Best Gold Stocks To Buy Now 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The best gold stocks to buy now are:

Eldorado Gold Corporation (EGO) – а mid-tier gold producer with diversified mining operations in Canada, Turkey, and Greece.

AngloGold Ashanti Limited (AU) – one of the world’s largest gold miners, operating across Africa, Australia, and the Americas.

Royal Gold, Inc. (RGLD) – a gold-focused royalty and streaming company with a diversified portfolio of mining interests.

Gold Fields Limited (GFI) – a South African gold mining giant with operations in Australia, Ghana, and Latin America.

Franco-Nevada Corporation (FNV) – a leading gold royalty and streaming company known for stable cash flows and low operational risk.

Wheaton Precious Metals Corp. (WPM) – specializes in gold and silver streaming deals, offering strong exposure to precious metals.

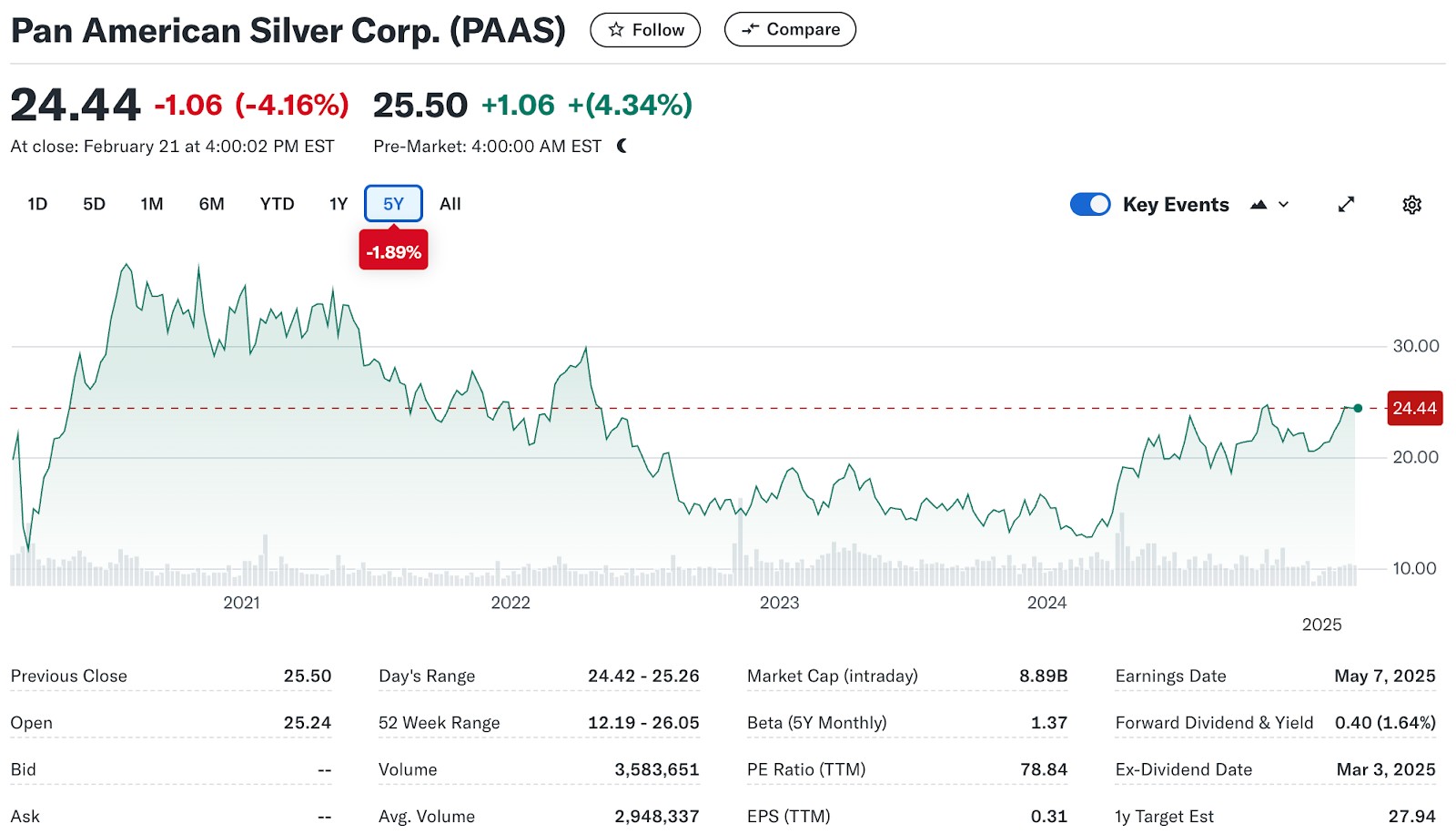

Pan American Silver Corp. (PAAS) – a major silver and gold producer with a strong presence in North and South America.

Gold has always been a go-to investment for those looking to protect their wealth, and its reputation as a safe-haven asset hasn’t changed. Lately, more people are exploring investment opportunities, and gold remains a top choice.

While buying physical gold is an option, investing in gold mining companies offers a simpler and potentially more profitable way to get involved. If you're considering this route, we’ve rounded up some of the top gold mining stocks worth watching. Let’s dive in!

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What are gold stocks and investments?

Gold stocks and investments are often seen as safe havens, but beginners usually focus too much on well-known mining giants instead of exploring niche opportunities. One under-the-radar strategy is investing in royalty and streaming companies rather than traditional mining firms. These companies don’t mine gold themselves; instead, they finance miners in exchange for a percentage of future production. This model gives them exposure to gold prices without the risks of operational costs, labor disputes, or mine shutdowns.

Another overlooked approach is analyzing central bank buying patterns. Most people track gold prices based on inflation, economic downturns, or geopolitical tensions, but few pay attention to the long-term gold purchasing trends of countries like China, India, and Russia. When central banks quietly accumulate gold reserves, it often signals upcoming shifts in currency policies or global trade balances — key indicators that can help you time your investments. Digging into central bank reports, particularly from the Bank for International Settlements, can give you an early read on where gold prices might head. This method helps you anticipate long-term price movements rather than just reacting to short-term market noise.

Top gold stocks to invest in

Based on the latest available data, here is an updated overview of top gold stocks, including their dividend yields, forward P/E ratios, and projected EPS growth over the next five years:

1. Eldorado Gold Corporation (EGO)

Founded in 1992, Eldorado Gold Corporation is a leading Canadian gold mining company operating in Greece, Canada, and Turkey. As of mid-February 2025, the company boasts a market value of about $2.1 billion USD, with shares trading at $13.98 USD. In 2024, Eldorado achieved an impressive 560% increase in earnings per share, highlighting its robust financial health. The company's main operations include the Olympias mine in Greece, the Lamaque Complex in Canada, and the Kışladağ and Efemçukuru mines in Turkey. This diverse presence helps reduce risks tied to regional uncertainties. Eldorado remains focused on exploration and development to maintain production levels and support long-term growth.

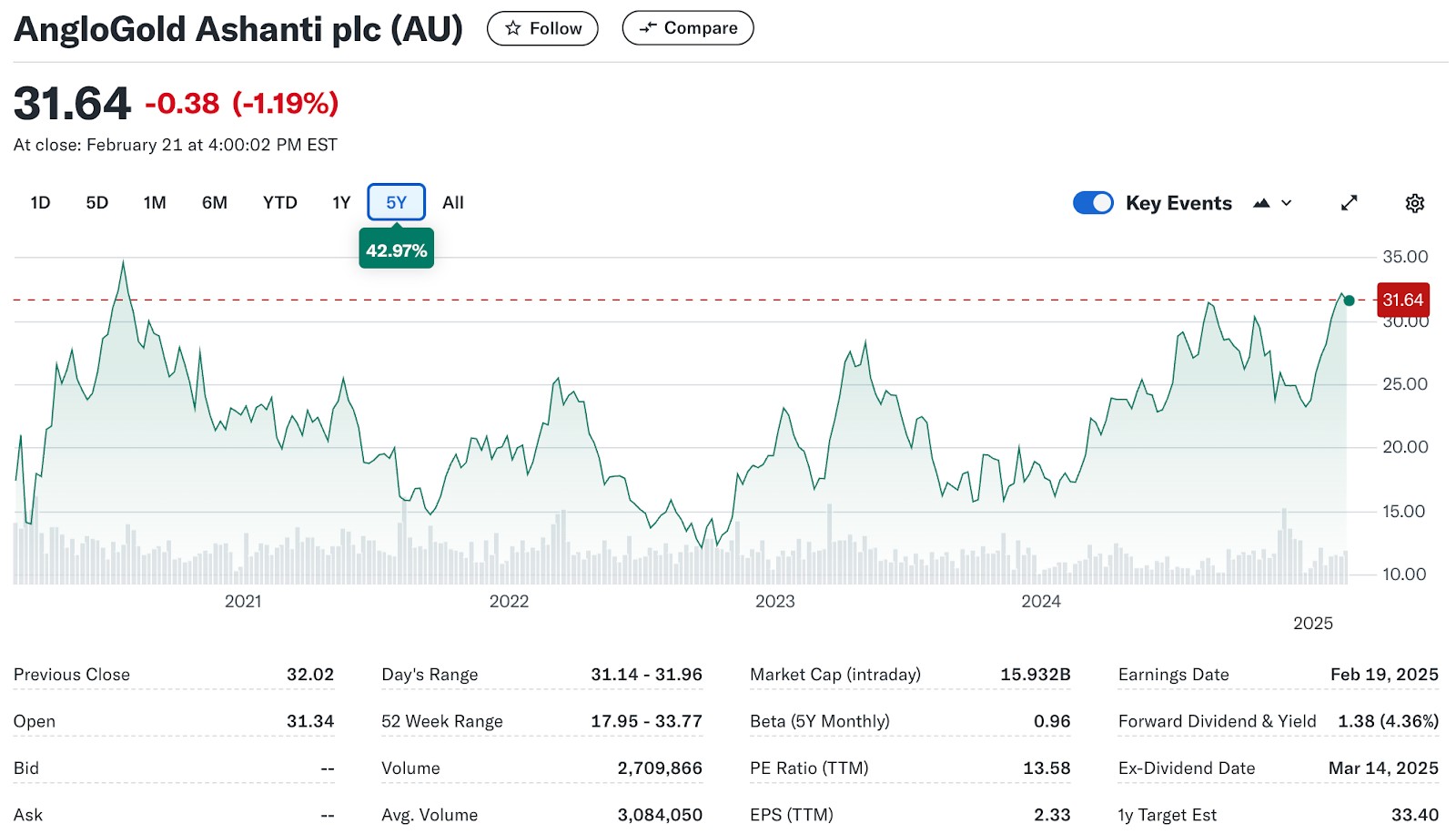

2. AngloGold Ashanti Limited (AU)

AngloGold Ashanti Limited, established in 2004 and based in South Africa, stands as one of the world's leading gold mining companies, with operations spanning Africa, Australia, and the Americas. Currently, the company has a market value of about $16.2 billion. Its shares are trading on the NYSE under the symbol AU.

In the third quarter of last year, AngloGold reported net earnings of $236 million, a significant turnaround from a $194 million loss in the same period the previous year, thanks to rising gold prices. The company is also set to acquire Centamin, an Egypt-focused gold mining firm, in a $2.5 billion deal expected to finalize this month.

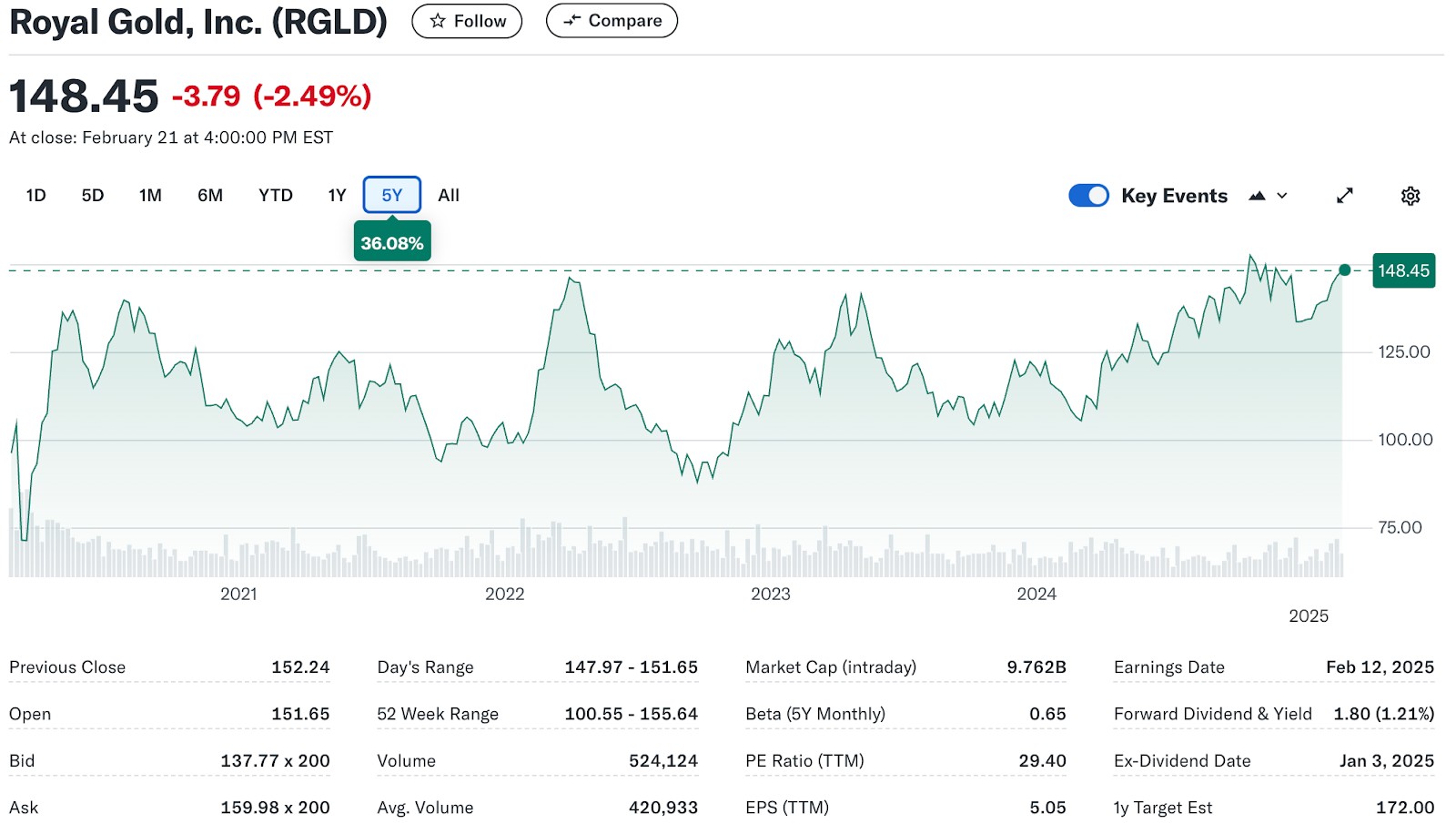

3. Royal Gold, Inc. (RGLD)

Royal Gold, Inc., based in the U.S., stands out in the gold mining sector through its distinctive approach of metal streaming and royalties. With a market cap around $9.66 billion and an EPS of $5.04, the company showcases robust financial health. Rather than engaging in direct mining, Royal Gold provides financing for mining operations in return for royalties or access to metals at discounted rates, effectively reducing operational risks. Its diverse global portfolio helps cushion against political and economic fluctuations, aiming for consistent growth and financial stability.

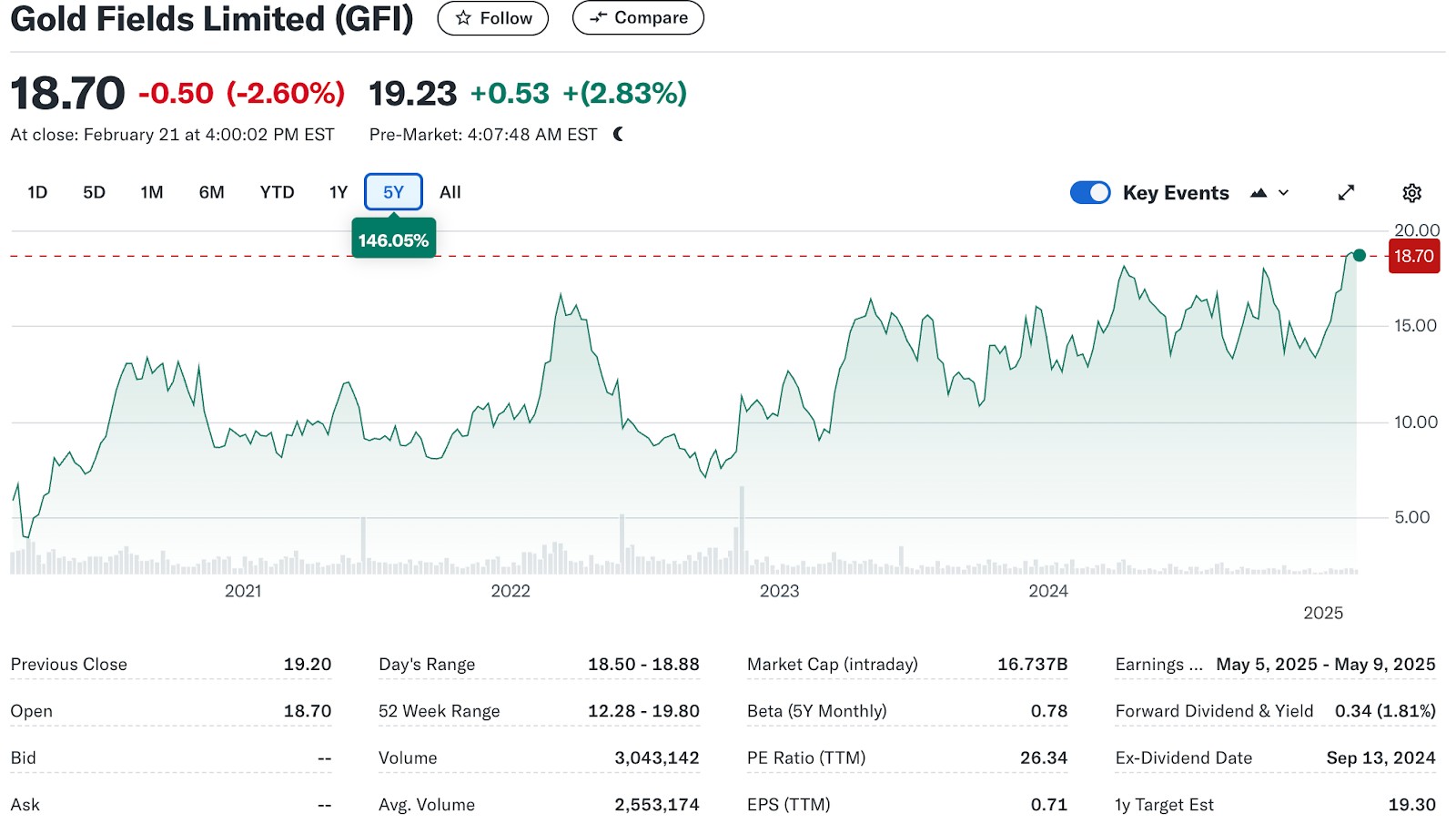

4. Gold Fields Limited (GFI)

Gold Fields Limited, founded in 1887, is a leading South African gold producer with operations in South Africa, Peru, Chile, Ghana, and Australia. As part of its growth plans, the company has expanded into copper exploration. Focusing on sustainability, Gold Fields uses advanced technologies to improve efficiency and support eco-friendly mining. The company works closely with governments and stakeholders to advance its projects. In the first half of 2024, Gold Fields reported revenue of $2,123.9 million, down from $2,266.3 million in the same period of 2023. As of February 18, 2025, the company's market capitalization is approximately $16.64 billion, with a stock price of $18.87.

5. Franco-Nevada Corporation (FNV)

Franco-Nevada Corporation stands out in the gold mining industry by focusing on royalties and streaming, allowing investors to gain exposure to gold prices without the challenges of running mining operations. By partnering with mining companies, Franco-Nevada secures the right to purchase a share of mined products on favorable terms. Their assets span across the U.S., Canada, and Latin America, and they are committed to sustainable practices in line with the World Gold Council's guidelines.

In the second quarter of 2024, the company reported having $2.4 billion in available capital and remained debt-free, highlighting its strong financial health. They generated $194.4 million in operating cash flow during this time. While there was a 21% drop in revenue compared to the same quarter the previous year — mainly due to factors like the halt of contributions from Cobre Panama and lower outputs from Candelaria and Antapaccay — Franco-Nevada's solid financial footing showcases its ability to navigate industry challenges.

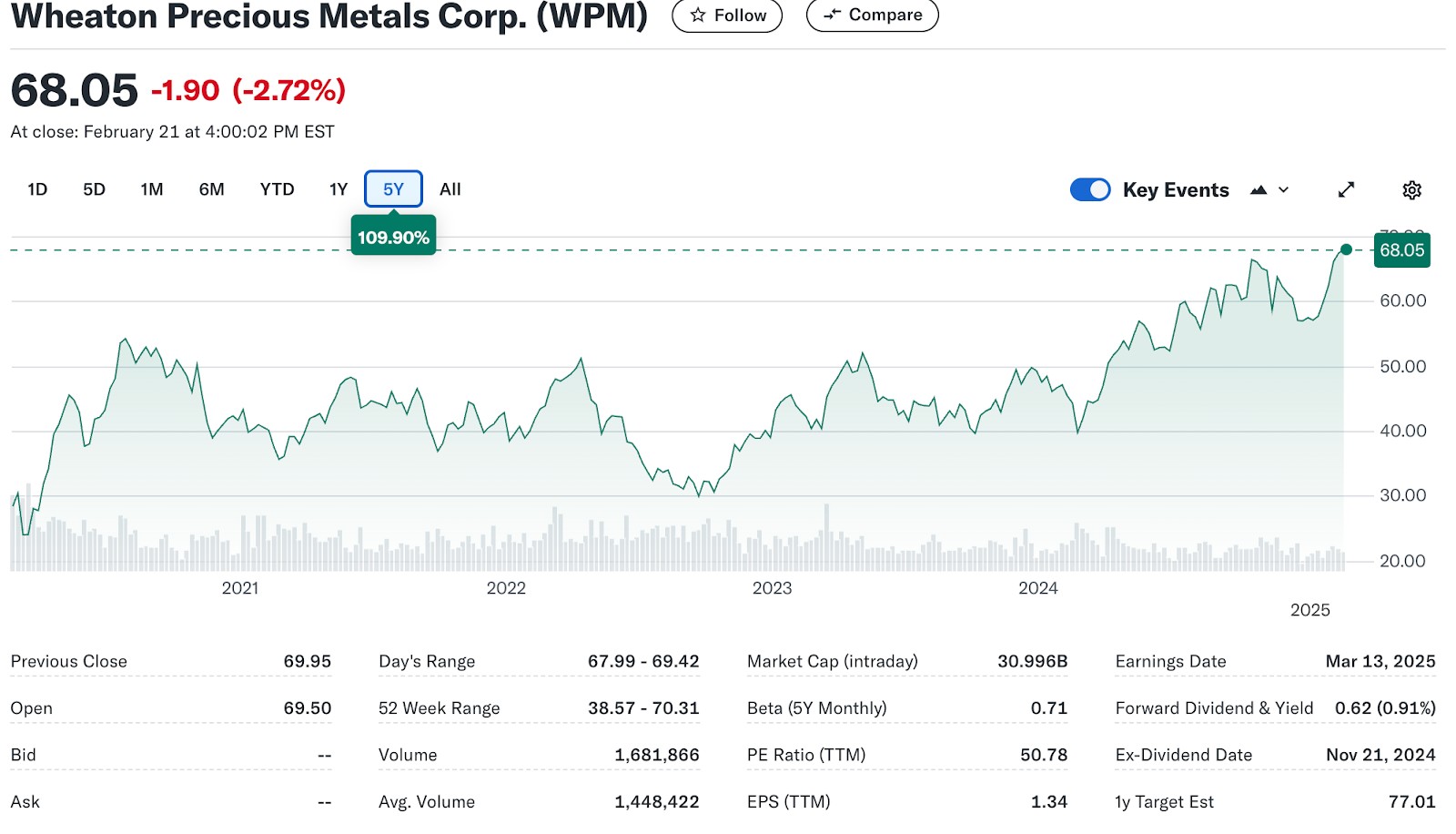

6. Wheaton Precious Metals Corp. (WPM)

Wheaton Precious Metals provides upfront funding to mining companies, allowing them to purchase precious metals at discounted rates. This approach eases the financial challenges miners face and guarantees Wheaton a steady and reliable income. As of February 2025, Wheaton's market value stands at about $30.62 billion. Experts anticipate that the company's earnings per share will grow by 4.8% annually over the next five years.

With a broad range of precious metals in its portfolio, Wheaton can better navigate market ups and downs. By continually adding new streaming agreements, the company aims for lasting growth without the typical risks that come with traditional mining operations.

7. Pan American Silver Corp. (PAAS)

Pan American Silver, established in 1994, has grown into a leading silver and gold producer across the Americas, operating in countries like Canada, Mexico, Argentina, Peru, Chile, Brazil, and Bolivia. This broad geographical footprint in politically stable regions has been key to the company's strong performance and resilience. By February 2025, the company's market value reached around $8.87 billion USD. In the third quarter of 2024, Pan American Silver achieved an EPS of $0.32. Their prudent financial practices have maintained healthy cash flows, and their significant cash reserves have enabled ongoing growth through expansion and acquisitions, setting the stage for continued success in the future.

| Gold stocks | Demo | Account min. | Interest rate | Basic stock/ETF fee | Min. stock/ETF fee | Android | iOS | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | No | No | $3 per trade | $3 per trade | Yes | Yes | Open an account Via eOption's secure website. |

|

| Yes | No | No | 1 | Zero Fees | Zero Fees | Yes | Yes | Open an account Via Wealthsimple's secure website. |

|

| Yes | No | No | No | Zero Fees | Zero Fees | Yes | Yes | Study review | |

| Yes | No | No | 0,15-1 | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | £1.00 in the UK, €1.00 in the Eurozone | Yes | Yes | Study review | |

| Yes | Yes | No | 4,83 | 0-0,0035% | $1,00 | Yes | Yes | Open an account Your capital is at risk. |

What will influence gold mining stocks in the middle term?

Gold mining stocks are affected by many factors, but some under-the-radar influences can significantly impact their performance in ways that most investors overlook.

Central bank gold lending operations. Many central banks lend out their gold reserves to financial institutions, impacting supply dynamics in ways that aren't immediately visible in market prices. If central banks tighten lending policies or recall gold loans, it can create sudden supply squeezes that drive up prices, benefiting mining stocks. On the flip side, aggressive gold lending increases artificial supply, which can suppress prices even if demand remains high.

Cost inflation in key mining jurisdictions. Instead of general inflation, pay attention to localized inflation in major mining regions like Peru, Canada, and South Africa. Rising costs for labor, energy, and equipment in these areas can quietly erode mining margins, even if gold prices are rising. Watch for governments in these regions introducing higher wage laws or environmental regulations — these can make even well-managed companies struggle with profitability.

The gold-to-silver production ratio shift. Some major gold miners also produce silver as a byproduct. When silver prices spike faster than gold, companies may start prioritizing silver extraction over gold, which can cause unexpected fluctuations in reported gold output. A lower reported gold output — even if it's a strategic decision — can lead to stock price drops, confusing investors who aren't tracking the full production mix.

Hidden political risks beyond nationalization. Everyone watches for government takeovers, but the real risks often come from regional politics. Localized disputes over water rights, indigenous land claims, and even unexpected regional tax changes can disrupt operations just as much as a national policy shift. Following news from regional newspapers in key mining zones often gives you a lead time before mainstream analysts start pricing in these risks.

How to choose gold stocks to buy?

Investing in gold stocks goes beyond picking the biggest names — understanding industry nuances can give you an edge. Here are some powerful yet lesser-known insights to help you make smarter decisions.

Watch for mine life misrepresentation. Many mining companies highlight their proven and probable reserves but conveniently ignore declining ore grades or rising extraction costs. A mine with 15 years of reserves might only be truly profitable for 7-10 years. Dig into technical reports to verify if their "proven" reserves are actually viable.

Follow the royalty and streaming companies. Instead of owning mines, these companies finance miners in exchange for a cut of future gold production, often at a fixed low price. They make money even when gold prices drop, unlike traditional miners who struggle with operating costs. Studying these companies can reveal which miners are worth watching.

Compare all-in sustaining costs (AISC) to the jurisdiction. A company boasting a low AISC might still be a bad bet if it's operating in politically unstable or high-tax regions. If two companies have similar costs, but one is mining in Canada and the other in the Democratic Republic of Congo, the risk profiles are vastly different.

Look for companies hoarding cash instead of over-expanding. Many miners chase growth by acquiring new projects, but these moves often dilute shares or strain cash flow. Companies that sit on large cash reserves in bullish markets are usually the ones that can make opportunistic acquisitions when others are desperate.

Study the CEO’s past projects — not just the company’s track record. A company’s history might look strong, but if the leadership team has a pattern of failed ventures or overpromising, that’s a red flag. Check their past roles, the companies they led, and how those companies performed under their watch.

Benefits and risks of investing in gold mining companies

- Pros

- Cons

Mergers and junior miner acquisitions create exponential returns. Many investors focus only on large, established miners, but the real windfall often comes when major companies acquire smaller junior miners with rich untapped reserves. Keep an eye on acquisition trends — smaller companies with proven reserves but limited infrastructure often get snapped up, and their stock can surge before the deal is even finalized.

Political instability can be an opportunity, not just a risk. While political instability in mining-heavy regions is usually seen as a downside, it can also create rare buying opportunities. When a mine temporarily halts operations due to government intervention or labor strikes, the stock usually plummets. However, experienced investors know that these disruptions are often temporary, and the mine resumes operations at a higher valuation once issues are resolved.

Royalty and streaming deals let you invest in gold profits without the risk of mining. Some gold companies don’t mine at all — they finance mines in exchange for a cut of future gold sales. These royalty and streaming companies (like Franco-Nevada or Wheaton Precious Metals) generate revenue without the same risks as miners, making them a great alternative for gold exposure without direct exposure to operational challenges.

High-grade gold reserves aren’t always better than low-grade ones. Many beginners assume that high-grade gold reserves (more gold per ton of rock) mean higher profits. In reality, low-grade deposits in stable regions with cheap labor and energy costs can be far more profitable than high-grade deposits in politically risky or remote areas. Investors who only chase high-grade mines often overlook safer, more consistent long-term plays.

Environmental regulations can wipe out a mine’s value overnight. A gold mine that looks highly profitable today might be shut down tomorrow due to environmental violations. Governments are getting stricter on mining operations, and even well-established companies can suddenly face multi-million-dollar compliance costs or outright shutdowns. Always check the company’s ESG (Environmental, Social, and Governance) reports and track past regulatory issues before investing.

Gold mining is cyclical, but company debt isn’t. Many investors assume gold stocks will always rebound when gold prices rise, but heavily indebted mining companies can collapse before they get the chance. Some gold miners take on massive loans when gold prices are high, only to struggle with repayments when prices dip. Always check the debt-to-equity ratio before buying mining stocks — high debt levels can make even a great miner a terrible investment.

Comparison with Index Funds

Risk tolerance. Gold mining stocks are more volatile, appealing to high-risk-tolerant investors, while index funds offer lower volatility for conservative investors.

Diversification. Index funds provide broad market exposure across multiple sectors, offering greater diversification than gold mining stocks.

Long-term growth. Index funds are ideal for long-term investments due to consistent growth, whereas gold mining stocks are typically leveraged for short- to medium-term gains tied to gold prices.

Stability. Index funds are generally more stable and less volatile compared to gold mining stocks, making them a preferred option for risk-averse investors.

Gold stocks vs. gold ETFs: what to choose?

Gold investing isn’t just about picking between stocks and ETFs — it’s about understanding the lesser-known details that can make or break your returns.

ETFs can quietly eat into your returns. While ETFs feel like an easy way to invest in gold, those tiny annual fees add up over time. If you're planning to hold for years, those charges can silently drain thousands from your investment. Look for the lowest-fee ETFs or consider dividend-paying gold stocks to counterbalance the costs.

Gold stocks don’t just follow gold prices. It’s a myth that gold stocks move in sync with gold itself. Mining stocks rise and fall based on things like fuel costs, government policies, and even worker strikes. Before you buy, check how much debt a company has, how efficiently they mine, and where their operations are based — these matter just as much as the price of gold.

Owning stocks means you control your investments. When you buy an ETF, you’re locked into whatever companies the fund manager includes — even the weaker ones. If you think a specific gold miner has strong potential, buying individual shares lets you directly benefit from its success.

Some gold stocks pay you while you wait. Many people invest in gold hoping the price will go up, but some mining companies actually pay solid dividends. If you find a miner with a history of steady payouts and strong cash flow, you can earn income while waiting for gold prices to rise — something ETFs don’t offer.

Individual stocks can see huge jumps from supply shocks. If a major mine suddenly shuts down, gold stocks tied to competing mines often shoot up in price. ETFs spread their risk across multiple companies, which means you miss out on these dramatic gains.

Hidden triggers that make gold stocks skyrocket

Gold mining stocks aren't just about tracking gold prices — real experts dig deeper. One overlooked but powerful indicator is the “project expansion to production ratio.” Many junior miners announce ambitious exploration projects, but few actually translate them into full-scale production. The real money isn’t in speculative drill results but in companies that efficiently move from discovery to extraction. Smart investors analyze past execution records: Does the company consistently hit its own development timelines? Are they securing infrastructure funding without diluting shareholder value? Spotting miners with a strong ratio of completed projects to announced plans can lead to massive gains while avoiding cash-burning speculations.

Another uncommon strategy? Study the geopolitical stability of supply chains, not just mining locations. Investors often focus on jurisdiction risk — whether a country is mining-friendly — but they ignore the bottlenecks between mines and refineries. Some of the best gold producers operate in stable regions but still suffer from unreliable ports, high transport costs, or policy-driven export restrictions. Instead of just checking country ratings, look at logistics reports and trade route efficiency. Miners with smooth, cost-effective supply chains tend to have lower risk, better profit margins, and more predictable stock movements.

Conclusion

Gold mining stocks provide a valuable opportunity for diversification, inflation hedging, and portfolio growth. While they carry inherent risks like market volatility and operational challenges, strategic investments in top-performing companies or ETFs can yield significant returns. Assess your financial goals, risk tolerance, and market outlook to make informed investment decisions and leverage the potential of gold as an asset class.

FAQs

Should I keep gold in my portfolio?

Yes, gold is recommended to be a crucial part of your portfolio for long-term benefits. It is largely considered a safe haven that maintains a long-term value regardless of the state of the economy.

Will gold demand grow in the long term?

Yes, gold will continue to rise in demand in the long term because it is a safe haven for investors to maintain the value of their assets during economic crises or potential stock market sell-offs.

Should I have long-term gold stocks investment?

Yes, long-term gold stocks investment is worth it.

What are the potential risks associated with investing in gold?

Investing in gold for long-term and short-term profit carries inherent risks. The price of gold can be too volatile due to high market demand, which makes it less predictable.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.