deposit:

- 149

Trading platform:

- MT4

- MT5

Leveled Up Society Review 2024

deposit:

- 149

Trading platform:

- MT4

- MT5

- One type of account

- four balance options

- refundable initial fee

- profit split is 80% to traders

- advisers and bots are not allowed

- transfer of positions overnight and trading during the weekends are allowed

- wide choice of assets

- high leverage

- Up to 1:100

Summary of Leveled Up Society Trading Company

Leveled Up Society is a moderate-risk prop trading firm with the TU Overall Score of 5.38 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Leveled Up Society clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. Leveled Up Society ranks 22 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Leveled Up Society provides beneficial trading conditions similar to its leading competitors. The platform offers a reliable broker, many financial instruments, and high leverage. The challenge is two-phase, the initial fee is refundable, and trading restrictions are minimal. The profit split of a trader is 80%, which is good. From the first day of trading on a live account, LUS traders can use the maximum leverage. They only need to place a stop loss and monitor the drawdown. As an additional income, socially active traders can receive payments for invited users.

Leveled Up Society (“LUS”), an American prop (proprietary) firm, offers funding to traders who are ready to complete a two-phase challenge. The first phase lasts 30 days, and the second lasts 60 days. The trades are not brought to the interbank market during the challenge. When traders complete the challenge, they receive a balance ranging from $25,000 to $200,000, with the possibility of scaling up to $1,000,000. Leveled Up Society offers only one type of account. No instant funding is available. The initial fee starts at $149, but depends on the balance; and it is refundable upon the successful completion of the challenge. Traders’ profit split is 80%. Currencies, cryptocurrencies, stocks, indices, metals, commodities, and raw materials are available for trading. Leverage depends on the asset, its maximum is 1:100. The prop firm is partnered with the Eightcap broker. The platform offers a standard referral program with bonuses for invited users.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $149 |

| ⚖️ Leverage: | Up to 1:100 |

| 💱 Spread: | No |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, commodities, raw materials, and metals |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Leveled Up Society:

- Universal account conditions, transferring positions overnight, and trading during the weekends are available;

- Clients need to trade for at least 5 days within a 30-day cycle. There are no other restrictions;

- There is no mandatory profit target, traders only need to monitor the drawdown;

- Partners’ profit split is 80%. No additional fees are charged;

- Withdrawal of profits is possible to bank cards, e-wallets, or crypto wallets;

- Upon completion of the challenge, partners of the platform receive up to $200,000 on their accounts;

- Scaling is available to each partner of the firm. The maximum balance is $1,000,000.

👎 Disadvantages of Leveled Up Society:

- Despite the freedom of action, there are still some restrictions. For example, it is necessary to keep the delay when trading news;

- The firm’s partners can trade only through MetaTrader 4 (MT4) and MetaTrader 5 (MT5); thus, other trading platforms are not available;

- Technical support of Leveled Up Society can be contacted via email and live chat.

- A call center, which is the most efficient communication channel, is not available.

Evaluation of the most influential parameters of Leveled Up Society

Trade with this prop-trading company, if:

- You prefer a flexible profit target approach. Leveled Up Society doesn't impose mandatory profit targets, allowing traders to focus on monitoring drawdown instead.

- You appreciate a generous profit split. Partners enjoy an 80% profit split, with no additional fees charged.

- You prefer diverse withdrawal options. Profit withdrawals are possible to bank cards, e-wallets, or crypto wallets, providing flexibility in accessing funds.

Do not trade with this prop-trading company, if:

- You require trading on platforms other than MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The firm's partners can only trade through these platforms, limiting options for traders who prefer alternative platforms.

- You need immediate assistance. While technical support is available via email and live chat, there may be limitations in accessing real-time assistance for urgent matters.

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Leveled Up Society News

- Analysis of Leveled Up Society

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Leveled Up Society

- User Reviews of Leveled Up Society

- FAQs

- TU Recommends

Geographic Distribution of Leveled Up Society Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Leveled Up Society

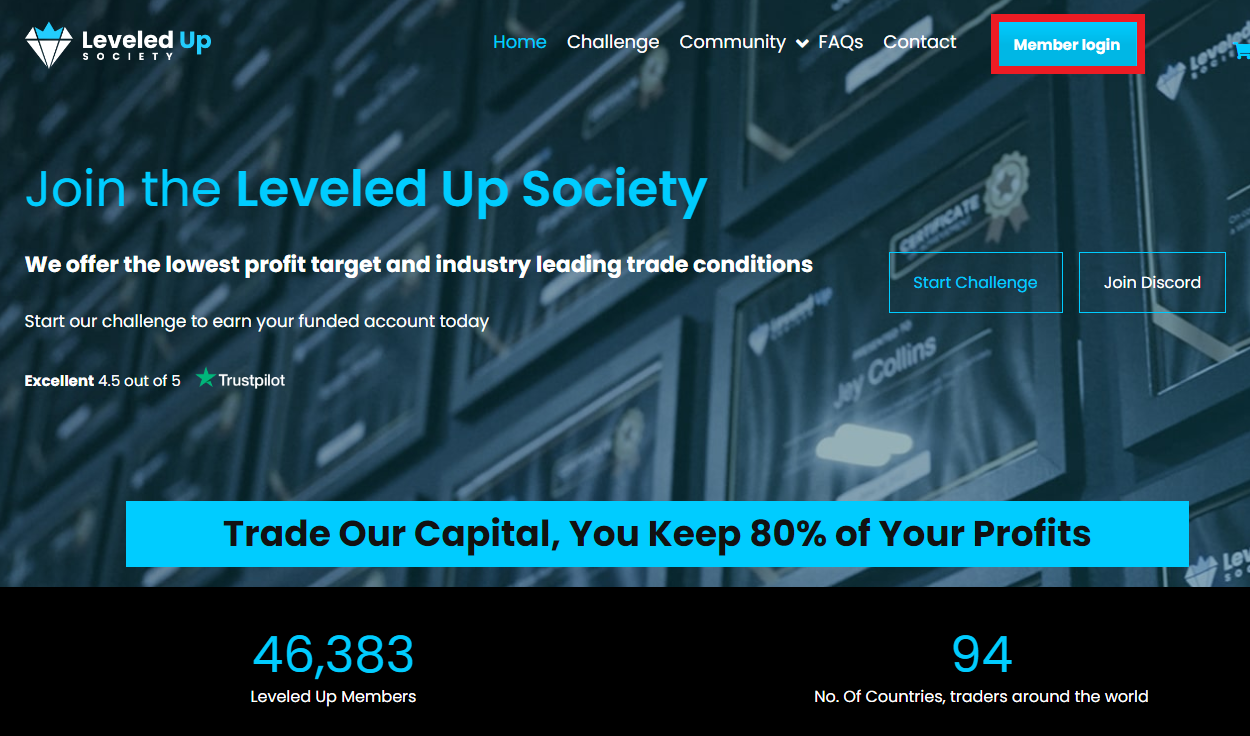

Leveled Up Society is one of the youngest representatives of its segment. However, being a partner of the Australian broker, it quickly gained confidence in the global market. Now the firm has more than 40,000 traders from 94 countries, which is a significant achievement. In addition, the Trustpilot platform gives the firm 4.5 out of 5 points, which is a high score.

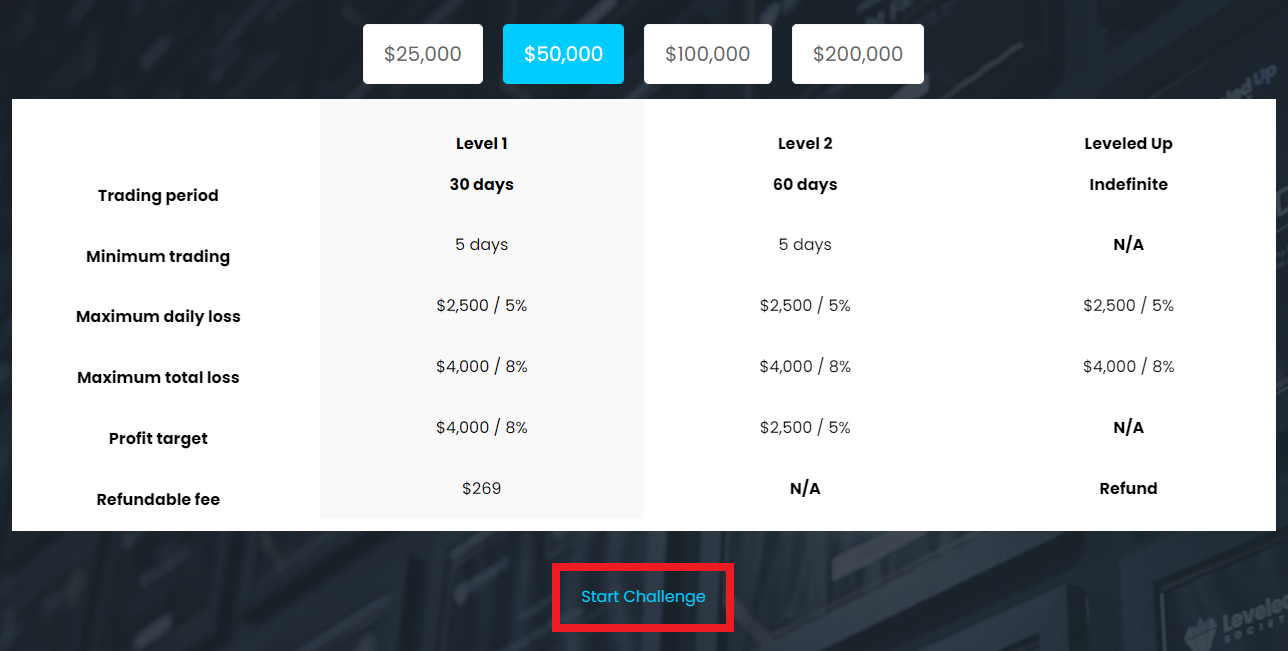

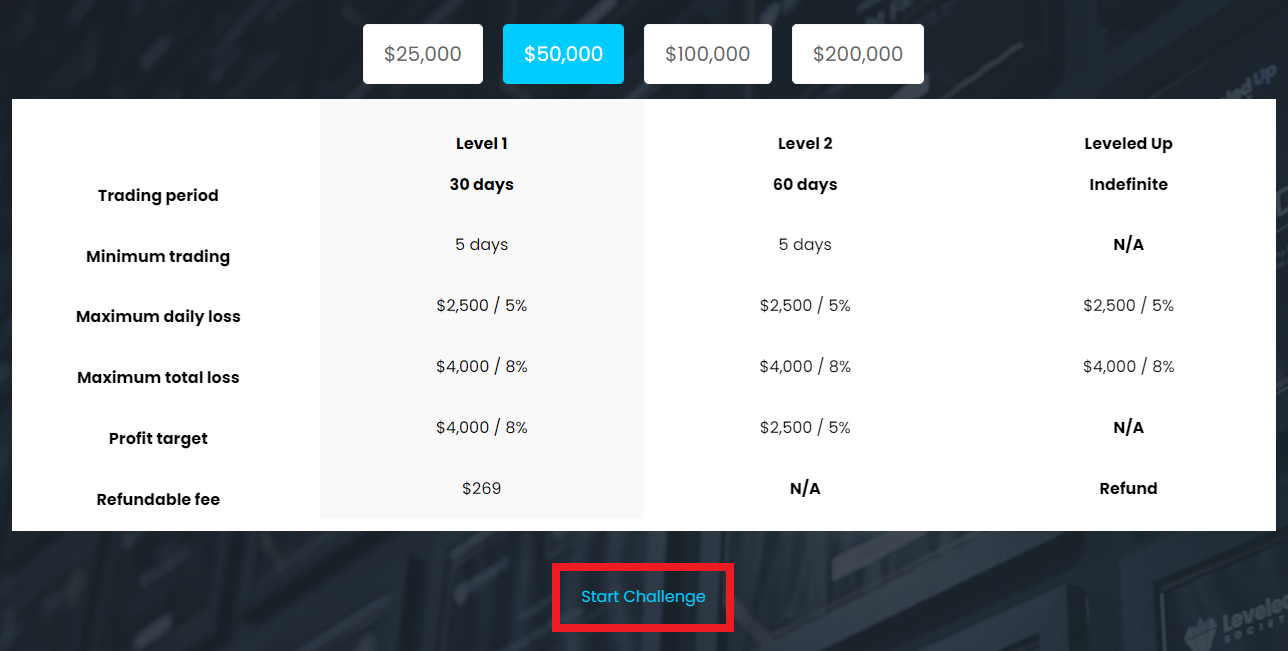

The prop trader does not offer unique mechanisms for its trading conditions. Everything is simple, transparent, and intuitive. Traders choose a balance from $25,000 to $200,000, pay initial fees, and complete a two-phase challenge. In the first phase, which takes 30 days, your profit target is 8% and in the second 60-day phase the profit target is 5%. During the challenge, traders work on demo accounts, but with real quotes. Upon successful completion of two phases, traders become partners of the prop firm, their initial fee is refunded, and their account gets funded by LUS.

The account balance can be scaled. To do this, you need to constantly trade in the positive. Then, regardless of the initial funds, the amount can be incrementally increased up to $1,000,000. Traders have the opportunity to transfer positions overnight and trade during the weekends. Trading news is available with some restrictions.

Usually, experts and users agree on the main advantages of the platform. First, there is a large choice of assets, namely currencies, cryptocurrencies, stocks, indices, raw materials, commodities, and precious metals. Leverage is available for all instruments, and its maximum is 1:100. The trading mode is relatively free, and it is necessary to be active at least 5 days a month. Activity means at least one closed position. In general, this is a standard limitation. Note that you can only trade through MT platforms, including their mobile versions. Other solutions are not available, which is sometimes regarded as a disadvantage.

The partner’s profit split is 80% from the first day of trading on a live account. This is a fairly high indicator because there are many firms that pay 50%-70% to traders. As a source of additional income, you can consider a referral program. Thus, according to the sum of the factors, Leveled Up Society is recommended for review by traders of all levels.

Dynamics of Leveled Up Society’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Proprietary trading firms do not offer typical investment solutions. That is, their partners cannot, for example, buy dividend stocks or invest in cryptocurrency staking. The purpose of a prop firm is to provide traders with funds for active trading. Nevertheless, sometimes partnership (referral) programs are considered as an option for passive income. This is when a trader receives bonuses for inviting new users. However, understand that in reality you have to be very active on the internet, and, even better, have a popular blog, otherwise you won’t be able to make good money.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program from Leveled Up Society:

Each partner of the firm can receive a personal link and place it on any website without restrictions. A user who registers on the website using this link as a referral will receive a 5% discount on his initial fee. The link owner will receive 7.5% of the total amount paid by the referral. As soon as link owners invite 99 referees, special conditions are triggered. Their link will still give a 5% discount, but they will also receive 10% of the referral’s initial fee. The number of referrals is not limited. Thus, if partners of the prop firm are really active on the network, they can receive an additional source of regular income.

Trading Conditions for Leveled Up Society Users

The initial fee depends only on the balance that traders choose. For example, if they want to receive $25,000 in their accounts, the fee is $149. And if they need $200,000, the initial fee will be $1,069. The fee is refundable, but traders will receive it back only upon successful completion of both phases of the challenge. Assets available for trading during the funding stage are also available during the challenge stage. Leverage depends on the asset. For example, the maximum leverage for gold and commodities is 1:10, while you can trade currencies with leverage of 1:100. If at some point traders face a situation that they cannot resolve by themselves, it is recommended that they contact the firm’s technical support team. It is available by email and live chat. Also, there is a ticket system in the corresponding section of the website. Support is available 24/5, from Monday to Friday only.

149

Minimum

deposit

1:100

Leverage

24/5

Support

| 💻 Trading platform: | MT4, MT5 |

|---|---|

| 📊 Accounts: | Account |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank cards, e-wallets, and crypto wallets |

| 🚀 Minimum deposit: | $149 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, commodities, raw materials, and metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

One type of account; four balance options; refundable initial fee; profit split is 80% to traders; advisers and bots are not allowed; transfer of positions overnight and trading during the weekends are allowed; wide choice of assets; high leverage |

| 🎁 Contests and bonuses: | No |

Comparison of Leveled Up Society to other prop firms

| Leveled Up Society | Topstep | FTMO | Funded Trading Plus | Fidelcrest | Earn2Trade | |

| Trading platform |

MT4, MT5 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MetaTrader4 | NinjaTrader, R Trader Pro, Finamark |

| Min deposit | $149 | $1 | $155 | $119 | $99 | $90 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:1 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | 10% / 10% | 10% / 10% |

| Execution of orders | No | ECN | Instant Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Leveled Up Society | Topstep | FTMO | Funded Trading Plus | Fidelcrest | Earn2Trade | |

| Forex | Yes | No | Yes | Yes | Yes | No |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | No |

| CFD | No | No | Yes | Yes | Yes | No |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | No | No | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

Leveled Up Society Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | Not available (set by the broker) | No |

One of the main advantages of Leveled Up Society is the absence of an extensive system of accounts. Some firms offer different account types, and traders get confused when choosing the best option. In this case, there is only one account and all traders are in the same condition. Experience, ambitions, preferred trading style, and initial balance do not affect the partner's opportunities and limitations. For example, assume you take a balance of $50,000 and your colleague takes a balance of $200,000. You will trade with the same comfortable parameters, the difference is that it will be easier for your colleague to scale, as the balance increases as a percentage; but he will also suffer a heftier initial fee.

Detailed review of Leveled Up Society

There are quite a few prop traders registered in the U.S. that provide their capital to traders worldwide. Typically, these firms work with a limited number of brokers or even first-tier liquidity providers. Leveled Up Society is partnered with Eightcap, an Australian broker well known in the global market. It is reliable, licensed, and offers access to the most popular international markets, from fiat currencies and cryptocurrencies to raw materials and commodities. LUS partners can use almost the entire pool of the broker’s instruments with leverage that varies depending on the chosen asset. At the same time, different trading strategies are available to traders. The restrictions are minimal and aimed at protecting the capital of the prop firm. A smart approach to partnership attracts many partners from different parts of the world.

Leveled Up Society by the numbers:

-

46,000 funded traders;

-

Up to $200,000 in funds at the start;

-

Scaling maximum is $1,000,000;

-

Profit split is 80% or partners;

-

Withdrawal fee is $0.

Leveled Up Society is a prop trading firm for trading many financial instruments

Often prop firms focus on a specific group of assets, such as currency pairs. Sometimes stocks, indices, or cryptocurrencies are added to them. Few platforms provide their partners with as much choice as Leveled Up Society does. A large number of financial instruments are beneficial for two reasons. First, traders do not need to limit themselves. They choose the required asset and work within the framework of their usual strategy. Second, if partners of the prop firm have the ability to trade different instruments, this is a good opportunity to diversify risks. And protecting your funds is extremely important when you trade with significant leverage.

Useful features of Leveled Up Society:

-

Traders do not need to puzzle over choosing the right type of account. The prop firm offers only one type of account and four balance options. The amount of funds for trading is selected based on the experience and ambitions of traders;

-

Partners of the prop firm are obliged to place stop losses and not to forget about the drawdown, otherwise they trade at their own discretion. You can hedge, transfer positions overnight, or trade during the weekends;

-

The initial balance does not really matter, as traders can scale their accounts at any time. To do this, they need to trade with a profit, and then they will be able to increase their balance up to $1,000,000 over time.

Advantages:

The challenge takes place in two phases. The profit target of 8% and 5% for each phase, respectively, is more than achievable;

At the funding stage, traders do not need to strive for a profit target, they can trade at their own pace;

Upon completion of the challenge, you can receive a balance of $25,000, $50,000, $100,000, or $200,000;

Traders cannot use advisors or bots, most other trading methods are allowed;

The prop firm’s partner can trade fiat currencies, cryptocurrencies, stocks, indices, commodities, raw materials, and precious metals;

Technical support does not work on weekends, but it answers very quickly even at night on the weekdays.

Guide on how traders can start earning profits

Usually, traders’ first priority is to decide on the type of account that suits their tasks and trading style. However, in this case, it is not important, because Leveled Up Society offers only one account type with universal characteristics. The only thing a partner can choose is the balance. There are four options, namely: $25,000, $50,000, $100,000, and $200,000. The size of the initial balance does not affect the account possibilities and scaling conditions, although it will certainly be easier to reach $1,000,000 by starting with $200,000. That is why traders must clearly understand how actively they intend to trade and scale, and what tasks they set for themselves in the near and long term. In any case, they make a choice based on their experience and real possibilities.

Account conditions of Leveled Up Society:

-

The first phase of the challenge lasts 30 days and traders need to achieve a profit of 8%. The second stage takes 60 days and the required profit is 5%. Upon successful completion of the challenge, there is no profit target and the initial fee is fully refunded. To scale, a trader needs to trade in the positive. The balance increases on individual terms by sending a corresponding request to technical support. The maximum drawdown is 8%, and daily is no more than 5%. Stop loss is mandatory.

Investment Education Online

Proprietary firms are interested in their partners improving their skills. After all, the more experienced the traders are, the better they trade, and the higher their profits are. Correspondingly, the profit of the firm also grows. For this reason, some platforms offer training programs to their partners, publish guides, and even arrange webinars with experts. However, not all firms implement this approach. Leveled Up Society does not provide centralized education, but it does have a blog on its website that posts many helpful materials.

Leveled Up Society suggests that if traders can complete the challenge, they have sufficient skills in professional trading. Therefore, the firm does not provide detailed guides. Nevertheless, the blog contains many interesting articles about trading strategies, common mistakes by novice traders, as well as advanced life hacks.

Security (Protection for Investors)

Leveled Up Society is officially registered in the U.S. Thus, such firms do not need to have international regulation, because they do not send their traders’ transactions to the interbank market. This is done by brokers. In this case, it is Eightcap. It turns out that from the point of view of security, the status of the broker is more important for traders than the prop firm’s status. Eightcap is a licensed and regulated organization. Its official website provides license numbers and relevant legal information.

👍 Advantages

- Traders can contact the prop firm’s technical support

- It is possible to contact the broker’s lawyers

- Possibility to send a request to the international regulator

👎 Disadvantages

- It is impossible to solve a disputable issue via regional financial institutions

Withdrawal Options and Fees

-

Upon completion of the challenge and receipt of funding, partners of LUS trade on standard conditions, placing trades and making money;

-

The first withdrawal of funds is available 30 days after the funding stage begins. Traders submit withdrawal requests via technical support;

-

There is no minimum and maximum limit, partners of the prop trader can withdraw any earned amount at their discretion;

-

The application is processed over several days, and the progress is displayed in the user account;

-

A new application can be submitted no earlier than 14 days after the previous one;

-

Bank cards, e-wallets, crypto wallets, and other withdrawal channels are available.

Customer Support Service

Technical support is necessary if clients face a situation they cannot solve on their own. It is very important to traders that help is received promptly. Many experts consider client support to be a key component of the platform, which allows traders to visually assess the quality level of the firm. In the case of Leveled Up Society, you have the opportunity to use live chat, email, or create a ticket in the appropriate section.

👍 Advantages

- Non-partners of the firm can contact technical support

- All communication channels are available 24/5

👎 Disadvantages

- Client support does not work on weekends

- Call center is not available

It is impossible to contact technical support on weekends. On other days, the following communication channels are available:

-

email;

-

live chat on the website and in the user account;

-

tickets at.

The firm has its official Discord channel, as well as Instagram and YouTube profiles.

Contacts

| Foundation date | 2022 |

| Registration address | 3500 NW 114th Ave STE 215, Doral, FL 33178 |

| Official site | https://leveledupsociety.com/ |

| Contacts |

Email:

support@leveledupsociety.com,

|

Review of the Personal Cabinet of Leveled Up Society

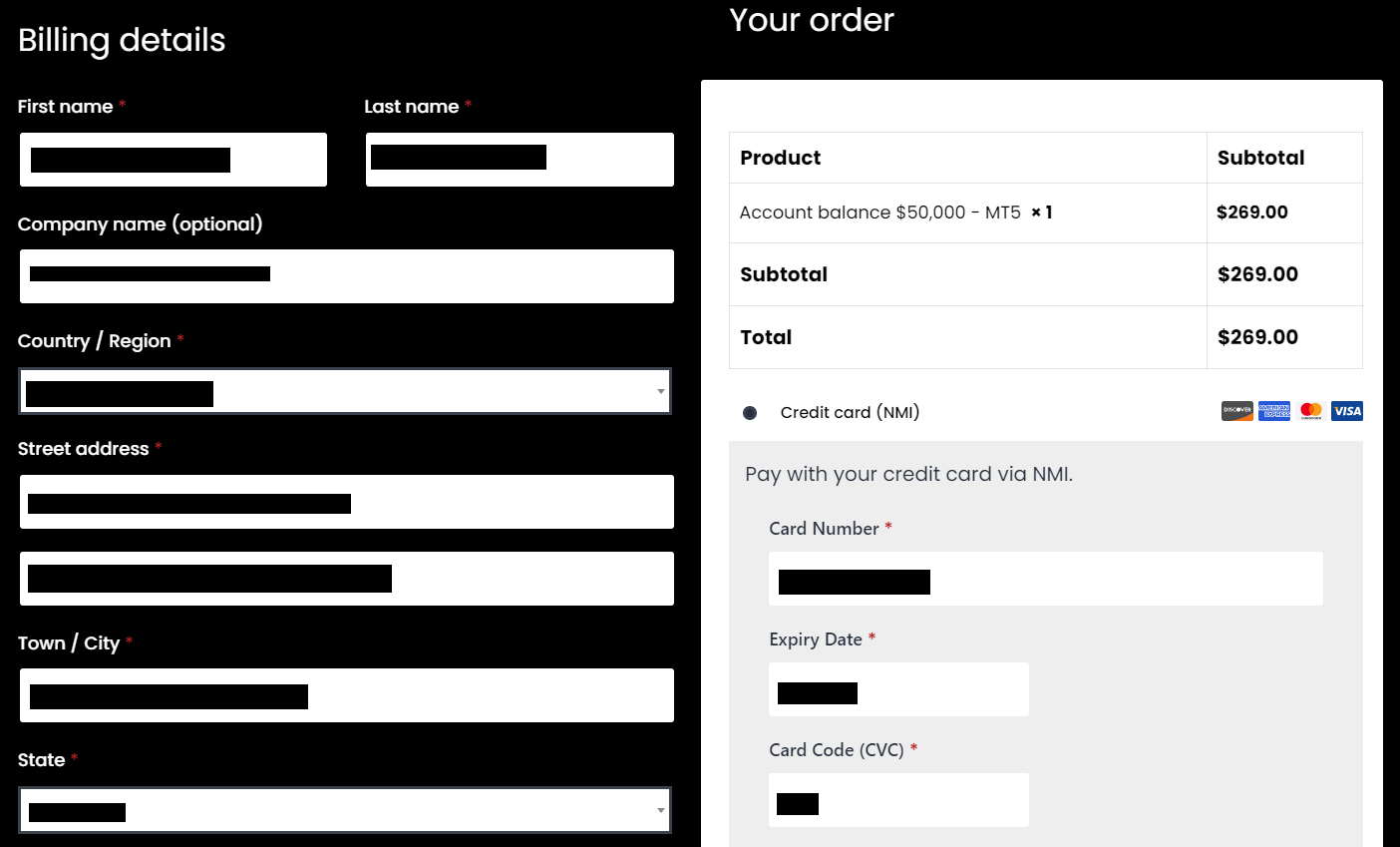

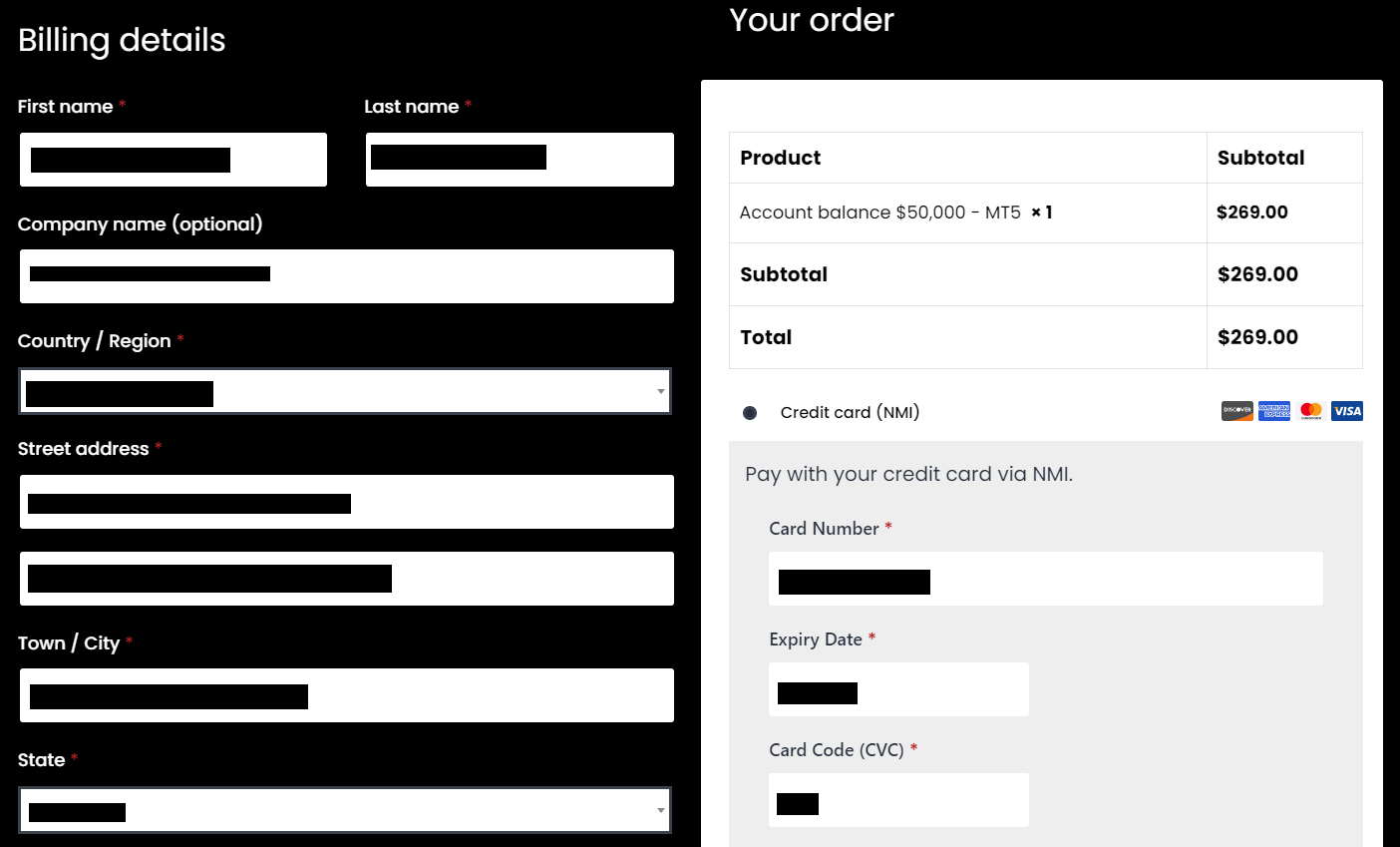

To start trading with the prop firm, register on its official website and pay the initial fee. TU offers a short guide below.

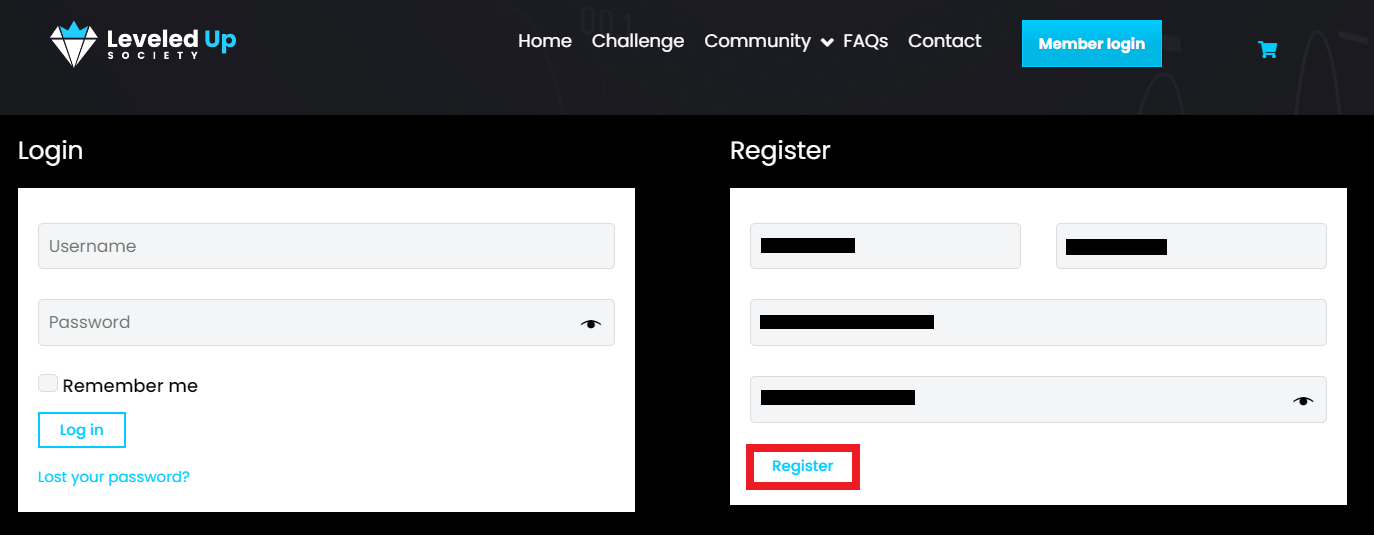

Go to the Leveled Up Society website and click the "Member Login" button in the upper right corner.

On the left is a block for traders who are partners of the platform. If you are registered, enter your username and a password, and then click the "Log In" button. If you don't have a user account, enter your first and last names, email address, and a password in the right block. Click the "Register" button.

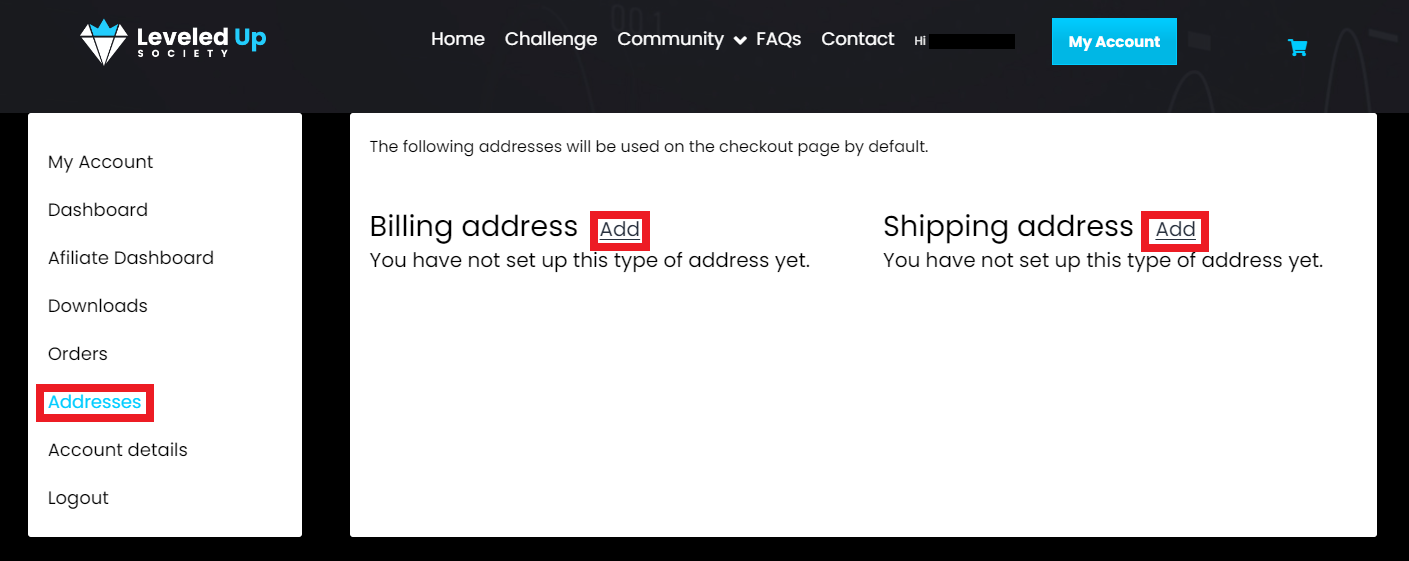

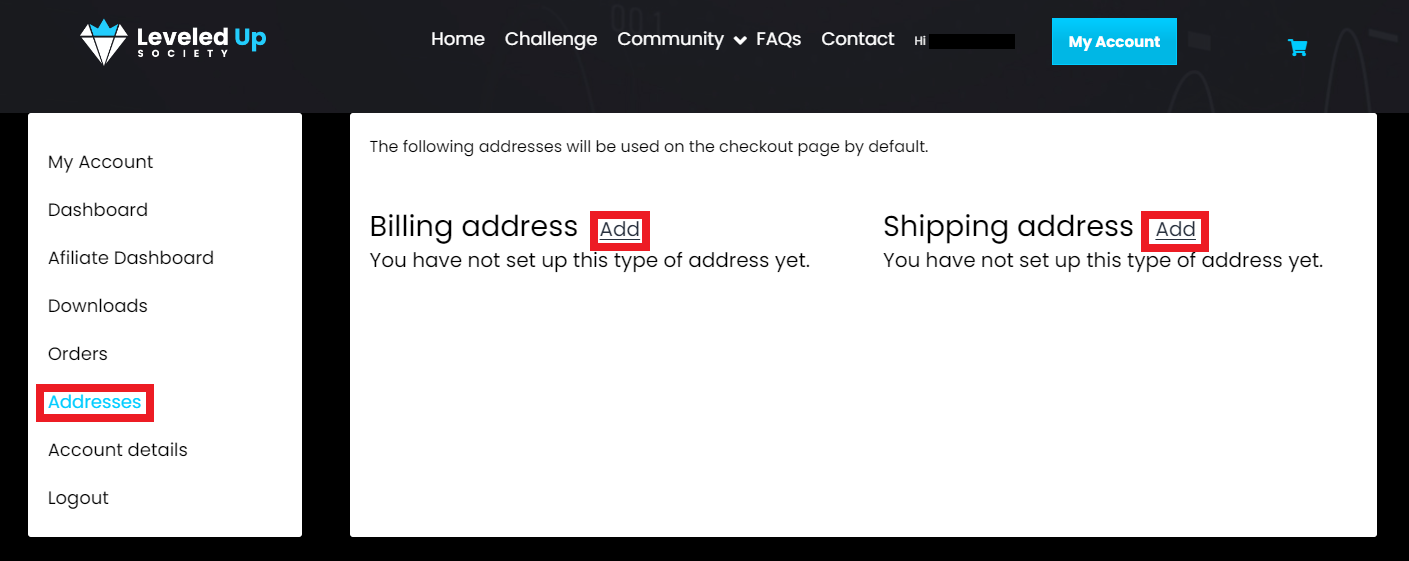

You have gained access to your user account. Go to the "Addresses" section and enter your billing details following the instructions on the screen.

Go back to the main page of the website and scrawl it to the block that lists the balance options. Choose the one that suits you and click the "Start Challenge" button.

Enter the required details, select a payment option, and check the account conditions. Agree with the firm's policy by ticking the appropriate boxes, and click the "Place Order" button. As soon as the funds are debited from your card or your wallet and credited to the account of the prop firm, you can start the challenge.

Other features of Leveled Up Society’s user account:

-

My Account. Here traders can review the latest activity on their accounts;

-

Dashboard. This block contains aggregated detailed information on the account;

-

Affiliate Dashboard. Traders can see their referrals here, their status, and the payments they receive;

-

Downloads. In this section, a partner of the prop firm can download MT4 and MT5;

-

Orders. It displays the payment of initial fees and applications for withdrawals with an indication of their status;

-

Addresses. In this section, you must provide personal data to receive payments;

-

User account details. Traders can change the login, password, and other general information;

-

Logout. Activation of this option instantly terminates the current session, requiring a new login.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Leveled Up Society rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Leveled Up Society you need to go to the company's profile.

How can I leave a review about Leveled Up Society on the Traders Union website?

To leave a review about Leveled Up Society , you need to register on the Traders Union website.

Can I leave a comment about Leveled Up Society if I am not a Traders Union client?

Anyone can post a comment about Leveled Up Society in any review about the company.

Traders Union Recommends: Choose the Best!