Questrade Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- FxPro Edge

- Questrade Trading

- Questrade (Mobile app)

- Questrade IQ

- Questrade Global

- 1999

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- FxPro Edge

- Questrade Trading

- Questrade (Mobile app)

- Questrade IQ

- Questrade Global

- 1999

Our Evaluation of Questrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Questrade is a high-risk broker with the TU Overall Score of 2.55 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Questrade clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. Questrade ranks 355 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Questrade is an online investment broker for various purposes. The company focuses on clients from Canada.

Brief Look at Questrade

Questrade Inc. is a reliable broker that has been providing services since 1999. The company offers a wide range of trading instruments: currency pairs (Forex), stocks, ETFs, CFDs, options, bonds, mutual funds, and individual investment instruments. The main office is located in Toronto and this broker opens 200,000 new accounts each year. Questrade Inc. is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and a member of the Canadian Investor Protection Fund (CIPF). Learn about Questrade Canada

- A wide range of instruments, access to the stock markets of 18 countries.

- The broker is regulated by the Canadian IIROC.

- Instruments for passive investments.

- Various professional trading platforms.

- Low fees for ETFs.

- Fast account opening, especially for Canadian citizens.

- Relatively high commissions for Forex traders.

- Restrictions for Non-Canadian Customers.

- Limited choice of payment systems for deposits and withdrawals.

TU Expert Advice

Financial expert and analyst at Traders Union

The Questrade group is a steadily growing online broker from Canada that started working in 1999. It provides services in 2 main areas: independent investing (offered by Questrade Inc.) and the QuestWealth portfolio (offered by Questrade Wealth Management Inc.). The QuestWealth Portfolio is a service for Canadian residents only. It will help those who want to retain and increase their capital. For example, save for education or retirement.

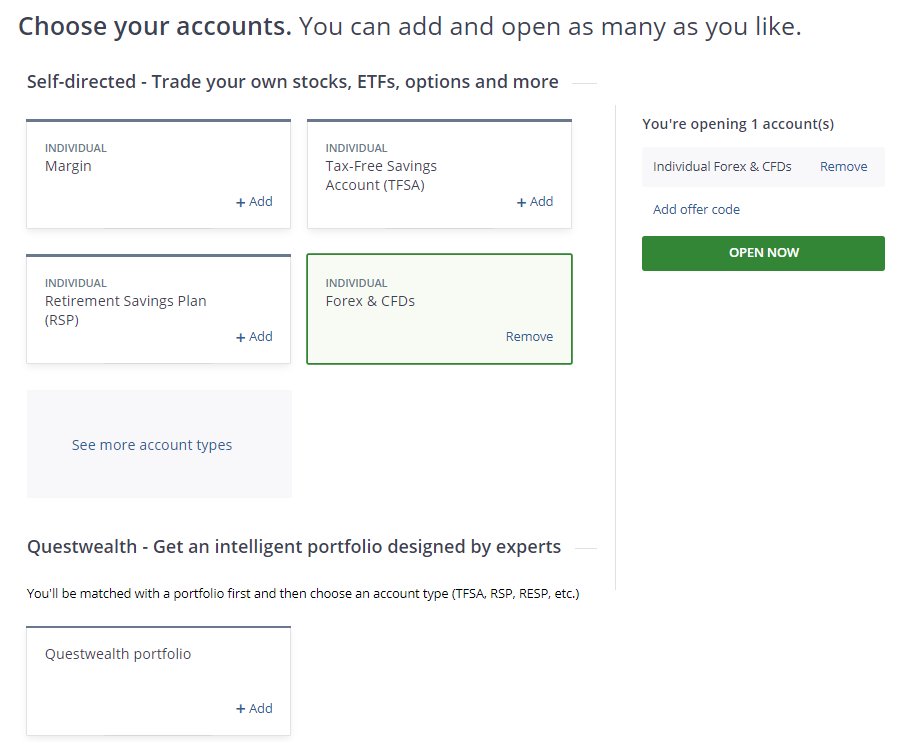

Questrade offers many types of accounts: TFSA (Tax-Free Savings Account), RRSP (Savings Account for Retirement), Margin (for leveraged trading), RESP (Account for Education Savings), corporate accounts for legal entities, accounts for trading Forex and CFD contracts. Some accounts are only available to Canadians.

For transparency, more information on spreads, commissions, and other costs for each instrument can be found on questrade.com. Detailed terms of trading accounts can be checked with technical support specialists. Online chat operators respond quickly, but they do not always give the best information, and there is support in Chinese and French.

Questrade Summary

| 💻 Trading platform: | Questrade Trading, Questrade app (for Android and iOs), Questrade IQ, Edge, Questrade Global + 11 platforms from partner companies |

|---|---|

| 📊 Accounts: | TFSA, RRSP, RESP, Margin, Forex & CFD. Some accounts are available only for Canadians |

| 💰 Account currency: | USD, CAD |

| 💵 Replenishment / Withdrawal: | Wire transfer, Interac Online (Canadian Residents), Visa Debit Card |

| 🚀 Minimum deposit: | from 1 CAD |

| ⚖️ Leverage: | up to 1:20 for retail trade, CFDs, and Forex |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0.8 pips |

| 🔧 Instruments: |

Currency pairs (110), CFD on shares (18 exchanges), CFD on indices (16), ETF (1800), Income guaranteed certificates, stocks, options, and bonds on TSX, NASDAQ, NYSE, and other exchanges |

| 💹 Margin Call / Stop Out: | 100% |

| 🏛 Liquidity provider: | Canadian banks, plus direct access to exchanges |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | No inactivity fees, no fees to buy ETFs |

| 🎁 Contests and bonuses: | Yes |

Questrade offers clients up to 1:20 leverage, depending on the asset and the account chosen for trading. Potential clients can test the trading conditions on demo accounts. The broker does not provide Islamic accounts (swaps).

Questrade Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

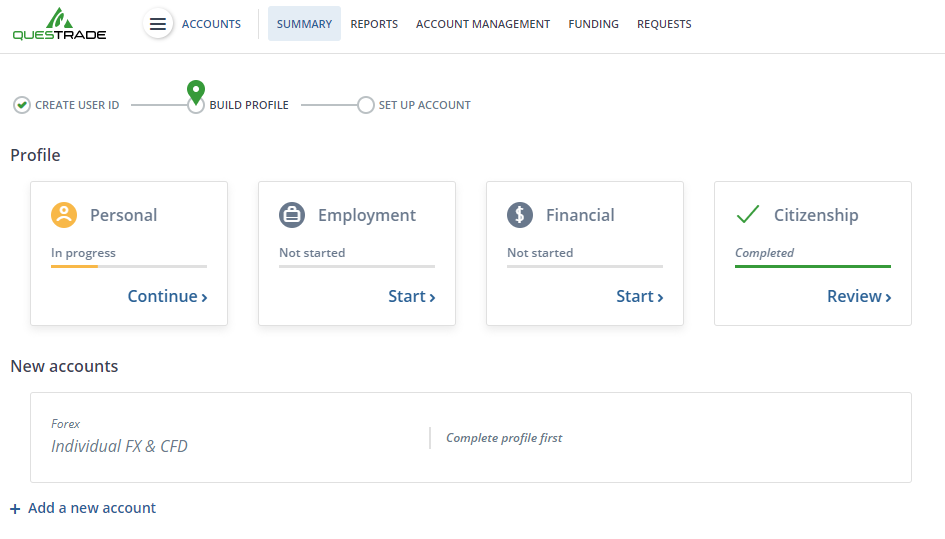

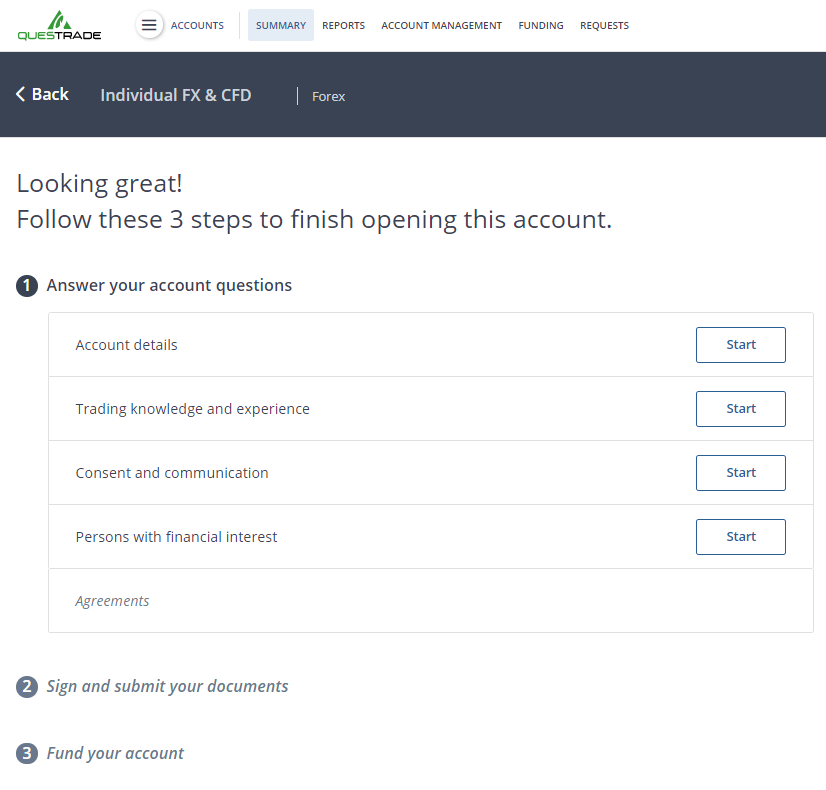

To start trading with Questrade, you need to become a client of the broker by opening a trading account. A quick guide looks like this:

Click Open Account on Questrade’s website.

After that, select the type of account.

After choosing an account, you will need to indicate your full name (as in your passport) and come up with a password. After that, a personal account will be created. To use all the functionality of the account, you need to create a profile by providing more information about yourself, your financial position, your attitude toward risk, and your goals for opening the account.

After creating the profile, you need to complete the creation of the selected account. In this case, the client will have to answer similar questions asked during the creation of the profile. So the procedure for opening an account may seem convoluted.

Also in the personal account, the client has access to:

-

Various real-time reports on accounts.

-

Forms for deposits and withdrawals of funds.

-

Section for working with the affiliate program.

-

Support interface.

-

Section for downloading trading platforms.

Regulation and safety

Questrade, Inc. is a member of the CIPF. This means that clients are eligible for the CAD 1 million coverage offered by CIPF. This is more than in Europe and the USA. In addition, there is an option to get additional private insurance for 10 million Canadian dollars.

The broker thoroughly monitors security. Digicert technology monitors the security of transactions. You can protect accounts with Touch/Face ID and receive notifications of suspicious account activity. There is a function of security questions, you can also enable two-step authentication. Questrade is confident about its reliability, therefore, it guarantees a 100% refund of any unauthorized transactions in the account of Questrade clients that lead to direct losses. In 2019, Questrade received a banking license, which shows it is very reliable.

Advantages

- Client funds are segregated from Questrade capital and are kept in segregated bank accounts

- Regulated as bank brokerage services

- In case of violation of the obligations prescribed in the offer by the broker, the client can file a complaint with the Canadian regulator

Disadvantages

- To open an account, you must provide detailed financial information

- You cannot make a deposit and withdraw funds without verification,

- Limited choice of electronic payment systems for making deposits and withdrawals

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Forex & CFDs | from $8 | Yes |

There are swaps (commission for transferring the position that remains open after 17:00 EET to the next day). A commission is charged for trading CFDs. For example, while trading CFDs the commission of 1 cent per share is charged for US shares, but not less than $ 9.95 per trade. Also, the analysts of Traders Union compared the size of the average trading commission of Questrade, Admiral Markets, and FxPro. The results of the comparison are presented in the form of this table.

| Broker | Average commission | Level |

|---|---|---|

|

$8 | |

|

$1 | |

|

$8.5 |

Account types

Questrade offers a wide variety of accounts (some are only available to Canadian citizens), and customers can have multiple account types at the same time.

Demo accounts and free transfer of an existing account from another broker are also available.

Questrade is a broker that connects directly to exchanges, and also uses ECN (Electronic Communication Networks) and ATS (Alternative Trading Systems) technologies to quickly execute trades with minimal costs.

Deposit and Withdrawal

-

Wire transfers usually take about 3 business days.

-

For non-Canadian customers, only wire transfers are available.

-

US dollars can only be sent to US dollar accounts.

-

Canadian dollars can only be sent to CAD accounts.

-

To be able to make a deposit, you must go through verification.

-

Questrade does not charge withdrawal fees for wire transfers less than CAD 50,000 or USD 25,000. However, the commission for a bank transfer is $ 20-40 (depending on the client’s residence).

Investment Options

Investment Programs, Available Markets and Products of the Broker

The company does not provide clients with the opportunity to invest in PAMM or MAM accounts.

The structure of the group includes Questrade Wealth Management, which offers to invest in the Questwealth portfolio, which allows you to invest in ETFs at reduced commissions, and in turn, significantly increases the return on investment up to + 30% over a 30-year horizon.

Money management solutions with Questrade Wealth Management program

Questwealth’s portfolio is based on ETFs. It is automated and managed by a team of experts. Management fees start from 0.25%. By investing in Questwealth, clients save on overhead costs as it is cheaper than buying ETFs directly from the market. You don’t need any special knowledge to invest in Questwealth. The calculator on questrade.com allows you to calculate how much you’ll have on the account, based on the following data:

-

the amount of the initial investment;

-

the number of regular deposits;

-

the investment term.

The dividends received on the stocks in the Questwealth portfolio are automatically reinvested, so clients’ money never stops working. Questwealth portfolios have a proven track record of performance over 10 years. To start investing, clients have to fill out a very simple application form to indicate their goals. The status of the portfolio can be monitored online in real-time. The company also sends monthly reports and quarterly market comments so that clients always know exactly what is happening with their money. Clients can also change their portfolios as needed.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Questrade’s affiliate program:

-

The affiliate program is a solution for those who are ready to attract new clients to Questrade. The professional service Post Affiliate Pro is used for attracting clients. It has many tools for tracking the effectiveness of attracting referrals.

The remuneration can be paid using two methods, which include by the opened account of the attracted client or as a percentage of the commissions that the attracted client pays. For its part, Questrade provides referral clients with a $50 discount on commissions. The program has three levels. You can receive remuneration not only for your referrals but also for clients who are attracted by your referrals.

-

The My Family program is a great way to reduce your trading costs. According to its terms, you can link your account with the account of a family member and that way reduce the cost of trading commissions.

Customer support

Support service operators are available five days a week. Working hours: Monday-Friday, 7:30 am to 8:00 pm Eastern Standard Time.

Advantages

- You can ask a question without being a client of the company in the online chat

- There is support in three languages: English, French, and Chinese

Disadvantages

- No 24/7 support

Available communication channels with customer support specialists include:

-

telephones;

-

email — for questions related to the affiliate program;

-

online chat on the website;

-

feedback form.

Not only a registered client but also a trader without an active account can contact the support team.

Contacts

| Foundation date | 1999 |

|---|---|

| Registration address | 5700 Yonge Street, Unit G1 Toronto, ON Canada M2M 4K2 |

| Official site | https://www.questrade.com/ |

| Contacts |

1.416.227.9876

|

Education

There is no advanced training section on questrade.com. A FAQs section informs clients how they can best use the services of this broker and how they can solve problems that may arise.

The broker does not have cent accounts, so the only option to consolidate the knowledge gained in practice will be training on the Practice Account.

Comparison of Questrade with other Brokers

| Questrade | RoboForex | Pocket Option | Exness | TeleTrade | FxPro | |

| Trading platform |

Questrade (Mobile app), Questrade Global, Questrade IQ, Questrade Trading | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $1 | $10 | $5 | $10 | $1 | $100 |

| Leverage |

From 1:1 to 1:20 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.8 points | From 0 points | From 1.2 point | From 1 point | From 0.8 points | From 0 points |

| Level of margin call / stop out |

100% / 10% | 60% / 40% | 30% / 50% | No / 60% | 70% / 20% | 25% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed Review of Questrade

Questrade builds its work around the observance of three rules: focus on the customer, low commissions, and a wide range of investment instruments. Clients can make transactions on their own (self-directed investing) or they can contact the company’s experts to invest in the Questwealth portfolio they have created. This is a special tool that serves various purposes.

Questrade by the numbers:

-

21 years in the brokerage market.

-

$25 billion in assets under management.

-

9-time winner of the Best Companies in Canada.

Questrade is a broker for long-term investment

Questrade’s clients do not have access to desktop and mobile terminals such as MetaTrader 4/5, but the broker has proprietary platforms such as Questrade Trading, Questrade Apps, Questrade Global, and IQ Edge, as well as 11 platforms from the broker’s partners. Such a wide range of platforms opens up the possibility of trading in different styles, with analysis of volumes, option curves, and other advanced features.

Questrade’s useful services:

-

Intraday Trader. This is an intraday market scanner that monitors the emergence of patterns and notifies the user in real-time. The scanner was created by Recognia, the world leader in technical analysis. You can customize the scanner by patterns and securities.

-

IPO Center. The broker gives you the possibility to buy initial shares listed on the exchange. Each month there are about 20 shares. For those interested, the broker sends out a bulletin describing the shares that are undergoing IPO.

-

A subscription to various market data offers alerts based on specified criteria, observation lists.

-

VectorVest is a partner share analysis and portfolio management service that analyzes, sorts, ranges, and displays over 23,000 shares daily to assess value and risk.

-

Using the Questrade API, you can develop your own fully functional and analytical applications to work through your brokerage account.

Advantages:

There are nine asset classes available for trading and investing, such as stocks, bonds, options, currency pairs, precious metals, ETFs, mutual funds, guaranteed income certificates, energy CFDs, and other base assets.

Insurance coverage of up to CAD 10 million for Questrade Inc clients.

Access to trading 1800 ETFs of various classes.

Low commissions for the Questwealth portfolio.

Buy ETFs and reinvest dividend income without any trading fees.

User Satisfaction