deposit:

- $99

Trading platform:

- MetaTrader4

- MetaTrader5

deposit:

- $99

Trading platform:

- MetaTrader4

- MetaTrader5

- Two types of accounts with six balance levels on each

- Low entry threshold

- Loyal trading conditions

- Many assets

- Moderate leverage

- No significant restrictions

- Classic trading platforms

- Profitable referral program

- Regular competitions

- Up to 1:30

Summary of Traddoo Trading Company

Traddoo is a moderate-risk prop trading firm with the TU Overall Score of 5.87 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Traddoo clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. Traddoo ranks 15 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Traddoo is well-known in the trading environment. It partners with a trusted broker Eightcap, providing loyal trading conditions with a competitive profit split. The firm’s clients work with MT4 and MT5, have access to over 100 financial instruments, and leverage up to 1:30. Among the disadvantages are some restrictions on trading to protect the firm’s capital, the prop trader does not provide its services in a number of countries, and its managers cannot be contacted by phone. However, the firm's disadvantages are more than offset by its advantages, including regular competitions with cash prizes and a partnership program with 15% payments of each referral’s first deposit.

Traddoo is registered in the U.S. and operates under local jurisdictions. The proprietary (prop) trader offers two account types, namely the 1-phase challenge and the 2-phase challenge. The minimum deposit is $99. The profit split is 80/20 or 75/25 depending on the account type and balance. Traders work through MetaTrader 4 and MetaTrader 5. More than 100 assets, such as currencies, cryptocurrencies, stocks, indices, metals, and CFDs are available. Leverage depends on the selected financial instrument, the maximum is 1:30. Traddoo allows trading news, scalping, hedging, and the use of advisors. Weekend trading is not available. The prop firm partners with Eightcap, the broker that provides traders with a raw spread trading account. A raw spread account provides a direct link between the broker and the interbank market. The firm does not charge trading fees, and traders pay only spreads and the broker's fees. Profits are withdrawn through Deel, such options as Visa/MasterCard bank cards, Coinbase, Paypal, Payoneer, Revolut, and Wise are available.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $99 |

| ⚖️ Leverage: | Up to 1:30 |

| 💱 Spread: | As on the Eightcap’s raw account |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, metals, and CFDs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Traddoo:

- Low entry threshold, intuitive interface, and two account types. Instant funding is coming soon;

- Fair profit split and no monthly or other additional fees, thus traders’ costs are minimal;

- The prop firm’s partners work at their own pace, there are no restrictions on the number of trading days, strategies, and trading styles;

- There are many financial instruments in the pool and moderate leverage;

- The most popular withdrawal channels are available, including bank cards, e-wallets, and online transfer systems;

- Traders can lift all restrictions, including mandatory stop loss and a ban on weekend trading for an extra fee;

- Technical support works 24/7.

👎 Disadvantages of Traddoo:

- The prop firm operates globally, however, residents of countries included in the OFAC (the Office of Foreign Assets Control) blacklist cannot work with it at the moment;

- Client support can only be contacted via email, live chat, and Discord; a call center is not available.

- Traddoo does not offer structured education, there are only articles in the blog on its website.

Evaluation of the most influential parameters of Traddoo

Geographic Distribution of Traddoo Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Traddoo

Traddoo has been operating for several years with official registration. The platform partners with Eightcap, one of the world market leaders with confirmed regulations and numerous positive reviews. Traddoo opens raw spread accounts with the broker offering optimal trading parameters that suit most traders.

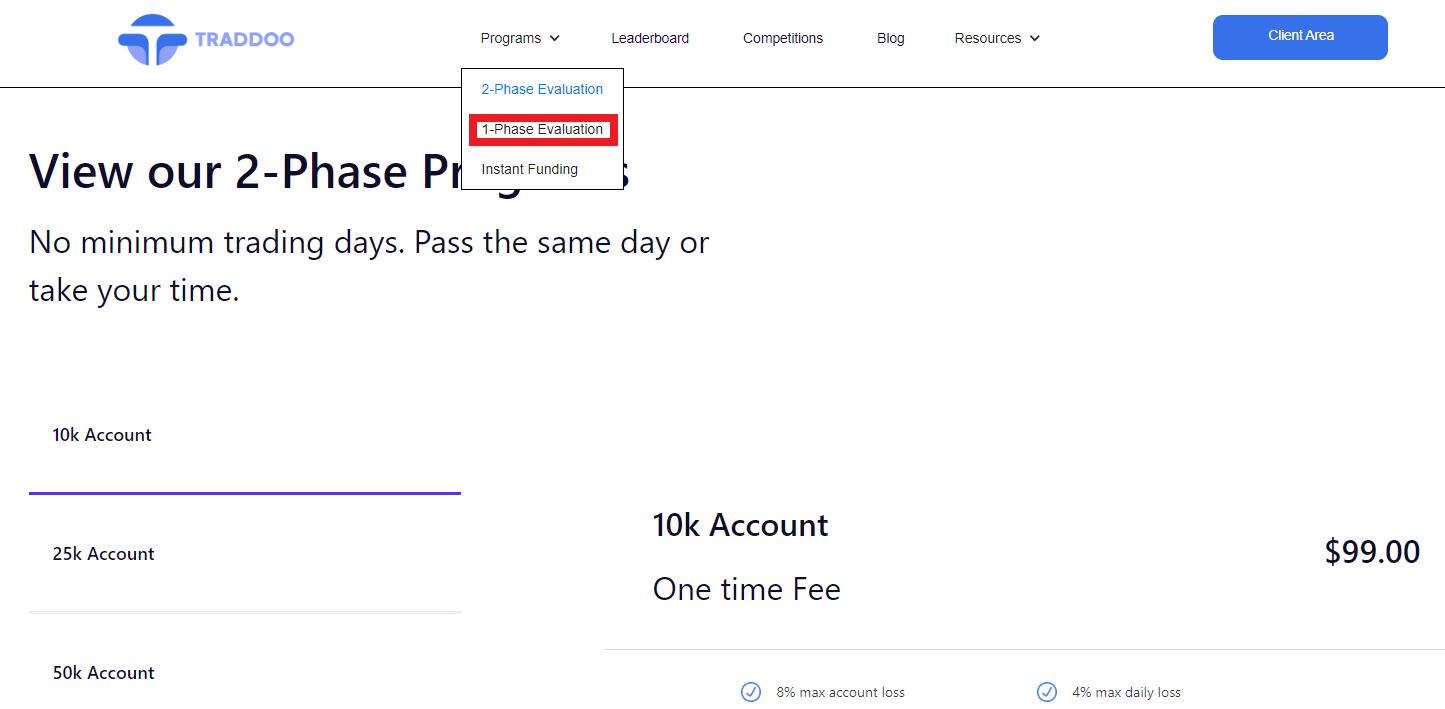

Traders have access to account types with 1-phase and 2-phase challenges. According to the company, the instant funding account is in development and will be introduced in the coming months. The initial fee of $99 is a competitive indicator. The targets of the challenge are 10%/5% for a 2-phase challenge and 10% for a 1-phase challenge. The analysis of user reviews did not reveal any disadvantages of the prop trader in terms of trading opportunities. The only restriction that traders need to consider is the ban on weekend trading. However, this restriction can be lifted for an extra fee, like mandatory stop loss.

The permissible drawdown per day is 4%, and the total is 5%-8% depending on the account type. These are also competitive indicators, as they are the same for most prop firms. Among the conceptual advantages, there’s a favorable profit split of 75%-80%, adequate leverage of up to 1:30 for currency pairs, and a wide range of withdrawal methods. There are more than 100 financial instruments and the list is continuously updated. Traders can easily build a diversified portfolio. The prop firm offers a referral program with payments higher than the average for the segment.

There are no complaints about technical support, although the absence of a call center can be considered a disadvantage. Also keep in mind that residents of some countries cannot work with this prop firm, as it is registered in the U.S. and complies with the requirements of OFAC.

Dynamics of Traddoo’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Prop trading firms usually do not offer their partners any investment opportunities such as investing in dividend stocks, cryptocurrency staking, or other options. Platforms like this one are focused strictly on active trading with a profit split. However, there is a possibility for additional income, which is the referral (partnership) program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program from Traddoo

Each partner of the prop firm receives an individual referral link. It can be published on specialized forums or sent via instant messengers or email. Any user who follows the link and registers on the firm's website becomes a referral of the link’s owner. The first ten referrals do not bring anything to the link’s owner, but for each next referral, traders receive a 15% bonus of their deposit amounts. The number of referrals is not limited.

Traddoo’s partnership program has two advanced options. The first is a quarterly bonus. All traders are divided into groups during registration. Once every 3 months, selected traders can receive 10% of the partner income of the group where they are members. The second option is free accounts. Traders who invite many referrals to the platform are given new accounts without initial fees. The more active traders are, the more expensive accounts they get (meaning the available balance).

Trading Conditions for Traddoo Users

For all prop firms, initial fees depend on the account type and balance. Traddoo offers account types with 1-phase and 2-phase challenges, and a balance ranging from $10,000 to $400,000. The initial fee for a $10,000 balance is $99. But if traders want to get a balance of $400,000, they need to deposit $4,000. For balances of $25,000, $50,000, $100,000, and other amounts, deposits differ, but in general, they are below the market average. Leverage is also not a static value, as it depends on the asset. The lowest trading leverage for cryptocurrencies is 1:2, the highest is 1:30 for currencies and metals. Traders do not have to use the maximum leverage, they can trade without it. Technical support is represented by email, live chat, and a Discord channel, and works 24/7.

$99

Minimum

deposit

1:30

Leverage

24/7

Support

| 💻 Trading platform: | MetaTrader 4 and MetaTrader 5 |

|---|---|

| 📊 Accounts: | 1-phase challenge and 2-phase challenge; balances are from $10,000 to $400,000 |

| 💰 Account currency: | USD |

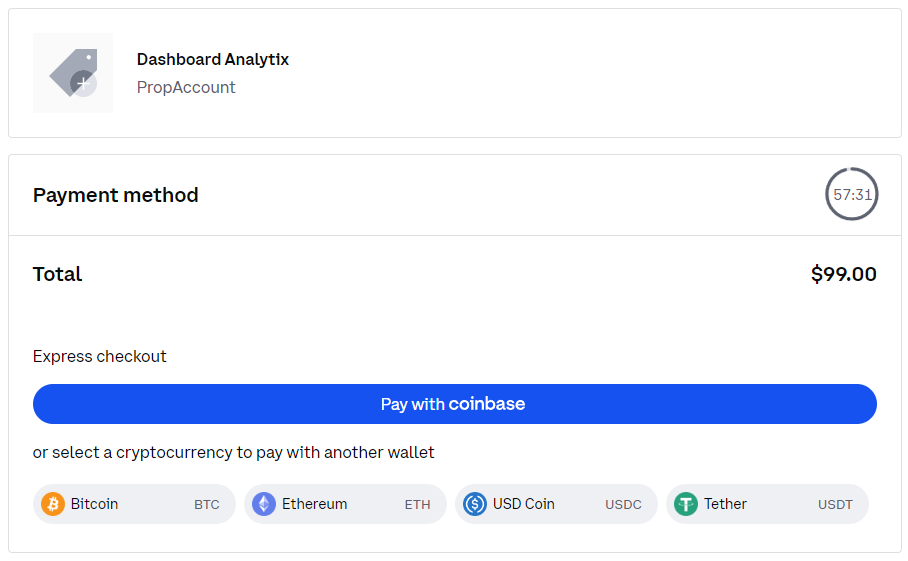

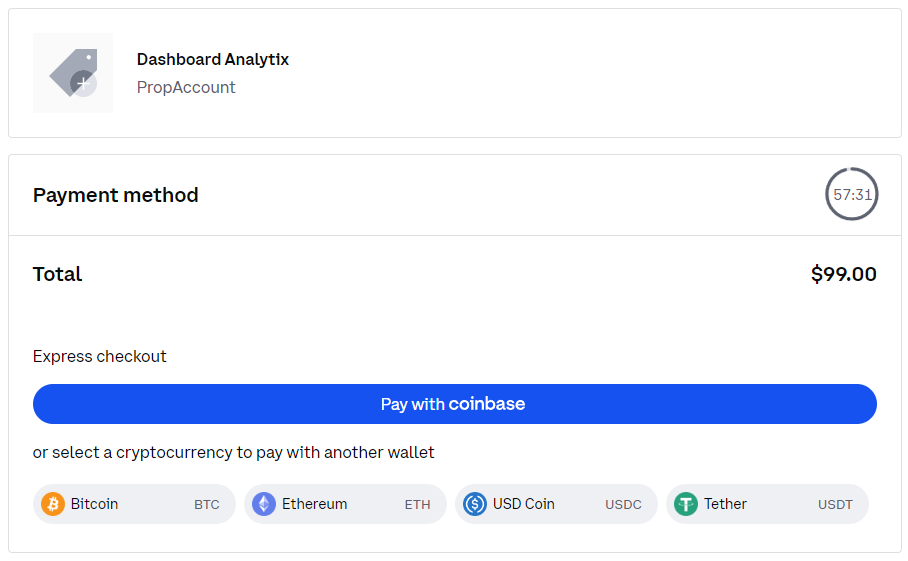

| 💵 Replenishment / Withdrawal: | Visa and MasterCard bank cards, Coinbase, Paypal, Payoneer, Revolut, and Wise |

| 🚀 Minimum deposit: | $99 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | As on the Eightcap’s raw account |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, metals, and CFDs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

Two types of accounts with six balance levels on each; Low entry threshold; Loyal trading conditions; Many assets; Moderate leverage; No significant restrictions; Classic trading platforms; Profitable referral program; Regular competitions |

| 🎁 Contests and bonuses: | Yes |

Comparison of Traddoo to other prop firms

| Traddoo | Topstep | FTMO | Funded Trading Plus | Elite Trader Funding | The Concept Trading | |

| Trading platform |

MetaTrader4, MetaTrader5 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | NinjaTrader, Rithmic, TradingView, Tradovate | MetaTrader4, MetaTrader5 |

| Min deposit | $99 | $1 | $155 | $119 | $80 | $77 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

No |

From 1:1 to 1:200 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0.9 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | 75% / 50% |

| Execution of orders | No | ECN | Instant Execution | Market Execution | No | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Traddoo | Topstep | FTMO | Funded Trading Plus | Elite Trader Funding | The Concept Trading | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | No | Yes |

| Stock | Yes | Yes | Yes | No | Yes | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | Yes |

Traddoo Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| 1-phase challenge | $1 | No |

| 2-phase challenge | $1 | No |

Today, almost all brokers offer floating rather than fixed spreads, which depend on the asset and the current state of the market. Trading fees are clearly defined. Different brokers have different fees, and there are those that do not charge any other fees besides spreads. At Eightcap, spreads and fees depend on the account type. Spreads are 0.5-1.8 pips or 0-0.1 pips while the fee is $0 or $3.5. But this data is for traders who work directly with the broker.

Detailed review of Traddoo

Traddoo offers two account types and six balance options, which allows traders to choose the best option based on their trading preferences. Expert testing confirmed user reviews that the challenge is of moderate difficulty. It is enough to filter out those who are not familiar with interbank trading. Also, it causes no problems for experienced traders. Further, partners of the prop firm work on objectively comfortable conditions. However, remember that the drawdown value differs depending on the selected balance, so the total drawdown can be 5% or 8%. Also, Traddoo allows lifting almost all restrictions for an extra fee, but this option is not always appropriate. From a technical point of view, the platform works perfectly.

Traddoo by the numbers:

-

Minimum deposit is $99;

-

Over 100 financial instruments;

-

6 account balance options;

-

Profit split is up to 80%;

-

Subscription fee is $0.

Traddoo is a prop firm for trading various assets

There are prop traders that offer one group of assets, such as currency pairs. Others may offer an extended list of instruments, including indices, stocks, etc. If a firm works with a broker who has, for example, precious metals, commodities, and energies, it is not at all necessary that all of them will also be available to partners of a prop firm. Prop traders rarely provide access to all assets of a broker with which they partner. Traddoo is a lucky exception because the platform partners with Eightcap and allows its clients to work with all the financial instruments offered by the broker. These are currency pairs, cryptocurrencies, stocks, indices, metals, and CFDs. There are more than 100 assets in total and the list continuously expands. This amount is more than enough to form a diversified portfolio, in which the drawdown of one instrument will be effectively offset by the stable and progressive positions of others.

Useful features offered by Traddoo:

-

Referral program. This prop firm offers a referral program with one of the biggest bonuses, which is 15% of the first deposit of each invited trader starting from the 10th one. The program also includes additional options that allow increasing income and getting new accounts for free;

-

Traders competition. In the near future, the prop firm intends to launch a system for ranking traders. The most active and successful partners will receive unique bonuses and cash prizes. The longer a trader stays among the top traders, the larger his bonuses;

-

Leaderboard. Another innovation of the prop firm is about to be launched. The top 10 traders will be displayed in a separate rating with such information as their recent trades, win rates, portfolios, etc.

Advantages:

A standard or accelerated challenge and a small balance step (six positions) allow choosing initial conditions based on traders’ experience, preferences, and ambitions;

The prop firm offers more than 100 assets from six groups with leverage up to 1:30 and minimal restrictions, which allows traders to earn on their own conditions;

Traddoo’s partners can work through MetaTrader 4 and MetaTrader 5, which are the most popular and functional solutions with desktop and mobile versions;

Reliability of the firm is ensured by its broker Eightcap, which is one of the leaders in the segment It is also an officially registered and licensed company that can be trusted;

Traddoo has an excellent support service, approved by users and experts. It is represented, among other things, by a live chat and Discord channel, where managers are present 24/7.

Traddoo provides loyal working conditions, transparency, and a low entry threshold. Thus, the prop firm is equally convenient for novice traders and professionals.

Guide on how traders can start earning profits

At the start, the most important thing is to choose the right account type and balance. Traddoo offers two account types. The difference between them is minimal. The 1-phase challenge is completed faster, but these accounts have slightly stricter requirements for the maximum total drawdown. The balance step, maximum daily drawdown, and available leverage are the same on both account types.

Account types:

Traders can have several accounts. The initial fee for each account is paid separately, and the challenge is mandatory for new accounts.

Investment Education Online

Traders are only successful if they constantly develop by independently studying educational materials, programs, new tools, and trading methods. Many prop firms try to increase the competence of their partners through training. However, Traddoo does not provide such an opportunity. The firm offers only basic FAQs and a blog. The blog regularly publishes useful articles, but they are not collected in a single system and cannot be considered full-fledged training.

The prop firm assumes that its partners have at least minimal knowledge and can successfully trade with capital from $10,000. Traders comprehend everything else over time, gaining practical experience. This is a common approach. Moreover, Eightcap, which is Traddoo's official partner, has a high-quality training system.

Security (Protection for Investors)

Prop firms are not financial institutions authorized to bring their clients' trades to the interbank market. This can only be done by brokers with which they partner. Therefore, only official registration is required from the firm itself. But the broker is subject to additional requirements, such as it must be officially registered and must have a license from a regulator. Regulators monitor the fulfillment of obligations and transparency of the broker's work. Traddoo is officially registered in the U.S. and its broker Eightcap works with the Bahamas Securities Commission. This means that clients of the prop firm have nothing to worry about.

👍 Advantages

- Traders can apply to managers and lawyers of the prop firm; and also seek help from lawyers of Traders Union

- Possibility to address the Bahamas Securities Commission

👎 Disadvantages

- Non-residents of the Bahamas cannot address regional finance authorities

Withdrawal Options and Fees

-

If traders have registered on the prop firm’s website, paid the initial fee, and successfully completed the challenge, they may start real trading;

-

After concluding successful trades, clients make income. The profit split is 80/20. On 1-phase challenge accounts with a balance of $10,000-$25,000, traders’ profit split is 75%;

-

Traders can submit withdrawal requests once every 30 days. It is impossible to withdraw funds more often;

-

The following withdrawal channels are available: Visa or MasterCard bank cards, the Coinbase crypto wallet, the Paypal online transfer system, as well as Payoneer, Revolut, and Wise wallets;

-

To submit a withdrawal request, contact technical support by email. The request is processed within a few days.

Customer Support Service

Technical (client) support is important for any company. After all, traders can encounter situations that they cannot resolve on their own. Moreover, requests to withdraw funds from Traddoo are submitted through technical support. Therefore, it is critical that managers always stay in touch and be able to process requests in the shortest possible time. Otherwise, the partner may simply be disappointed in the firm and move to a competitor. Traddoo offers professional assistance 24/7. This means that specialists are available every day, including weekends, and they can be contacted even at night. Communication options are email, live chat, and the Discord channel.

👍 Advantages

- Traders can apply to technical support 24/7

- Non-clients can contact support

👎 Disadvantages

- A call center is not available

Thus, if you intend to work with Traddoo or are already a partner of the firm, the following channels of communication with technical support are available to you:

-

email;

-

Discord channel;

-

live chat on the website and in the user account.

Note that Traddoo has an official Twitter profile. Subscribe to it to keep up-to-date with events and not miss the firm’s latest news.

Contacts

| Foundation date | 2022 |

| Registration address | The headquarters is located in Delaware (the USA). |

| Official site | https://www.traddoo.com/ |

| Contacts |

Email:

support@traddoo.com,

|

Review of the Personal Cabinet of Traddoo

To start working with Traddoo, register on its website, select the account type and balance, and make a deposit. Below is a step-by-step guide.

Go to the company's website and click the "Get Funded" button.

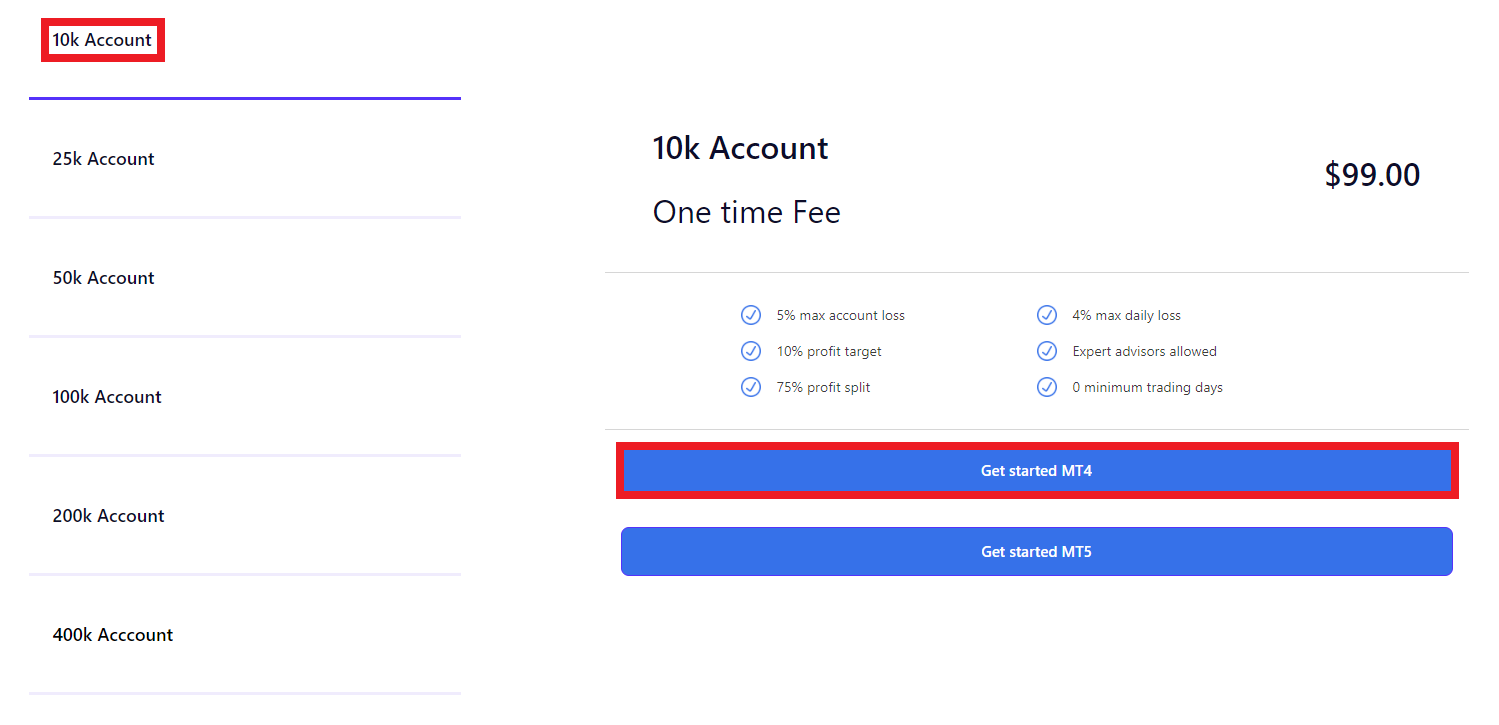

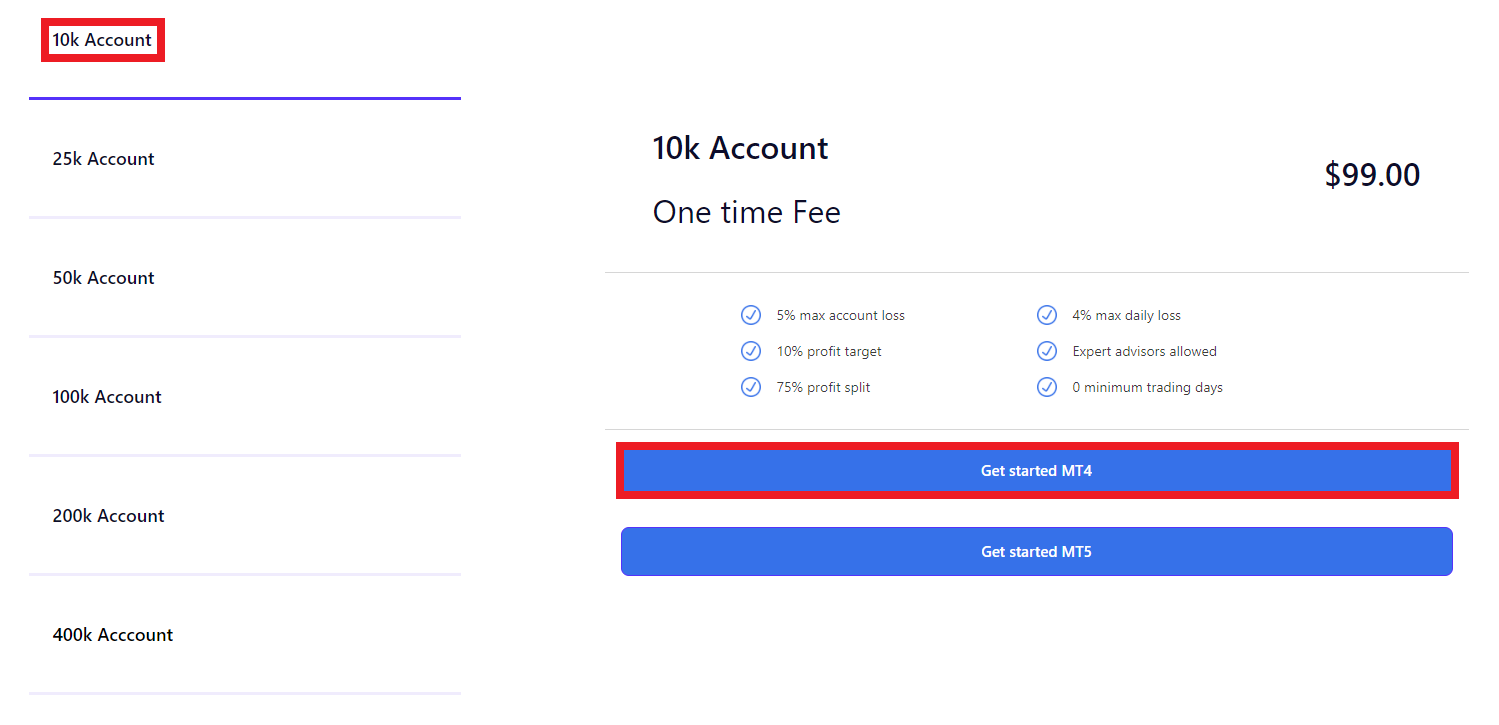

A page with 2-phase challenge accounts will open. To view conditions of 1-phase challenge account types, click the “Programs” button in the top menu and select 1-Phase Evaluation.

Review the conditions of the selected account type. Scroll the page to the block with balance options and choose the one that suits you. Then, on the right side of the screen, click the "Get Started MT4" or "Get Started MT5" button to select your preferred trading platform.

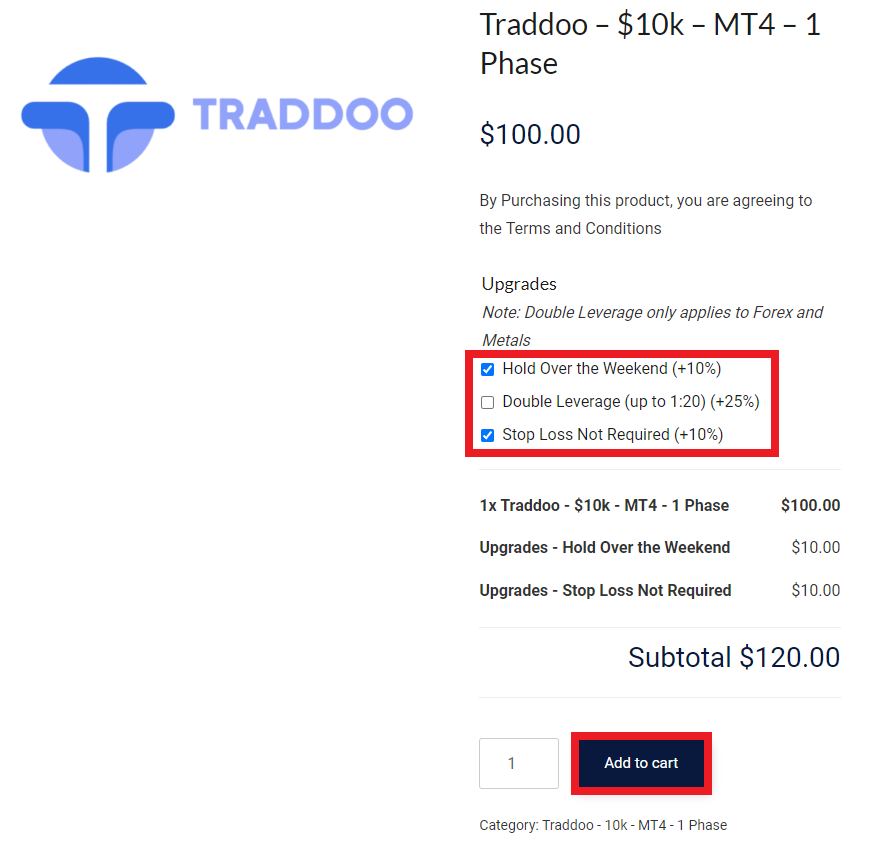

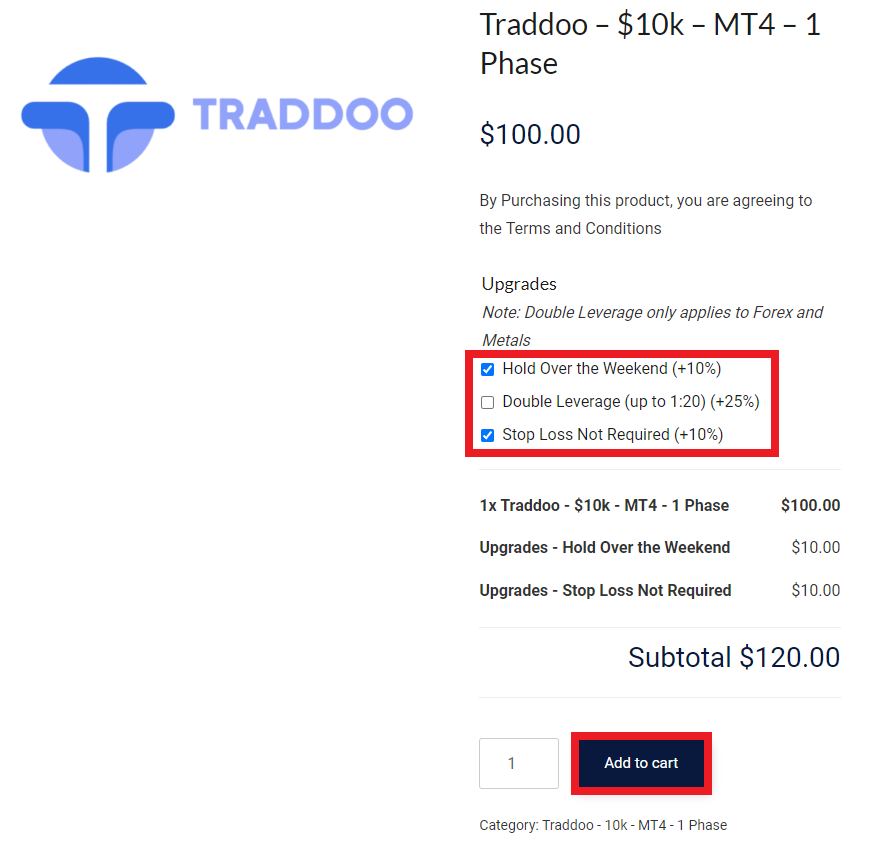

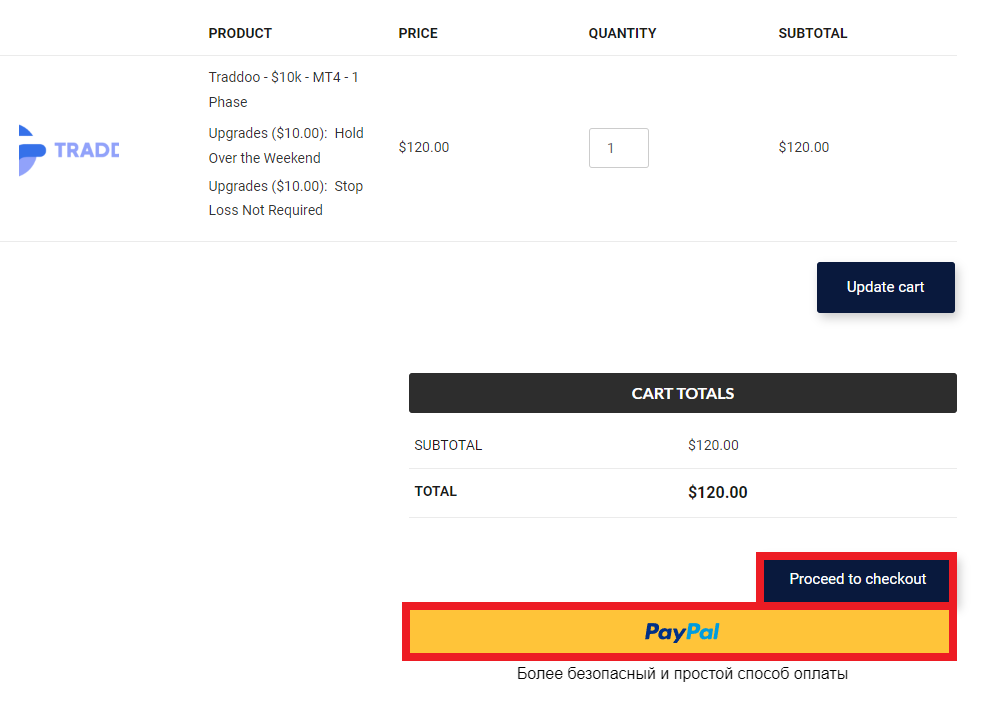

If necessary, select additional options by ticking appropriate boxes. Note that each option has a price that will be added to the initial fee. Click the "Add to Cart" button.

In the shopping cart, check the conditions of the account type you selected. Your preferred payment method will be listed at the bottom (you'll make your choice later). Click the "Proceed to Checkout" button.

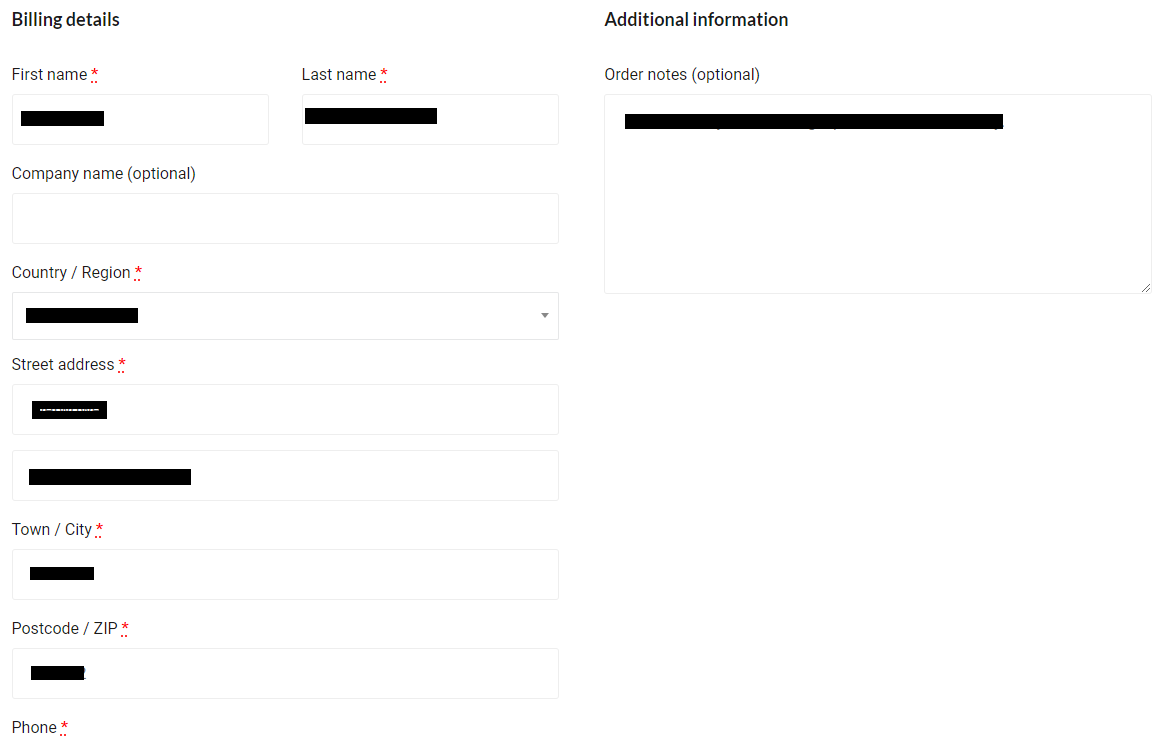

Enter your first and last names, and the name of your company, if necessary. Select your country of residence. Enter your registration address, phone number, and email. In the right block, you can optionally leave a comment for the manager.

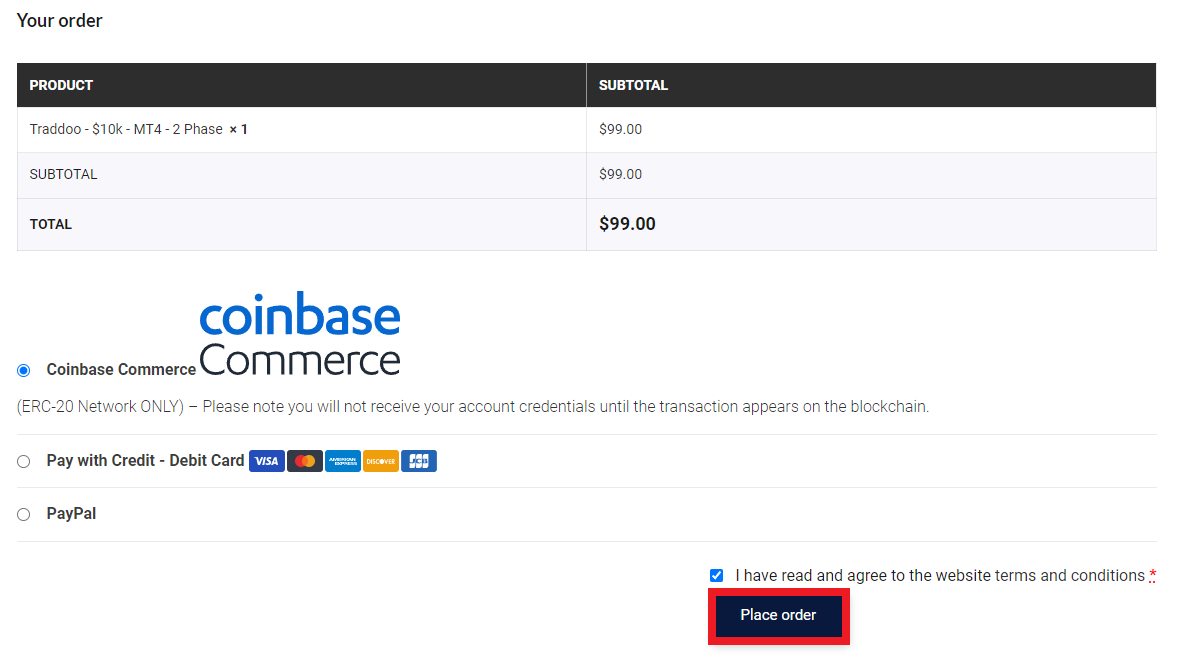

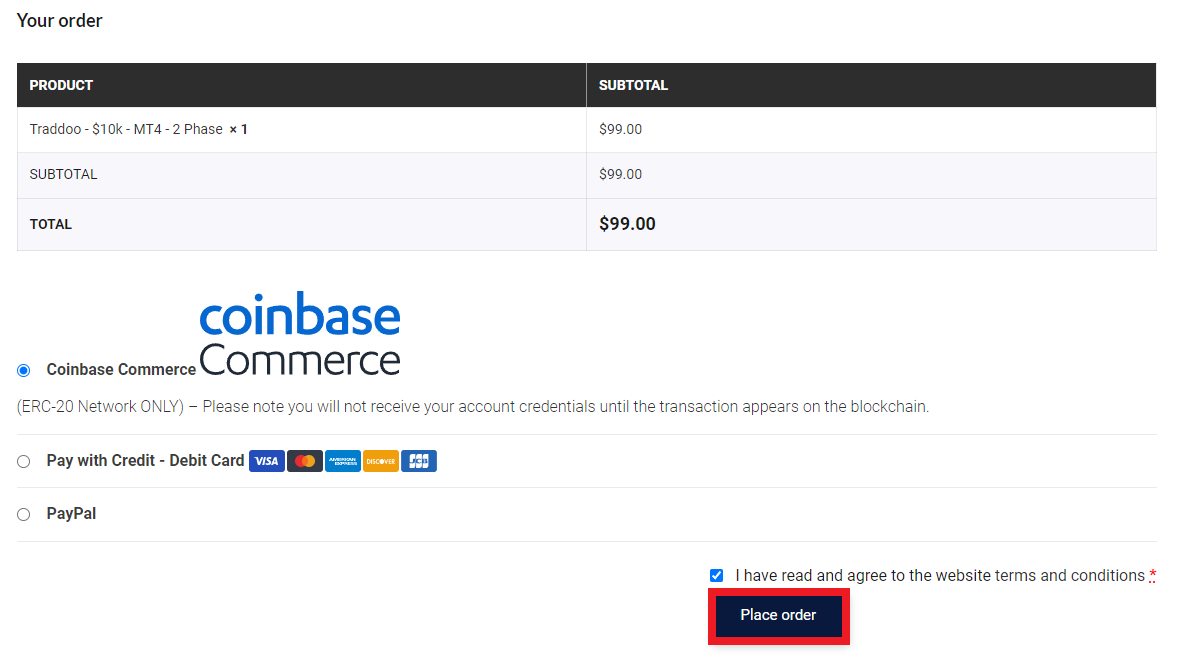

At the bottom of the screen, select the payment option such as a bank card, crypto wallet, or online transfer system. Enter the required data (for example, card number). Agree to the terms of service by ticking the box and click the "Place Order" button.

You will be redirected to the payment system. Follow the instructions on the screen to make a transfer or payment. After that, you are required to verify your personal data. Upload scans/photos of identification documents (passport or driver's license). Wait for the verification to complete and get full access to your user account. Now you can trade through the selected trading platform.

Features of the user account:

Traders can monitor the status of their accounts using detailed information. An archive of trades and information on current trades are available, as well as the status of transactions such as deposits and withdrawal requests;

Traders can download MT4/MT5 via links in the user account. The support center is also available here;

Information on the referral program is displayed in the corresponding menu providing the number of referrals, payouts, and additional options;

As soon as the firm fully implements the competition project, the rating of traders will be presented in the user account.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Traddoo rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Traddoo you need to go to the company's profile.

How can I leave a review about Traddoo on the Traders Union website?

To leave a review about Traddoo , you need to register on the Traders Union website.

Can I leave a comment about Traddoo if I am not a Traders Union client?

Anyone can post a comment about Traddoo in any review about the company.

Traders Union Recommends: Choose the Best!