Please note:

The data on large options positions in major market assets, which can be received regularly via Market Chameleon newsletters, will be useful for regular forex traders as well.

The Best Free Stock Alert - eToro

Best Free Stock Alerts:

eToro - the best for automatically copying trades

Market Chameleon - best for experienced traders

MarketWatch - convenient stock monitoring

M1 Finance - the best for beginners

CNBC - favorable conditions for alerts

Stock alert services are highly demanded by both beginners and experienced traders. Such services can be completely free or paid, but with a basic free version, such as Market Chameleon and CNBC. Traders Union specialists have analyzed the most popular of the alert services, taking into account the reliability and accuracy of signals, functionality and usability to help you choose the most suitable tool for tracking changes in the financial markets.

How can I get free stock alerts?

You can use financial news sites and stock market apps to receive free stock performance alerts. In addition, subscribing to email newsletters or setting up alerts on trading platforms provides timely notifications of market movements and stock price changes.

Which is better, a free or paid stock alert?

The choice between free and paid stock alerts depends on individual preferences and needs. Free alerts can be useful for casual investors or people on a tight budget. However, paid services often offer more comprehensive analysis, personalized recommendations, and faster notifications.

What are the alert channels?

Notification channels for stock updates include email alerts, mobile push notifications via specialized apps, SMS alerts and social media platforms such as Twitter or Reddit where users discuss and share real-time information about securities. Some brokerage platforms also offer customizable alert features.

Why is it beneficial for beginners to use free Stock Alerts?

Free stock performance alerts are useful for novice investors as they provide an opportunity to familiarize themselves with market dynamics, track stock price changes, and learn strategies without financial commitment. The alerts help beginners build confidence and expand their knowledge before considering paid services or investing.

TU experts have selected the 5 best platforms with free stock alerts.

| Stock Alerts Provider | Alert channel | Term of use | Pros | Cons |

|---|---|---|---|---|

|

Push, Email |

Free |

1. Free stock alerts and notifications 2. Real-time updates on selected stocks 3. Integration with eToro trading platform |

1. Limited customization options 2. Limited range of alert channels 3. May require an eToro account to access |

|

|

Push, Email |

Service Level: - Starter - $0 - Stock Trader - $39/month - Options Trader - $69/month - Earnings Trader - $79/month - Total Access - $99/month |

1. Free stock alerts and notifications 2. Variety of alert channels 3. Customizable alert settings |

1. Limited features compared to paid plans 2. Advanced features available only in paid plans |

|

|

MarketWatch |

Email or test message alerts |

Free |

- Commission free - A great news source - Real-time stock market data, financial investment news, and market dynamics analyses are available |

- The platform has lots of distracting ads - The platform isn’t easy to navigate |

|

Email or text alerts |

Free |

- Commission free - Automated functions available - Customizable investing - Accessible credit line |

Not ideal for active traders |

|

|

CNBC |

Email, streaming content, or text alerts |

Free version and pro-version for $29.99 per month |

- After-hours and pre-market trading data available - Global market data and real-time market quotes on stock - Live streaming content on business and finance - iPhone, Android, and iPad-enabled |

The free version has limited capabilities |

eToro presents itself as a dependable stock alert service that offers traders a robust set of features and a user-friendly interface. It serves as an excellent option for those seeking accurate and timely alerts to make well-informed trading decisions. The platform fosters a vibrant community of traders who actively share insights and ideas, ensuring that traders never operate in isolation.

eToro's alerts can be personalized to suit individual preferences, enabling traders to receive notifications regarding projected economic events that may impact prices, whether they rise or fall. Furthermore, their alerts seamlessly integrate with traders' trading platforms, ensuring they stay updated on the latest market trends. Distinguishing itself from other alert services, eToro's alerts are grounded in both technical and fundamental analysis, offering traders a comprehensive market perspective. With its wide range of features, eToro empowers traders to stay ahead of the curve and maximize their potential profits.

Market Chameleon stands out as a comprehensive platform for options research, offering traders a wide range of information and tools to stay ahead in the market. The platform provides real-time data on options trading, historical stock prices, and extensive market analysis, equipping traders with valuable insights to make informed decisions. Market Chameleon caters specifically to options traders, offering intraday and end-of-day market data, press releases, earnings reports, and dividend information.

Please note:

The data on large options positions in major market assets, which can be received regularly via Market Chameleon newsletters, will be useful for regular forex traders as well.

The platform provides comprehensive data and analysis through direct download, including historical options trading data, volatility trends, upcoming earnings and dividend events, and daily stock market activity. With its vast resources, Market Chameleon serves as a valuable source of trading ideas, featuring a variety of trading ideas such as earnings alerts and options strategies.

The MarketWatch platform is a Dow Jones Inc. venture, which provides in-depth analysis of the stock or Forex market. It also provides an accurate presentation of the present and projected future market trends as well as timely and accurate trade alert details pertaining to stocks of interest or other investment options. Apart from presenting important market alerts and in-depth analyses, MarketWatch also offers a wide array of informative articles on trading, money, and the Forex and stock markets.

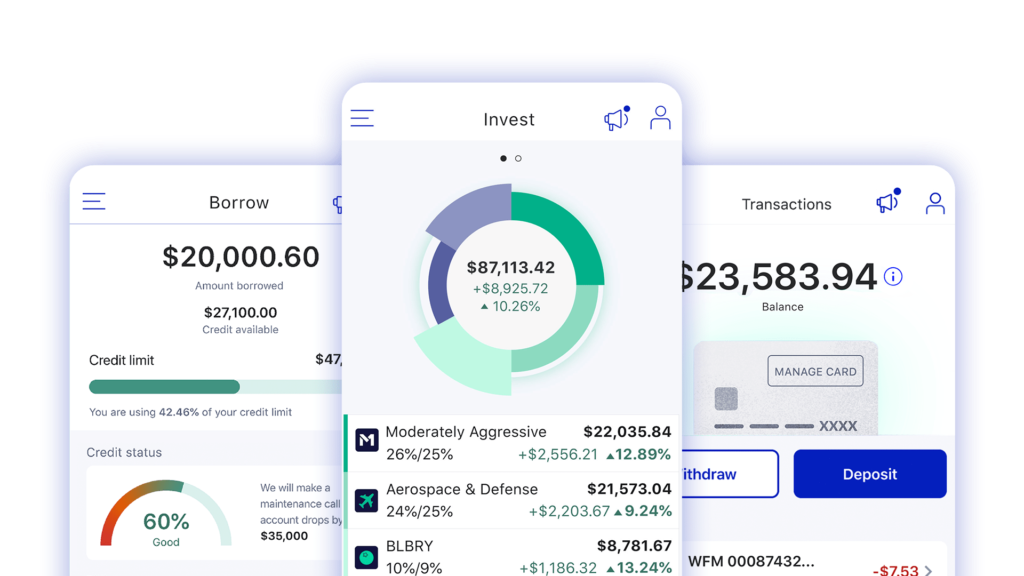

Do you like freebies? Well, most people do! M1 is one of these freebies in the stock trading industry. M1 is a trading platform that serves as a free portfolio, stock tracker, and trade management online platform. The platform also provides stock price alerts, and essential advice on selling and trading tactics. The platform belongs to M1 Financial services company established in 2015.

M1 doesn’t charge any fee for using its services on any Forex market or trading option. The platform is ideal for new traders who’re trying to grasp market and trading basics. It’s for this reason that it’s perhaps one of the best 2025 stock price alert platforms that helps starters in learning the ropes.

M1 also has useful content on Forex trade accounts, trading, and market details. Opening an account on M1’s platform is easy. All you have to do is sign up, provide personal details, and verification documents to get your account approval. Thereafter, you can deposit funds and start trading.

M1 Finance

The above highlighted stock alert services provide a wide array of services that improve your trading prospects by providing insights that may help you make prudent decisions that may reduce risk and increase profits.

Read on to learn more about the seven top stock alert services that traders use to reap profits in the trading and forex markets while reducing their trading risk and possible losses.

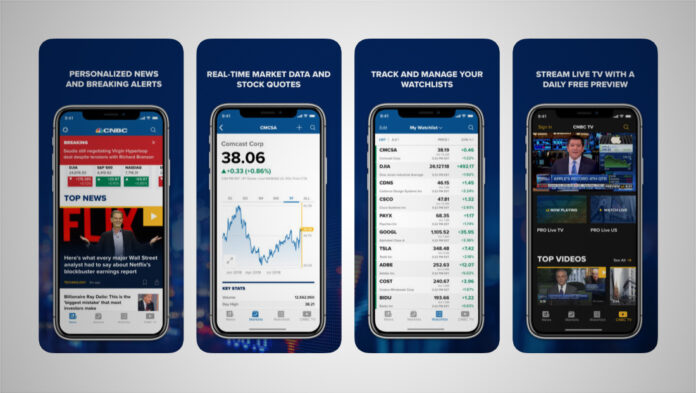

You know the CNBC for real-time financial market and business news coverage, but you may not have known that it’s part of the best stock price alerts platform in 2025. NBC is the main investor in the CNBC stock price alert platform.

CNBC’s platform presents stock projection estimates, real-time stock quotations, and projections of stock/forex market trends. All this information is given free of charge via the CNBC app and its online platform. In addition, you may also get access to popular CNBC shows on money matters, including “American Greed,” and “Mad Money.”

CNBC

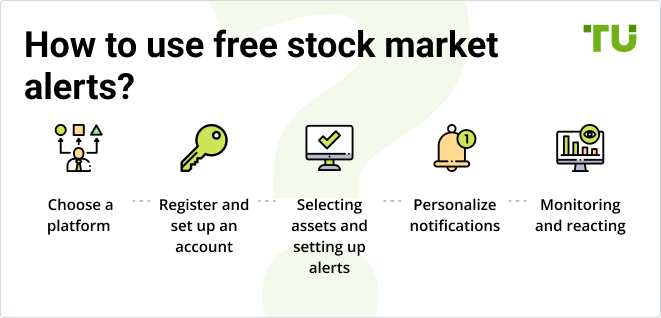

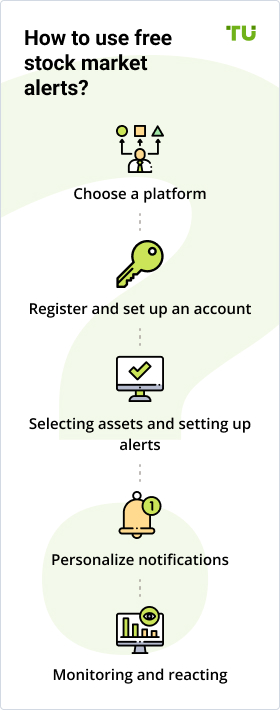

TU experts give a step-by-step algorithm for using free stock exchange notifications:

You should start by researching available platforms that offer free stock alerts, such as Yahoo Finance, CNBC, MarketWatch and others. Using Traders Union's advice, you should choose a platform that matches your needs and preferences.

You should register on the chosen platform, according to the instructions on the website or in the application, create a profile and log in to the account.

Next, you need to identify stocks to track and set up alerts in accordance with your investment strategy: specify the price or percentage change, when reached which alerts will be sent, if necessary and possible - set alerts based on technical analysis.

Here you should select the methods of receiving alerts (e-mail, SMS, mobile application, etc.), specify the frequency and time of receiving alerts.

It is important for active traders to regularly check the alerts they receive and analyze changes in the market to make informed decisions about buying, selling or holding assets.

Periodically, it is advisable to review the investment strategy based on the results and experience of using alerts and make adjustments to their settings.

By following this algorithm, a trader will be able to effectively use free stock alerts to manage an investment portfolio on the financial markets.

There are several types of alerts, each with its own benefits. Traders Union has reviewed the main types of free stock alerts and their features.

These are instant and one of the most effective ways to get market information. They appear directly on your mobile device or computer screen as a pop-up message, even if the corresponding app is closed. As a result of push notifications, you can receive information instantly and react to market changes quickly.

E-mail is a more traditional but still sought-after way to receive free stock alerts. Investors can set up email notifications to receive information about significant stock price changes, company news, and other market events. The pros of such notifications are the ability to save messages for later analysis and the organization of information.

These are text messages sent to investors' cell phones. This method of notification provides fast and direct delivery of market information, which makes it convenient for those who want to stay informed even without access to the Internet or mobile applications. The disadvantages of such information include the fact that not all operators offer free SMS.

Many investment platforms offer mobile apps with built-in notification features. These applications allow customizing notifications according to the user's investment strategy and include different types of alert (price changes, technical signals, news updates, etc.). Traders receive alerts directly to their gadgets.

When choosing the type of alerts, it is worth considering its convenience, speed of information delivery and compatibility with investment needs.

When choosing alerts, the question arises - are free alerts so beneficial to the trader? Is it possible to miss something important by neglecting paid versions? TU specialists have considered the pros and cons of paid and free versions and summarized them in the table.

The advantages of free alerts, except for the zero cost itself, are the simplicity of the interface and the minimum of settings, which is convenient for beginners. Basic functions, as a rule, are enough for novice investors or those who just want to stay informed about market events. The disadvantages include limitations on the number of alerts and frequency of their sending, as well as an incomplete list of customization functions and a lack of analytics.

Paid versions usually offer detailed customization, technical analysis, access to exclusive data and tools, and often priority client support. The disadvantages are complexity of use (sometimes) and unjustified overpayment for packaged functions that a trader does not use.

Comparative table of free and paid alerts

| Functions | Free alerts | Paid alerts |

|---|---|---|

Cost |

Zero |

Depends on the platform and tariff |

Setup options and tools |

Limited set |

Expanded set |

Data availability |

Basic data level |

Access to exclusive data |

Quantity |

Can be limited |

Not limited |

Support |

Not always complete |

Priority |

To get the most out of "stock alerts", you need to apply them correctly and avoid overloading them. In order to use alerts wisely (especially for beginners), Traders Union recommends:

Before you start using Stock Alerts, you should define your investment goals and what exactly you need the alert for. This will help you choose the most appropriate types of alerts.

It is necessary to clearly define the types of alerts that are most appropriate for the chosen trading plan. And then correctly set prices, percentage changes or other parameters of alerts.

This is a very important point. You should avoid information overload by setting a limited number of notifications. You should be able to focus on specific parameters that directly affect your investment portfolio.

It is worth not just reacting to alerts, but also analyzing the information received. You need to understand what events and factors affect stock prices and how they may affect your portfolio.

You don't have to react to every alert instantly. Before deciding to buy or sell a stock, it is advisable to be sure to do some additional analysis and risk assessment.

By utilizing these tips, beginners can get the most out of stock market alerts and manage their investments effectively.

"Typically, in the current market landscape, complimentary stock alerts adequately meet the requirements of the majority of traders. Those who are willing to pay for them often overpay for features that are little use later. Ultimately, alerts are only a catalyst. Traders still make trading decisions not on the basis of alerts, but as a result of analyzing the market situation after receiving them."

Free Stock Alerts (Free Stock Alerts) are an important tool for traders, helping them to be aware of the current market situation and build their investment strategy based on up-to-date information. When choosing a free or paid version, you should take into account the real needs of an investor. If you need basic functionality and want to save money, free versions can be a good choice. Paid features are needed mainly by trading professionals.

Stock alerts can be customized in various forms. Push notifications provide instant delivery of information, email provides the ability to organize and archive messages, SMS allows you to stay informed regardless of internet access, and mobile apps offer a convenient way to receive alerts on mobile devices.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Pre-market trading refers to trading activity in financial markets before the official opening of the regular trading session, allowing investors to react to pre-market news and events.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Winnifred Emmanuel is a freelance financial analyst and writer with years of experience in working with financial websites and businesses. Her expertise spans various areas, including commodities, Forex, stocks, and cryptocurrency. Winnifred tailors her writing to various audiences, including beginners, while also providing useful insights for those who are already familiar with financial markets.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).