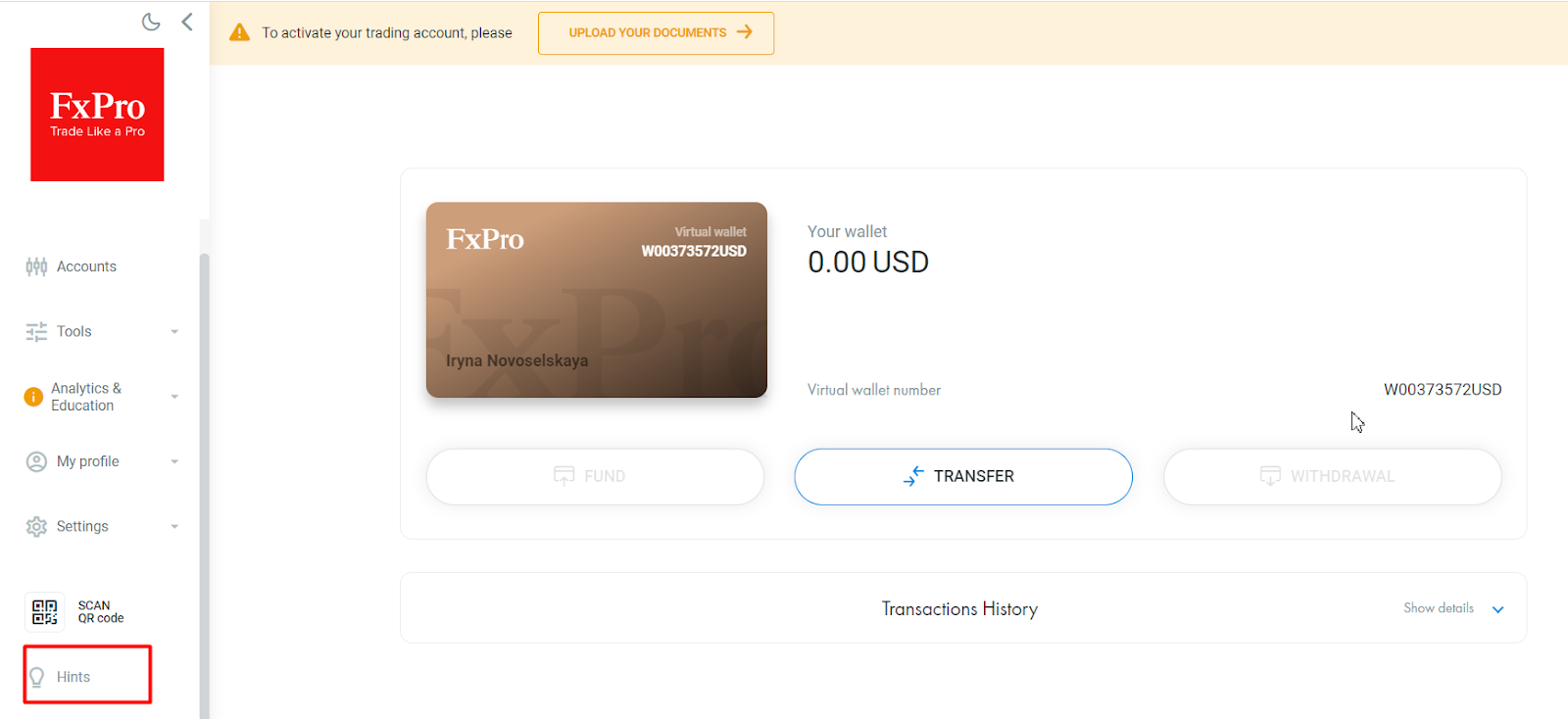

Wallet.

Photo: Review of FxPro Direct features – Wallet

Virtual wallet is the account you deposit money to and withdraw money from, but it is not linked to any trading platform. The algorithm of work is as follows:

Make a deposit to the account of the virtual wallet. The Deposit button. You can also deposit funds to the real account directly in the Accounts tab.

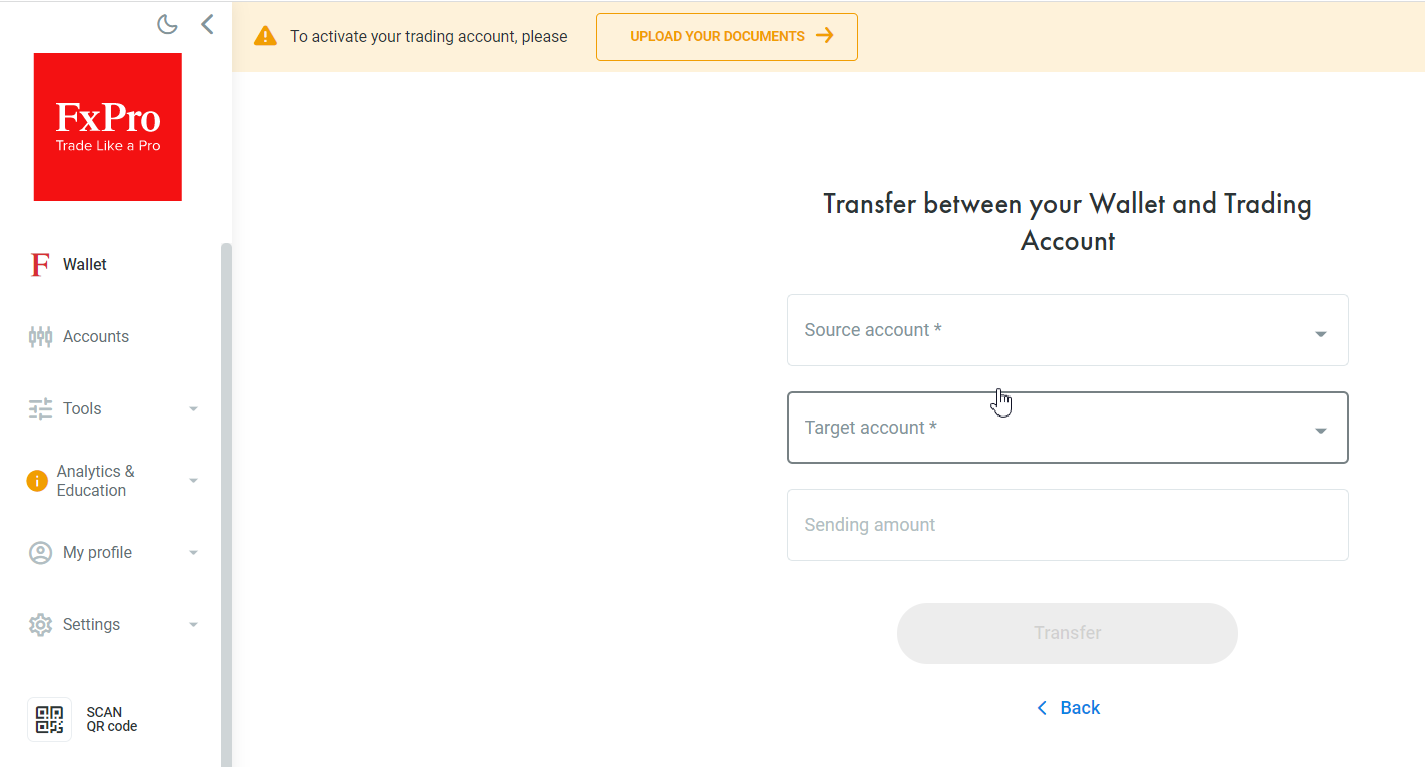

Transfer any amount to open real trading accounts. The Transfer button.

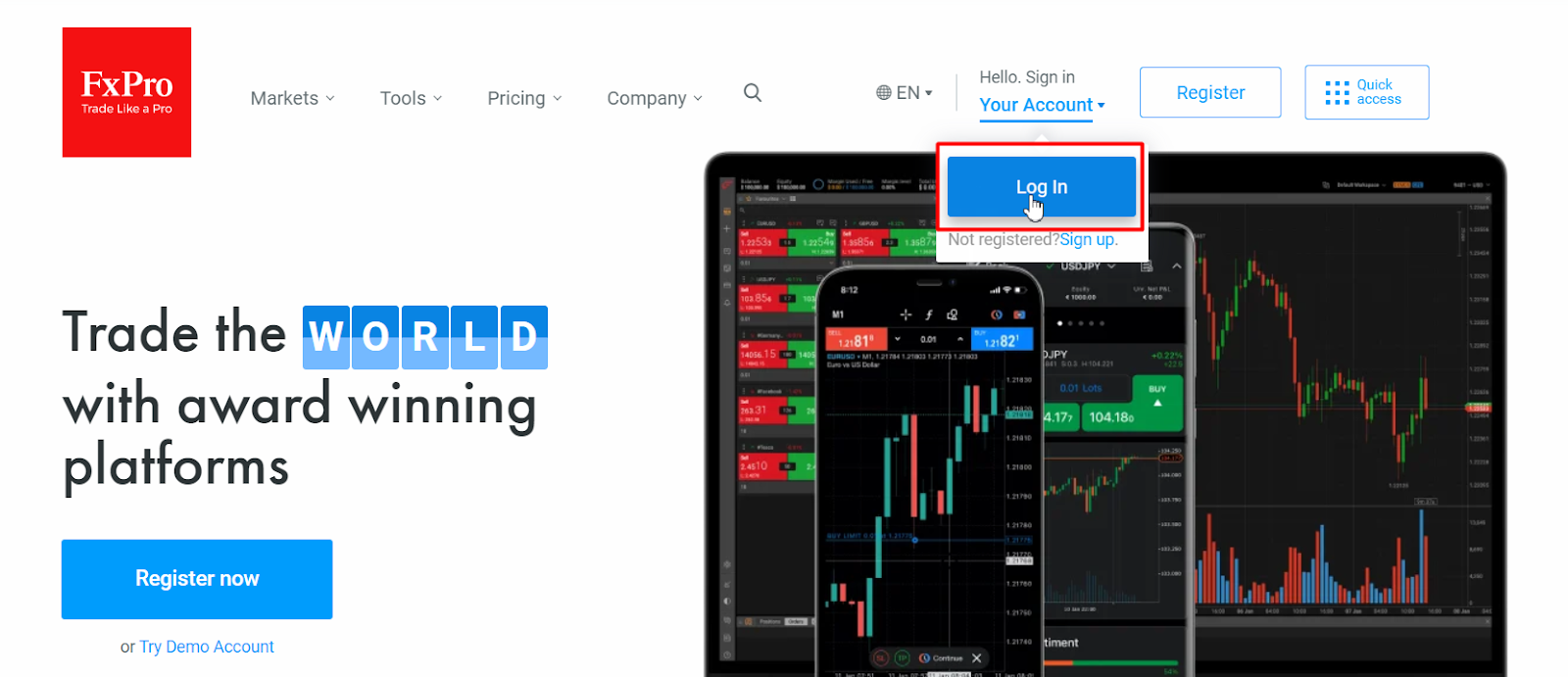

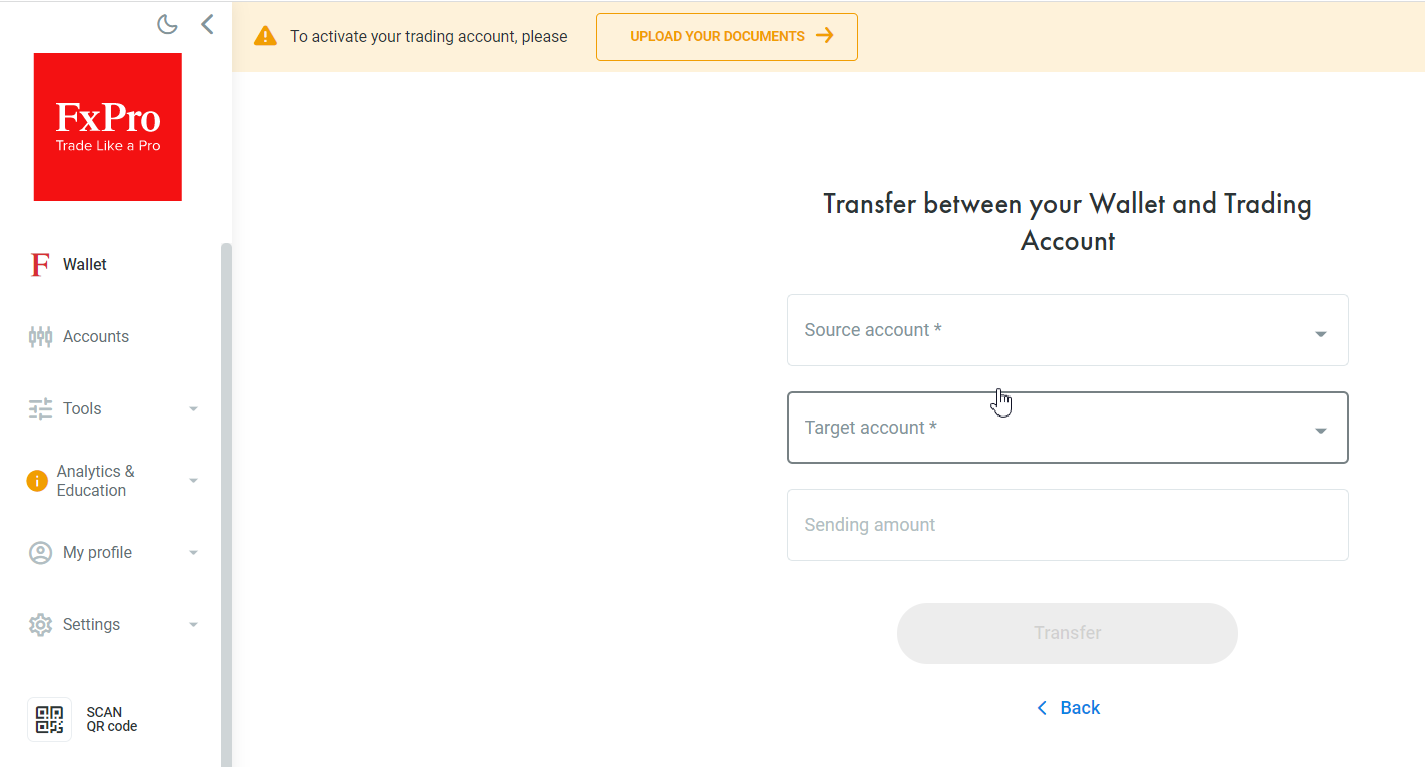

Photo: Review of FxPro Direct features – transfers between accounts

Open and close trades. If there is a Stop-Out on one of the accounts, you will keep the money on other accounts and the wallet.

If you want to transfer money from one account to another, you can use the wallet as a transit account.

Withdraw money from the wallet. The Withdraw button.

The history of transactions between the wallet and accounts is shown in the data display window.

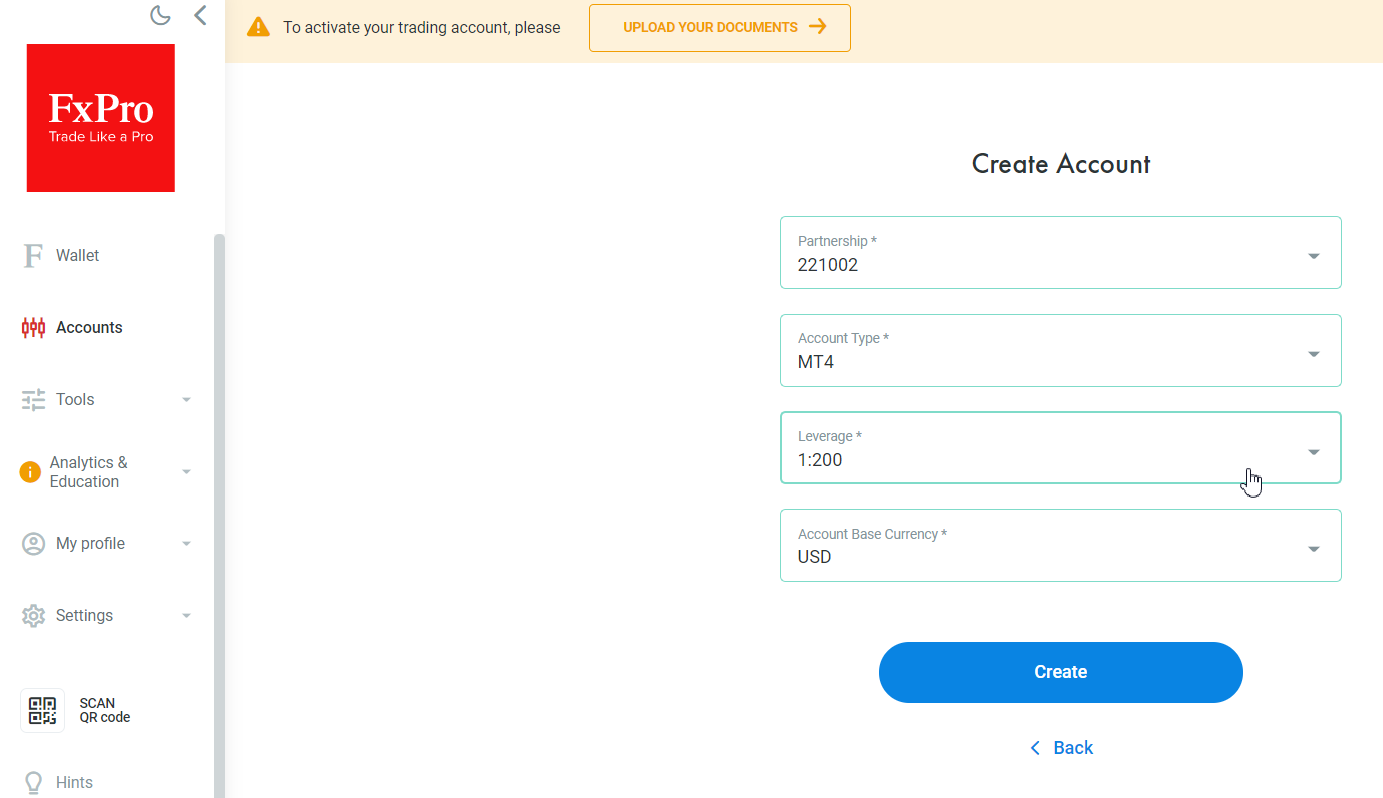

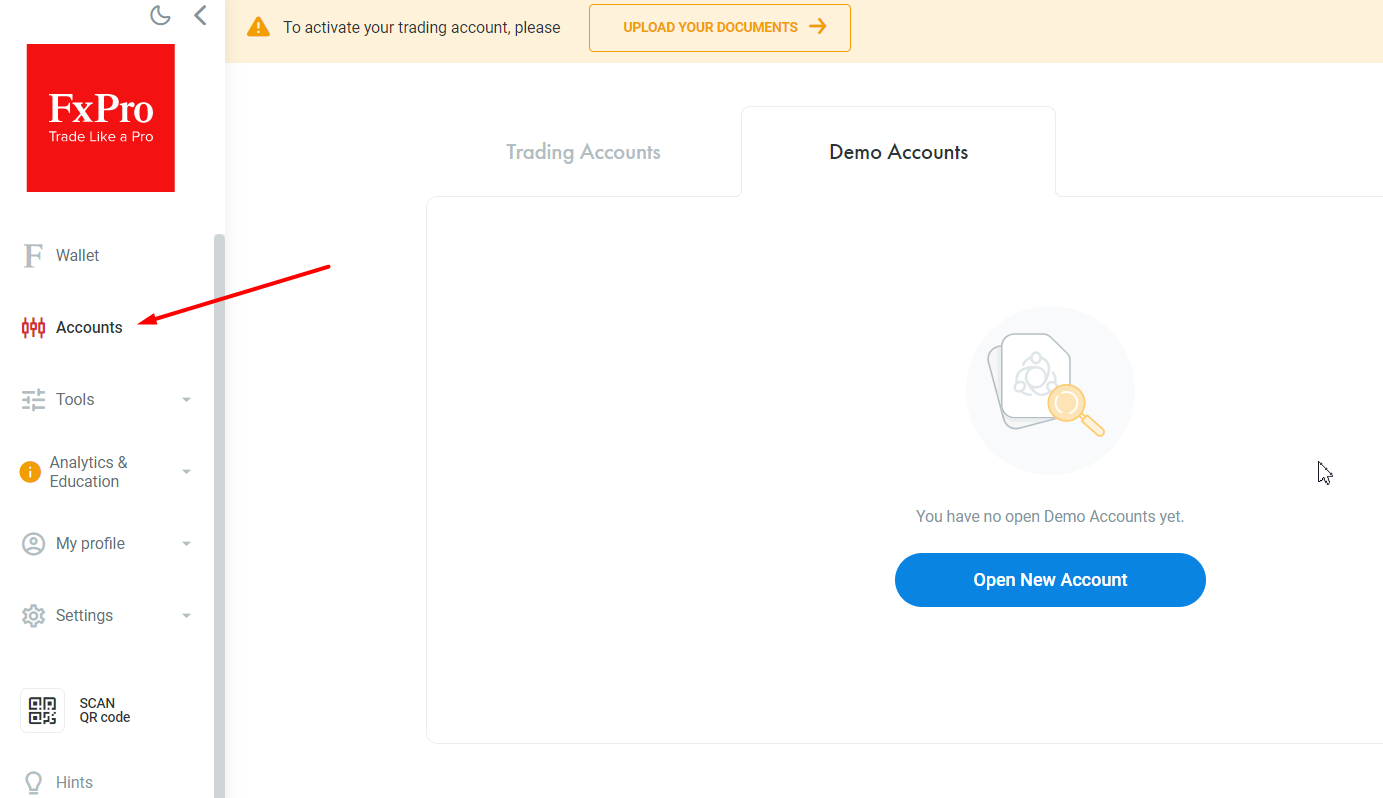

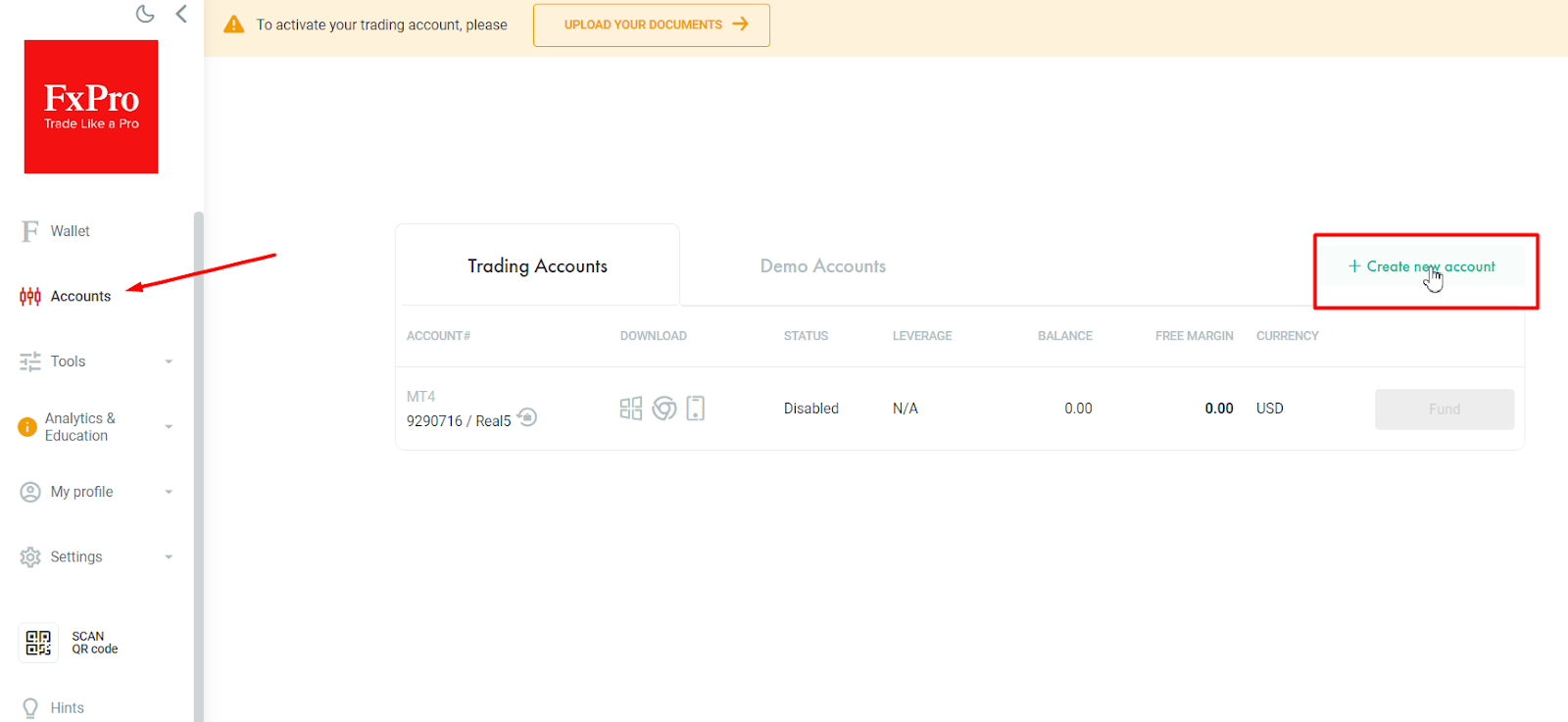

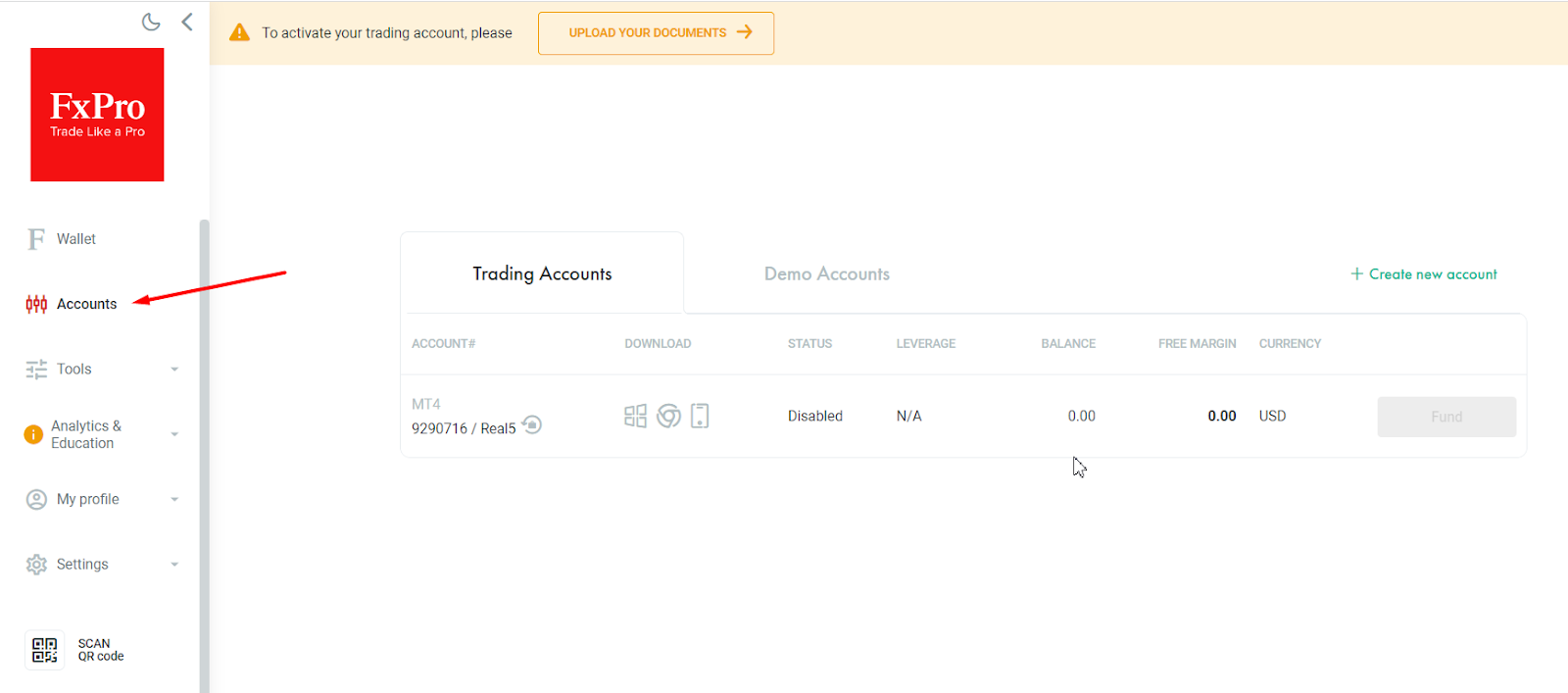

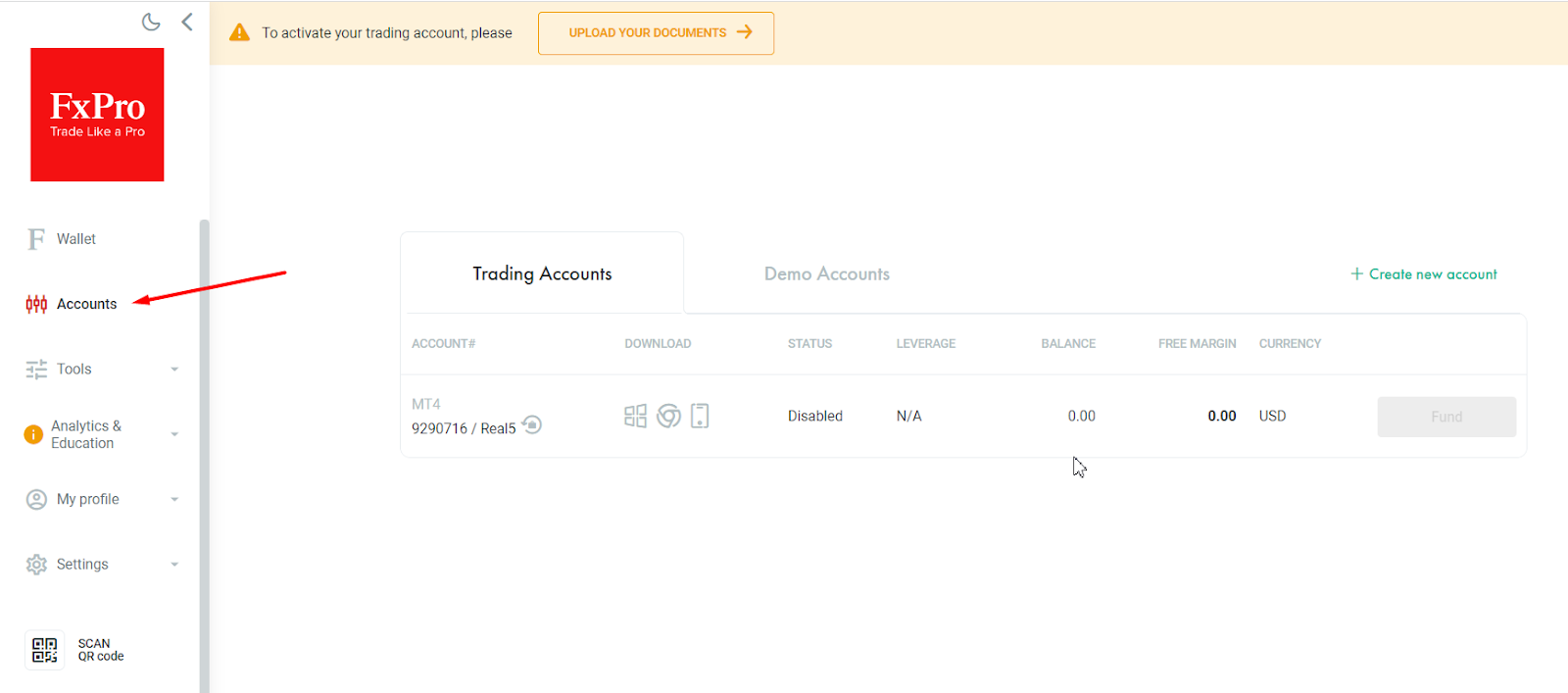

Accounts

This is the tab, where you can manage your accounts. Here, you can open and close real and demo accounts, view statistics, etc.

Additional features:

Changing the password to a specific account.

Installation files for the trading platform based on the account type (versions for desktop, browser, mobile). The screen below shows the accounts opened for the MT4 platform.

Changing leverage for a specific account.

Photo: Review of FxPro Direct features – Accounts

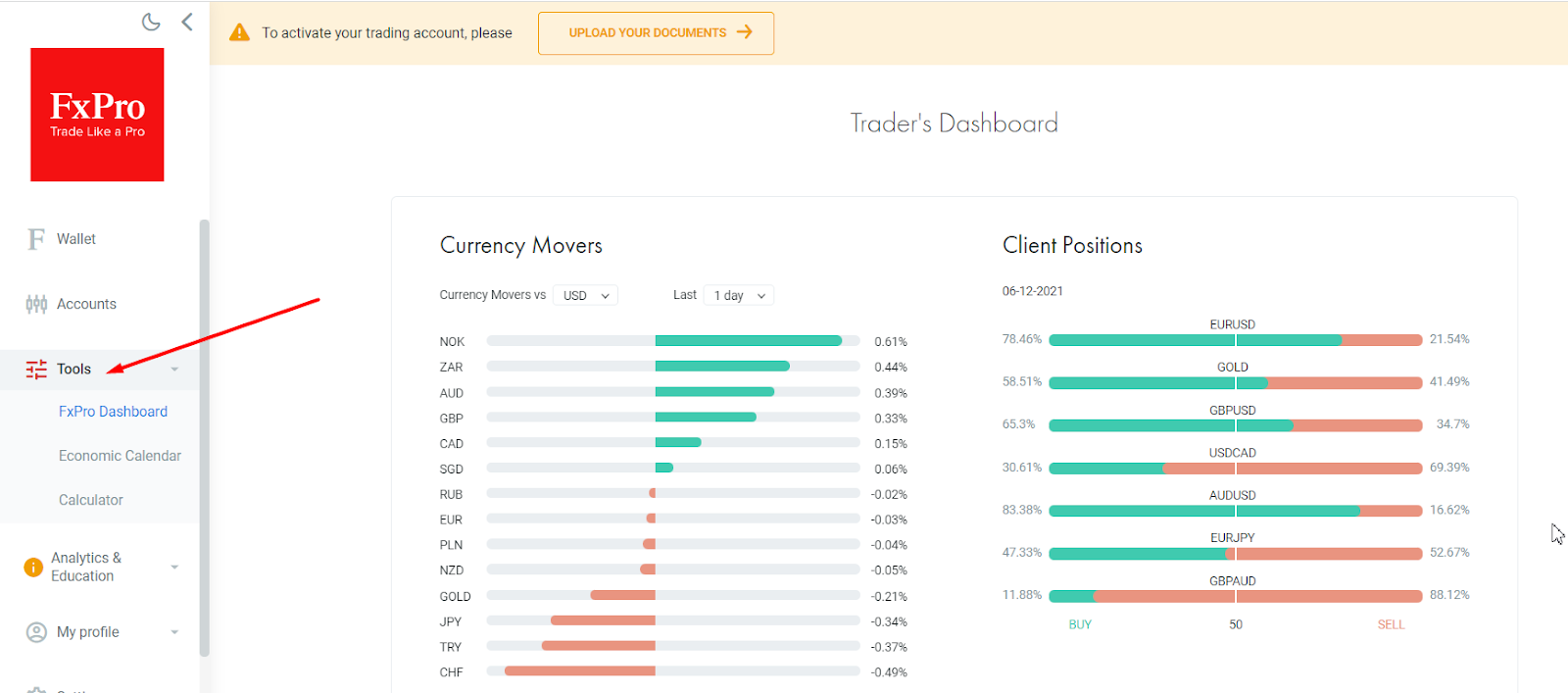

Instruments.

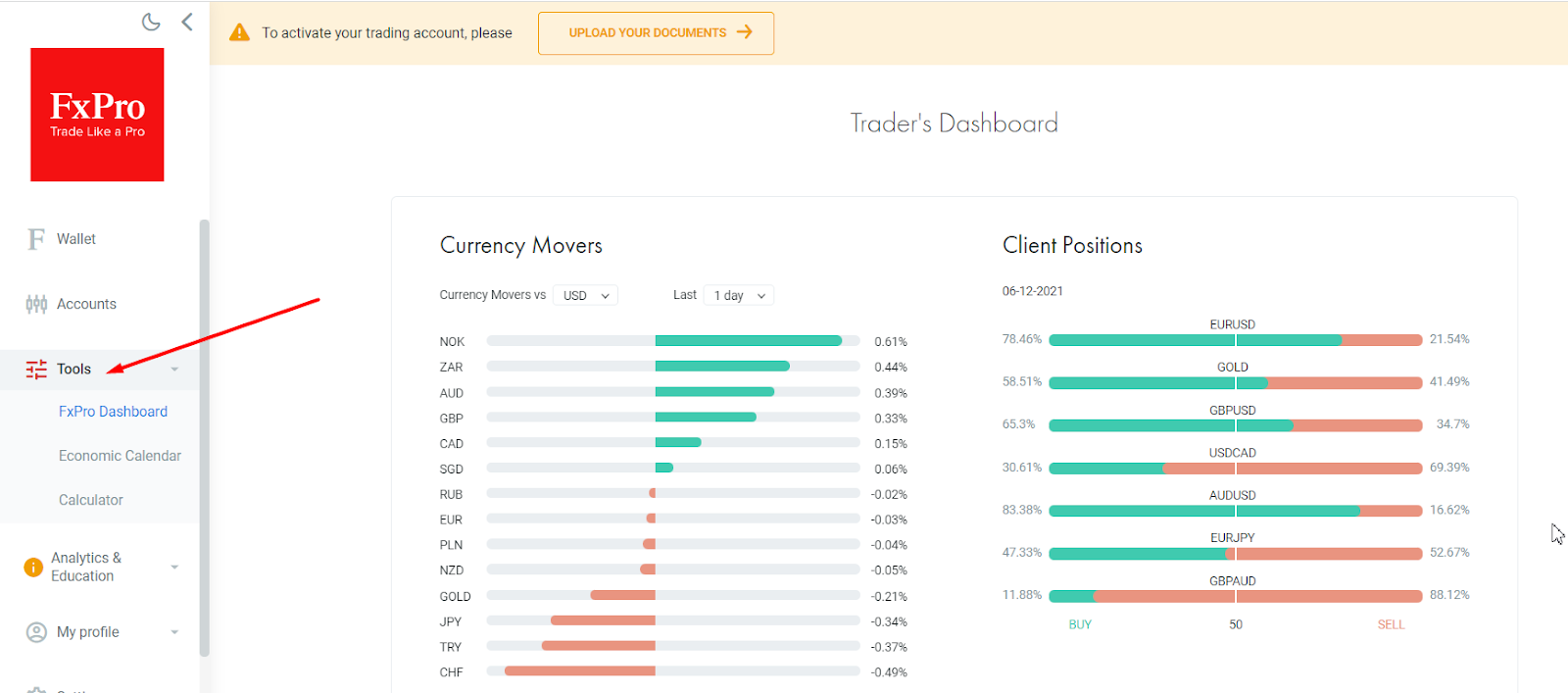

Trader’s supporting tools for building trading ideas. There are three sections:

Trader’s supporting tools for building trading ideas. There are three sections:

3.1. Trader’s dashboard, featuring four tables:

Price movement statistics in percentage for the chosen period. The list includes over 60 currency pairs, time frame – from 1 day to 1 year.

Market sentiment. The ratio of long and short positions of FxPro traders as of a specific date.

Quotes of the assets: currency pairs, assets of stock and commodity markets.

Schedule of sessions at the international stock exchanges.

3.2. Economic calendar. This is the list of news releases that impact the quotes of currency pairs and the time of their release. There is a filter that allows you to soft information by importance, period, currency pair.

3.3. All-in-One Calculator for calculating the cost of a pip, collateral amount, swap, cTrader’s fee.

Photo: Review of FxPro Direct features – Instruments

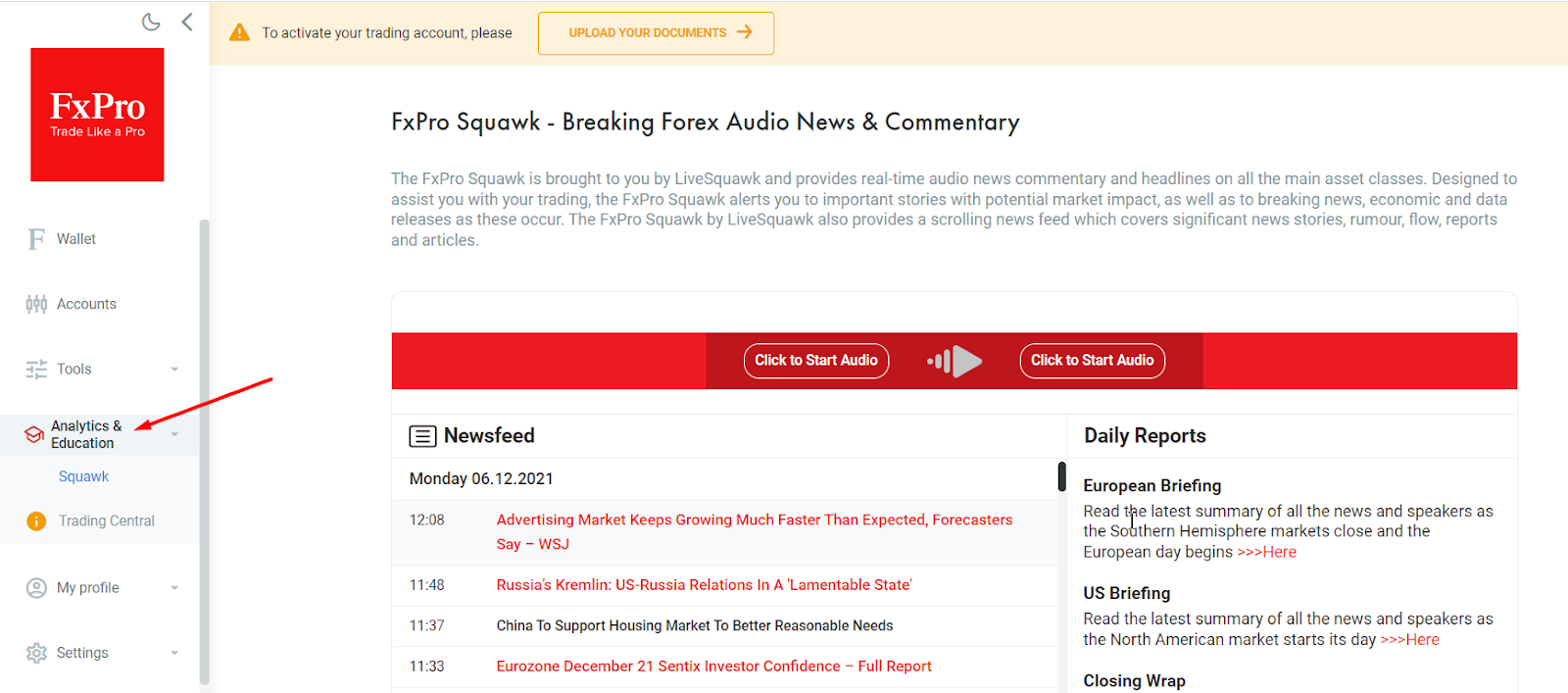

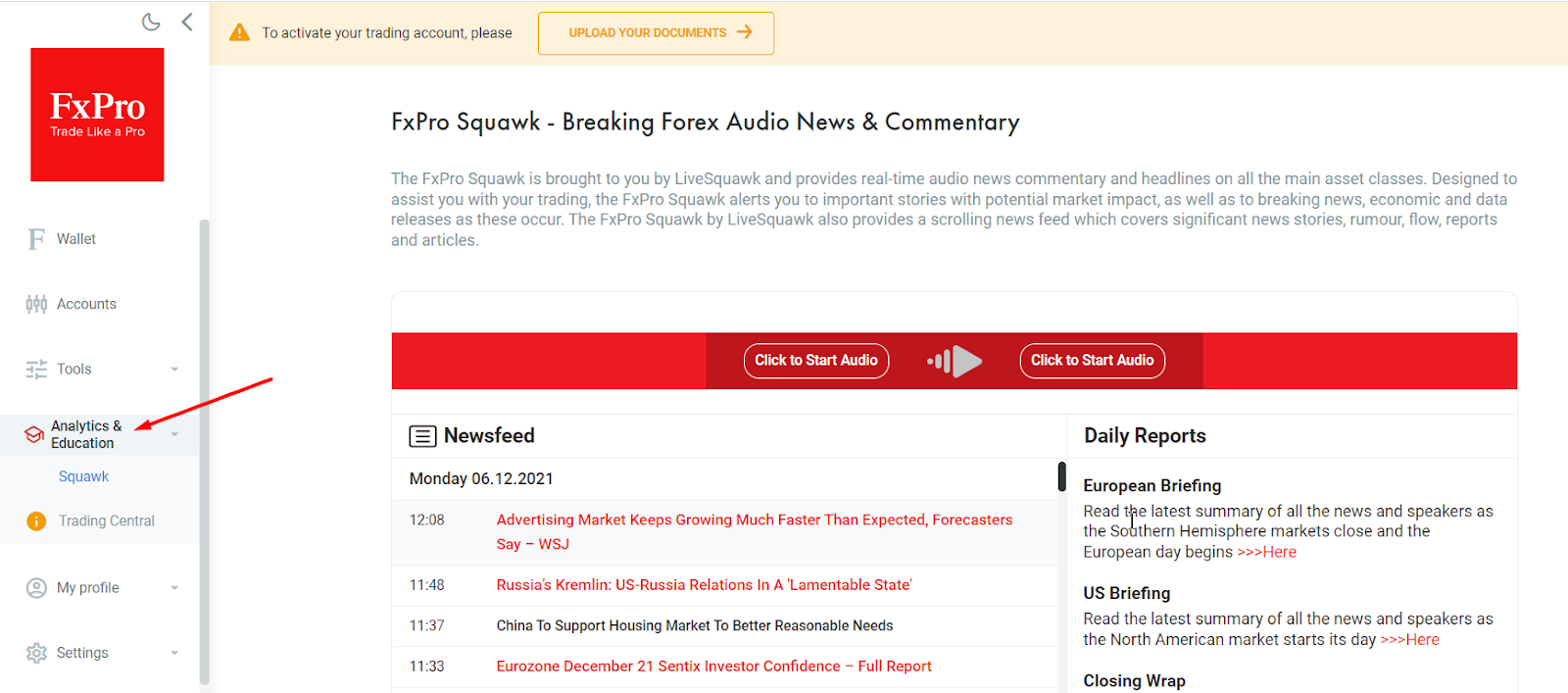

Analytics and education.

This section features analytical instruments and basic information and includes 4 subsections:

Squawk. Urgent financial news in audio format, including latest analytics, fundamental news alerts, newsfeed, latest reports and articles.

Trading Central. The company is an independent provider of technical analytics and trading signals. After you make a deposit on your account, the daily analysis is delivered to your FxPro Direct and email.

FxPro E-books. This is the broker’s e-library, where you can download books on trading for free (from basics to lot, from leverage to CFD, on fundamental analysis, etc.).

Webinars on different topics of fundamental analysis, risk management, psychology, etc.

Photo: Review of FxPro Direct features – Analytics and education

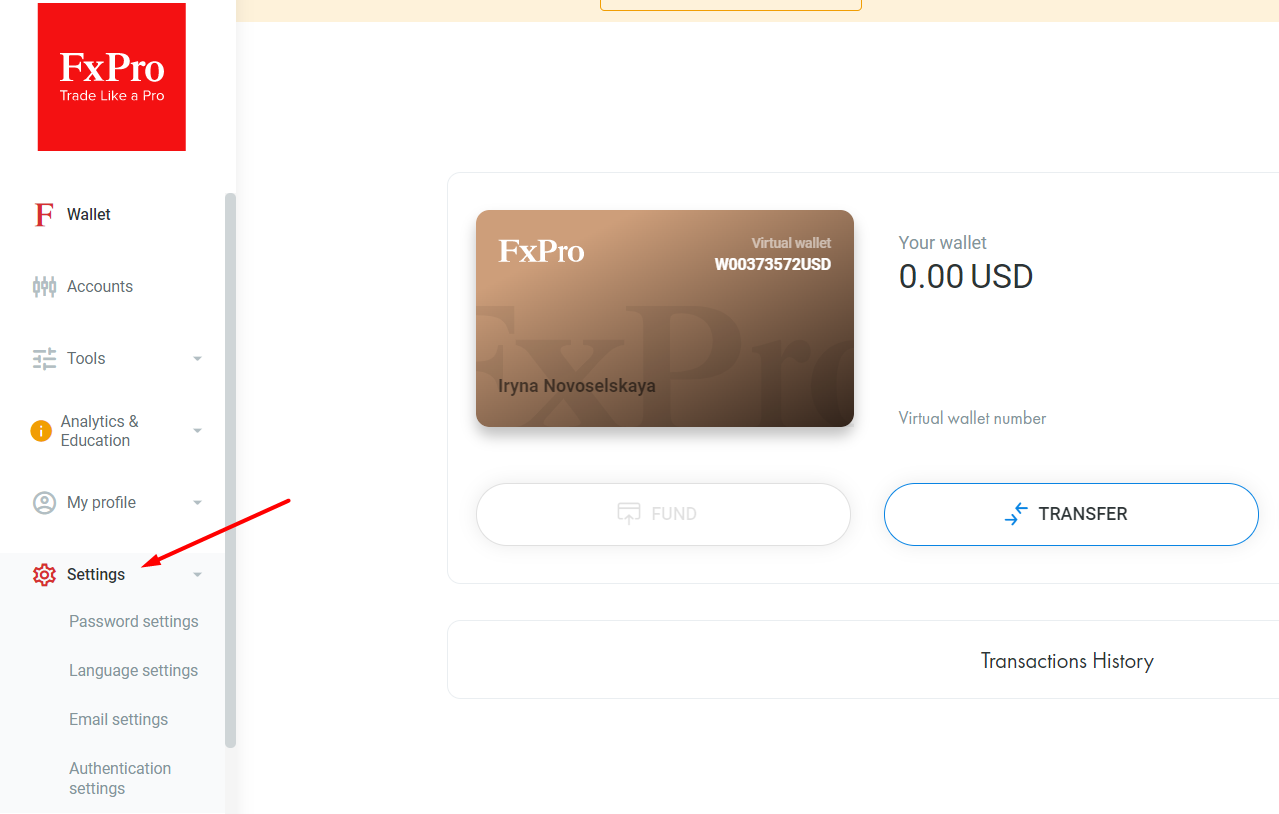

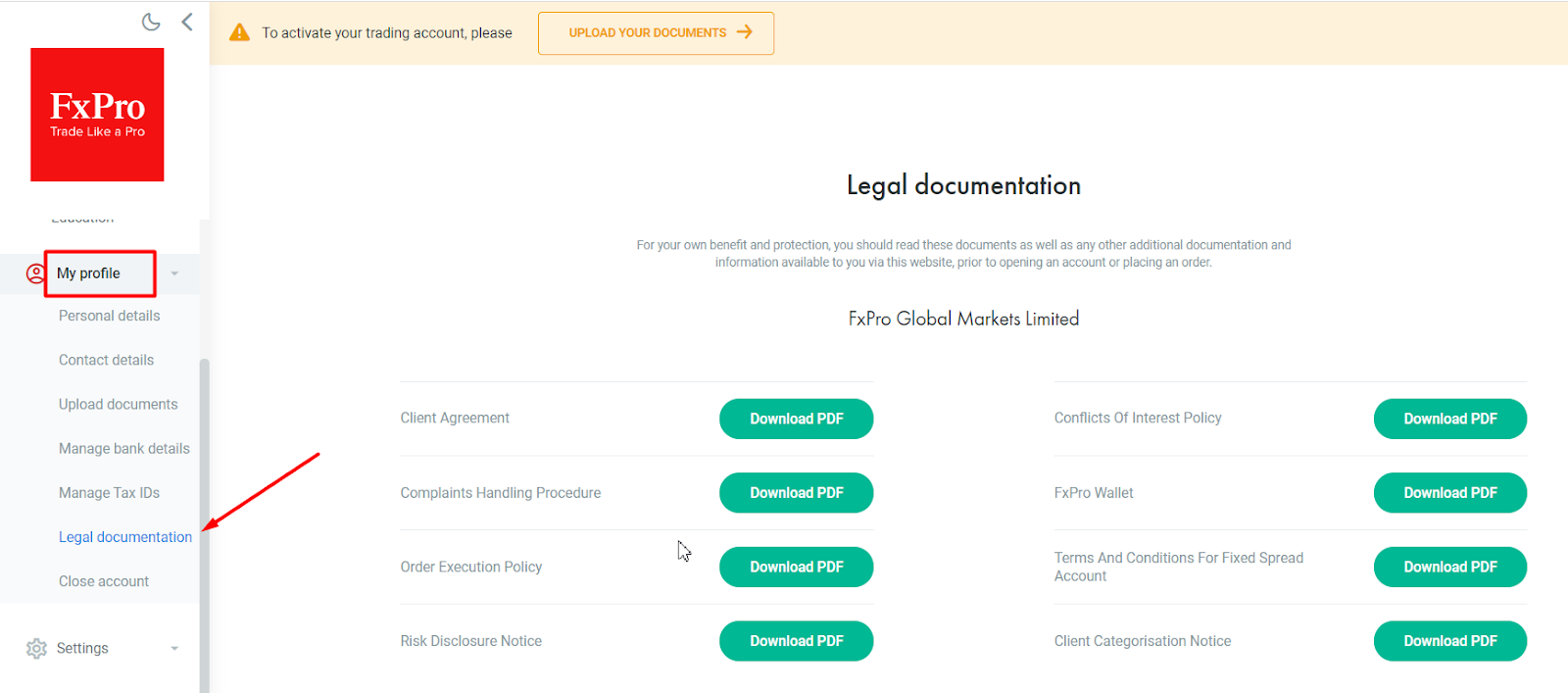

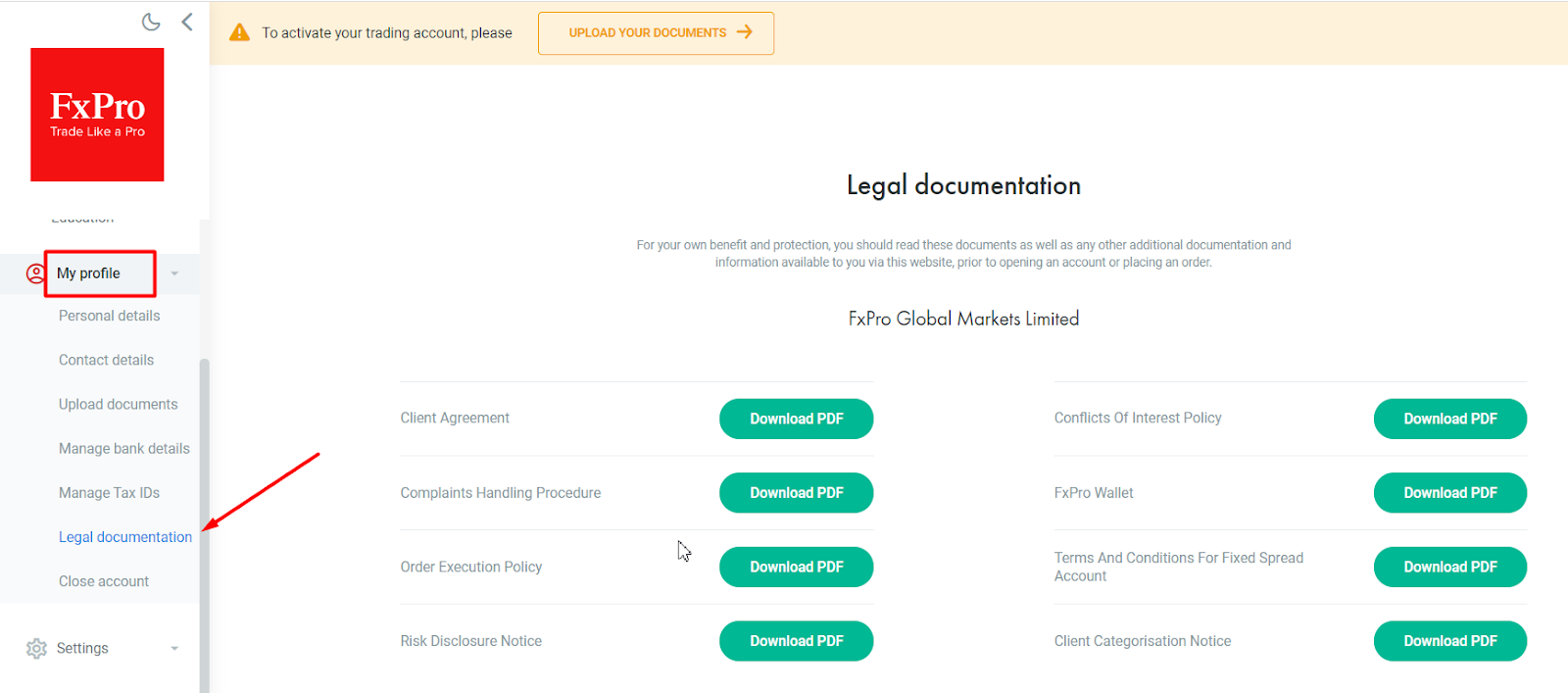

My profile.

This section is designed for changing personal information, if needed, uploading documents, etc. Here, you can change and add your personal data, contact information, pass verification, add bank details, tax ID numbers. Also here you will find all legal documentation that regulates the relations between traders and the broker: Client Agreement, Order Execution Policy, Risk Disclosure Notice, etc.

Photo: Review of FxPro Direct features – My profile

QR code

Downloading the FxPro Direct app. Use this QR code in order to download the application directly from Google Play or AppStore.

Hints.

Photo: Review of FxPro Direct features – Hints

A guide on the features of the FxPro Direct Login. If you don’t want to do it by trial and error, check out the guide that provides information on the main features of the account. It will take up to 10 minutes.

FxPro Direct Features

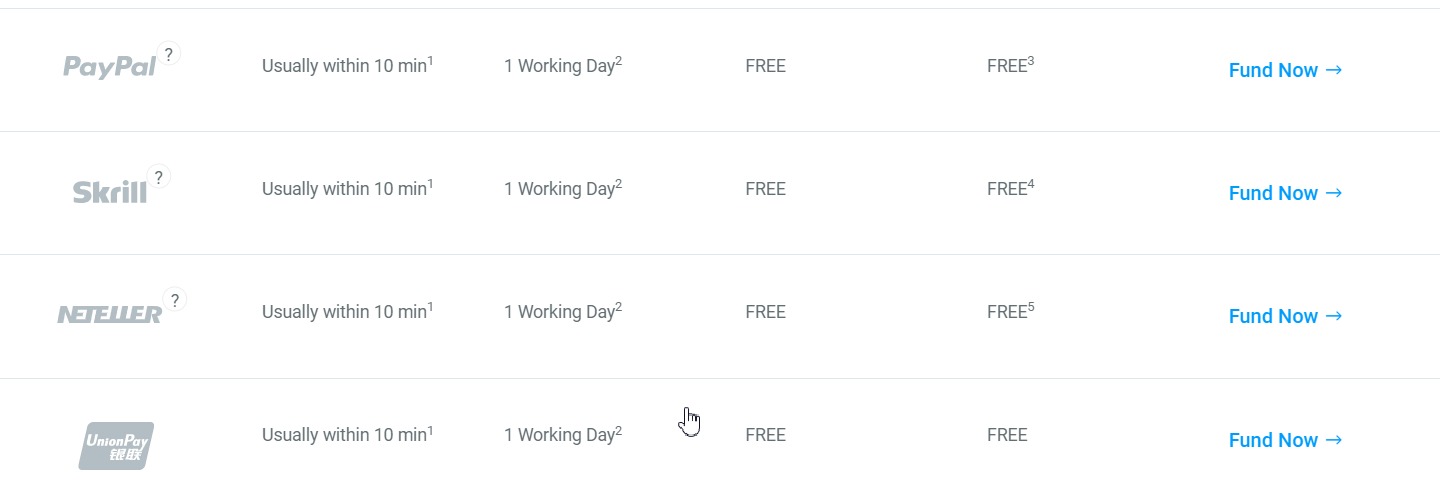

Managing accounts and transactions.

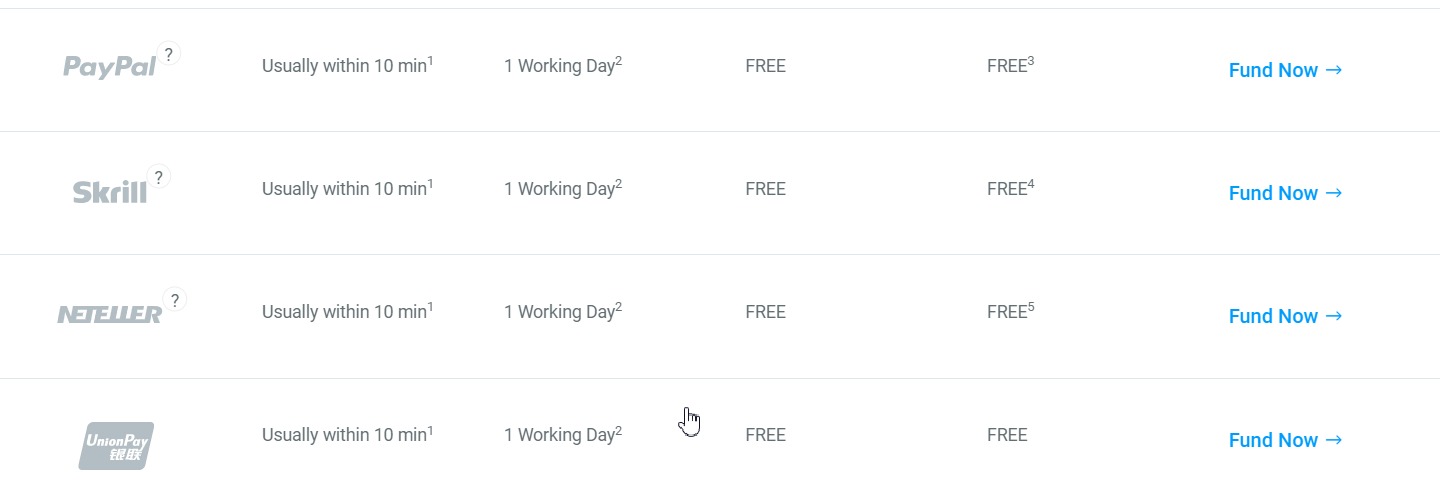

The procedure of account opening, using the wallet, internal and external transfers have already been analyzed in this review.

Photo: Review of FxPro Direct features – Depositing funds to the accounts

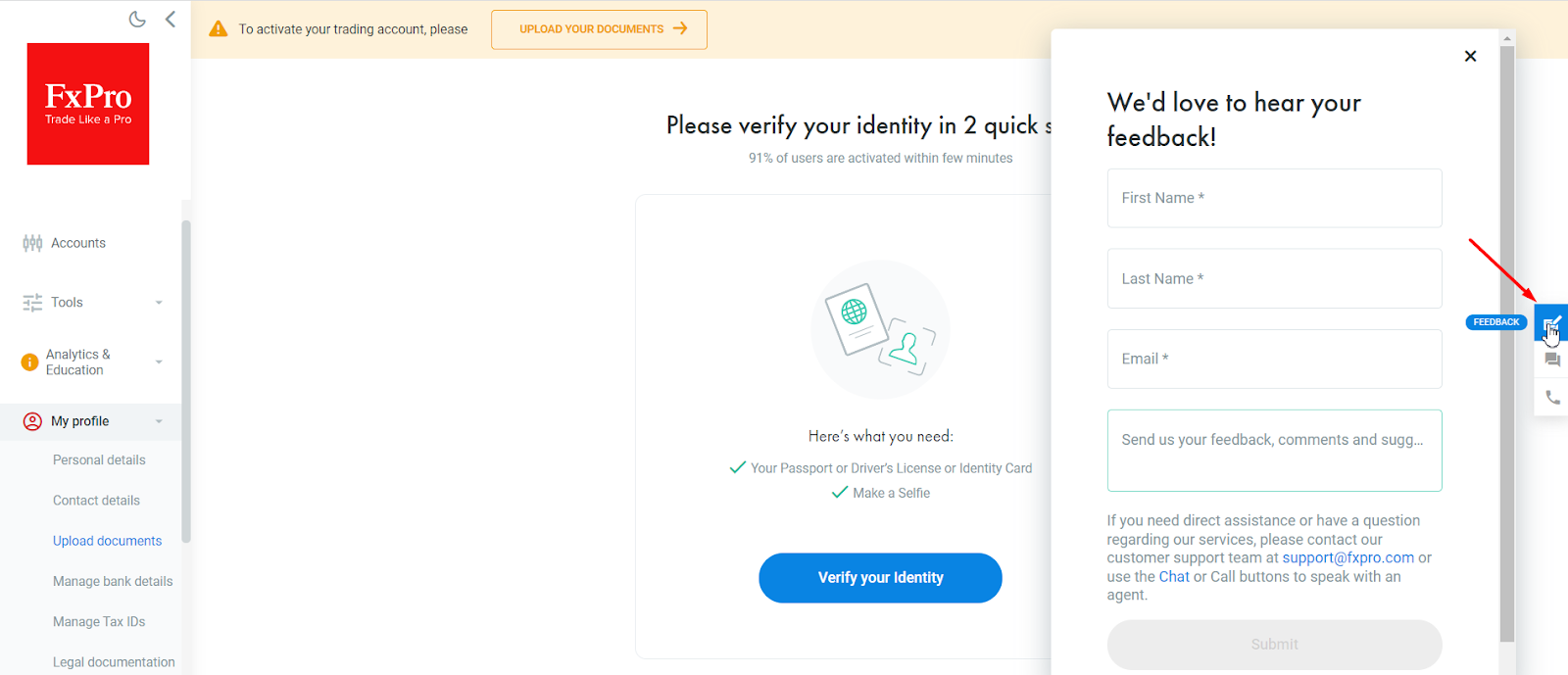

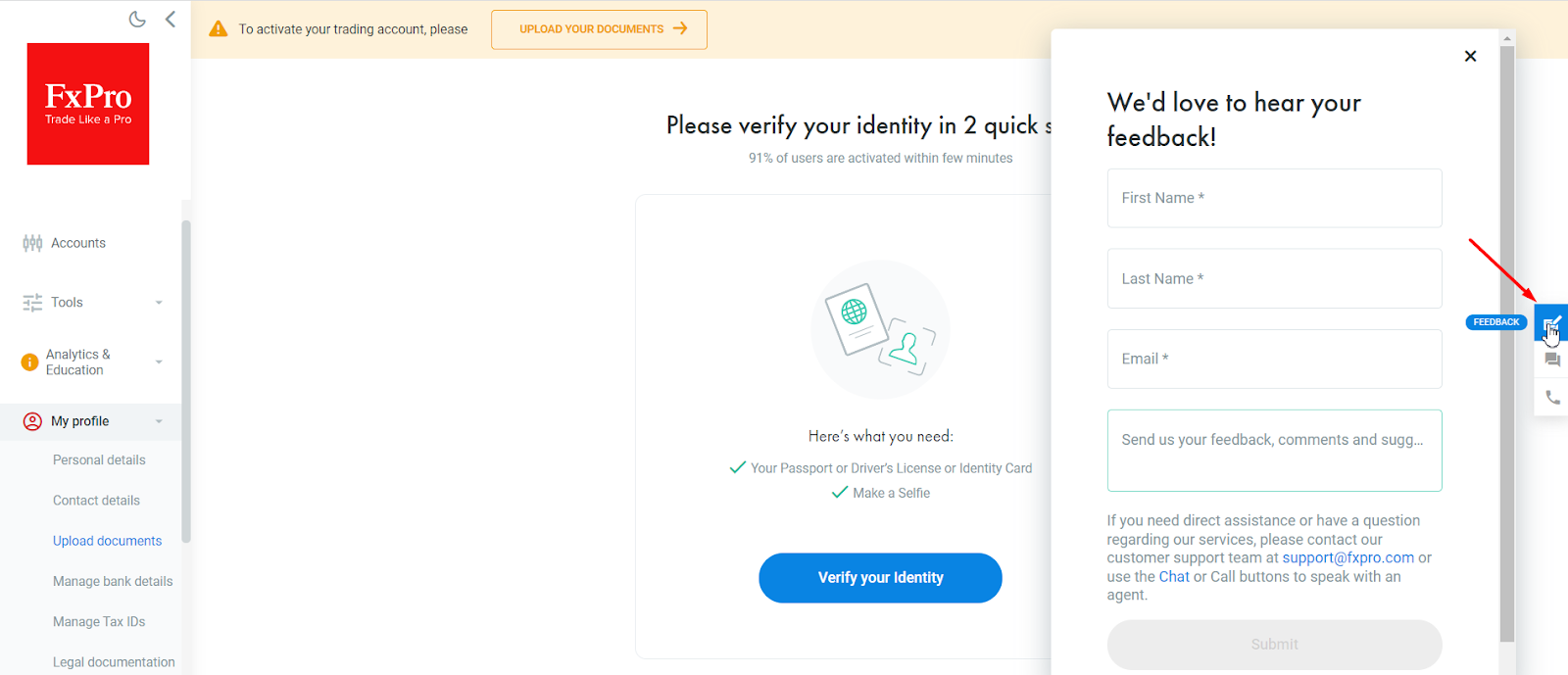

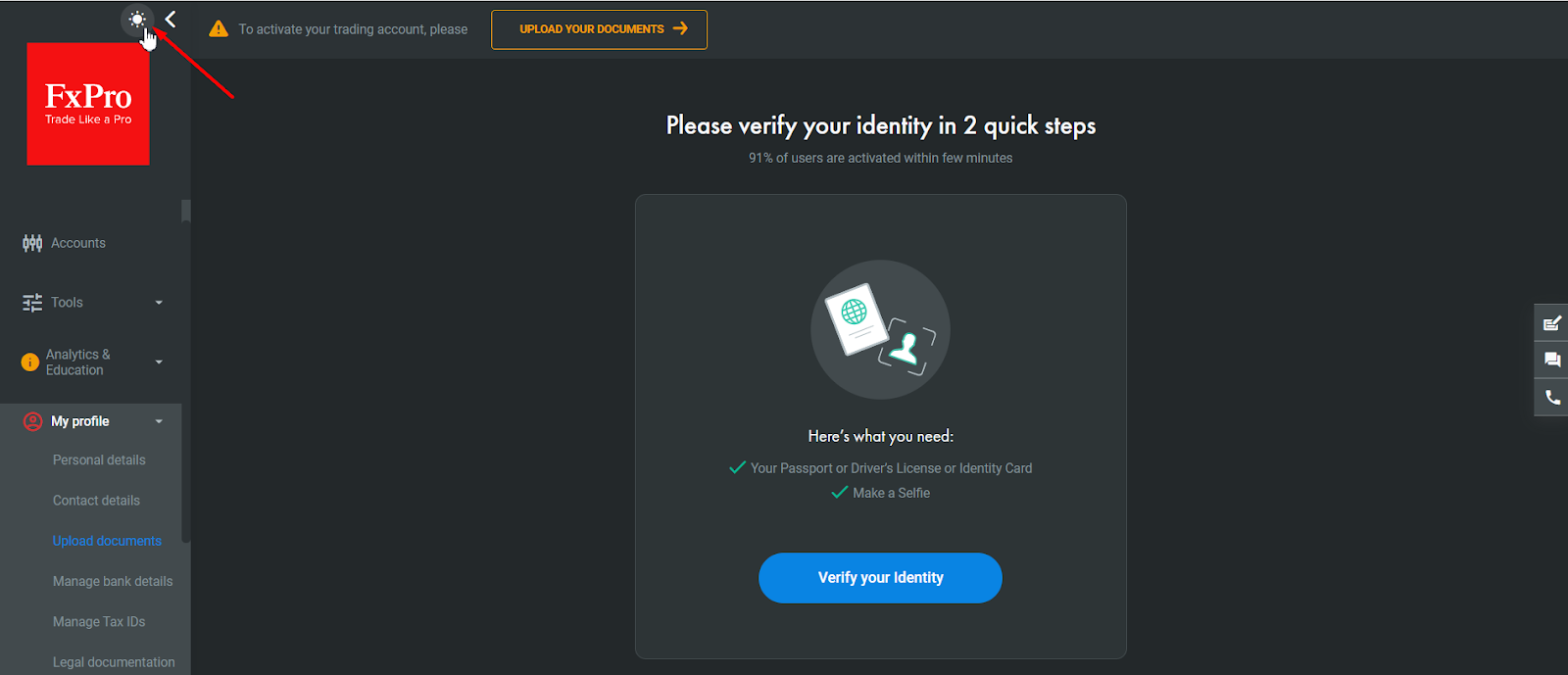

Verification.

Passing the verification procedure. For initial verification, you only need to send the photo of your passport and take a selfie. However, the broker may request to also provide proof of residence and proof that you are the owner of the card or electronic wallet.

Additional features of FxPro Direct

Customer support.

Review of FxPro Direct features – Customer support

The panel for quick access to customer support can be found on the right side of the FxPro Direct. Customer support responds to questions on the live chat within one minute.

In the “Feedback” the email of customer support is specified. If you need to send a letter to the broker with an attachment, that’s where you need to go.

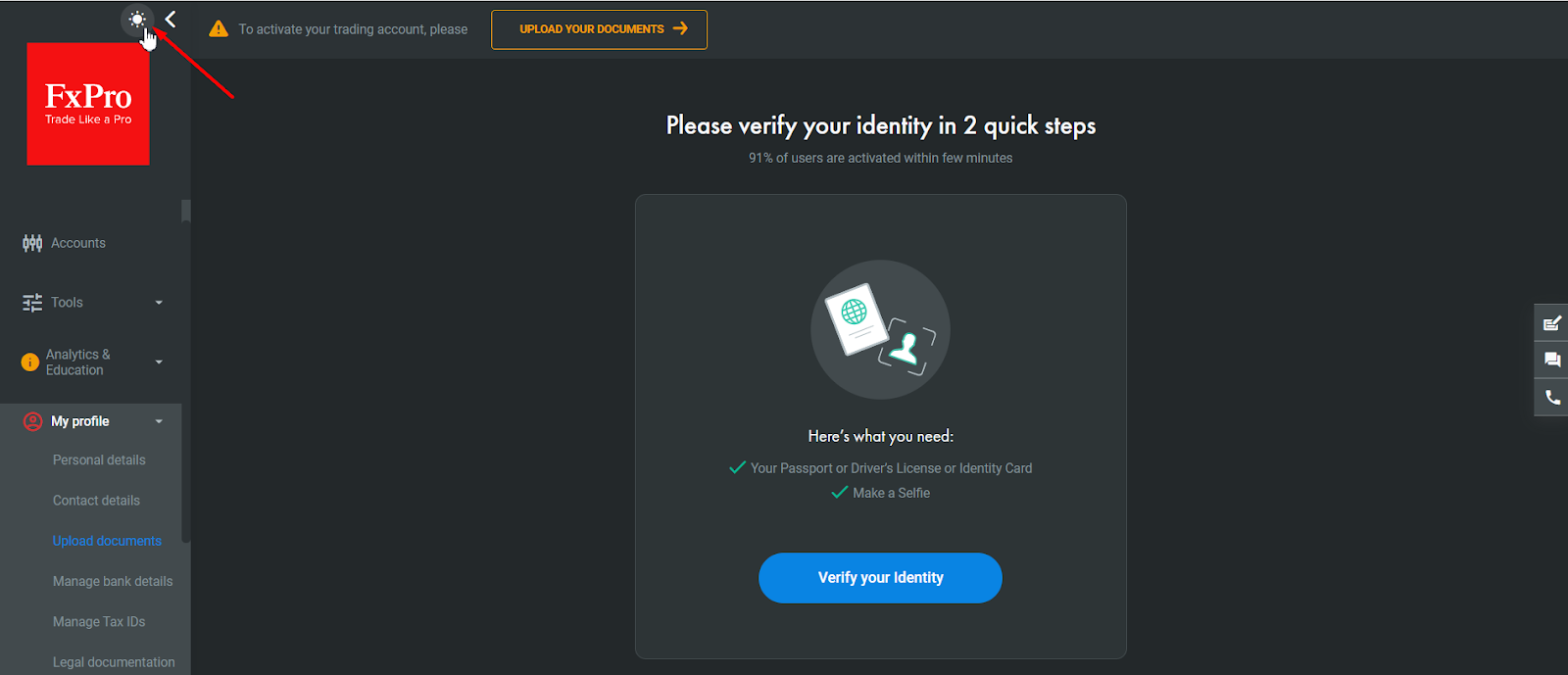

Changing the background theme of your FxPro Direct

Photo: Review of FxPro Direct features – FxPro Direct theme

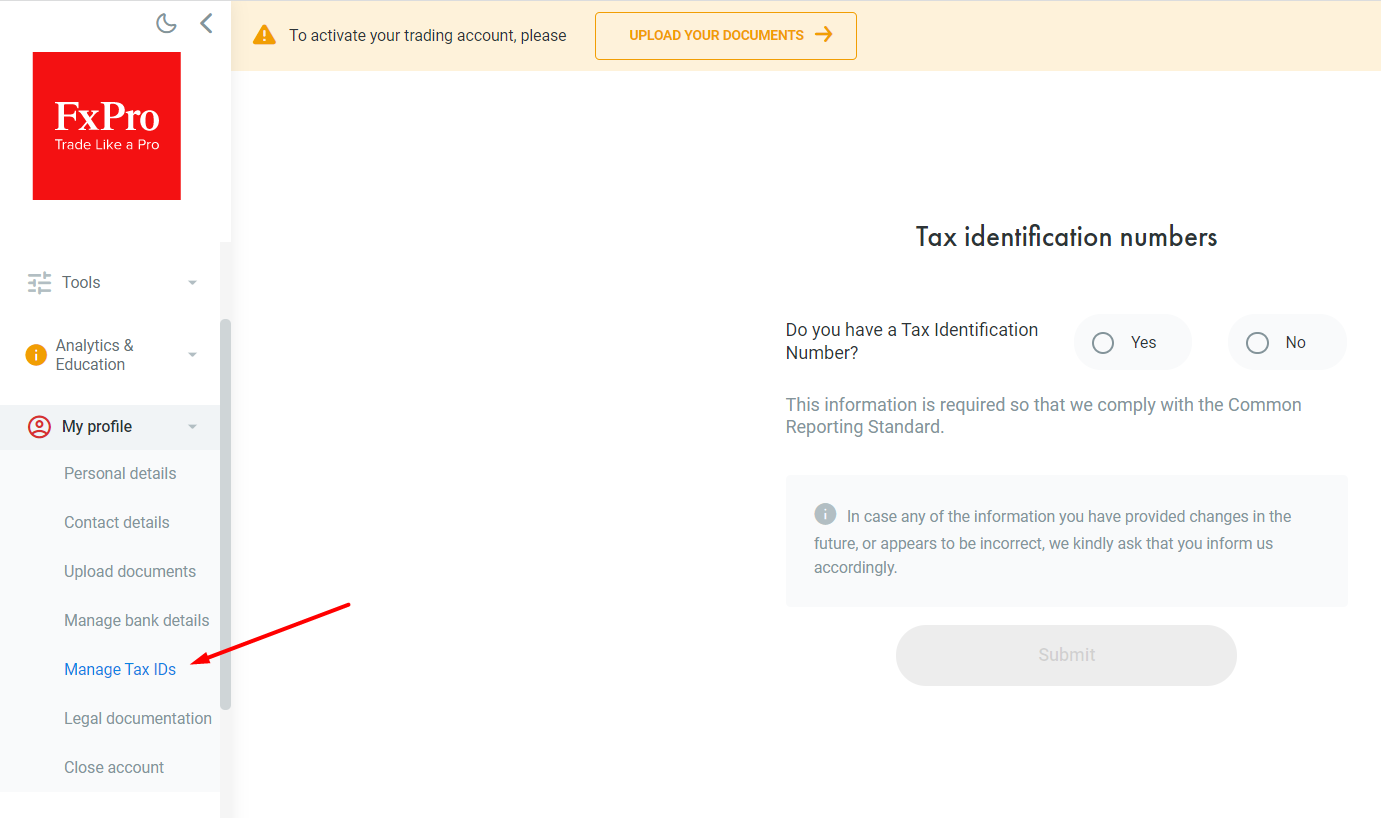

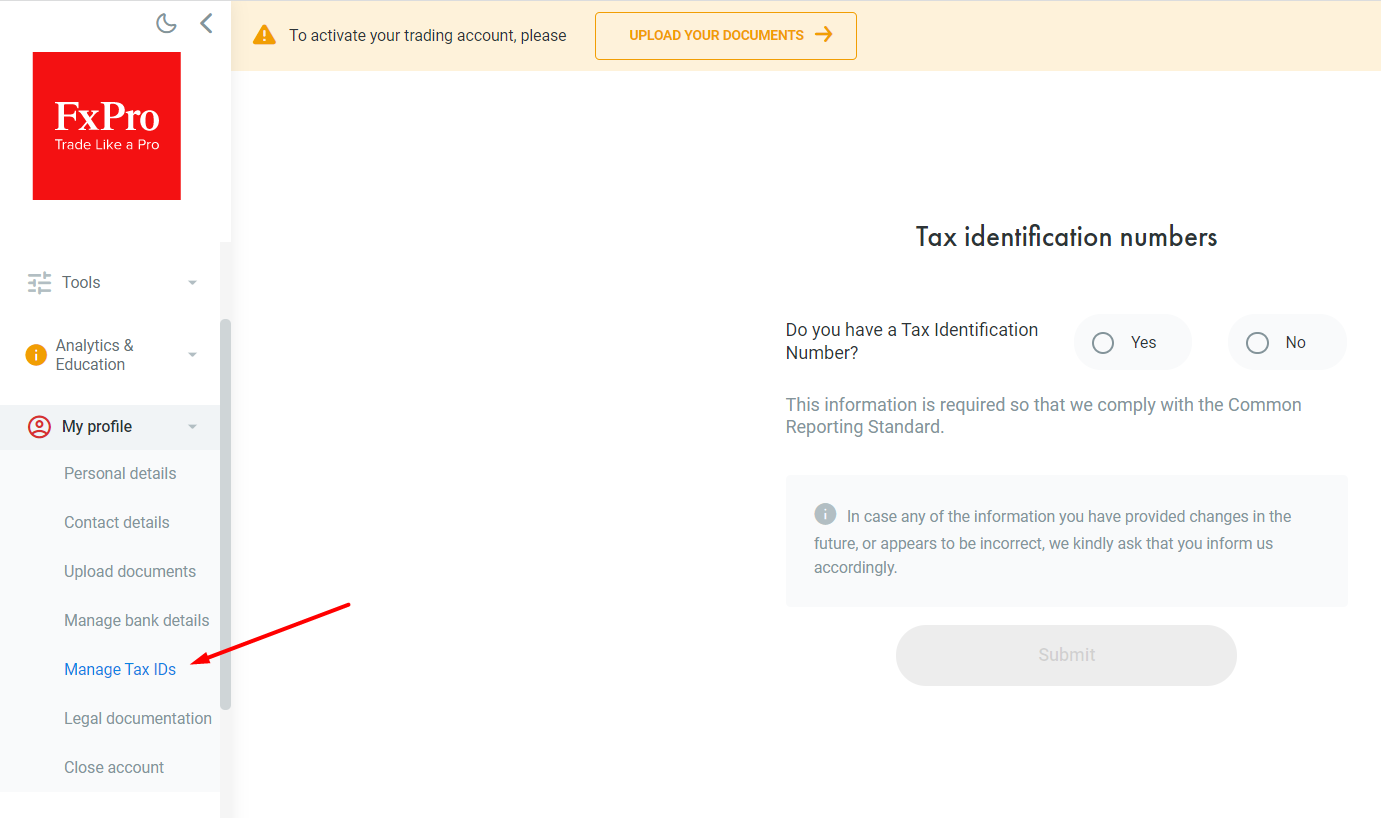

Entering tax identification numbers

FxPro is a regulated broker and this information is a requirement of the regulators for certain situations. Entering this information may be required if the broker acts as a tax agent.

Photo: Review of FxPro Direct features – Entering tax identification number