deposit:

- $250

Trading platform:

- MT4

- MT5

- ThinkTrader

- FCA

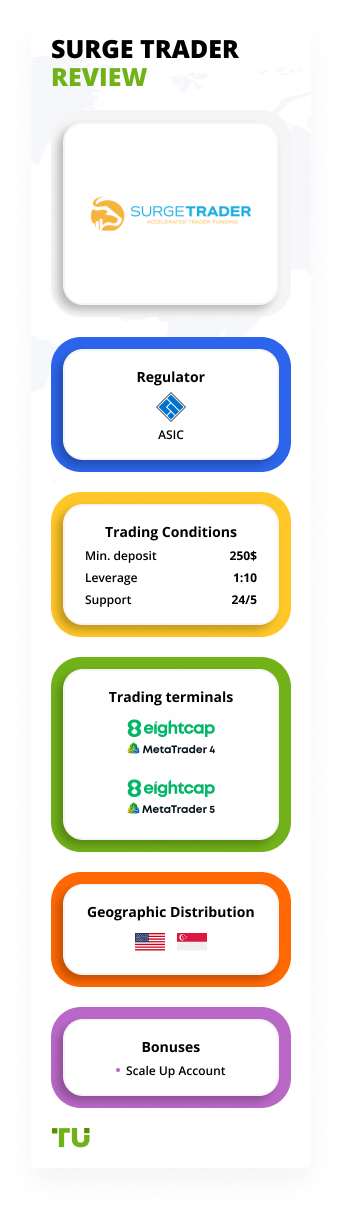

- ASIC

- FSCA

- FSA

- CySEC

- JFSA

deposit:

- $250

Trading platform:

- MT4

- MT5

- ThinkTrader

- Trading through ThinkMarkets broker, but subject to SurgeTrader terms and conditions

- 10:1 with an upgrade to 20:1 on forex and metals

Summary of SurgeTrader Trading Company

SurgeTrader is a moderate-risk prop trading firm with the TU Overall Score of 6.01 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SurgeTrader clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. SurgeTrader ranks 13 among 40 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

SurgeTrader is a relatively strict prop that supports professional traders with venture capital investments.

SurgeTrader is a prop company that offers traders capital from USD 25,000 to manage after passing the exam. It is a multinational company headquartered in Florida (USA). Financing is provided by the venture fund Valo Holdings.

| 💰 Account currency: | No data |

|---|---|

| 🚀 Minimum deposit: | USD 250 |

| ⚖️ Leverage: | 10:1 with an upgrade to 20:1 on forex and metals |

| 💱 Spread: | From 1 point |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, commodity market assets, stock assets |

| 💹 Margin Call / Stop Out: | No data |

👍 Advantages of trading with SurgeTrader:

- Reliability. Venture capital is provided by an international venture fund. Trading is carried out through affiliate broker ThinkMarkets, which is licensed by a number of regulators worldwide - FCA (UK), ASIC (Australia), CySEC (Cyprus), JFSA (Japan), FSCA (South Africa), and the FSA (Seychelles).

- No restrictions on the use of strategies. Any strategy may be applied, subject to the trading rules of the company. Permissible strategies include algorithmic trading, hedging, scalping, and Martingale.

- High income of the trader is 75% of the money earned.

- A wide range of assets includes more than 100 instruments as well as cryptocurrencies.

- No risk. If the maximum loss and drawdown requirements are met, the loss is covered by SurgeTrader.

- Transparency and loyalty. All legal documents and conditions are available on the website in the public domain. The company allows violations of trading rules if they are random and not systematic.

👎 Disadvantages of SurgeTrader:

- The high exam cost is from USD 250-6,500. In case of violation of trade requirements, the discount for re-taking the exam is up to 20%.

- Tough conditions. The daily drawdown is no more than 5%, and the maximum loss is up to 4%.

Evaluation of the most influential parameters of SurgeTrader

Trade with this prop-trading company, if:

- You're unsure about the required balance and want options. SurgeTrader offers 6 accounts with a 1-stage challenge and 5 accounts with a 2-stage challenge. You can receive from $25,000 to $1 million.

- Your goal is to maximize profits by any means. You have the option to scale your account, increasing the balance and profit share. The maximum share is 90%. Leverage is up to 1:20.

Do not trade with this prop-trading company, if:

- You're not prepared to overpay at the start. SurgeTrader's minimum deposit is $250 for a $50,000 balance. Many competitors charge 2-3 times less for the same balance.

- Constraints and limits prevent you from unleashing your potential. SurgeTrader has some of the strictest drawdown limits — a daily limit of 5% and an overall limit of 8%. Many platforms allow double the drawdown or even have no daily limits at all.

Geographic Distribution of SurgeTrader Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Saru84

Saru84  IN New Delhi

IN New Delhi

Availability of a debit account

I don't know yet

Hayk Harutyunyan

Hayk Harutyunyan  AM

AM

Good conditions to start trading

Questionable trading conditions

Expert Review of SurgeTrader

SurgeTrader is a classic prop company that allows traders to work with investors' money. The core of the proposal is as follows: are you confident in your abilities and your experience? Then you need to choose one of the company's course exam packages, get trained, and confirm your knowledge by passing the SurgeTrader Audition. Unlike other companies, SurgeTrader does not have a 30-day trial period. If you pass the test, within 24-48 hours you are assigned the appropriate status. This is one of the key advantages of the company.

The second advantage of SurgeTrader is high trading commissions. The trader receives an account from USD 25,000 to $1 million under management, depending on the initially chosen package. And 75% of the profit is the trader's income. But to get it, the trader must adhere to fairly strict trading rules regarding the maximum daily loss and drawdown. Although the company is loyal to non-critical violations and can be flexible with the trader, for major violations it has a zero-tolerance policy, which includes the cancellation of the “SurgeTrader” status and the need to re-pay the cost of the course.

The first impression of SurgeTrader is positive. The terms of trade are formulated very clearly, and there are not many of them. The price of the courses is relatively high, but this is offset by the nonexistence of a test period, loyalty to random errors, and the opportunity to reach your full potential. There are no restrictions on the strategies used.

How to get funded with Surge Trader prop company

Dynamics of SurgeTrader’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

SurgeTrader is an investment company in and of itself, ready to invest in professional traders. SurgeTrader works with a venture investment fund that is ready to transfer money to the management of the traders who have proved their professionalism on a test account.

SurgeTrader is a prop trading platform for confident traders

The prop trading model of SurgeTrader works as follows:

-

The trader pays for testing. The fee was introduced to eliminate beginners and traders without experience who are not ready for long-term cooperation. The amount depends on the chosen tariff plan. Tariff packages differ in the requirements for the target profit transferred to the management of the deposit.

-

Within a few minutes after the payment, the trader gets access to the account on the ThinkMarkets broker platform. The task is to earn money following the trading rules.

-

After passing the test mode, the trader gets access to a funded account. Its conditions are fully consistent with the conditions of the test mode. If a trader has paid for the exam package with access to USD 50K, in case of successful completion of the exam, he will receive a funded invoice for USD 50K.

There is a demo account for testing the trading platform. On it, you can go through test trading before paying for the exam. The trader's profit is 75% of the money earned. In case of major violations, the trader's account is disqualified, after which it is offered to pay for the exam with a 20% discount and take it again.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

SurgeTrader’s affiliate program:

-

The affiliate program is a classic affiliate program that provides a reward of up to 20% of the amount of the exam payment for each referral involved.

To obtain the status of an affiliate, you need to send an application by email, after which the company will provide access to the affiliate account. The account tools allow you to track affiliate statistics and the effectiveness of a marketing campaign. Remuneration payments are made at the beginning of each month.

Trading Conditions for SurgeTrader Users

SurgeTrader, through its affiliate, the ThinkMarkets broker, provides access to over 100 OTC assets. The account is single, and trading conditions are presented on the broker's website. Additional conditions for trading on a funded account are available on the SurgeTrader website.

$250

Minimum

deposit

1:10

Leverage

24/5

Support

| 💻 Trading platform: | MT4, MT5, ThinkTrader |

|---|---|

| 📊 Accounts: | Funded account |

| 💰 Account currency: | No data |

| 💵 Replenishment / Withdrawal: | Bank cards, PayPal |

| 🚀 Minimum deposit: | USD 250 |

| ⚖️ Leverage: | 10:1 with an upgrade to 20:1 on forex and metals |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1 point |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, commodity market assets, stock assets |

| 💹 Margin Call / Stop Out: | No data |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Trading through ThinkMarkets broker, but subject to SurgeTrader terms and conditions |

| 🎁 Contests and bonuses: | Yes |

Comparison of SurgeTrader to other prop firms

| SurgeTrader | Topstep | FTMO | Funded Trading Plus | Earn2Trade | The Trading Pit | |

| Trading platform |

EightCap M4, EightCap M5 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | NinjaTrader, R Trader Pro, Finamark | MetaTrader4, MetaTrader5, BOOKMAP, R Trader, QUANTOWER |

| Min deposit | $250 | $1 | $155 | $119 | $90 | $99 |

| Leverage |

From 1:1 to 1:10 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

50% / 50% | 1% / 1% | 50% / 50% | No | 10% / 10% | No |

| Execution of orders | Market Execution | ECN | Instant Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| SurgeTrader | Topstep | FTMO | Funded Trading Plus | Earn2Trade | The Trading Pit | |

| Forex | Yes | No | Yes | Yes | No | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | No | Yes |

| CFD | Yes | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | No | Yes | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

SurgeTrader Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| ThinkZero | From $1 | No |

| Standard | From $4 | Yes |

There are swaps commissions (for transferring a position to the next day). On the MT5 account, with a spread of 0 pips, there is a fixed commission of USD 3.5 for each full lot.

Also, the Traders Union analysts compared the fees of SurgeTrader with the fees of other Proprietary Trading Firms. The average value of both broker accounts, converted into USD, was taken as a basis. There are no commissions for withdrawing money.

Detailed Review of SurgeTrader

SurgeTrader is a prop company that provides venture capital funds to traders who do not have their own start-up capital, but who are ready to earn money professionally. The trader chooses a tariff package that specifies the amount provided for management and the target profit. Taking the exam costs from USD 250 to $6,500. The higher the cost of the package, the more money the trader will receive on the funded account in case of successful completion of the test.

Conditions for traders:

-

The conditions are tough. The daily drawdown is no more than 5%, the maximum daily loss is no more than 4%.

-

Mild conditions: obligatory setting of stop-loss orders, closing trades before the weekend, the maximum trades volume following the amount of the managed deposit. For example, for a deposit of USD 25K, it is 2.5 lots, and for USD 50K, it is 5 lots.

Other conditions are not provided. In case of a violation of the tough conditions, the trader's account is disqualified and the trader must re-take the paid exam. Violations of the mild conditions are acceptable but undesirable.

SurgeTrader is a prop company for professional traders

The main points the trader should know about the SurgeTrader prop company:

-

Anyone over the age of 18 can become a managing trader, who will show profitability and the ability to manage risks. The trader does not invest his money. He only pays the cost of the exam. If the demo account shows a return of 10% under tough and mild conditions, the trader gets a real funded account.

-

The Trader's income is 75%. Losses within the limits allowed by the company are covered by SurgeTrader.

-

When reinvesting, the percentage of allowable drawdown increases. If a trader has made a profit, he can increase the level of risk at its expense.

-

Account activity must be maintained at least once a month.

-

In case of disqualification of the account, the profit received is distributed following the conditions.

-

There is a limit on the maximum number of open lots.

-

All strategies are allowed. But the company can, at its discretion, influence high-risk trades.

-

Leverage. For cryptocurrencies, it is 1:2; for fiat currencies, oil, metals, and indices, it is 1:10; and for stocks, it is 1:5.

SurgeTrader operates through the ThinkMarkets broker, so it makes sense to look at its website as well because the trader will also have to deal with its trading conditions. But, since the trader has an agreement with SurgeTrader, the conditions of the prop company are basic.

Useful services of the SurgeTrader broker:

-

Membership in BKForex. Each trader who successfully passed the exam receives 1 month of free membership in the community. The community provides free trading ideas, webinars, a chat forum, a fundamental heatmap, unique trading ideas, etc. Paid access at the end of the grace period is USD 175 per month.

Advantages:

No commissions. The trader pays for the exam and there are no other payments. There are no commissions for withdrawing money.

Opportunity to develop your own trading business without investment. SurgeTrader provides money to start.

High commissions. The trader's profit is 75% of the money earned.

There is a free testing mode that allows you to understand the technology of prop trading.

How to Start Making Profits — Guide for Traders

To start cooperation, you must apply by email and pay for the selected tariff package. After payment, access to the test account and the conditions for its launch will be sent to your email. The conditions are to receive 10% profit and comply with the trading conditions of the prop company. After passing the exam, access to a real account with conditions similar to a test account is sent to the email.

Package types:

For each package, there are restrictions on the trade volume. The more funds there are under management, the greater the allowable trade volume is.

Bonuses paid by SurgeTrader

The SurgeTrader bonus program assumes a gradual increase to the next tariff package upon reaching 10% of the profit from the managed portfolio. After passing the exam, the trader is offered two options: get an account with a deposit corresponding to the selected tariff package, or continue the test period for free with a target profit of 10% to move to the next tariff level. The core of the bonus is that having paid a minimum package of USD 250, a trader can gradually reach the Advanced package. The offer does not apply to Expert and Master packages.

Investment Education Online

Free educational materials are presented in the "Free Trader Resources" subsection. Among them, there are articles on general topics about the rules of trading and professional technical reviews of tools. After passing the exam, a trader is granted access to the BKForex community for 1 month, led by analysts Kathy Lien and Boris Schlossberg.

There is a free account for training.

Security (Protection for Investors)

SurgeTrader is an international private company partnering with Valo Holdings venture fund. The company operates under US financial laws. Trading is carried out using the technologies and platforms of the ThinkMarkets, which is licensed by a number of regulators worldwide - FCA (UK), ASIC (Australia), CySEC (Cyprus), JFSA (Japan), FSCA (South Africa), and the FSA (Seychelles).

Surge Trader safety and regulation👍 Advantages

- Oversight of reputable global regulators

- SurgeTrader cooperates with well-known investment funds and managers

👎 Disadvantages

- Bureaucracy and complexity of resolving a disputed issue for private traders from jurisdictions other than the United States

Withdrawal Options and Fees

-

Withdrawal of money is allowed once a month. Withdrawal requests are accepted at any time.

-

Available systems for replenishment and withdrawal of money include banking systems and PayPal.

-

When withdrawing money, a recalculation is made taking into account the maximum and minimum sliding drawdowns. A trader cannot withdraw all 75% of the profit in full. You can learn more about this in the FAQs section.

-

There are no commissions for withdrawing money.

Customer Support Service

Traders can seek help from SurgeTrader and the ThinkMarkets broker.

👍 Advantages

- Assistance from both the prop company and the broker that owns the platforms

👎 Disadvantages

- Not observed

The company offers the following communication channels:

-

Feedback form.

-

Email.

-

Social media.

-

Chat on the company's website.

-

Free telephone connection.

Registration to contact the Support Service is not required.

Contacts

| Foundation date | 2018 |

| Registration address | 405 5th Ave South Naples, Florida 34102 |

| Regulation |

FCA, ASIC, FSCA, FSA, CySEC, JFSA |

| Official site | https://www.surgetrader.com/ |

| Contacts |

Email:

info@surgetrader.com,

Phone: 866-998-0883 |

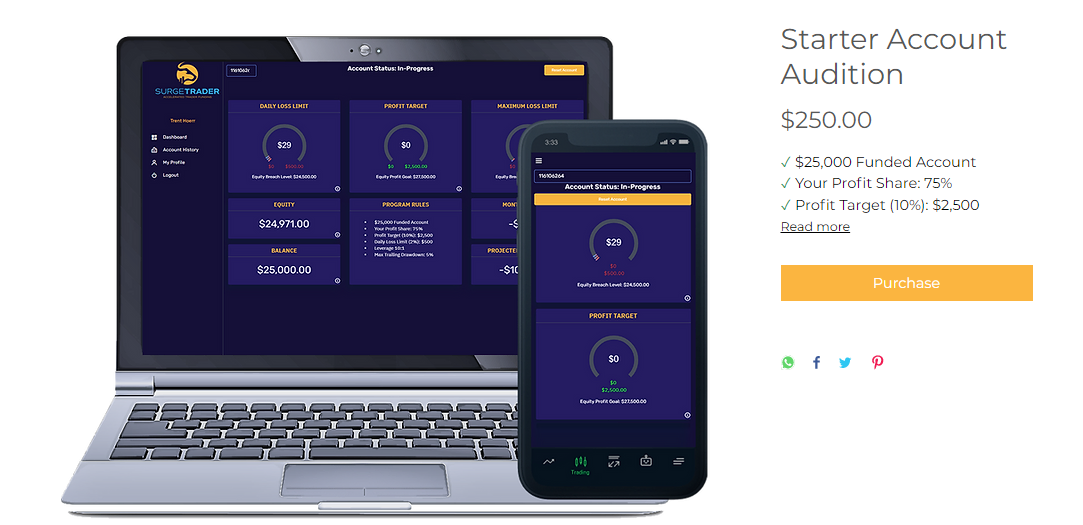

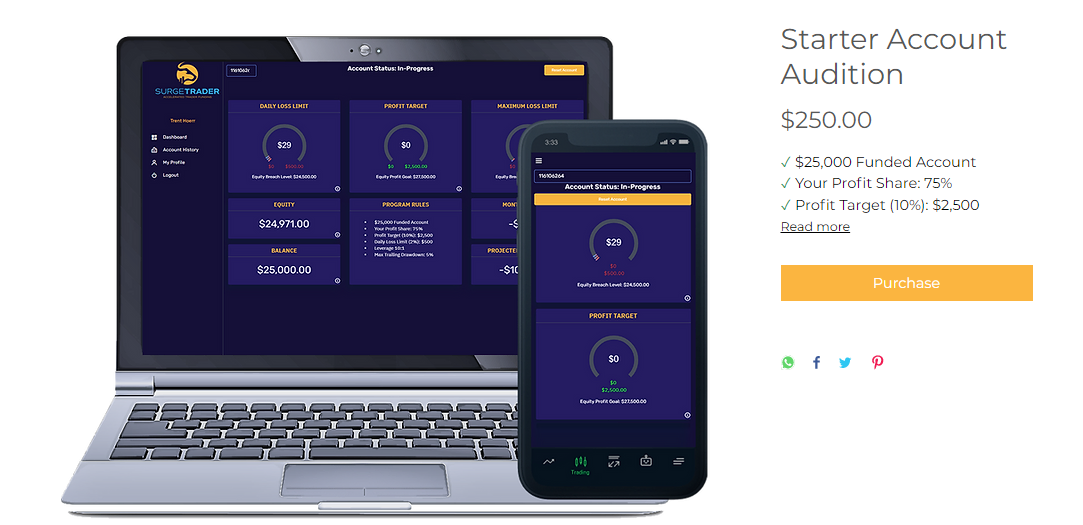

Review of the Personal Cabinet of SurgeTrader

To gain access to the user account, a trader must complete an application and pay for the package. Only after doing that, will the settings and access be sent to the trader.

How to apply:

Click on the "Start Trading" button.

You will be offered to choose a tariff package and then a platform.

Confirm the trading package purchase.

Available blocks in the broker's user account:

-

Management of basic profile information and verification.

-

Management of financial and trade information.

-

Analytics, financial events, and training.

-

Customer, financial, and technical support services.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Find out how SurgeTrader stacks up against other brokers.

Articles that may help you

FAQs

How do client reviews impact SurgeTrader rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about SurgeTrader you need to go to the company's profile.

How can I leave a review about SurgeTrader on the Traders Union website?

To leave a review about SurgeTrader , you need to register on the Traders Union website.

Can I leave a comment about SurgeTrader if I am not a Traders Union client?

Anyone can post a comment about SurgeTrader in any review about the company.

Traders Union Recommends: Choose the Best!