Can you Make Money Day Trading Gold?

This article provides facts and calculations from which you will learn that professional gold traders at the big banks earn about $300k per year, while average traders with $5k capital can expect to earn per year:

-

-$1,912 when trading gold on moving averages with a bot

-

+$48k when trading gold futures using a market profile

-

+$9,600-$10,800 when trading through a proprietary trading firm

-

+$5,760 when trading binary options on gold

In paradox, whatever figure you give in dollars per month can be the right answer to the question of how much a gold trader makes. This market is liquid and volatile enough to allow you to realize anything from quickly doubling your deposit to completely wiping it out.

There are no reliable statistics from reputable sources that reveal the actual profitability of a gold trader. This article is written to help the reader to understand for himself what the profitability of gold trading can be in his particular case.

-

Can you make a living trading gold?

Yes, trading gold in the financial markets can be a major source of income. However, you must have sufficient experience, knowledge, a working strategy and the necessary start-up capital.

-

Is gold good for day trading?

Yes, the gold market is quite volatile and liquid. Gold is traded 24/5 and you can use various financial instruments to capitalize on gold price differences.

-

When Should You Trade Gold Forex?

It is believed that the most favorable period for gold trading begins with the opening of the business day in London (the historic center of gold trading). A more detailed overview by hours: What Is The Best Time To Trade Gold Forex?

-

Which strategy is best for gold trading?

There is no one strategy that would be best - giving high returns, low volatility, frequent signals. The way to success in the gold market may be discipline, risk control, mastering many strategies and applying one of them based on the context and market conditions at any given time.

How much do gold traders make?

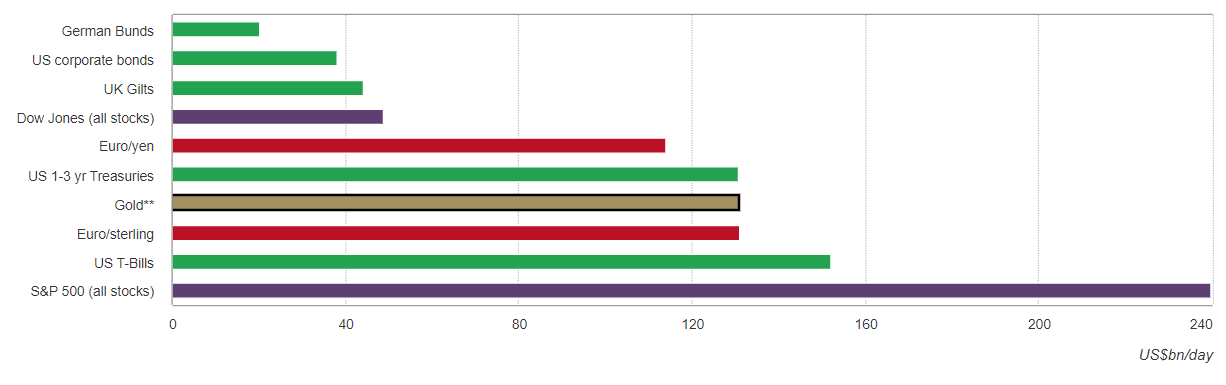

Major gold trading centers include the London OTC market, the U.S. futures market (especially through COMEX) and the Shanghai Gold Exchange (SGE). These centers account for more than 90% of global gold trading volumes, which (according to gold.org as of spring 2024) total $130 billion per day.

Gold trading volume

Market participants include global central banks, large banks, hedge funds, and professional private traders.

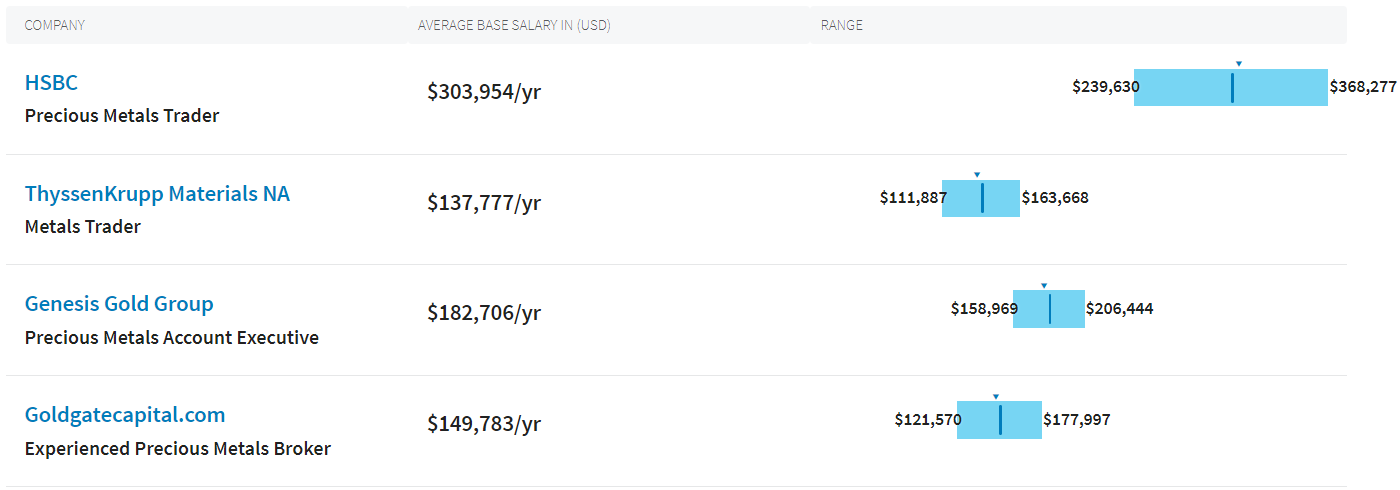

For example, according to salary.com, a gold trader working in HSBC bank can earn about 300 thousand dollars a year:

Traders' salaries

While earning high salaries, traders in banks have strict targets, risk tolerance standards and other metrics they must meet. It is also important to note that to get a job, one must be educated and pass tests before accessing real money to open positions.

If you trade gold as a private trader, then there is much more freedom - for example, you can increase the volume of a position above the norm if you "feel" that the trade will turn a profit. But at the same time, the amount of earnings will fluctuate extremely, including negative values.

Next, experts show how profits are calculated and how much you can earn in gold under several scenarios:

-

trading gold with a Forex bot

-

trading gold through a proprietary trading firm

-

trading a futures contract

-

trading a binary option

Gold trading bot: can it be profitable?

Trading gold with the help of a bot involves installing and running a bot (trading advisor), which will trade gold according to the rules described in it. Nonetheless, it's crucial to remember that:

-

Test results do not guarantee profitability in the future

-

There are risks of excessive optimization of bot parameters, untimely adaptation of the bot to constantly changing market conditions and others

To show the difficulties faced by algo-traders, experts will conduct an experiment with testing a trading bot on the gold market. This bot is included in MT4 terminal by default (you can open an account at MT4 broker, download the terminal and repeat the experiment). The algorithm is based on an elementary moving average trading strategy.

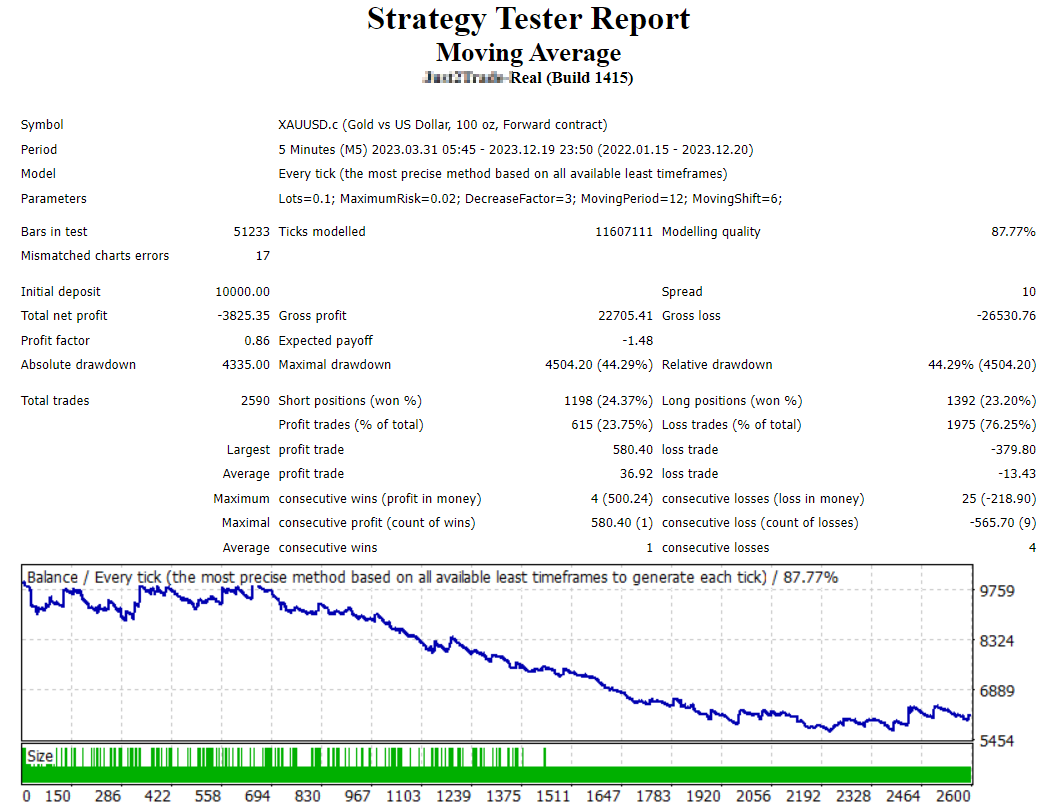

Testing the profitability of the bot on the gold market

Experiment settings:

-

Date: 2 years, comprising 2022 and 2023

-

Timeframe: 5-minute

-

Spread = 10

-

Bot parameter settings: default

Here are the results (as you can guess even before the experiment, they are negative):

Testing the profitability of the bot on the gold market

For 2 years, the bot made 2590 transactions on the gold market and "earned" minus 3825 dollars, that is, the trader's earnings amounted to minus 1912.5 dollars per year (excluding VPS and other costs).

As you can see from the yield curve, there were 3 thirds:

-

In the first and last (when market conditions were favorable) thirds, the bot did not drain the deposit. In fact, there could even be deposit growth there, if we exclude the influence of commissions and spreads. To reduce the impact of commissions on the bottom line when trading gold, read: Best Brokers for Commodity Trading in 2024

-

In the middle third, the bot consistently drained the deposit because the nature of the market and the settings of the moving average parameters did not match each other

Maximizing the difficulty of creating a bot that will universally trade in the plus side in any market conditions is one of the main reasons why trading bots fail. Including those that cost a lot of money.

By the way, bot sellers know this weak point and can:

-

show only test fragments where the bot does not fail

-

simply add dates from the history to the code that prohibit the bot from trading, so that there are no failures on the MT4 tester

If you want to try to achieve profitability in the gold market using bots:

-

Try to create a semi-automatic trading strategy. For example, run trend trading bots when, according to your analysis, the market is ready to make an important breakout

-

Question the promises of steady and excessive profits from trading bots

-

Use risk control. Do not allow the bot to lead to losses you cannot afford. Do not use martingale

Is trading gold futures profitable?

The second option is to trade manually in the GC gold futures market on the COMEX exchange. Yes, this can be a profitable endeavor.

In order to open a position = 1 standard intraday contract, you need to provide collateral of about 2,000 dollars (actual value may vary from broker to broker). But you can reduce the amount of collateral by 10 times if you trade a micro contract instead of a standard contract. Read more about the terms and conditions: 8 Best Futures Trading Platforms and Brokers 2024.

Let's say you are trading a strategy of bouncing off high volume levels.

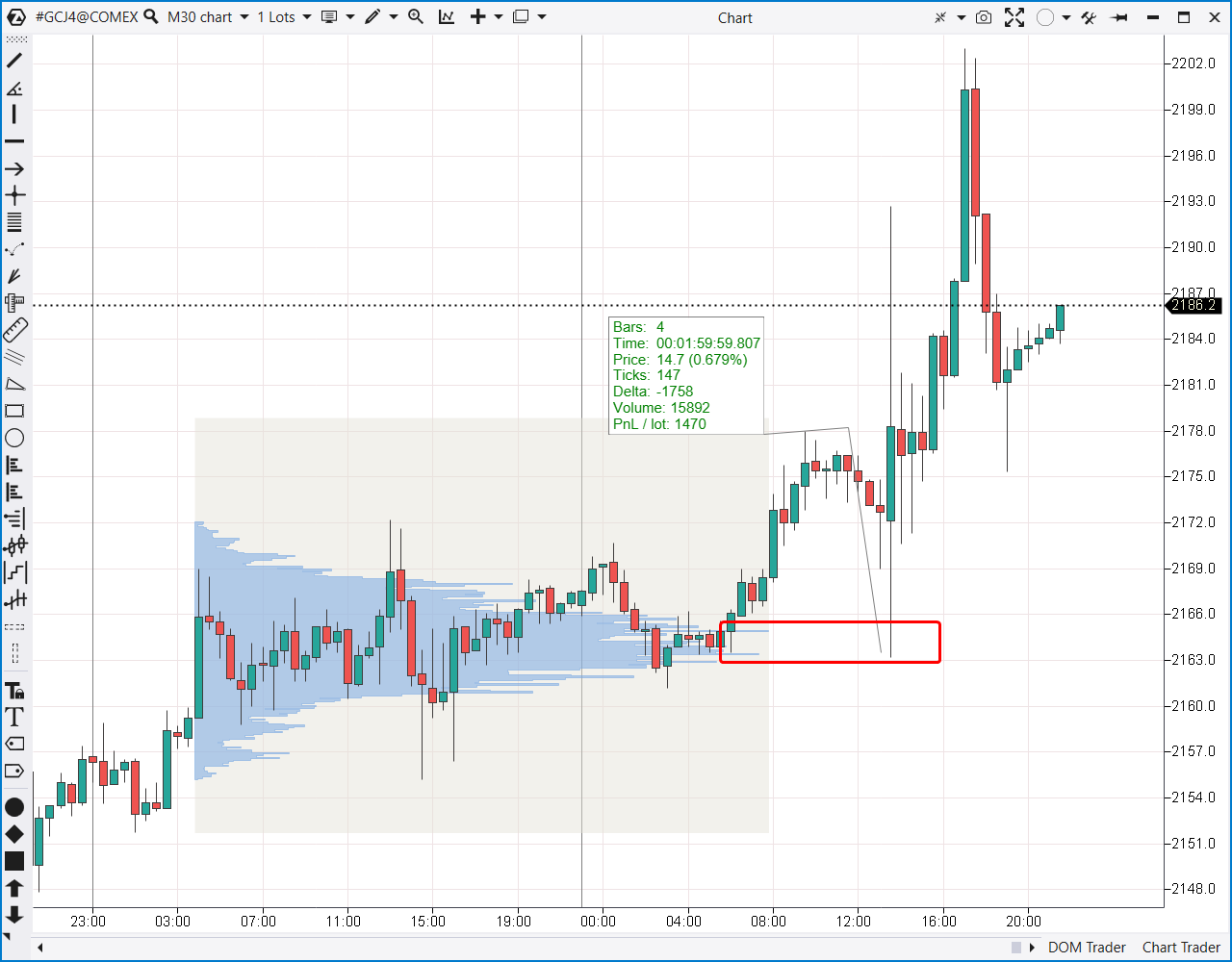

The screenshot below shows one of the successful setups:

ALT: Gold futures trading

In this case, the price dipped to test a large volume zone (shown as a red rectangle using the Market Profile Indicator) and then bounced off of it. Let's say you were lucky enough to buy 1 standard contract at 2165 and sell near the previous resistance at 2179.7.

Your profit = 147 ticks (1 tick equals 10 cents). Or 1470 dollars (excluding commissions, which are usually enough to pay for the price movement of 1 tick in your direction). This can be called a very successful day, despite the fact that you closed the long before the price continued its growth to the historical top.

Let's assume that trading gold on bounces from large levels, you make 0-3 trades per day (frequency of appearance and identification of sets). The achievable average result for a day = 20 ticks of price movement in your direction, or 200 dollars per day without commissions.

Then your earnings from gold trading for 20 days (or 1 month) will be = $4,000 dollars. Or $4k * 12 = $48k per year. Earnings can be multiplied if you trade not 1 contract, but two or more. Or increase your performance by "picking up" more than 20 ticks per day.

Best brokers to trade gold

Trading gold with prop companies

Prop trading companies provide capital to qualified traders on mutually beneficial terms. For example, you can get an account up to $100,000 or more to trade gold. Read more about how prop trading works in the article: How Do Prop Traders Make Money?

Let's say you have developed a strategy for trading gold, completed a challenge at a prop firm and have a $10,000 account.

Then you can trade gold on forex with volume = 1 lot.

Let's say your strategy allows you to earn from a 50 pips per day move in your direction (taking into account commission payments). Read more - How Does 50 pips a day forex strategy work?

For standard conditions, trading 1 lot will yield 50 dollars per day, or 1,000 USD for 20 days of work per month. +10% to the deposit is an acceptable benchmark for working with a prop trading firm. At the same time your earnings as a trader will be 80-90% of profits, that is $800-900 USD per month. Or $9,600-10,800 per year.

Earnings from gold trading can be increased if you trade not 1 lot, but 2. But at the same time the risks will grow, and in work with prop trading firms it can be critical. Read more:

What Happens If You Lose Money On A Funded Account?

Can I trade gold with binary?

Binary options trading is one of the options to earn money from gold price fluctuations. In this case, you will need to open an account with a reliable binary options broker.

The peculiarity of earning is in the calculation of profit. If in the standard case, earnings depend on the difference between the price of buying and selling gold, in binary options earnings usually depend on the outcome - whether you will be right in deciding that the price of gold will rise or fall in a certain period of time. Read more - How Does Binary Investment Work?

How much can you make with this?

Here is a table showing the average profit in dollars from 1 trade when trading binary options on gold with an initial bet of $100, depending on your success rate and payout level:

| Transaction success (%) | Average profit at 80% payout ($) | Average profit at 90% payout ($) |

|---|---|---|

50 |

-10.00 |

-5.00 |

55 |

-1.00 |

4.50 |

60 |

8.00 |

14.00 |

65 |

17.00 |

23.50 |

70 |

26.00 |

33.00 |

75 |

35.00 |

42.50 |

80 |

44.00 |

52.00 |

85 |

53.00 |

61.50 |

90 |

62.00 |

71.00 |

95 |

71.00 |

80.50 |

100 |

80.00 |

90.00 |

Calculations show that to make money in the gold market using binary options, you need to focus on having a strategy that will provide the right outcome 60% of the time.

Let's say you have such a strategy, which gives an average of 3 signals per day. Then trading with a bet = 100 dollars and payout = 80%, your earnings for 20 days (1 month) will be: 8 * 3 * 20 = 480 dollars per month. Or $5,760 per year.

It is important to be responsible in choosing your bet size. If it = $100, your total capital should be around $5,000. So that in case of failure, the loss is an acceptable 2% of the capital.

Gold trading for beginners

While trading gold can be a lucrative endeavor, it depends on how much effort you put into understanding how the price moves.

👍 Advantages explained

• The gold market is quite transparent. You can analyze the volumes down to each transaction in the futures market. You can also use information from the options market to make trading decisions

• Technical analysis and patterns. Gold lends itself well to technical analysis. Online, traders share their ideas and strategies for trading

• Liquidity and volatility. The price is quite mobile - the difference between high and low for 1 day is 1.2% on average

• Costs. Competition between brokers and a wide range of instruments related to gold (including ETFs and options) allows to minimize the costs associated with gold trading

👎 Disadvantages explained

• High competition. It is practically very difficult to develop a strategy that will give an opportunity to earn a lot and consistently. Trading on such simple strategies as RSI and other popular indicators is a way to gradually drain the deposit

• High volatility. Trading any "golden" asset requires a strict system of risk control and capital reserve in case of a long drawdown

• Complexity of complex analysis. The price of gold is influenced by many fundamental factors that are important to consider

• Manipulations. Constantly trading on the gold market, it is possible that you will increasingly notice price movements that are difficult to explain by a simple balance of supply and demand

Read more about Forex trading in the gold market: What is XAUUSD? Everything You Need to Know.

How to be a profitable gold trader?

To increase the likelihood of making money in the gold market:

-

Explore different instruments - futures, options, ETFs and others. Each of them can give you an advantage, provide important information for making a trading decision

-

Consider developing your own strategy. Instead of trying to find a working one based on simple solutions from popular indicators

-

Consider the option of a semi-automatic strategy. With a set of different trading algorithms, you can manually choose which one best suits the current market conditions

-

Look for investment strategy options. Medium-term investments in ETFs or gold mining stocks can effectively hedge speculative trading risks

-

Stay abreast of major events. Fundamental news has a strong influence on gold trading

To learn about the latest reviews of the gold market situation, visit the page: Gold Analysis Today – XAU/USD Support and Resistance.

Conclusion

Professional gold traders who trade gold on jobs in banks earn about 300 thousand dollars a year. Private traders can approach this amount if they have: sufficient trading capital, one or more low-risk strategies with a positive mathematical expectation of profit.

Team that worked on the article

For over 15 years, Oleg worked as a copywriter and journalist at advertising and marketing agencies, as well as radio and television companies. His writing style is aimed at using simple terms to explain only those things that matter to the reader – benefits, risks, and realizable ideas. During the 2008 financial crisis, Oleg got interested in the stock and Forex markets and thoroughly explored price action to start working as an independent expert in 2018.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.