The MetaTrader 4 platform is still the most popular trading terminal among traders, so many brokers offer access to it even if they have their proprietary platform. Therefore, many platforms for copying trades also work with MT4. This terminal connects both the proprietary copy trading services and independent social trading platforms providers, such as MyFxBook or ZuluTrade. Also copy trade is available on MetaTrader 4 from the official Traders Union MQL5 working with MT platforms.

Interested in Copy Trading? - Try RoboForexWhat is copy trading?

Social trading has become very popular over the past 10 years and the first trade copying service was developed in 2010. Since then, similar platforms have appeared both at brokers and as independent stand-alones. Brokers use them to attract clients and expand their functionality.

After the trader (strategy provider) opens a trade, it is automatically opened in the trading terminal for all subscribers. If the transaction is profitable, all those who have opened it get profit. However, if the strategy provider opens a trade at a loss, everyone will also suffer losses. Therefore, it is necessary to be cautious about your choice of traders.

The first copy trading service was developed in 2010. Since then, over 50 such platforms have appeared. Both proprietary services and independent platforms, such as MyFxBook and ZuluTrade are among them. Moreover, MetaTrader has an official community called MQL5, which also has a service for copying trades.

MetaTrader MQL5 copy trading review

MQL5 is the leading service of the MetaTrader 4. This is the official community of traders working with the MetaTrader terminals, and a large number of tools for trading terminals are provided here. In particular, there is an app store for MT, an overview of trading instrument quotes, an economic calendar, a VPS for trading, and much more.

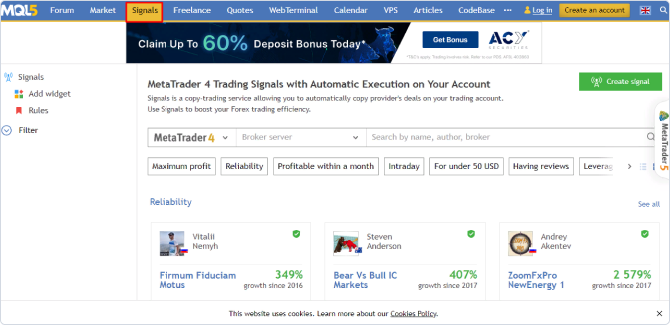

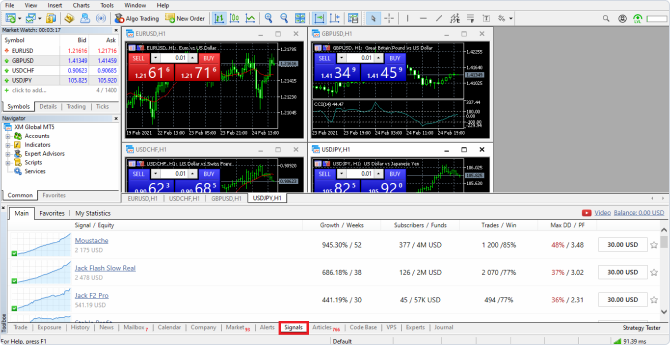

At MQL5, copy trading is represented by 1050 signal providers. To get acquainted with them, go to the Signals section, which is located in the upper menu of the platform.

Trader statistics

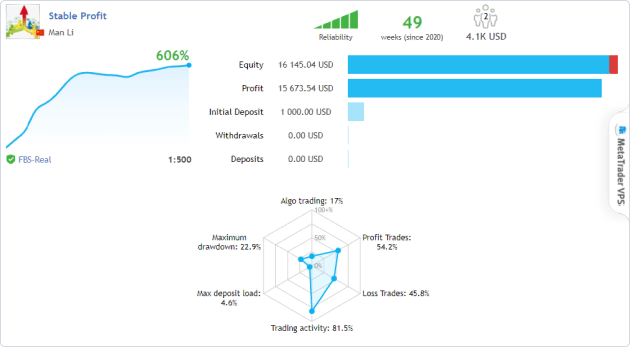

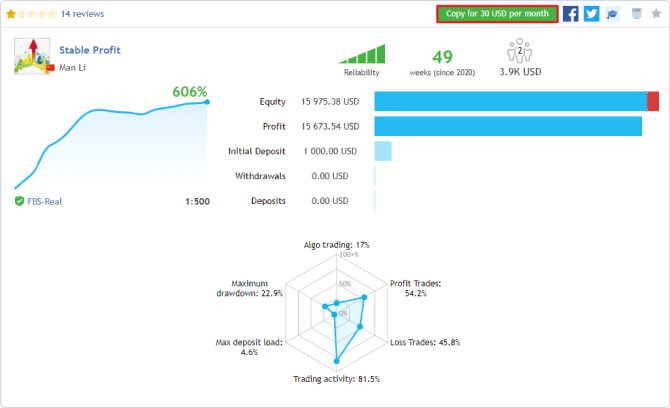

Trader statisticsMQL5 provides a large amount of information about strategy providers. In particular, traders are provided with 8 criteria for choosing a trader.

The list includes:

-

reliability – shows the risk level of the trader's trading strategy;

-

the number of weeks the account has been active;

-

the number of subscribers;

-

current balance;

-

profit;

-

initial deposit;

-

replenishment;

-

withdrawal.

The information is presented in the form of figures, charts, and infographics, so it is quite convenient to get acquainted with the data about the trader.

It is also worth noting the financial data.

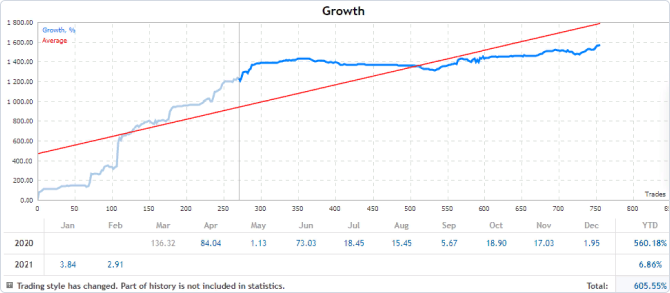

The platform provides users with three charts:

-

increase in funds;

-

profit;

-

the capital to balance sheet ratio.

There is a line of averages on the charts, so you can compare the financial success of a trader with the average on the platform.

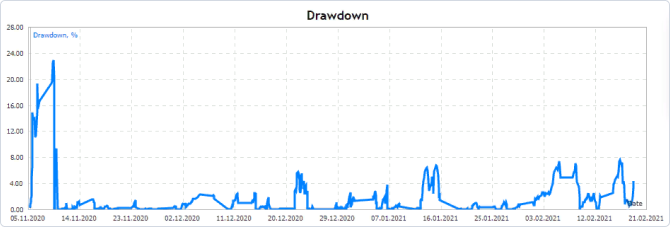

The drawdown chart is also available on the service. The data here is presented as a percentage ratio by date.

Social network and forum

Social network and forum

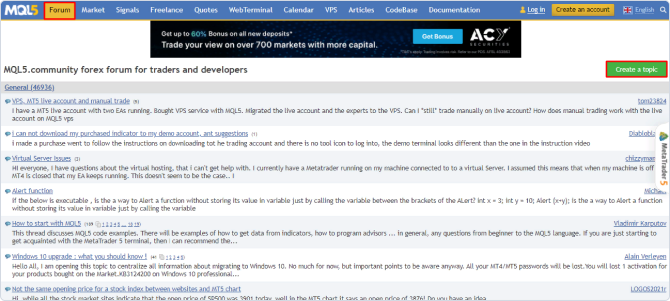

is a full-fledged social network of traders. It implements the functions of communication between traders and obtaining useful trading information. First of all, this is a forum. The MQL5 forum is quite active, and new topics are regularly created here.

However, there is a disadvantage. The forum is not structured, and all topics are created in a single section. You will have to search information manually for copy trading. This can take a long time, given that there are almost 47,000 topics on the forum. You can also get the information you need by creating your own discussion group. Click on the Create a Topic button.

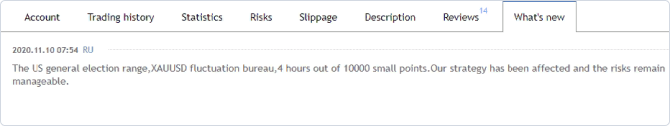

You can also get information in the trader's profile providing trades for copy trading. The platform has a blog where signal providers can publish the latest news about the markets or write about news or changes for subscribers. You can find the trader's blog in his account. Click the What's new section to read it.

How to monitor traders to whom you subscribe

How to monitor traders to whom you subscribeThe statistics of the account managers to whom you subscribe are monitored through the My Subscriptions section. Here are the key data about managers. In particular, you will be able to view the profitability, the number of transactions, and the types of transactions, etc.

MQL5 copy trading network review in 2025

A platform for copy trading |

MQL5 |

Regulation |

Depends on the broker |

Terminals |

MT4, MT5 |

The number of brokers offered |

Most brokers that work with MT4 and MT5 |

Top brokers |

AvaTrade, XM, IC Markets, Pepperstone |

The minimum investment for copy trading |

From $1. Set by the broker and signal provider |

Commission for using the service |

No |

Traders' commission |

From 1 to $1,000 per month. The average is $50 |

Types of accounts |

Set by the broker |

Network size |

1050 signal providers |

Markets |

Forex, CFD, cryptocurrencies, stocks, and commodities. The list of markets depends on the broker you select. |

How to get started to copy traders on MT4

The mechanism for subscribing to traders on different copy trading platforms is implemented in different ways. Let's consider the procedure for copying trades in MetaTrader 4 using the example of MQL5.

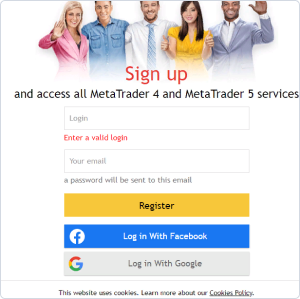

Registration

RegistrationYou need to have trading accounts with a broker and a copy trading service to copy trades via MQL5. Click on the Create an Account button on the main page to open an account on MQL5.

The form includes only two items:

-

1

user name;

-

2

email address.

After that, you will get an email with a login password to the email address specified. Next, log in to the platform. You can also register via Google or Facebook.

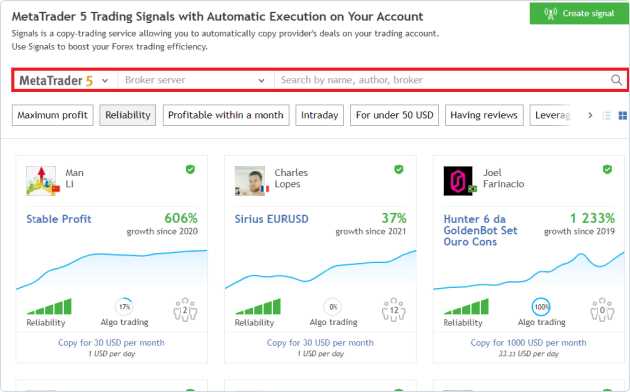

How to copy trade via MQL5

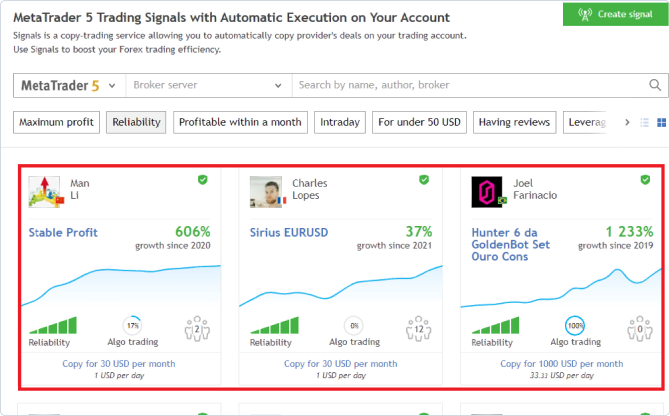

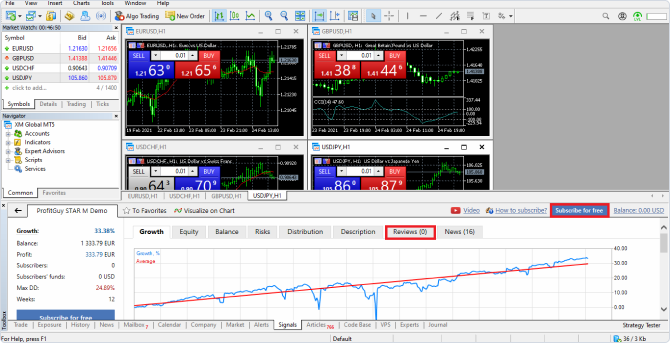

How to copy trade via MQL5The connection is made directly through the copy trading service for some brokers cooperating with MQL5. After you log in and follow the copy trading page, select a trader. Detailed statistics are provided in the accounts of the MQL5 signal providers, but after you go to the platform, you will see a brief overview.

The following data is provided there.

-

1

percentage return;

-

2

profitability curve;

-

3

signal security;

-

4

percentage of algorithmic trading usage;

-

5

number of subscribers.

You can use filters or categories to customize your search.

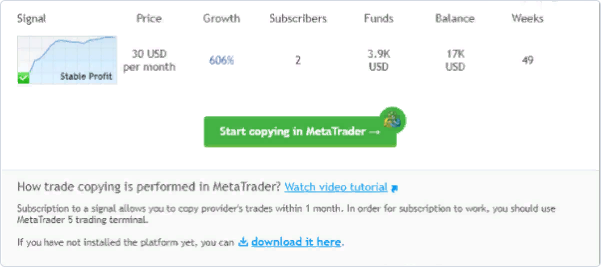

When you find a suitable strategy provider, follow his profile. The Copy button is located on the top panel. If the signals are paid, the subscription price will also be indicated on the button. In the example below, the subscription price is $30, so the button says “Copy for 30 USD per month”.

After that, you will see a window on MQL5 to confirm your subscription. Here you will also find brief statistics of the signal provider.

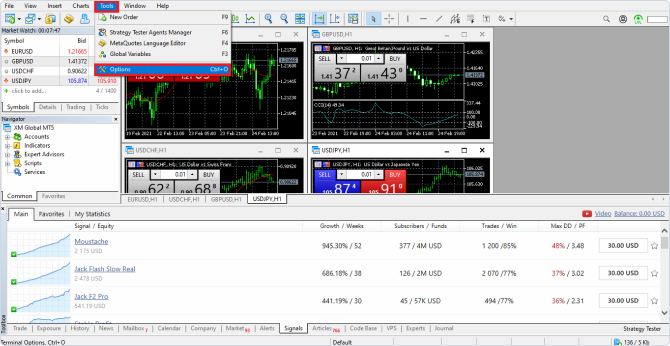

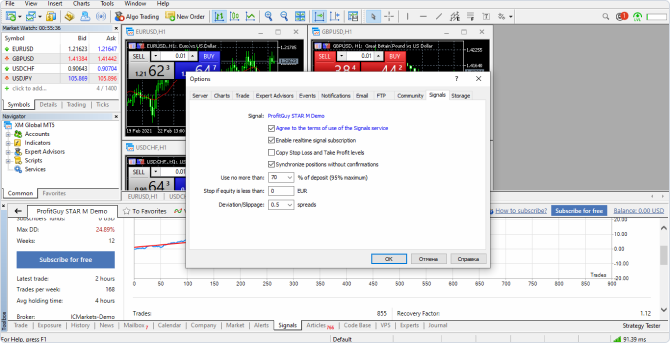

How to customize copy trading via MT4

How to customize copy trading via MT4Some brokers subscribe to signals via a trading terminal. If you need to connect in this way, open a trading terminal after registering in MQL5. Next, open the Toolbox menu and select Signals. You will see a list of signal providers that is identical to the one available on MQL5.

After that, open the Tools menu and click on Options.

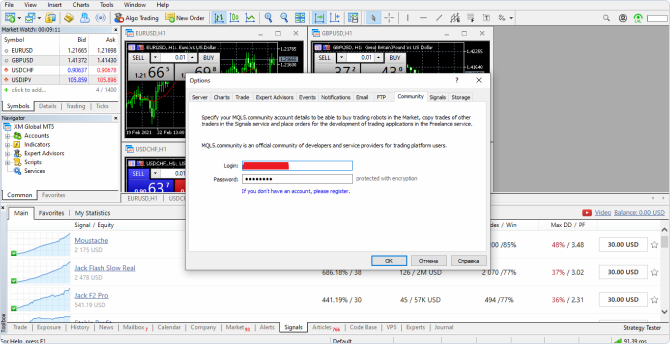

You will need the Community item in the Options menu. After that, MetaTrader 4 will prompt you to create an account in MQL5. If you have done this before, select “If you have an account, please log in”. Here you specify the username and password from MQL5.

After completing the authorization, select the trader to copy from among the list that appears after clicking on Signals. Click on the nickname and click Subscribe.

Next, configure the copy trading. The MQL5 platform on MetaTrader 4 will prompt you to specify the following parameters:

-

1

copy Take Profit and Stop Loss;

-

2

synchronization of positions without confirmation (if you clear a tick box, each transaction copied will need to be confirmed manually);

-

3

closing the trade if the deposit amount goes below the values allowed (specify the amount);

-

4

limit of spreads for execution.

After that, just click OK and all the trades that the signal provider will open will be opened in your MetaTrader 4 terminal.

How to copy the best traders in MetaTrader 4

The choice of traders differs, depending on the platform you use for MT4 copy trading. Let's consider how to choose a strategy provider, using the example of the MQL5 platform. First of all, the search will help you find a trader on MQL5. This is an effective way if you know the nickname of the strategy provider.

In the search, you can select:

-

trader's name

-

account name

-

the broker

that the strategy provider works with.

Moreover, there is a server search on MQL5. The list includes servers of all companies that are partners of MQL5.

The category’s availability is among the MQL5 search options. After clicking them, the service will automatically sort from best to worst.

The categories on the platform are as follows:

-

1

by maximum profit;

-

2

by signal reliability;

-

3

by profitability for the month;

-

4

-

5

signals for traders with a deposit bot more than $50;

-

6

has been reviewed;

-

7

the leverage is up to 1:100;

-

8

uses automated trading.

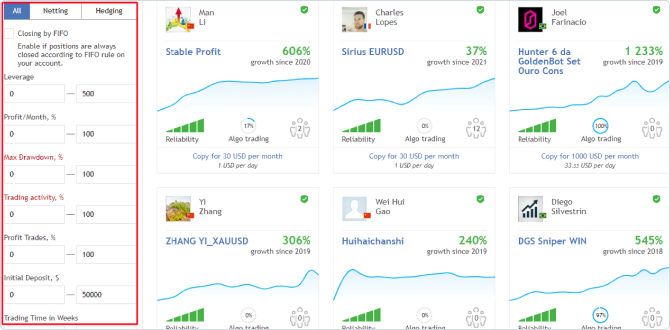

Filters

FiltersYou can also search for suitable traders using filters. MQL5 offers subscribers 10 options for choosing trading signal providers.

The list includes:

-

1

leverage ratio;

-

2

the amount of profit per month (as a percentage);

-

3

maximum drawdown;

-

4

trader activity;

-

5

percentage of profitable trades;

-

6

initial deposit amount;

-

7

account activity time (in weeks);

-

8

number of transactions per week;

-

9

number of users copying trades;

-

10

subscription cost.

MQL5 filters have their own features. In particular, users can choose between netting and hedging traders. You can also select the "Close by FIFO" option. It is intended for traders who work according to the FIFO (First In, First Out) rule.

The pros and cons of MT4 copy trading

👍 Pros

• A well-known platform that many brokers and traders work with

• Support for a large number of copy trading services

👎 Cons

• Adjust the options for copy trading can be complicated

Can I make money by copying traders on MT4?

MT4 copy trader services help you get extra profit. Moreover, trades are displayed in your trading terminal, so you can gain extra trading experience and master the traders' strategies. The profitability of a copy trading depends on the degree of risk of the signal provider's strategies, and the trading instruments used, etc.

However, the MetaTrader social trading services don't provide a guaranteed profit. There are also risks here. If the strategy provider opens a losing trade, all subscribers will suffer losses. Therefore, it is extremely important to follow the rules of capital management and choose the best traders.

How to use ZuluTrade copy trading in MT4

ZuluTrade pros and cons

👍 Pros

• Simple and user-friendly interface

• Well-developed statistics

• Proprietary licenses

👎 Cons

• Blog and forum are rarely updated

• There are commissions for using the service

• Filters work inefficiently

Main features of the provider

Regulation |

Greece and EU (HCMC), USA (CFTC), Japan (KFB) |

The number of brokers offered |

34 |

Top brokers |

AvaTrade, FXCM, IC Markets, TickMill, EverFx, WelTrade, Axi, InstaForex, FX Open, AAAFx, Oanda, Swissquote |

The minimum investment for copy trading |

Is indicated by the broker. On average from $50 to $1,000. Combos service is from $2,000 |

Commission for using the service |

Profit Sharing Plan: $30 monthly subscription + 25% share of profits. Classic Plan - depends on the broker chosen. On average, $20 per standard lot for a currency pair. |

Brokerage commission |

Execution fees are charged according to your broker's terms. |

Types of accounts |

Profit Sharing, Classic |

Network scale |

Over 1,000 strategy providers |

Markets |

Forex, CFD, cryptocurrencies, stocks, commodities. The list of markets depends on the broker you choose. |

How to use MyFxBook Copy trading in MT4

MyFxBook pros and cons

👍 Pros

• Copying trades on the platform is free (a commission may be charged by brokers)

• Convenient analytics for traders

• You can try copy trading on a demo account

👎 Cons

• There are no filters for searching traders (only sorting is available)

• The interface is outdated and obsolete

• The connection is slow

Main features of the provider

Regulation |

Doesn't accept funds from users, doesn't need licensing |

The number of brokers offered |

39 |

Top brokers |

Tickmill, IC Markets, FxOpen, Pepperstone, Axi (Axitrader) |

The minimum investment for copy trading |

$1,000 |

Commission for using the service |

0%* |

Signal providers |

185 |

Brokerage commission |

Depends on the broker |

Types of accounts |

Depends on the broker |

Markets |

Forex, CFD, crypto, indices, commodities (depends on the broker) |

* a commission may be charged by brokers

What are MT4’s fees for copy trading?

The fees for copy trading on MetaTrader 4 depend on several factors. First of all, they vary, depending on the brokers. Companies can set their own commissions or mark-ups. Due to this, they pay affiliate remuneration to the platforms that provide copy trading.

A copy trading service commission may also be charged. In particular, this is practiced by ZuluTrade.

There are two tariff plans here:

Profit-Sharing

this type of account provides a commission of $30 per subscription and 25% of the transaction profit.

Classic

this plan is calculated as the price per trading lot. The price may vary depending on the broker. The average commission is $20 per lot.

The MQL5 copy trading service doesn't charge commissions for transactions, but there are payments to traders. The commission is charged in the form of a subscription. The cost varies from 1 to $1,000, the average cost is $50. Some traders provide signals for free.

As for MyFxBook, the platform doesn't charge a commission either for transactions or strategy providers’ benefits. The service gets revenue from advertising and partner fees from brokers and independently pays remuneration to clients.

Summary

MetaTrader 4 is a popular trading platform. It is used by many brokers, so many copy trading services work with this terminal. Brokers offer both their own services and independent platforms, such as MyFxBook or ZuluTrade. However, MQL5 is still one of the most popular independent services. This is a copy trading service from the official MetaTrader community.

Each platform has its features, advantages, and disadvantages. The principles of connection and the terms of commissions also differ because they depend both on the site and directly on the broker you work with. MetaTrader alone is not a broker, so before choosing a platform, it is important to read the terms of copy trading in the company you cooperate with.

Expert review

The MetaTrader 4 trading terminal, despite its “age”, is still among the most popular. It provides clients with huge opportunities and it is possible to work with a large number of tools for independent trading (if there are no tools, you can add them), and use automated trading, etc. However, the main advantage is that many copy trading services are focused on MT4.

With the help of copy trading on MetaTrader 4, you can get extra income but also valuable information about the trading strategies of successful traders. If you cooperate with MQL5, you can even choose a signal provider through the trading terminal. The choice of selecting a copying transactions service depends on your preferences, but the pool is quite large.

Antony Robertson,

Traders Union Financial Analyst

MetaTrader 4 copy trading reviews

-

1

Cecilia Erickson, 29, New York

I decided to choose MQL5 for copy trading since I work with MT4 and am a member of the Union. I was attracted by a good range of traders. After a year of work, I can say that the service helps to make a profit. However, I consider the commission in the form of a subscription to be a disadvantage since you have to pay not only for profitable but also unprofitable transactions.

-

2

Blak Clifford, 44, New Jersey

I use ZuluTrade to copy trades via MetaTrader 4. I like that it is quite simple to connect to and it is convenient to choose traders. Moreover, I also appreciate the Combos service. However, the commissions of this copy trading service, in my opinion, are quite high. This is the main disadvantage.

-

3

Angel Gimson, 42, Washington, D.C.

I've been working with MetaTrader 4 for a long time, but I decided to try copy trading only 5 months ago. To do this, I chose the MyFxBook platform because I also use it for analytics in independent trading. The platform is stable and allows you to make a profit. The commission policy is very profitable. Only the outdated interface spoils the impression.

FAQ

Can I connect copy trading to the online version of the MT4 trading terminal?

Some copy trading platforms offer the ability to connect to the online version. However, connecting to desktop terminals is more popular.

Are there any traders offering only auto trading?

This also depends on the platform you are working with. For example, there are such traders on MQL5.

Can brokers charge a commission for connecting to MT4 copy trading services?

It depends on a broker’s policy. As a rule, the commission is charged in the form of a mark-up to the spread in each direction.