deposit:

- $225

Trading platform:

- MetaTrader4

deposit:

- $225

Trading platform:

- MetaTrader4

- Different types of accounts and balance options

- refundable initial fee

- trader’s split is 80%-90% of the net profit

- scaling balance

- profitable referral program

- Up to 1:100

Summary of TopTier Trader Trading Company

TopTier Trader is a moderate-risk prop trading firm with the TU Overall Score of 5.94 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TopTier Trader clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. TopTier Trader ranks 14 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

TopTier Trader provides conditions much more profitable than many of its competitors. It has a refundable initial fee, an adequate challenge, and many types of accounts with different balance options. A trader has the opportunity to receive up to $300,000 at the start. There are almost no restrictions for the trading process; you can trade any number of days within a cycle, trade news, and hold positions. But advisors are prohibited. It is also important that the firm’s partner cannot obtain additional funding on a Regular account. Yet, traders keep 80% of the profit, and the split increases to 90% subject to successful trading within several months. These are really profitable and competitive conditions.

The TopTier Trader proprietary (prop) firm provides a wide choice of accounts with a balance ranging from $25,000 to $300,000 for trading on MetaTrader 4 (MT4). To get an account, traders need to register and pay an initial fee, which ranges from $255 to $1,399. After that, traders go through a two-level challenge that can last from 40 to 70 days. During the challenge, they trade on a demo account and need to achieve a target profit of 5%, 8%, or 10%. The maximum total and daily drawdowns, as well as the minimum number of trading days, are important. Depending on the type of trading instrument used, traders can have leverage up to 1:100. If the challenge is completed successfully, a partner of the prop firm gets an account with the requested balance. The initial fee is refundable. Initially, traders get 80% of the net profit, then the split is 90%. There is no target profit, it is the drawdown that matters. TopTier Trader offers a profitable affiliate program that allows traders to earn up to 20% of the initial fee of the invited referral.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $255 |

| ⚖️ Leverage: | Up to 1:100 |

| 💱 Spread: | No |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, indices, and commodities |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with TopTier Trader:

- There are three account groups, each with four balance options for traders with different trading styles, experience, and ambitions;

- The only restriction for the firm’s partners is the forbidden use of advisors;

- Traders get 80% of the net profit from the first day of trading on a live account and 90% of the profit for further successful and steady trading;

- A large choice of trading instruments, such as currency pairs, cryptocurrencies, indices, and commodities is offered;

- The drawdown conditions are loyal. The maximum daily drawdown is up to 5%, the maximum total drawdown is up to 10%;

- Trading is carried out on the most popular trading platform, MetaTrader 4, which has a mobile version;

- Technical support is provided via a call center, live chat on the website, email, and Discord;

- The challenge is quite simple; to complete it successfully you do not need to have exceptional trading experience.

👎 Disadvantages of TopTier Trader:

- There is no balance scaling on Regular accounts, that is, if traders choose an account with a balance of $100,000, they cannot increase it with additional funding;

- Although MetaTrader 4 is convenient and popular, many traders are used to working with other platforms. TopTier Trader does not support them;

- The prop firm regularly holds contests between its partners, however, traders with little experience cannot count on a prize because of the high competition with professionals.

Evaluation of the most influential parameters of TopTier Trader

Table of Contents

Geographic Distribution of TopTier Trader Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of TopTier Trader

TopTier Trader was established in 2021, which means it is a fairly young project. Nevertheless, even at the start, it received increased interest from traders because Vital Markets, which is part of the Vantage International Group, became its liquidity provider. This is one of the largest brokers in Australia. Thanks to this partnership, TopTier Trader offers its clients hundreds of trading assets including currencies, cryptocurrencies, indices, and commodities. The leverage for the listed groups is 1:100, 1:2, 1:30, and 1:40, respectively. This prop firm does not set restrictions on trading styles and strategies (the only restriction is that you can't copy trades or use expert advisors). So, there are optimal conditions for successful progressive trading.

Another plus of the platform is the variety of accounts that it offers. They are Regular, Extended with scaling, and Swing. The range of the account balance is from $25,000 to $300,000. Extended accounts differ from Regular accounts in that every three months traders can receive additional funding in the amount of 25% of the current maximum balance. This is possible if they traded a plus within these three months, and their target profit reached 6% or more. Most prop firms that offer scaling set a much higher target profit (usually it is 10%-16%). So the conditions of TopTier Trader are objectively loyal.

Standard limits do not cause issues. Drawdowns depend on the type of account: daily drawdown is up to 5%, a total drawdown is up to 8% or 10%. It is also an advantage that the firm works with MetaTrader 4. It is reliable, proven, and convenient, and you can install a huge number of extensions on it to automate many routine processes. The firm's technical support works without breaks and days off, and is available by phone, live chat, and email. Comprehensive testing of the website and the TopTier Trader user account did not reveal any weaknesses. Based on the factors above, this prop firm can be recommended for review.

Dynamics of TopTier Trader’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Prop trading firms usually do not offer their partners dividend stocks, staking investments, and other investment solutions. The essence of proprietary trading is that traders receive a part of the firm’s capital at their disposal, and in return, they give the firm a share of their profits. This mechanism is designed for active trading. Sometimes a referral program is considered as a way of passive income. It allows the firm to stimulate the influx of new partners, and existing partners receive bonuses for inviting interested users. However, in reality, this is an active income, since in order to make a significant profit, you need to communicate a lot with colleagues on the internet, and, even better, have a popular blog.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

TopTier Trader affiliate program:

Each partner of the firm receives a referral link. It can be placed on any platform without restrictions. Users who follow the link and register on the website of the prop firm become its referrals. When a referral pays the initial fee, the owner of the link receives 7.5% of this amount. If referrals fail the challenge or decide to open another account, they will pay the fee again, and the link owner will again receive profit, but it will be 5% of the amount this time. As soon as the total number of referrals becomes more than 25, the payouts from the initial fee will increase to 10%. If the number of referrals is 50 or more, the bonus will be 15%. And if a trader invites more than 100 new partners to the website, the payouts will be 20%. This is one of the most profitable referral programs offered by prop firms.

Trading Conditions for TopTier Trader Users

The initial fee depends on the account and balance selected. The maximum initial fee is $1,399 for a Plus account (with scaling) and a balance of $300,000. Swing accounts are only regular, without scaling. The fee is refunded upon successful completion of the challenge. The platform does not charge fees to its partners; it only keeps 20% of the profit (or 10% if a trader has been trading successfully for a long time). The leverage is determined by the group of assets that a partner uses. The highest leverage is available for currency pairs, it is 1:100. Using leverage increases the risk, but at the same time, it allows you to earn many times more. In terms of technical support, among all prop firms, TopTier Trader's support is considered one of the best. Specialists work without breaks and days off, a firm’s partner can contact them by phone, live chat, or use email. Additionally, the firm has a community on Discord.

$225

Minimum

deposit

1:100

Leverage

24/7

Support

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Regular, Swing, and Extended (with scaling) |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards, e-wallets, and crypto wallets |

| 🚀 Minimum deposit: | $255 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, indices, and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Different types of accounts and balance options; refundable initial fee; trader’s split is 80%-90% of the net profit; scaling balance;profitable referral program |

| 🎁 Contests and bonuses: | Yes |

Comparison of TopTier Trader to other prop firms

| TopTier Trader | Topstep | FTMO | Funded Trading Plus | Funded Next | True Forex Funds | |

| Trading platform |

MetaTrader4 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MetaTrader4 | cTrader, MT4, MT5 |

| Min deposit | $225 | $1 | $155 | $119 | $99 | $89 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:1 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | No |

| Execution of orders | No | ECN | Instant Execution | Market Execution | N/a | N/a |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| TopTier Trader | Topstep | FTMO | Funded Trading Plus | Funded Next | True Forex Funds | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | No | Yes | Yes | Yes | No | No |

| Crypto | Yes | No | Yes | Yes | No | No |

| CFD | Yes | No | Yes | Yes | No | No |

| Indexes | Yes | No | Yes | Yes | Yes | No |

| Stock | No | Yes | Yes | No | No | No |

| ETF | No | No | No | No | No | No |

| Options | Yes | No | No | No | No | No |

TopTier Trader Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Regular | Set by a liquidity provider | No |

| Swing | Set by a liquidity provider | No |

| Extended (with scaling) | Set by a liquidity provider | No |

All prop trading firms earn in the same way. They receive initial fees (or subscription fees) and a share of their partners’ profit. Since trading fees do not depend on the platforms of this format, it is difficult to compare them by this metric.

Detailed review of TopTier Trader

Usually, traders try to choose firms that have been on the market a long time. However, in the case of TopTier Trader, this requirement need not be that strict, because the liquidity provider for the firm is Vital Markets, one of the leading brokers. In addition, the static and dynamic analysis of the prop firm shows that it operates 100% transparently and completely fulfills its obligations to its clients. TopTier Trader does not charge fees except for the initial fee and profit split (first it is 20%, then the split is 10%to the firm). The firm provides hundreds of trading instruments. The most popular of them is currency pairs that are traded with leverage of up to 1:100. This significantly increases the profit of the firm's partner.

TopTier Trader by the numbers:

-

$150,000,000 of funding paid to partners of the firm;

-

TopTier Trader is currently available in 108 countries;

-

5,000,000 positions are opened per month;

-

8 hours is the average time for the profit withdrawal upon the application;

-

Trader’s profit split is 80%-90%.

TopTier Trader is a prop firm for trading currencies, cryptocurrencies, indices, and commodities

Many prop firms offer trading a definite group of instruments, most often these are currency pairs. Of course, it is more profitable for partners when there are as many groups and instruments as possible. First, it allows them to use convenient assets that they are used to and which fit into their proven strategy. Second, trading different instruments is a method of risk diversification. And a trader definitely wants to minimize risks, especially when trading with high leverage.

Useful services of TopTier Trader:

-

Traders are offered three types of accounts and four balance options, which allows them to choose the most individualized account;

-

The firm prohibits the use of advisors, but for the rest there are practically no restrictions on the implementation of the chosen trading strategy;

-

Since TopTier Trader works with MetaTrader 4, partners of the prop firm have the opportunity to use the MT mobile application for convenience.

Advantages:

Partners of the prop firm need to care about only the drawdown, there are no unnecessary restrictions and prohibitions;

Traders can immediately get an account with a balance of $300,000 and trade at their own pace;

Extended accounts allow clients to scale their balance up to $2,000,000;

There is a mandatory target profit only during the challenge on a demo account;

The profit split for partners of the firm is 80% and if they trade successfully for a long time, this split increases to 90%.

Guide on how traders can start earning profits

First, it is important to decide which account you need. If you are interested in swing trading, choose a Swing account. Regular accounts are optimal in most cases, because they have favorable parameters, and are good for traders of any level. It is advisable to choose Extended accounts for professionals who aim at constant growth. Only Extended accounts offer balance scaling. You need to trade in plus for three months and have a target profit of at least 6%, then the balance can be increased by 25%. In three months, the next increase is possible, and so on up to $2,000,000.

Account types:

Note that Swing accounts are technically Regular accounts and are subject to the same rules. Therefore, the balance on this type of account cannot be scaled.

Investment Education Online

Prop firms are interested in sponsoring experienced traders. After all, the more professional the partners are, the more the firms earn. And the more they earn, the higher is a firm's profit. Therefore, some firms present educational materials on their websites. TopTier Trader doesn't do that, the website only has standard FAQs and a blog.

There are materials on money management and trading psychology in the blog. In general, the prop firm relies on the fact that its partners are already good at trading.

Security (Protection for Investors)

Prop firms do not bring their traders' positions to the interbank market, this is the work of brokers. Therefore, they do not need to have a special license, official registration is enough. TopTier Trader’s partner is Vital Markets. It has all the proper licenses, which can be found on its official website.

👍 Advantages

- Clients can submit requests to the prop firm’s lawyers

- Traders can contact the broker’s support directly

👎 Disadvantages

- No regional authorities which traders could apply

Withdrawal Options and Fees

-

The challenge takes place on a demo account, so traders do not earn profits at the evaluation stage;

-

At the financing stage, all positions are opened on a live account, and a trader keeps 80% of the profit;

-

If traders regularly earn money and continue to trade successfully, the split increases to 90%;

-

When partners of the prop firm decide to withdraw their profits, they submit withdrawal requests via technical support;

-

Withdrawal of profits is available to bank cards, e-wallets, or crypto wallets;

-

Consideration of the application can take from several hours to several days (it takes 8 hours on average).

Customer Support Service

Technical support at TopTier Trader is highly rated. A partner of the firm can address the support via call center, live chat, or email. There is also a community on Discord, where managers and colleagues are always present.

👍 Advantages

- Non-registered users can apply for technical support

- Managers are available 24/7

👎 Disadvantages

- Responses via email are not prompt during rush hours

For technical support assistance, use the following contact options:

-

call center;

-

email;

-

live chat and Discord.

The firm has profiles on Instagram, Twitter, and other social media where important news is published and traders can ask questions to managers.

Contacts

| Foundation date | 2021 |

| Registration address | Nicholas Castillo 8 The Green, Dover, DE 19901 |

| Official site | https://toptiertrader.com/ |

| Contacts |

Email:

support@toptiertrader.com,

Phone: 888-396-8550 |

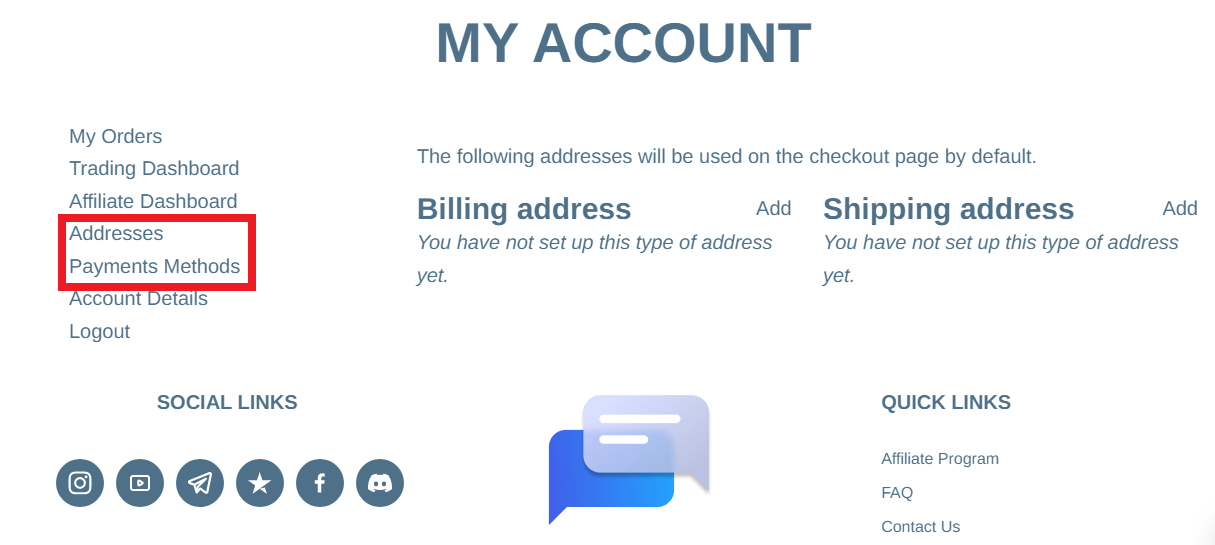

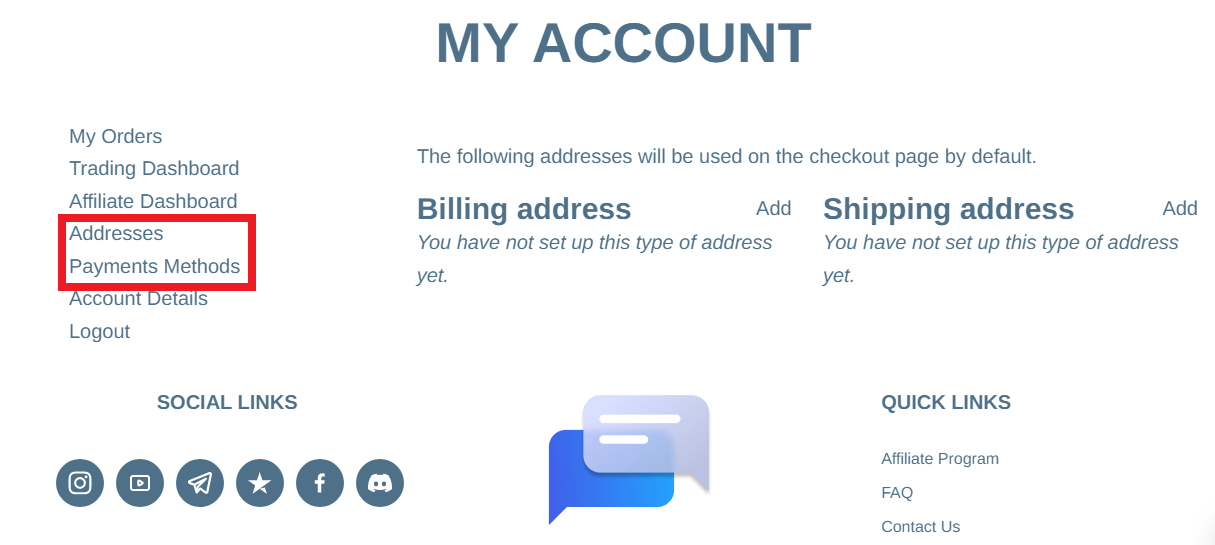

Review of the Personal Cabinet of TopTier Trader

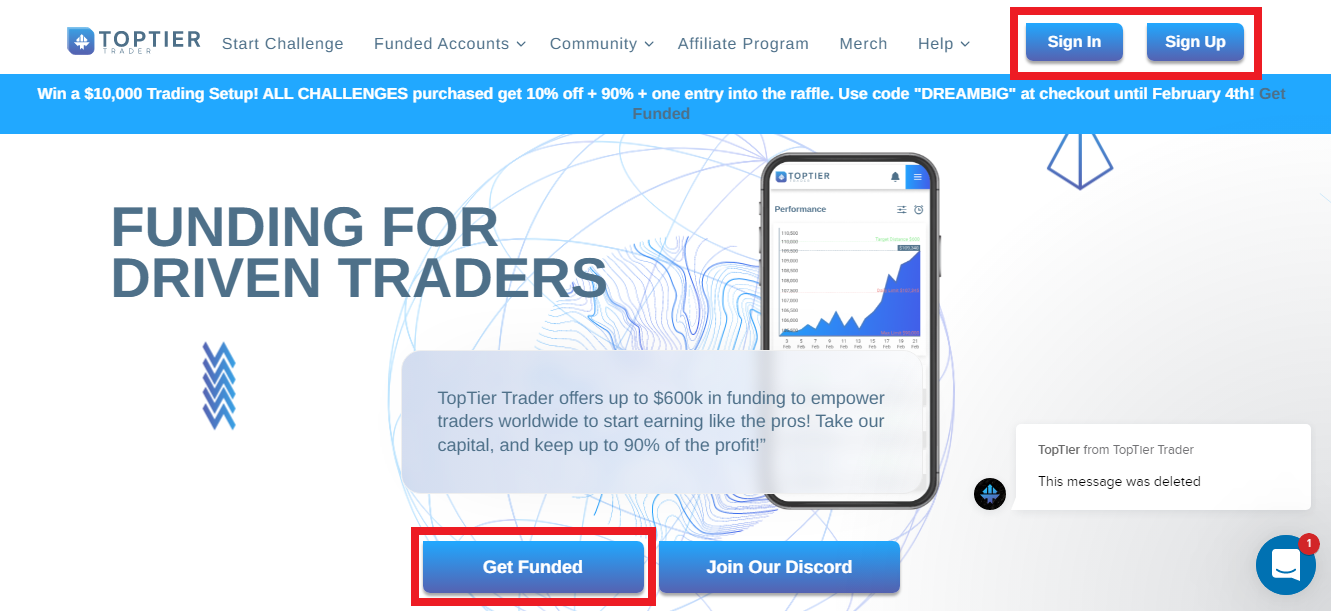

Go to the homepage of this prop trader’s website. In the upper right corner, click the "Login" button if you already have a user account. If you don't have it, click the "Register" button. You can also click "Get Funded".

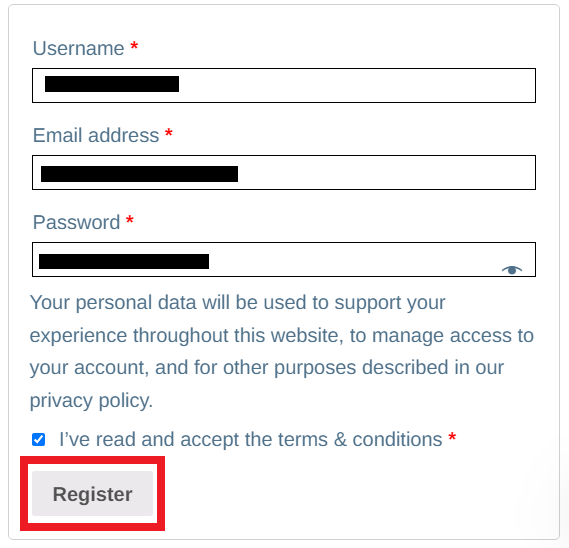

On the right is the block with data for registration. Create a username and password, enter your email address. Then agree to the terms of service (tick the box) and click "Register".

Being in the main menu of the user account, go to "Account Details" and enter your first and last names. Then go to "Addresses". Add at least one billing and one shipping address. Select the payment methods in the corresponding paragraph. In each case, just follow the instructions on the screen.

Now go to "My Orders" and select the type of account that suits you best. After that, an application for payment will be generated and the method you specified will be automatically applied. Once the firm receives payment, you can start the challenge.

Services of TopTier Trader’s user account for traders:

In the My Orders section all the accounts you paid for are displayed, here you can always select a new account;

The Trading Dashboard section displays aggregated data on all your accounts, including the status of challenges;

In the Affiliate Dashboard section, information on referrals and bonuses that you received for them are indicated;

The Addresses section is needed to verify and confirm your payment information;

In the Payment Methods section, you can add and correct the methods for the withdrawal of profits;

In the Account Details section there are all your profile settings, including security settings;

The Logout section allows you to exit your user account. To log in again you will have to enter your registration data.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact TopTier Trader rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about TopTier Trader you need to go to the company's profile.

How can I leave a review about TopTier Trader on the Traders Union website?

To leave a review about TopTier Trader , you need to register on the Traders Union website.

Can I leave a comment about TopTier Trader if I am not a Traders Union client?

Anyone can post a comment about TopTier Trader in any review about the company.

Traders Union Recommends: Choose the Best!