Equiti (Equiti Group) Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- MetaTrader4

- EQTrader

- FCA (UK)

- JSC (Jordan)

- SCA (UAE)

- CMA (Kenya)

- FSA (Seychelles)

- CBA (Armenia)

- 2007

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- MetaTrader4

- EQTrader

- FCA (UK)

- JSC (Jordan)

- SCA (UAE)

- CMA (Kenya)

- FSA (Seychelles)

- CBA (Armenia)

- 2007

Our Evaluation of Equiti Group Ltd

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Equiti Group Ltd is a broker with higher-than-average risk and the TU Overall Score of 4.97 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Equiti Group Ltd clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Equiti offers favorable trading terms for both beginners and experienced traders, as well as investors.

Brief Look at Equiti Group Ltd

Equiti is the joint name of the companies that are part of the Equiti Group Ltd. Holding conglomerate, formed in 2008. The regulators that monitor the business units in Europe, Asia, Africa, and North and South America are six international commissions, including FCA 528328 (UK), JSC 50248 (Jordan), FSA SD064 (Seychelles), SCA 20200000026 (UAE), CMA 107 (Kenya), and CBA 0011 (Armenia). Equiti offers its clients online trading of currency pairs and CFDs on favorable terms, access to the most popular platform among traders, MetaTrader 4, and a pool of liquidity from 35 providers.

- Processing of trades using ECN (electronic communication network) technology without the involvement of a dealing center.

- Operation under the licenses of six regulators and insurance coverage of up to 1 million US dollars per client.

- MT4 and EQTrader trading platforms are available on any device.

- More than 300 assets and no limitations on the use of expert advisors, and scalping strategies.

- Availability of a training demo account and accounts with different minimum deposit sizes.

- The Premiere account allows the client to trade with spreads of 0.0 pips and zero fees on trades with CFDs on US stocks.

- The ability to invest in Multi Account Manager (MAM) trust management accounts, which allow passive investors to earn income without trading independently.

- High minimum deposits on accounts with narrow spreads; e.g., to start trading on the Premiere Account, the client needs to deposit $20,000.

- No bonuses for clients.

- No referral program for retail traders. The company offers remuneration only to introducing brokers (IBs).

TU Expert Advice

Financial expert and analyst at Traders Union

The Equiti Group offers two types of trading accounts. They differ not only in the level of spreads but also in the size of the minimum deposit. The company uses a stop-out system. If the trader's trading account balance falls below 30% of the required margin for an open position, the system automatically starts closing orders. The broker closes the positions that can cause the most losses to the client first.

Traders who want to trade currency pairs with spreads starting at 0.0 pips must open a Premiere account and deposit $20,000 or more. Along with that, there is an additional trading fee on accounts of this type. It is calculated using the nominal value of the currency. The fee for Forex assets is $70 per $1 million, and the fee for metals is $7 per 1 lot of turnover. If a trader buys or sells any currency (except US dollars), the broker calculates the fee by converting the number of lots bought or sold in nominal currency into US dollars.

The official website and user account of Equiti Group are available in four languages, while client support service is available in nine. Although the company does not provide VPS services, clients can obtain servers from third-party providers. The broker also allows clients to apply various strategies, including high-frequency and algorithmic trading using expert advisors.

- You are an experienced trader seeking a diverse range of instruments. Equiti Group Ltd offers forex, CFDs on indices, commodities, shares, ETFs, and cryptocurrencies, providing a broad spectrum of trading options.

- You value global access and diverse account options. Equiti Group Ltd caters to retail, professional, and institutional clients with local offices in Europe, Americas, Middle East, Africa, and Asia Pacific regions, offering flexibility in account types.

- You appreciate educational resources and research tools. Equiti Group Ltd provides webinars, market analysis, and trading strategies to enhance your trading knowledge.

- You are looking for low deposits. Equiti Group Ltd has high minimum deposits on accounts with narrow spreads, such as the Premiere Account, requiring a $20,000 deposit to start trading.

Equiti Group Ltd Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4 (mobile, desktop), EQTrader (WebTrader) |

|---|---|

| 📊 Accounts: | Demo account, executive account, Premiere Account, and Managed Account |

| 💰 Account currency: | USD, EUR, GBP, AED |

| 💵 Replenishment / Withdrawal: | Bank transfers, credit and debit cards, Equiti Union payment cards, Neteller, Skrill, FasaPay, GlobePay, Dinarak, Equiti MasterCard prepaid cards, and local payment systems |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:500 for currency pairs and precious metals, 1:200 for CFDs, and 1:20 for stocks |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 lots |

| 💱 Spread: | Floating, from 0.0 pips |

| 🔧 Instruments: | Currency pairs, precious metals, CFDs on stocks, CFDs on indexes, ETFs |

| 💹 Margin Call / Stop Out: | 100%/30% |

| 🏛 Liquidity provider: | 35 liquidity providers — top-tier banks and prime brokers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution, ECN |

| ⭐ Trading features: | Direct market access, narrow spreads on Premiere accounts, regulatory oversight within six jurisdictions, and the ability to open swap-free accounts |

| 🎁 Contests and bonuses: | No |

Equiti provides two types of ECN accounts for trading, 66 currency pairs, 6 precious metals (including gold and silver), 37 CFDs on indexes, and 240+ CFDs on stocks. Clients are given a fixed leverage. Floating spreads are available on both types of accounts, with the EUR/USD pair starting at 1.6 pips on Executive; and 0.0 pips on Premiere. The type of order execution is market execution. It is allowed to use automatic expert advisors (EAs). The client can trade both standard and micro-lots. The minimum deposit amount depends on the type of account selected. It is $500 for the Executive account and $20,000 for the Premiere account.

Equiti Group Ltd Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

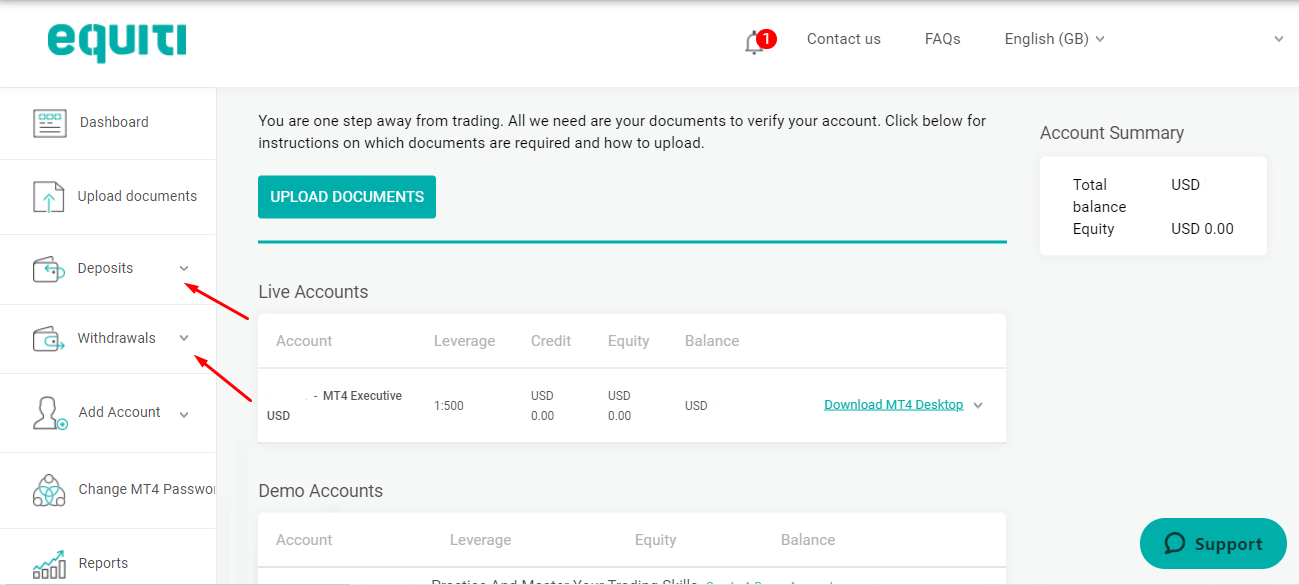

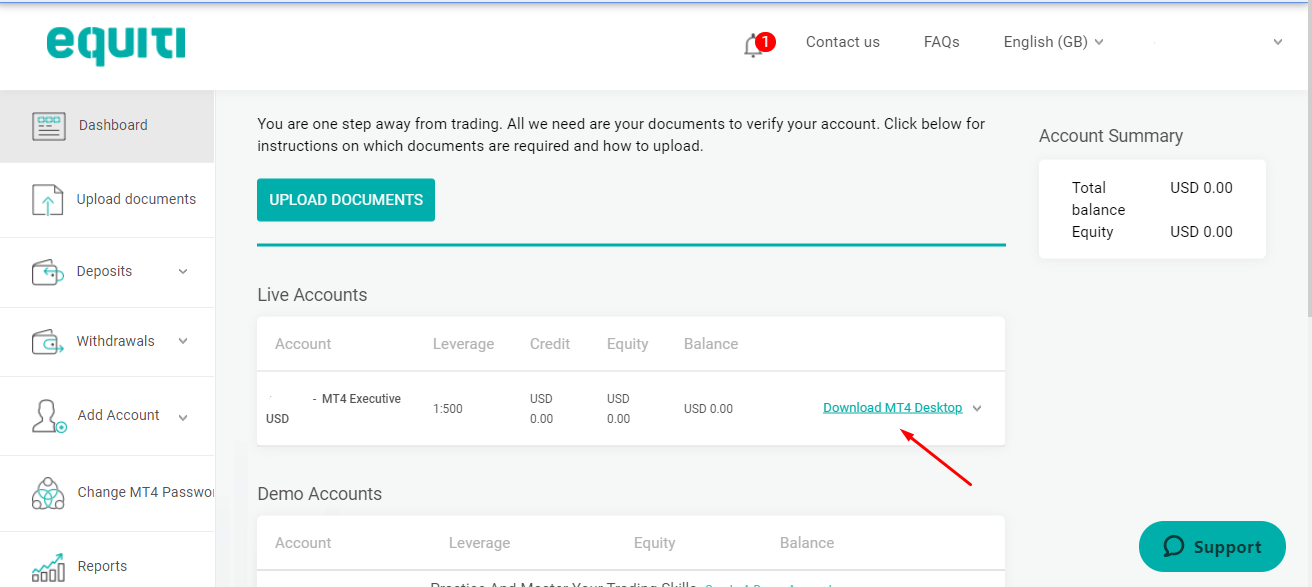

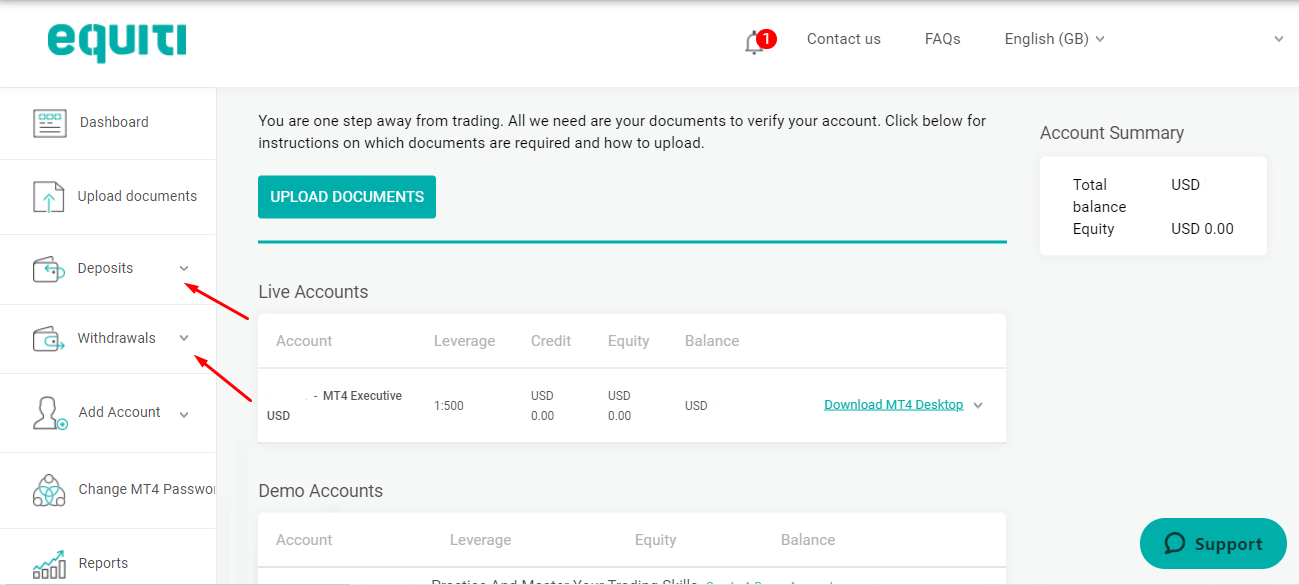

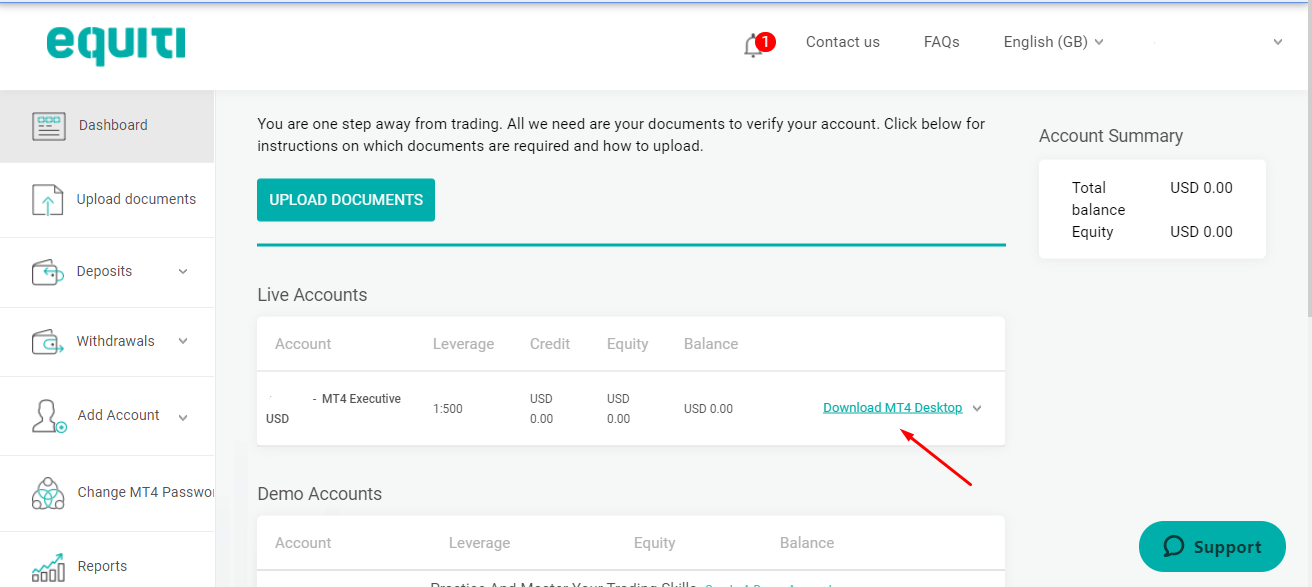

Trading Account Opening

A brief guide to signing up with and opening an account with an Equiti Group broker follows:

Register on the Traders Union website to receive a rebate of the spread from the TU in the future. Next, go to the broker's website using the Traders Union referral link and click "Open Live Account" on its main page.

Fill out the registration form with your contact information (first and last name, phone number, email address, and referral code, if applicable) and personal details (country of residence, date of birth, address, field of professional activity, financial status, and trading experience). To make a deposit and start trading, you need to verify your account. To do this, you need to upload a copy of the front and back of your ID document with a photo. To verify the address, you must also provide a scan of a document issued within the last 12 months. This may be a bank statement or a receipt for utility bills. Note that the document should contain the full name and full address of the residence. It can take up to two minutes to process an application for a new account.

Through the user account, the Equiti client has access to the following functions:

Also, through the user account, the trader can:

-

Select the interface language: English, Arabic, Chinese, or Russian.

-

Generate detailed statistics on active accounts.

-

Change the MT4 password.

-

Open a demo account.

-

Choose the preferred option for receiving marketing newsletters from the company: physical mail, email, phone, or WhatsApp.

-

Go to the section for quick communication with support service via WhatsApp.

Regulation and safety

Equiti Group consists of six regulated business units. Their activities are monitored by the supervisory authorities of the jurisdiction in which the company is registered. In total, Equiti Group is licensed by the following regulators: FCA (UK), JSC (Jordan), SCA (UAE), CMA (Kenya), FSA (Seychelles), and CBA (Armenia).

The broker offers the "Client Funds Insurance" program to retail traders with an account balance of $25,000 or more. The maximum amount of coverage is $1 million per client. This insurance is used to cover losses that may arise as a result of the forced liquidation of positions (margin call). The policy is issued by a leading international insurance company, the name of which is not specified on the equiti.com website.

Advantages

- All client funds are kept in separate bank accounts and are not mixed with the company's funds.

- Clients are protected from falling into a negative balance

- The insurance policy is available to clients from different jurisdictions

Disadvantages

- Insurance coverage is available for accounts with balances of $25,000 or more.

- Trading is not allowed without identity verification

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Executive | From $5 | Yes, for certain payment systems |

| Premiere | From $1 | Yes, for certain payment systems |

When a client transfers an open position for several assets to the next trading day, the broker writes off or credits the funds to the client’s account. The bet amounts are indicated in the "Swaps&Rollover" section.

Traders Union analysts compared the average trading fees of three Forex brokers: Equiti Capital, RoboForex, and PocketOption. Based on the comparisons, each company was assigned an appropriate fee level.

| Broker | Average commission | Level |

|---|---|---|

|

$3 | |

|

$1 | |

|

$8.5 |

Account types

Equiti provides traders with two types of ECN accounts with the market watch. Clients can trade the entire range of available assets with fixed leverage from both accounts using the MetaTrader 4 platform. Each client can have no more than three trading accounts.

Account types:

Equiti provides clients with a training demo account.

The broker provides accounts with a variety of trading terms, allowing not only active, experienced, and novice traders, but also passive investors, to find a suitable option.

Deposit and Withdrawal

-

Equiti clients are not charged a fee for withdrawing funds through a bank transfer within the country, as well as through Dinarak, FasaPay, GlobePay systems, and credit or debit cards. Withdrawing funds to international bank accounts costs 30 USD, 10 EUR/GBP, and 100 AED/SAR; on Neteller and Skrill, the fee is 1%, but no more than 30 USD/EUR/GBP/JOD, and 100 AED/SAR.

-

The minimum withdrawal amount depends on the selected payment system. Clients can withdraw from $30 or the equivalent in local currency via FasaPay and local payment systems, Dinarak — from 25 JOD, GlobePay — from 30 USD/EUR/GBP, 100 AED, 2000 INR, Neteller, and Skrill — from 30 USD/EUR/GBP/JOD, and 100 AED/SAR. The minimum withdrawal amount by bank transfer is 25 JOD, 50 USD/EUR/GBP, and 100 AED/SAR, while the minimum withdrawal amount to a bank card is 30 USD/EUR/GBP/JOD/AED/SAR.

-

Withdrawal requests are pending for 1-5 business days for local payment systems, and 1 business day for bank cards, Neteller, Skrill, Dinarak, FasaPay, and GlobePay. Withdrawal processing time for bank transfers is 1 business day within the country and 3-5 business days on withdrawal to international bank accounts.

Investment Options

In addition to independent trading, Equiti Capital clients can use the broker's investment solutions. Currently, the company does not offer copy trading. However, traders who work in MetaTrader 4 can connect to social trading platforms provided by third-party signal providers. Also, to receive passive income, investors can invest in managed MAM accounts.

The Money Manager Program is an investment solution for money management developed by Equiti Group

Equiti Capital clients who cannot or do not want to trade independently can open a Managed Account. It is a virtual investment account that is automatically linked to the account of the manager chosen by the investor. The manager trades with both his own funds and the capital entrusted to him. The investor can monitor all online trades but cannot interfere with the manager's trading.

Features of the Money Manager Program are:

The client can deposit into the investment account only by internal transfer from a trading account through the user account. The income from managed accounts is also withdrawn to a previously opened trading account.

The amount of leverage on the trust management account is determined by the MAM manager, who makes trades in MT4. The investor cannot change the size of the leverage.

Managed accounts do not have access to the MetaTrader 4 trading platform. The investor can track his trades and open positions through his user account on the website.

By default, managed accounts reach the stop-out level when the investor's capital drops to 30% of the margin used. Also, the owner of a trust account can manage risks by setting a certain stop-out level.

To participate in the Money Manager program, a trader must first register on the broker's website, open a trading account, and then open a managed account. After selecting the manager and agreeing to the terms of the limited power of attorney, the investor can deposit capital that will be used by the manager to make trades.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Equiti Capital’s referral program:

Introducing broker (IB) is a program that allows partners to earn income from each trade completed by the broker's clients on the market. The remuneration is negotiated with the potential partner on an individual basis over the phone.

The introducing broker does not execute trades or provide back-office services, since these are handled by Equiti. The IB can track the activity of connected clients online through the user account.

Customer support

The client can ask a question to a chatbot on the website at any time of the day. The call center is available 24/6 from Sunday to Friday.

Advantages

- The website's virtual assistant is available 24/7

- Support is provided in 9 languages

Disadvantages

- No live online chat with a specialist

The broker is reachable through the following channels:

-

a call to the numbers listed at the bottom of the website's main page and in the user account;

-

email;

-

request via a chatbot on the website;

-

WhatsApp messaging (the service is available only to registered clients);

-

contacting company representatives via Facebook or Twitter.

Client support can be contacted not only by Equiti Group clients but also by traders who have not yet opened a trading account with a broker.

Contacts

| Foundation date | 2007 |

|---|---|

| Registration address | Second Floor, Jouba Complex, Suliman Al Nabulsi St 32, Boulevard, Jordan |

| Regulation |

FCA (UK), JSC (Jordan), SCA (UAE), CMA (Kenya), FSA (Seychelles), CBA (Armenia)

Licence number: 50248, 528328, 607136, 0011, AAAAFF, Seychelles |

| Official site | https://www.equiti.com/ |

| Contacts |

+962 6 550 8305, +44 203 519 2657

|

Education

The educational section of the Equiti Group platform is called Academy. It contains e-books, lessons in video format, and infographics on financial markets. There is also a webinar sub-section. It is currently incomplete, but the company intends to add a comprehensive program of online educational lectures from leading Equiti Capital analysts in the future.

A beginner can open a demo account with virtual currency at Equiti Capital to master the fundamentals of trading currency pairs and CFDs.

Comparison of Equiti Group Ltd with other Brokers

| Equiti Group Ltd | RoboForex | Pocket Option | Exness | Vantage Markets | InstaForex | |

| Trading platform |

EQTrader, MetaTrader4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, WebTrader, Mobile Apps | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $500 | $10 | $5 | $10 | $50 | $1 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 30% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 30% / 10% |

| Execution of orders | Market Execution, ECN | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of Equiti

Equiti Group is a fintech (financial technology) company and an online platform for trading assets in the currency and financial markets. It has offices in Europe, North and South America, the Middle East, Africa, and the Asia-Pacific region. The broker's operation is regulated by six reputable international commissions. Equiti Capital provides clients with access to individual, professional, and institutional brokerage services through a network of branches and subsidiaries.

Equiti Group holding activities by the numbers:

-

More than 13 years of providing brokerage services.

-

Regulated in 6 jurisdictions.

-

Over 300 assets are available for trade.

-

300 team staff.

-

Client support is available in 9 languages.

Equiti Group is a world-class provider of Forex online trading technologies

Equiti is an STP, DMA, and NDD broker that provides ECN accounts for trading currency pairs and CFDs. The company allows its clients to enter the international market and trade UK, US, and EU stocks. CFDs on American stocks are traded with zero fees. Client positions are not held by the company; instead, they are sent directly to liquidity providers, which are represented by 35 top-tier banks and prime brokers with aggregated prices. Such a pool of liquidity ensures the execution of trades at the best prices. Equiti's trading servers are located in London.

The broker's clients can trade via the desktop or mobile MetaTrader 4 platform. The platform works on Windows, iOS, and Android devices. Clients can also use the EQTrader web platform, which requires no installation. The company's own WebTrader has a user-friendly, customizable interface and supports a large number of built-in technical indicators, charts, and display tools. The web terminal's trading panel displays the trade value and available margin even before the order is placed, which is a handy function.

Useful Equiti services:

-

Trading schedule on holidays. For maximum visualization, trading instruments are grouped by asset classes. The table provided on the website shows London time.

-

Expiration dates. The expiration dates of the current contracts (the time of the last trade) and the start date of trading in the next contracts (the time of the first trade).

-

Indicators master. It is a button in the WebTrader user panel that allows a trader to add useful indicators such as Trend, Oscillators, Customize, and Bill Williams.

-

Monitoring lists. It is available in the EQTrader web platform. The client can add currency pairs, commodities, stocks, and indexes to favorites.

-

Insight. A section of the website that contains the economic calendar, the latest news, useful articles, market reviews, and reports generated based on technical analysis.

Advantages:

The broker offers a wide range of payment systems. Deposits and withdrawals are possible not only using bank cards and wire transfers but also electronic wallets.

Client service in 9 languages is available 24/6.

Clients can trade from any device, including mobile, desktop, and tablet computers. A web platform developed by EQTrader does not require installation.

Traders can trade CFDs on stocks of 18 European, 33 British, and 214 American companies.

Providing free analytics from in-house experts, as well as access to webinars, workshops, practical trading guides, and exclusive events aimed at improving trading skills.

Equiti clients are allowed to hedge positions and scalp.

User Satisfaction