Copying trades of professional traders on the Forex market is one of the most popular and advantageous ways to enter the market for a novice trader. After all, repeating the actions of experienced players implies that you can achieve their level of return rate. At the same time, you can borrow their experience and learn the art of asset management from real life examples.

Today’s social trading platforms make this work easy and almost entirely automatic. However, as with any investment, copy trading has not only advantages, but also hidden pitfalls.

Traders Union analysts have prepared a review featuring all main stages for starting copy trading from broker selection to real life examples of copying trades.

Why you should consider copying trades on Forex

First, let’s see why this type of work in the financial markets is worth considering.

Copying trades on Forex has several undeniable advantages:

-

1

A novice trader can copy the trades of an experienced trader automatically, which does not require in-depth understanding of the market and time expenditure.

-

2

There is an opportunity to borrow the strategies of successful traders.

-

3

You can start with a small amount – from $100.

-

4

You can get a higher than average profitability.

-

5

You can stop copying, reduce or increase the amount you allocated for a specific trader at any time.

-

Huge selection of markets and strategies for copying. You can distribute your portfolio among different traders.

As for the drawbacks, there are these:

-

1

A novice trader can copy the trades of an experienced trader automatically, which does not require in-depth understanding of the market and time expenditure.

-

2

There is an opportunity to borrow the strategies of successful traders.

We can sum up that copy trading is suitable for the novice traders or investors aiming to diversify their portfolio. At that, you always need to remember about the risks and avoid putting more money into it than you are prepared to risk.

Learn more about copy trader from the article on our websiteBest brokers to copy trades in 2024

An increasing number of Forex brokers are now offering the copy trading service. However, different brokers have different conditions, which is why the choice must be made as consciously as possible.

We have compiled a rating of Top 10 Forex brokers that meet the strict selection criteria:

-

1

They hold a license of one of the top regulators;

-

2

They offer a good quality, reliable copy trading platform;

-

3

They provide beneficial trading conditions and a wide range of financial instruments.

How to start copy trades on forex

In order to start copying trades, you need to follow this algorithm:

-

Select a broker that offers this service and open a trading account.

-

Connect to one of the copy trading platforms. Several companies, such as eToro, RoboForex, Instaforex have proprietary social trading platforms. However, the majority of other brokers (for example Xero Market) offer third-party developer platforms, the most popular of which are ZuluTrade, MQL, Myfxbook and Duplitrade.

-

Perform analysis of trading results of the traders you can copy.

-

Select from one to several dozen traders and set the limit of funds and risks for copying each trader.

-

Monitor financial results.

Below we will show you one of the strategies on starting to copy trades on eToro platform using specific examples.

Why eToro is the best broker to copy trades

Having analyzed the services of dozens of brokers, Traders Union experts selected eToro as the best broker for copy trading. eToro’s advantages include:

-

Reliability.

The broker is regulated in the UK (FCA), European Union (CySEC) and Australia (ASIC), which indicates a high level of reliability.

-

Experience.

eToro is one of the pioneers of social trading and has been offering forex copy trading services since 2010.

-

Largest platform.

eToro social network is the largest in the world. The strategies of over 100,000 traders are available for copying.

-

Technological effectiveness.

There are several dozens of instruments of statistical analysis for selecting traders and monitoring the results.

-

Trading conditions.

The copiers only pay the broker’s commission, which is either low or average, depending on the market. In particular, there is no commission at all on US stocks copying. In addition, the broker offers access to trading 2,300 instruments on the Forex, Stock, Cryptocurrency and CFD markets.

Below, in our review we will perform the analysis based on the eToro platform. If you’d like to gain a deeper understanding of the services this broker offers in terms of copy trading, please read the professional review.

How to copy trades with eToro

As we’ve already mentioned, the broker has a proprietary social trading platform. In addition to communication and knowledge exchange, the features for copying trades titled eToro CopyTrader occupy an important place on it.

First, you need to familiarize yourself with the eToro platform. We recommend opening a demo account. It will take no longer than 10 minutes. In this case, you can test all the features using the virtual $100,000 without any risks.

Open an Account68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Now, let’s take specific examples to see what we need to start copying trades on eToro. First, you need to access the broker’s online platform. You can familiarize yourself with the features of eToro by opening a live account or a demo account. Opening a demo account is free and you will be given virtual $100,000 for testing.

For the purposes of convenience let’s break down the process into three steps.

-

1

Step 1.

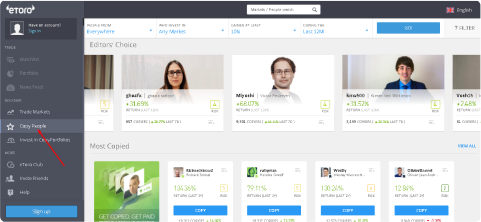

Selecting traders for copying trades. For this, in the open online platform, you need to select Copy People in the menu on the left of the screen. It is best to diversify your profile and select several candidates. Noteworthy, the minimum entry threshold for each trader is $500. You will therefore need around $1,000 in order to compose a small social portfolio.

Past performance is not an indication of future results

There are two methods of searching for traders to copy on eToro.

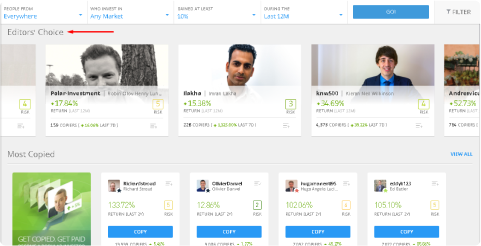

The first and the simplest one is to follow the advice of eToro editors. The traders in the special menu at the top of the working space have been selected based on many criteria, such as risk to return ratio, markets, period of trading without serious slippages, etc. If you do not feel like you are ready to figure out the filters for selecting the traders, this option is the best for you.

Past performance is not an indication of future results

It is desirable that you have traders with different strategies and conservative risk criteria in your portfolio at first. You can see the performance, portfolio and the strategy of each trader by pressing on the profile picture.

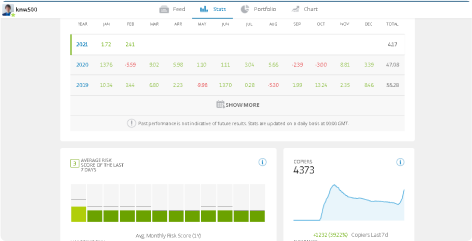

Let’s select the profile of a trader with the username knw500. After analyzing statistics you can see that the trader has been showing a high return rate in the period of two years and his maximum monthly drawdown was 9.98%. At that, the trader was assigned a low risk level – 3 points by eToro algorithm, and over 4,000 copiers. Based on the key criteria, he is a good candidate for copying.

Past performance is not an indication of future results

Read about how to use eToro’s filters for searching on your own in eToro Copy Trading Review.

Find other managers on eToro using the same mechanism.

-

2

Step 2.

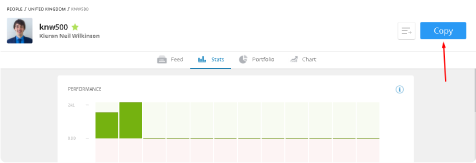

Starting to copy trades on eToro. It is very simple to add a trader to the list of the copied traders. All you need is to click Copy on the profile page.

Past performance is not an indication of future results

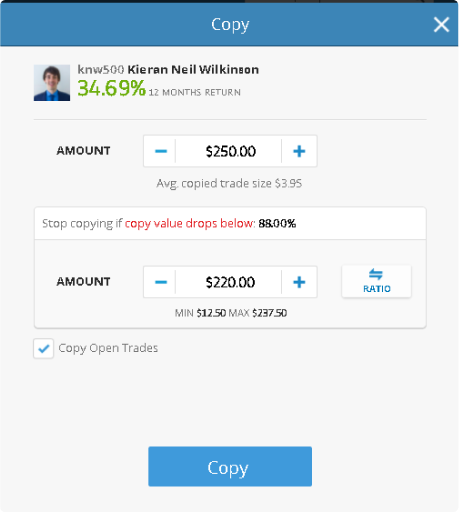

The system will offer you to select the key criteria – the amount you are allocating for copying and the risk value, when the copying stops. This is all done manually. We chose to stop copying if the copy value drops lower than 88%, and we allocated $250 for copying this trader.

Past performance is not an indication of future results

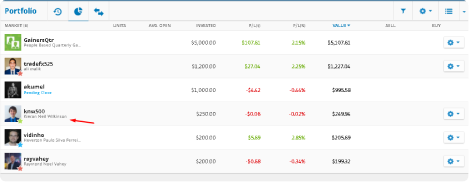

After that, we click Copy again. The trader will be automatically added to your Portfolio on the web platform.

-

3

Step 3.

Monitoring the results in the Portfolio. Trader knw500 has been added to our trial portfolio, which we created earlier. We received around 2% return in one week, which is not bad at all. However, for a more accurate assessment, at least 1-2 months are required. To receive more detailed statistics, you just click on the trader’s profile.

Past performance is not an indication of future results

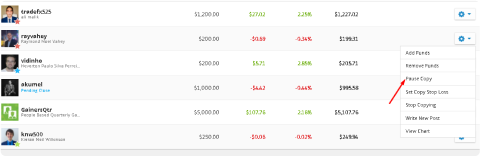

Using the settings button opposite each trader, you can stop copying, change the amount for copying or set Stop Loss at any time.

Past performance is not an indication of future results

Of course, it is better not to allow the loss of more than 10-15% of the investment amount. It is like the professionals say – the key objective is to preserve capital, and then the profit will come.

3 strategies to copy trades on forex

Selection of the best strategy for copying trades on Forex depends on many criteria. Traders Union Experts note that the following needs to be taken into consideration when building a strategy:

-

1

Assessment of risk to return ration.

-

2

Risk diversification.

-

3

Analysis of the results.

Below, we offer three strategies the traders can use.

-

1

High-risk strategy with high return potential.

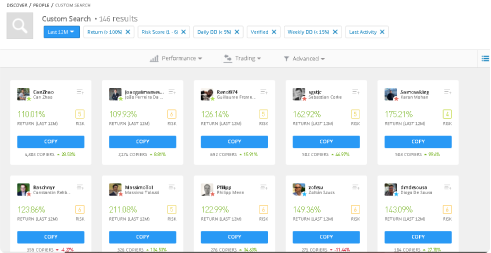

This strategy implies selection of traders for your portfolio by their return indicator. For example, using a filter on eToro, you can find profiles of traders, who have shown over 100% return rate in the 12 months.

Past performance is not an indication of future results

Advice: The higher the return rate potential, the higher the risk. One should not focus exclusively on this criterion. Also, you shouldn’t allocate more than you are prepared to risk for this kind of copying trading strategy on eToro.

-

2

Conservative strategy.

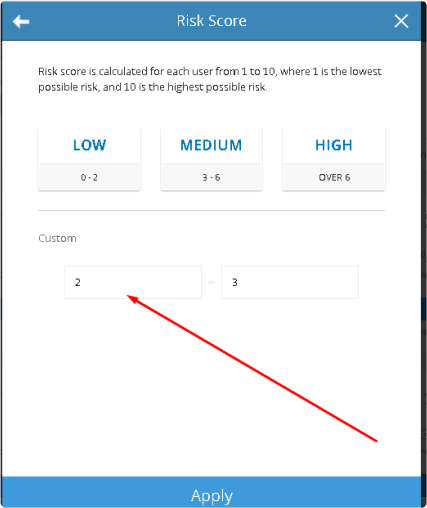

This strategy implies search for traders with minimum risk criteria – this means that they haven’t had large drawdowns in the past 1-2 years and prefer not to perform many trades. Using eToro filter, you can set up risk criteria as you see fit. For example, we chose the conservative 2-3 points. The return potential with such traders will be lower, but the risk of loss will also be tremendously reduced.

Past performance is not an indication of future results

-

3

Mixed strategy.

This strategy implies the use of the portfolio principle. An investor can allocate a bigger share of his capital to copy traders with conservative strategies, and the smaller share – to copy traders with risky strategies.

In any case, we should keep in mind that the financial market always carries an element of unpredictability and there is a risk of loss with any strategy.

Is it risky to copy forex trades?

Any investment in the financial markets carries risks, but their level is different. Having considered the pros and cons, we believe that copy trading should not be viewed as the main source of income. The majority of investors treat it as a potentially good additional source of income.

You can earn much more than by putting the money into a savings account or by buying and selling assets on your own. The risk of losses still remains. Copy trading is not a bag of gold. Even if a trader has shown excellent results for several years, it still does not exclude a possibility of suffering a loss in the future.

Is it risky to copy forex trades?

The best strategy is to make copy trading a part of a larger investment portfolio. This method has undeniable advantages, such as easier start on the market with a profit potential at the level of professionals and a low entry threshold.

However, one shouldn’t fully rely on one of the financial market instruments as the only source of income. Do not forget about the rules of diversification of sources of income.

Summary

Copy trading is an interesting and rapidly developing segment of the financial market. The majority of Forex brokers already offer this service. However, all stages – from selection of the broker to starting to copy forex trades, must be treated responsibly. We have provided examples to make your task easier. Nonetheless, the field for independent learning also remains quite large.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Expert commentary

Investor Reviews

I’ve been working with AvaTrade, Zulu platform, for over three months. I started with copying two traders and now expanded my portfolio to four. I think the minimum threshold is a bit too high for testing – $500, but it is worth it. The choice of strategies is huge; you can subscribe to over 10,000 traders.

Emma Cramer, 39

Beginner Investor

UK

I’ve been copying trades on eToro for three years now. I’ve gone through different stages. First, I decided to rely on my smarts and selected traders on my own. The result, however, was not so good – I barely broke even. Now, I don’t fuss and simply copy traders from the top list, which the broker offers. In 2020, I copied 5-6 people and the average return rate was 27%.

Patrick Gilbert, 25

Investor

US

I’ve developed a rather negative opinion about copy trading. I tried MQL. The choice of signal suppliers is definitely huge, but when you start copying, all kinds of bad things come out. I’ve just had bad luck. I look at the trader’s statistics and it seems good, but as soon I start working with him, the slippage begins. This has happened several times. I simply decided to drop it. Maybe I should try a different platform.

Trevor Forman, 47

Manager

US

FAQ

What commissions are charged for copying trades?

Investors pay the standard commission to the broker for closed trades on the platform. Some social trading platforms have the management fee paid to the copied trader, which can range from 10% to 30% on average.

I want to earn passive income. Should I consider copy trading?

Copy trading can definitely be considered as one of the sources of passive income. However, it is recommended to diversify your investment and not to invest all your disposable funds.

Which brokers offer the best copy trading services?

You can review the top ten brokers for copy trading in this article. The rating was compiled by Traders Union experts based on such criteria as reliability, functionality and trading conditions.

How much can I earn on copy trading?

There cannot be an exact amount here. Your profit will depend on the manager, market situation, commissions. It is important to understand that nobody can give you a guarantee of a profit in copy trading. You can both make good money and suffer losses. For this reason, the choice of the platform and signal supplier need to be treated with great responsibility.

Antony Robertson,, Traders Union Financial Analyst

«Copy trading is a promising area of personal finance. Over 11 years of evolution from the first platform until today, social trading grew into a full-fledged ecosystem with millions of managers and investors. I know several examples among my acquaintances, who earn a good return – 20-30% annual.

What I would not recommend on this market is to be greedy. You shouldn’t chase the traders with risky strategies. The rule ‘slow and steady wins the race’ works great in investment. Always set strict criteria for selection of the managers and don’t forget that even professionals make mistakes».