TigerWit Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- TigerWit app

- TigerWit Web

- FCA

- SCB

- SVGFSA

- 2012

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- TigerWit app

- TigerWit Web

- FCA

- SCB

- SVGFSA

- 2012

Our Evaluation of TigerWit

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TigerWit is a moderate-risk broker with the TU Overall Score of 5.04 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TigerWit clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The TigerWit broker is suitable for traders with different trading styles who are interested in certain CFDs, STP accounts, and working with a regulated Forex intermediary.

Brief Look at TigerWit

TigerWit is a holding company that comprises four STP brokers and has been operating since 2015. It is regulated by reputable international commissions such as FCA (679941), SCB (SIA-F185), and SVGFSA (181LLC2019). TigerWit specializes in Contracts for Difference (CFDs) trades and targets African, European, and Asian traders with varied investment backgrounds. The company was awarded the titles of Most Transparent Forex Broker (Africa) and Best Forex Fintech Broker (Asia) at the Global Forex Awards 2020 - Retail.

- The available minimum deposit is $50 on all real accounts.

- Strong regulation in several jurisdictions, including by the British Financial Conduct Authority.

- Availability of negative balance protection for retail traders and deposit insurance from the Financial Services Compensation Scheme (FSCS).

- High leverage, the maximum size of which for currency pairs can reach up to 1:400.

- The ability to trade independently or copy the trades of successful market participants.

- Tight spreads from 0.6 pips on major currency pairs.

- Access to trading through all possible versions of MT4, as well as to work with the proprietary terminal TigerWit.

- A fewer number of assets available for trading compared to those of its competitors.

- Limited choice of payment systems which you can use to deposit and withdraw funds.

- Broker services are currently not available in several countries, including the USA, Canada, Belgium, and Japan.

TU Expert Advice

Financial expert and analyst at Traders Union

TigerWit is a broker for independent and social trading that has been providing entry to the CFD market for over six years. The reliability of the company is confirmed by the use of blockchain, the presence of several international licenses, and the use of segregated bank accounts for storing client deposits. Traders who open an account here have access to six classes of high-leverage CFDs.

TigerWit is an STP broker, so clients only pay trading commissions in the form of a spread. The company does not prohibit scalping, hedging, or news trading. There is no time limit for opening orders. However, every trader who uses borrowed funds to make trades must have enough money on the account balance to cover margin requirements and swap adjustments.

The minimum deposit at TigerWit is $50, which is an acceptable amount even for a Forex beginner. However, the broker does not provide Micro accounts, so traders (both experienced and beginners) are forced to test conditions, risking dollars, not cents. Also, the disadvantages of TigerWit include the lack of high-quality training, analytics, and an economic calendar on its official website.

TigerWit Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ4 (desktop, mobile, WebTrader), TigerWit app, TigerWit Web |

|---|---|

| 📊 Accounts: | Demo account, Live account, Islamic account |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Telegraphic transfer, Neteller, Paysec, internet banking |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.6 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, stock indices, energy resources, precious metals, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 300% / 50% |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant, Market |

| ⭐ Trading features: | Negative balance protection is not available for professional clients |

| 🎁 Contests and bonuses: | Yes |

TigerWit offers one type of STP account, as well as its Islamic counterpart (swap-free account) with a minimum deposit of $50. Cent accounts are not available, but a demo account can be opened. Leverage ranges from 1:50 to 1:400. Spreads are floating and they start from 0.6 pips. All accounts are opened in US dollars. Traders who prefer to trade through a mobile application or browser can use both MetaTrader 4 and the proprietary TigerWit terminal. The desktop version of the trading platform is presented by MT4 Desktop.

TigerWit Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

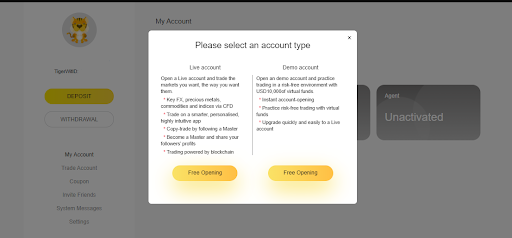

Trading Account Opening

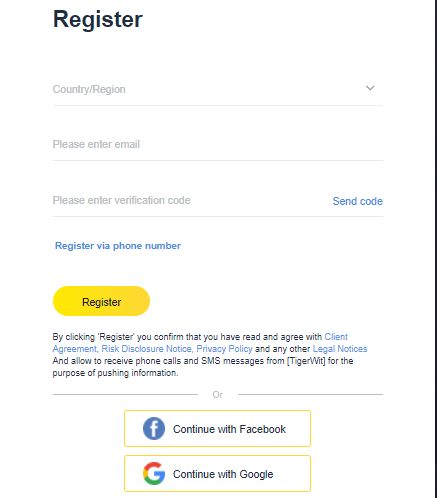

To start trading with TigerWit, you need to go through the registration procedure. Specialists at the Traders Union have prepared a short instruction on how to open an account with a broker. So, you need to:

Register with the Traders Union’s website and then go to your TigerWit profile and click Open Account. Performing these actions will allow you to receive a rebate against the broker’s spread in the future. After that, also click Open Account on the official website of the broker.

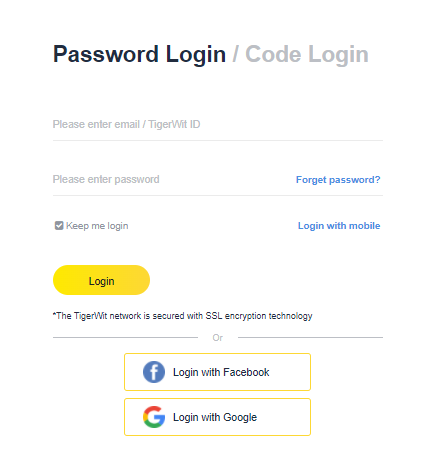

In the registration form, indicate the country in which you currently reside as well as your email address. You can also register using your phone number or Facebook/Google profiles.

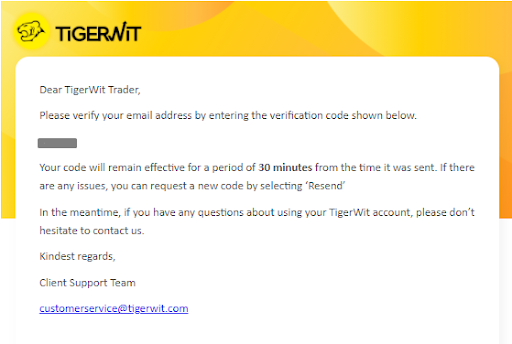

Then you need to confirm your email address. To do this, find a letter with a 6-digit verification code in your mailbox and enter it in the form on the website. The code is only valid for 30 minutes from the moment it was sent.

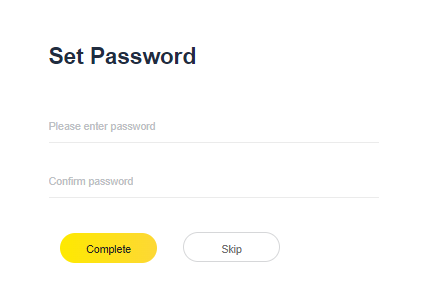

Next, you need to come up with a strong password and repeat it.

Now you can log in.

The following functions are available in the personal account:

Other features that are available in your personal account:

-

Verification.

-

Phone confirmation.

-

Trading through the proprietary web terminal.

-

Viewing information on transactions for the last 6 months.

-

Making an application for withdrawal of funds.

-

Copying a link to attract referrals.

-

Displaying data on accrued referral bonuses.

Regulation and safety

TigerWit unites 4 companies, the activities of which are controlled by the state financial authorities of various jurisdictions. The UK division also participates in the Financial Services Compensation Scheme (FSCS), which insures client investments up to £85,000 per person.

TigerWit is regulated in the UK by the Financial Conduct Authority (FCA), in the Bahamas by the Securities Commission of The Bahamas ( SCB) and in Saint Vincent and the Grenadines by the Financial Services Authority of St. Vincent and the Grenadines (SVGFSA).

Advantages

- Client funds and company capital are separated and segregated

- Retail traders have negative balance protection

- Regulators are involved in resolving disputes between the broker and its client

Disadvantages

- Verification of personal documents is a mandatory procedure

- FSCS coverage only applies to UK traders

- Professional customers are not protected against a negative balance

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Live Account | from $6 | No, for the first 4 withdrawals per month |

There are swap (commission for moving a position to the next day) fees.

Also, the Traders Union specialists compared the size of TigerWit’s trading commissions with similar indicators of competitors. The comparative results are shown in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$6 | |

|

$1 | |

|

$8.5 |

Account types

Clients have access to 2 types of real accounts — those with and without swaps. These are STP accounts that can only be opened in USD.

Account types:

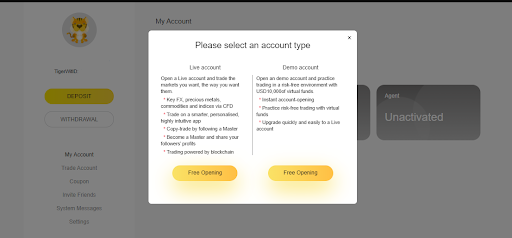

Also, each trader can open a demo account and practice trading in a risk-free environment with virtual funds of $10,000.

TigerWit offers STP accounts with universal terms for beginners and experienced traders, which are also suitable for clients who comply with the Muslim Sharia code.

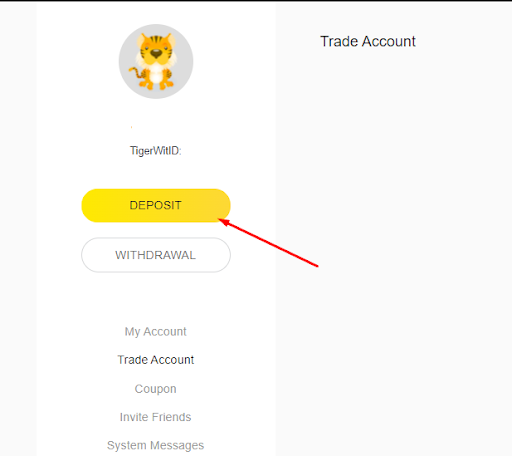

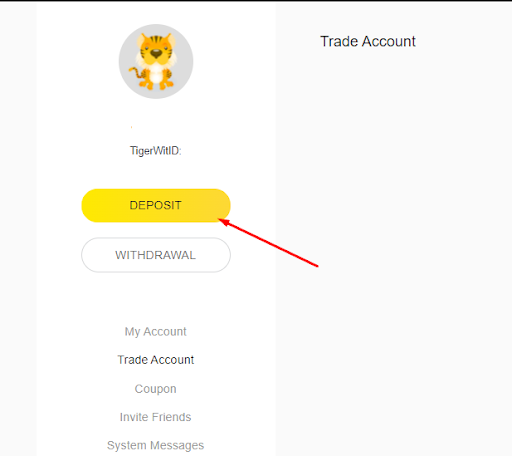

Deposit and Withdrawal

-

TigerWit supports several withdrawal methods such as Neteller, Paysec, and wire transfers.

-

Withdrawal applications are processed on the day they are submitted. After the request is approved, the trader receives funds transferred via Neteller and Paysec within three business days. A wire transfer can take up to five business days.

-

Only clients who have passed verification can apply for the withdrawal of profits.

-

The minimum withdrawal amount is $30.

-

Each client has 4 free withdrawals per month. For each subsequent withdrawal, the company charges $1 as a processing fee.

Investment Options

TigerWit offers investment programs with its proprietary copy trading service, as well as MAM accounts, which allow for earning passive income not only for beginners but also for professional traders. The broker’s clients can also connect to the social trading platform, which is available to all users of the MetaTrader 4 terminal.

Ways to get investment income without actively trading

Investors who prefer to receive passive income in TigerWit have access to:

-

Copying trades of TigerWit Masters. The broker’s website contains a rating of clients with the most successful trading strategies. A potential investor can sort them by the chance of winning (it is measured as a percentage), by the amount of income over the last 30 days, and by the number of connected traders. The profile of each master indicates the minimum investment required to start copying, as well as the percentage of traded assets. The master earns 20% of the income of each connected investor.

-

Copying transactions of traders registered with the MQL4.community. A potential investor chooses a provider on a special showcase of trading signals. Suppliers can be selected based on more than 10 parameters, such as: leverage used, strategy type, minimum deposit, monthly fee, etc. After connecting to the selected signal provider and paying for the subscription, his transactions will be automatically copied to the investors’ account within a month.

-

Investing in MAM accounts. Connecting an investor to the Multi-Account Manager allows him to copy the manager’s transactions, but at the same time, he pays a commission only for successful transactions. Also, the investor can, at his discretion, adjust the position: open or close an order, and/or increase or decrease the amount of the transaction. You can connect to the MAM account only through the MT4 terminal.

TigerWit clients can become not only investors but signal providers. All the conditions for registering as a master are listed on the broker’s official website. To become a MAM account manager, a trader must have 3 or more subscribers and invest at least $3,000 in trading.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

TigerWit’s affiliate program:

-

The Masters program is for traders who want to earn income from other clients of the broker who desire to copy their (the master’s) trade signals. The size of the partner reward is 20% of the profit of the connected investors. A trader who has passed verification, traded for more than 20 days with a profit of 20%, and deposited at least $500 into the account can become a master.

TigerWit generates lists of the best masters and publishes them on the website, thus promoting successful trading strategies. At the same time, a trader who has received the master status cannot copy trades from other signal providers.

Customer support

The support service answers users’ questions 24 hours a day. However, on weekends and holidays, customer service staff are not available.

Advantages

- Anyone can ask a question in Live-chat on the site

- From Monday to Friday, client support specialists are available 24/5

Disadvantages

- Support is unavailable on Saturday and Sunday

- Operators selectively answer questions and suddenly leave the chat

- Experts do not give detailed answers, but simply copy the text from the website

Clients can use the following communication methods:

-

phone (the number is indicated in the footer of the website);

-

email;

-

online chat on the website and in the personal account.

A user can ask a question to the support service even without registering with the broker.

Contacts

| Foundation date | 2012 |

|---|---|

| Registration address | TigerWit LLC, The Financial Services Centre Stoney Ground, Kingstown, St. Vincent and the Grenadines |

| Regulation | FCA, SCB, SVGFSA |

| Official site | https://global.tigerwit.com/ |

| Contacts |

+44(0)203 637 9705

|

Education

A minimum of attention has been paid to learning how to trade on the TigerWit website. Articles on Forex basics can be found in the Products and Guides sections. There is also an Education section on the site, but it does not provide training, it contains answers to questions (FAQs) on the trading conditions of TigerWit.

For trading without risks, the broker recommends opening a demo account with a virtual currency deposit.

Comparison of TigerWit with other Brokers

| TigerWit | RoboForex | Pocket Option | Exness | IC Markets | FxGlory | |

| Trading platform |

MT4, TigerWit app, TigerWit Web | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, cTrader, MT5, TradingView | MT4, MobileTrading, MT5 |

| Min deposit | $50 | $10 | $5 | $10 | $200 | $1 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 8.00% |

| Spread | From 0.6 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 2 points |

| Level of margin call / stop out |

300% / 50% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 20% / 10% |

| Execution of orders | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed Review of TigerWit

TigerWit is an OTC execution marketplace that uses blockchain capabilities to provide increased efficiency, security, and transparency of trading processes. The broker’s clients can trade on their own or copy the trades of successful traders - members of the TigerWit community. The company offers STP accounts (including Islamic) with flexible leverage, as well as training accounts.

TigerWit’s success by the numbers:

-

It has been operating for over 6 years.

-

It has 4 representative offices regulated in different jurisdictions.

-

Client services are in 8 languages.

-

Offers proprietary mobile application, which has been installed by more than 500,000 traders via Google Play.

-

Received a $5 million investment from the American technology company Susquehanna International Group (SIG).

TigerWit is a high leverage CFD broker

TigerWit is suitable for traders who are interested in CFD trading. Through its intermediary, you can make transactions with 40 currency pairs, 2 precious metals (gold and silver), crude oil, natural gas, and cryptocurrencies, including Bitcoin. They also offer to trade CFDs on 20 popular world stocks and stock indices of the USA, Great Britain, Australia, Japan, etc. The minimum order size depends on the asset class: for FX, crude oil, and precious metals, it is 0.01 per lot; for gas and indices, it’s 0.1 per lot; for cryptocurrencies, it’s 0.2 per lot; and for stocks, it is 1 per lot.

The broker gives its clients the right to choose an acceptable trading platform — proprietary TigerWit or MetaTrader 4. Both terminals are available in mobile and web versions. However, MT4 can also be installed on a computer or laptop. TigerWit doesn’t have a desktop version.

TigerWit’s useful services:

-

Blog. It is a section of the site with news, market reviews, forecasts for changes in exchange rates, and the value of popular asset classes.

-

Guides. They describe the copying rules and indicate the Master’s commissions.

-

FAQs. This section contains explanations of the trading conditions offered by the broker.

Advantages:

TigerWit is a large holding company and all its members have received licenses from international regulators.

In addition to the popular MetaTrader 4 platform, the TigerWit proprietary development is available to clients.

The broker offers low-level commissions, the amount of which does not depend on the increase or decrease in trade volumes.

The broker does not prohibit connecting expert advisors, scripts, and trading robots, that is, it allows algorithmic trading.

Muslim traders have access to Islamic accounts that fully comply with Sharia rules.

Registration with a broker takes no more than 5 minutes and takes place online.

All clients of the broker can receive passive income by copying trades and investing in MAM accounts. Successful traders can broadcast signals or become managers and thus receive additional profits for completed transactions.

User Satisfaction