Which cryptocurrencies to buy in October 2023 for a long term

Although the cryptocurrency market has long been flat under pressure from regulators and FTX bankruptcy, analysts believe that the next growth wave could begin as early as 2025. Among the most promising coins for long-term investment and diversification are BTC, SOL, TON, TRX, BNB, and XRP.

The cryptocurrency market has fluctuated over the past year. After 2022 (bankruptcies of Terra and FTX), investors grew more cautious and do not rush to buy Bitcoin and other altcoins. Everyone is waiting for some kind of optimistic push, but there is none. Amid small local positive news, Bitcoin was able to move away from the lows of 16-18K, but there are no fundamental factors in the market for a breakout at 30K. Regulatory actions could be a strong driver, although right now the are putting pressure on the market instead. Examples are SEC (the Securities and Exchange Commission) lawsuits against Binance and Coinbase, as well as pressure on Binance from regulators in other countries.

Over the past month, certain tier 3 coins have shown high profitability, Hifi Finance being the leader. This coin is known in narrow circles and its daily 25% price drop suggests that the price was artificially pumped for a short time, after which a rapid roll back occurred. BTC showed 3% profitability.

Top September news of the cryptocurrency market

Top September news of the cryptocurrency market:

-

SEC is to approve several applications for ETFs. Until today, the regulator has been interfering by rejecting applications for spot Bitcoin ETFs. However, SEC Chair Gary Gensler has crossed the line. Information that the Congress is once again considering a possibility of dismissing him has appeared in the media

The main complaints are that under Gensler, Ethereum and top tokens have been recognized as securities and the maximum number of lawsuits against top startups has been filed since 2008. All this deprives the country of tax revenue and prolongs the crypto winter. Gensler’s dismissal will be a strong driver, as it will be perceived as reducing pressure on the market. Gensler himself still wants to accept several applications so that he can then start working in one of the Bitcoin ETFs.

-

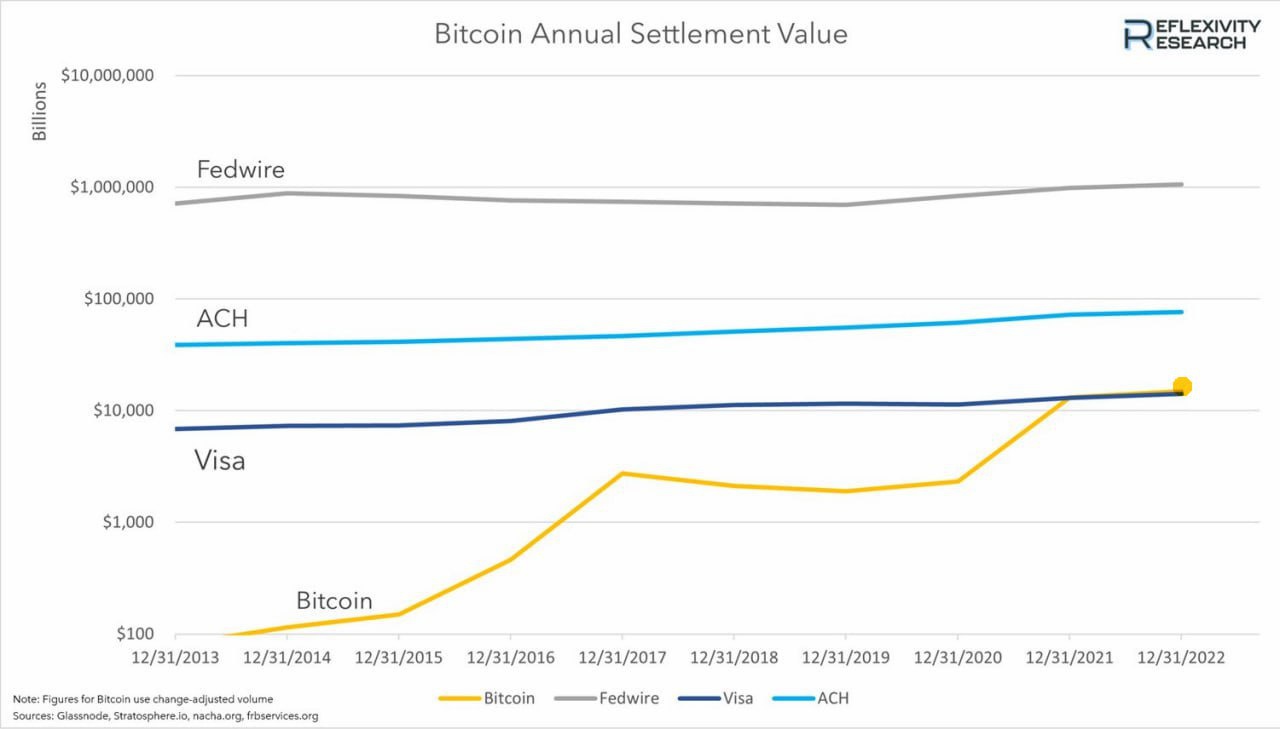

The number of transactions on the Bitcoin network has exceeded the number of transactions on the Visa network. According to the Reflexivity Research, the record was set on September 15, when the number of transactions exceeded 700,000 for the first time in history. This indicates that the market is gradually recovering and the confidence in BTC remains at a high level. Strong surges of activity were observed in 2017 and 2021 during the cryptocurrency boom. It is quite possible that a new boom is coming soon

-

The U.S. inflation rate is rising again. The data announced on September 13 is not encouraging. With inflation at 3.2% in July, in August it was 3.7% against the forecast of 3.6%. According to analysts, the Fed (the U.S. Federal Reserve System) has exhausted its resources for increasing rates, so it is unlikely to expect its growth. Weakening of USD benefits the cryptocurrency market

-

Binance is under SEC pressure. Pressure on the largest exchange from the regulator continues. Two top managers have recently resigned from Binance.US. The regulator, meanwhile, accuses the exchange of non-cooperation and proposes to freeze digital assets of the American division. The situation is rather disappointing, but the regulator’s defeat could be a good price driver

-

Central and South Asia are leading among the countries introducing cryptocurrencies. According to the Chainalysis analytical portal, the top 5 countries actively implementing cryptocurrency technologies are India, Nigeria, Vietnam, USA, and Ukraine. Brazil is in the 9th place, China - 11th, Russia - 13th, and Japan is 18th

The conclusion is not straightforward. Popularity of cryptocurrencies in Nigeria and India can be explained by weak national currency, loyal legislation, and poor tax control. Popularity of cryptocurrencies in the USA is proof that SEC cannot stop interest in cryptocurrencies.

Best cryptocurrencies for long-term investment

In the short term, there are no strong fundamental factors that could push the market towards an uptrend yet. This, however, does not apply to long-term investing.

Several arguments in favor of buying cryptocurrencies now are:

-

There have been bankruptcies of major exchanges, such as Mt.Gox, BTC-E, and Wex. Regulators have been putting pressure on exchanges and introducing restrictions for several years now. But this did not stop BTC from setting the all-time high in 2017, drawing a new maximum in May 2021, falling in price by half, and setting a new historical record again in November of the same year

-

Cyclicity. If we follow the wave theory of market development, we can see the next market pump in 2025

-

Technology’s value. A number of countries are developing their own CBDCs (Central Bank Digital Currency); large corporations are integrating cryptocurrency payment systems and NFT technologies into their networks, and Metaverse is gradually entering everyday life. An analogy can be drawn with dot-coms. Of more than 9,000 cryptocurrencies, only a small number of startups are of interest, and only few of them will be able to stay in the market

Coins that might be interesting for long-term investment:

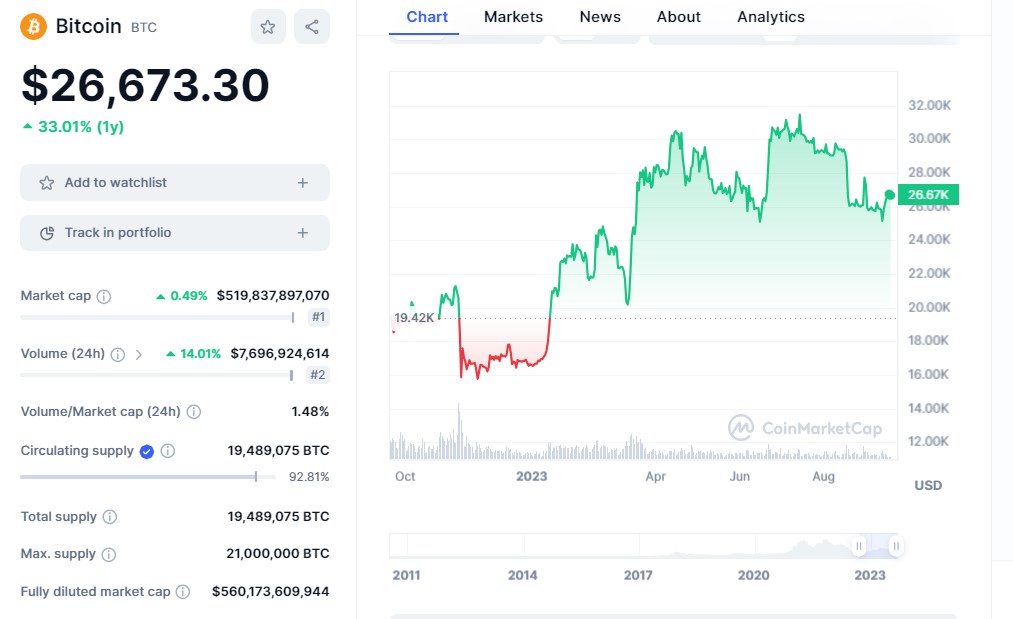

Bitcoin (BTC). It is a universal long-term investment solution, the top cryptocurrency. BTC has been a constant market driver since its appearance. Its share in total capitalization is 49% as of September 1, 2023. Several factors that could push the BTC price up:

- Upcoming halving. The halving of miners' profits, expected in approximately 9 months, reduces the number of people who want to mine. If supply decreases with limited emissions, the price rises

- Regulatory policy. SEC is loyal to BTC. The coin was recognized as a commodity in the middle of 2022. Launching of a spot Bitcoin ETF remains uncertain. Sooner or later it will be resolved in a positive way, which will increase the BTC trading volume and accordingly push the price up

If fundamental factors appear, BTC goes up first, followed by other coins. Although, there is a minus: less popular coins may register a 5x growth, while BTC price will only double over the same period. Still, it is the best cryptocurrency for the conservative option.

Here you can find the long-term BTC price prediction.

-

2

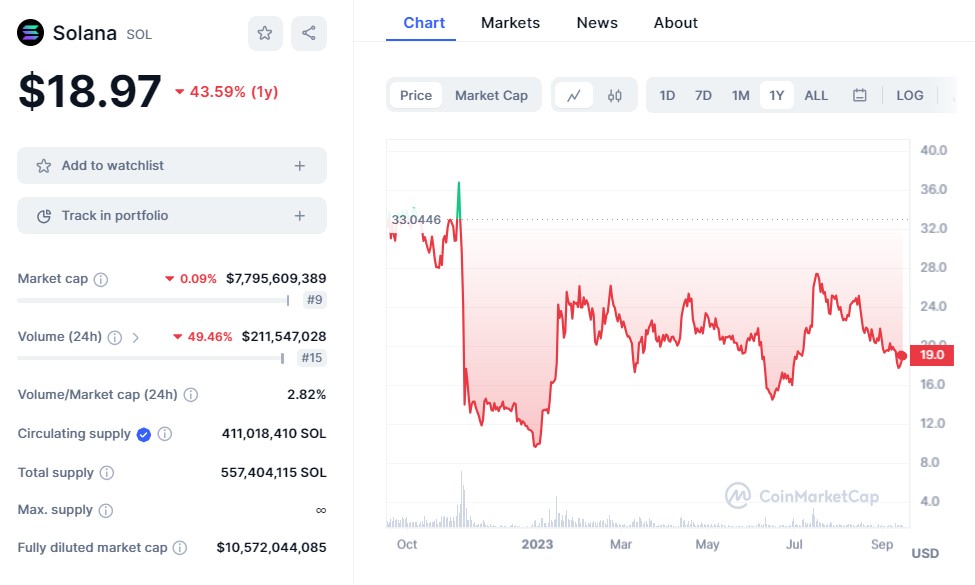

Solana (SOL). Solana is a startup that competes with Ethereum quite successfully. The platform is used to deploy decentralized applications on its blockchain. Its advantages are higher transaction processing speed and lower network fees

Recently, the project has been criticized for its periodic failures. The situation with FTX also puts pressure on the coin. In particular, the court recently allowed the bankrupt exchange to sell assets worth $100 million per day. FTX owns about 16% of all SOL coins, worth about $1.16 billion. And if these coins gradually get on the market, the price will drop.

According to analysts, it is too early to write off the startup. Conversely, its developers are actively eliminating gaps in the network, and the issue with FTX will soon be resolved. Therefore, now is one of the best times to buy the coin at its price bottom with a long-term perspective. Or at least watch it.

Here you can find the long-term SOL price prediction.

-

3

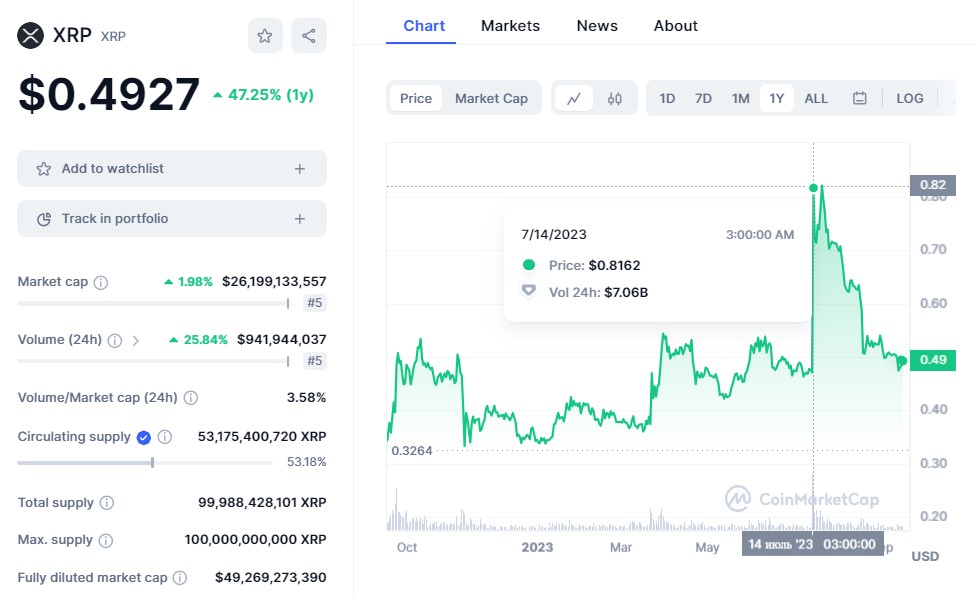

Ripple (XRP). In July, Ripple price almost doubled due to the news that the New York court in a dispute with SEC supported the cryptocurrency startup, refusing to recognize coins as stocks. And although later it turned out that this decision was incomplete and an appeal was filed against it (which caused the coin to roll back to its previous positions), this is a real example of what will happen when Ripple Labs wins next trials. No one knows when this will happen, but the first important step has already been taken. Therefore, it is better to buy the coin in advance

Here you can find the long-term XRP price prediction.

-

4

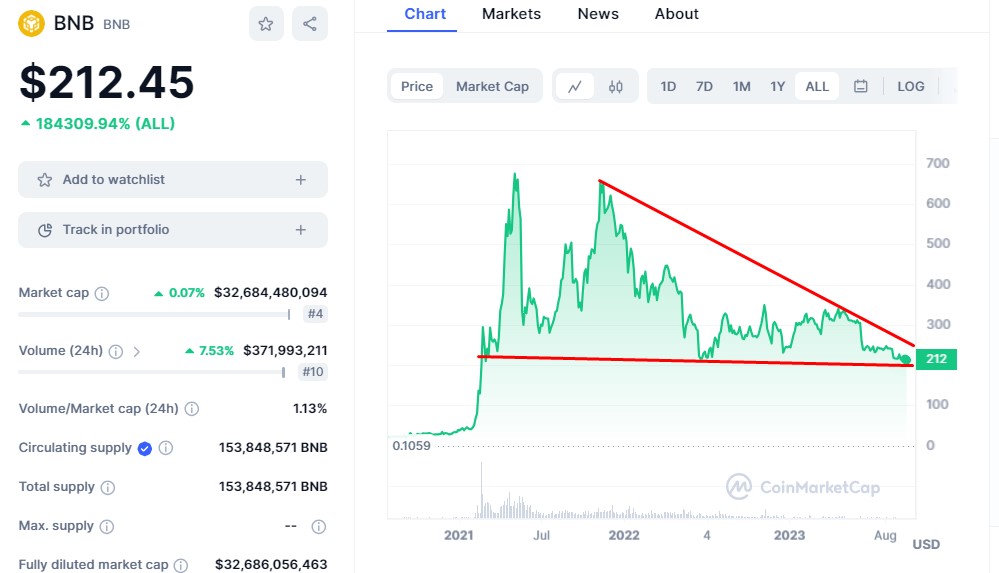

BNB (BNB). BNB is the native coin of Binance. The coin hit a strong support level due to pressure on Binance from regulators and rumors of artificial price manipulation on the part of the exchange. Decrease in the amplitude of movement and the focus on the angle of the triangle gives reason to assume that the coin can at least return to the level of USD 340-350 against positive news

Here you can find the long-term BNB price prediction.

-

5

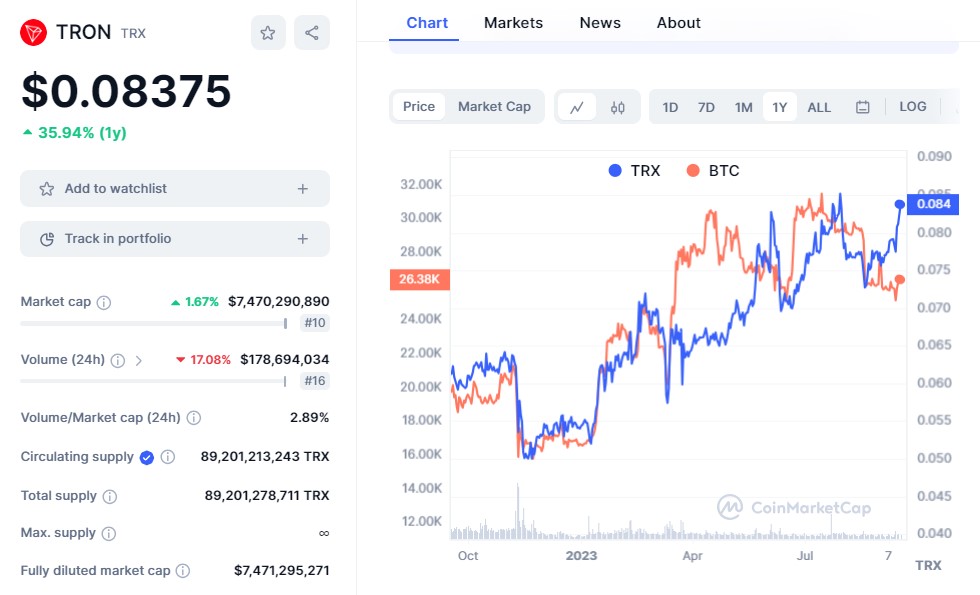

TRON (TRX). Tron is a dark horse that sometimes shows very impressive results. Justin Sun, who owns HTX (rebranded Huobi) and Poloniex exchanges, is behind it. Payments in USDT (TRC20) are perhaps the most popular in the crypto environment due to low fees. Comparison with the BTC chart shows that TRX may be a better investment at some point

Here you can find the long-term TRX price prediction.

-

6

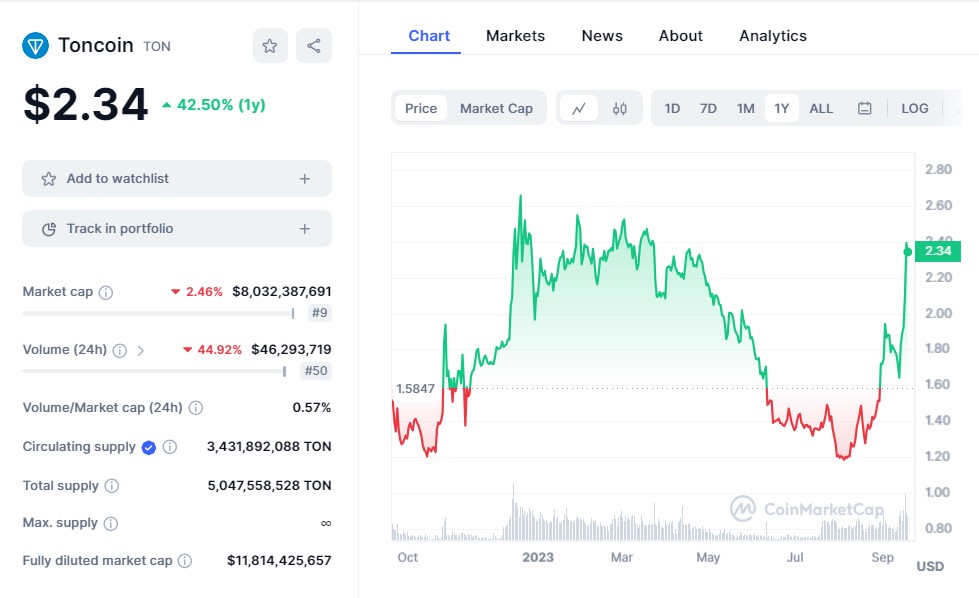

TON. “Rising from the dead” is what some analysts call this coin, expecting its price to break out soon. Telegram owners began to develop the platform in 2018. Later they abandoned the project, but returned to it after certain events. The coin appeared in the CoinMarketCap rating in 2021 on yet another pump wave and almost immediately entered the top 10 cryptocurrencies in terms of capitalization

During August-September, the coin price increased more than twofold and analysts believe that this is not the limit. In September, the TON Foundation announced integration of the TON Space cryptocurrency wallet into Telegram. The platform owners plan to connect 30% of all messenger users to The Open Network by 2028. On this news, the coin price increased by more than 15%.

-

7

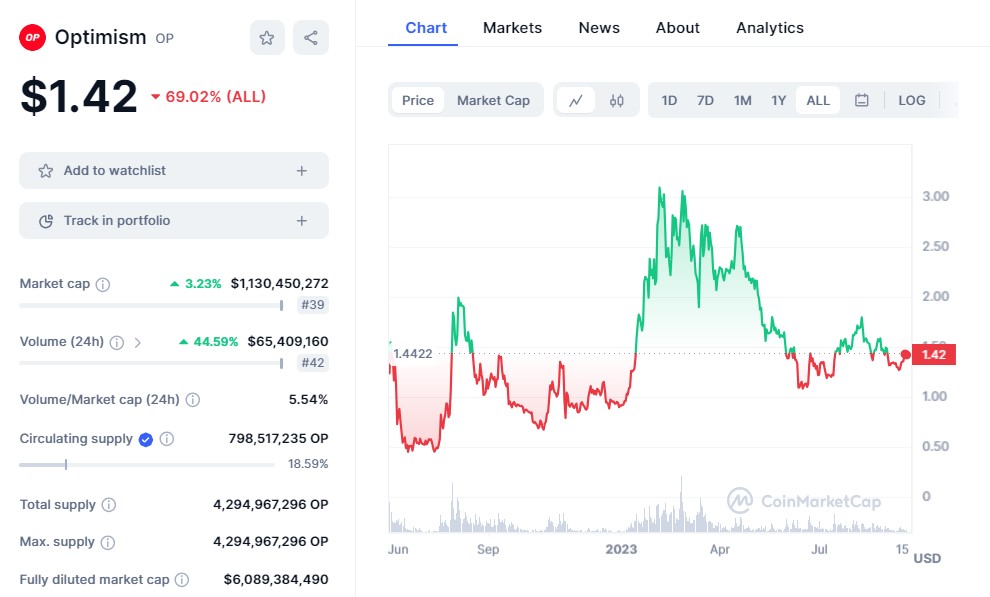

Optimism (OP). This coin entered the market too late, missing the boom of 2021. But this did not prevent it from showing more than threefold growth during the crypto winter. The startup is a Layer two (L2) solution aimed to increase Ethereum’s speed. Practical benefits and frequent airdrops will support the coin price in the future

In addition to the above coins, it is worth adding Ethereum to diversify risks. ETH is a coin with a future and is the second main driver of the entire market. After switching to the PoS (Proof of Stake) algorithm, developers continue to improve the network. And although there are plenty of competitors for the deployment of DApps (decentralized applications), Ethereum continues to retain its leadership.

How to invest in cryptocurrencies

Anyone can invest in promising cryptocurrencies without leaving home. There are two main options. The first one is purchasing crypto on cryptocurrency exchanges and then holding it in an exchange account or cold wallet, as well as trading CFDs with a broker. The second option is more suitable for short-term speculative trading due to swaps. However, leverage up to 1:1000 and fee-free short positions are available. Cryptocurrency exchanges are more suitable for long-term purchases.

How to invest. Some tips from professionals:

-

Wait for the next price reversal after reaching the price bottom. For example, it makes no sense to buy BTC at 30K if there are conditions for the price to drop to 26-27K. Although you are buying for a long term, the difference of 3-4K is significant

-

Do not hold your money in cryptocurrency exchange accounts. This is appropriate in the short term, but in the long term it makes no sense. Transfer your cryptocurrency to a cold wallet. Be careful and neither follow third-party links nor enter your personal data or wallet details on third-party websites, as there is a risk of phishing. Do not click unfamiliar links, as keyloggers and other fraudulent software can catch you

-

Do not rush to sell coins during local drawdowns. Your goal is long-term investment. And it must bring at least 100%, which is quite realistic within a 2 year period

It is important not only to buy on time, but also to sell on time. If the price increases by 100%, sell 50% of the purchased cryptocurrency, which will allow you to fully pay back your investment. Use the remaining 50% at your discretion.

Investments in cryptocurrencies. Expert opinions

In this block you will study the expert opinions. This is what analysts think about the future of cryptocurrencies:

-

Tom Lee: Co-Founder of Fundstrat research company: If SEC gives the green light to Bitcoin ETFs, the BTC price could rise above 150K due to excess of demand over supply

-

Kevin Kelly: Co-Founder and Head of Research at Delphi Digital: BTC has crypto cycles that repeat once every 4 years on average. Each time after the all-time high, Bitcoin decreases by 80%. The next crypto cycle matches the upcoming halving in 2024

-

Robert Kiyosaki: The United States cannot curb inflation, so USD will face difficult times, and BTC as an alternative currency will rise to 120K and above in 2024

Traders Union expert opinion

September is traditionally a bad month for cryptocurrencies. The beginning of autumn is psychologically perceived as the start of a new working season after summer vacations. Therefore business activity is still weak, as investors are pulling themselves together. Fundamental factors are not encouraging yet, but only if it is about the short term. There is an opinion that a new round of SEC claims means an attempt to clear the way for the digital dollar, but this is only an assumption. The success of Ripple shows that attitude of countries towards cryptocurrencies is gradually changing for the better. This means that positive changes in the field of legislation are possible, at least regarding BTC. Any such news will be taken positively, and the entire market will follow Bitcoin. Therefore, in the long term, the BTC price could once again reach the highs of 2021.

Summary

The cryptocurrency market continues to be one of the most volatile and high-risk markets, but at the same time it is the most profitable and promising one. Continued pressure from regulators will sooner or later come to an end and cryptocurrencies will rise again. Analysts find it difficult to say exactly when to expect it, predicting a period of 1-2 years. Therefore, there is an advice: make sure you buy cryptocurrencies while they are near the price bottom. Be patient and fortune will definitely smile at you!

FAQs

Which cryptocurrency is the most promising in 2024?

TON, BNB, XRP, and SOL are showing promise, according to analysts. Each of these coins has their own internal drivers that can enhance the effect of fundamental factors affecting the entire market. The potential of BTC and ETH, that are top cryptocurrencies, remains.

Which coin to buy now?

Create a diversified portfolio of different coin classes, such as Bitcoin, top 30 coins, Metaverse coins, and DeFi (Decentralized Finance).

What is the most stable cryptocurrency?

Bitcoin is a cryptocurrency with relatively stable growth and decline dynamics. It is a market driver and is the first to react to any fundamental factors. BTC has a lower level of volatility, which is why the coin is well suited for conservative long-term strategies.

Which cryptocurrency is the most reliable?

The most reliable cryptocurrency is one recognized by regulators and that has practical use. Among stablecoins, Tether (USDT), secured by real assets, can be called reliable. Other reliable types of coins are BTC and ETH.

Glossary for novice traders

-

1

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

2

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

3

Ethereum

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

-

4

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

5

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).