What Are Nasdaq100 Market Hours

The Nasdaq-100 can be traded directly during standard US market hours from 9:30AM to 4:00PM EST. Individual stocks can also be traded during these times. The index can also be traded in pre-market hours of 8:00AM to 9:30AM, and after-market hours from 4:00PM to 8:00PM EST. Traders can also trade futures and options to speculate on the Nasdaq-100’s performance almost 24 hours a day, Sunday to Friday.

The Nasdaq-100 is a stock market index that tracks the performance of 101 equity securities based on 100 of the largest non-financial companies listed on the NASDAQ stock exchange. Though the NASDAQ itself operates according to standard US market hours, there are also other options to trade the Nasdaq-100 that can be executed outside of those hours. In this article, Traders Union looks at the trading hours of the Nasdaq-100, examining changing volatility across the Nasdaq-100 trading week, and gives readers tips on how to trade the Nasdaq-100.

Nasdaq100 market hours

The NASDAQ, which stands for National Association of Securities Dealers Automated Quotations is an American stock exchange based in New York City and is the most active exchange in the world, by volume. The Nasdaq100 is a collection of the most actively traded companies within that exchange. It’s made up of companies from various sectors, such as the tech industry and manufacturing, but excludes the financial sector. Most of the world’s largest companies are listed on the Nasda100, including Apple, Microsoft, Amazon and Meta.

The Nasdaq is open for trading five days a week, from Monday to Friday. It opens at 9:30AM local New York Time and closes at 4:00PM.

Time zones

As the Nasdaq is based in New York, it runs on Eastern Standard Time, which is five hours behind Greenwich Meridian Time (GMT-5). This means that all company stocks in the Nasdaq100 are also only open for trading during the same market hours as the Nasdaq, 9:30AM EST to 4:00PM EST. Traders in countries outside of the USA directly trading in stocks listed on the Nasdaq100, or trading in the index as a whole, should account for the difference in time zones.

When trading futures that track the Nasdaq100, traders can participate in the futures market nearly 24 hours a day. They can engage during pre-market hours and after-hours sessions, which provide additional opportunities and risks compared to the standard trading day.

Advice on timing NASDAQ100 index trading

There are several ways to trade the Nasdaq100 index. These are:

Nasdaq-100 Futures : Nasdaq-100 futures are financial contracts that derive their value from the Nasdaq-100 index (derivatives). Traders buy or sell futures contracts based on what they speculate will be the future value of the index. They are leveraged instruments, meaning traders can control a larger position with a smaller amount of capital. Nasdaq-100 futures can be traded from 6PM EST on the previous day to 5PM EST on the current day, Sunday to Friday. Trading also halts from 4:15PM to 4:30PM EST.

Contract for Difference (CFD) : CFDs are derivatives that enable traders to speculate on Nasdaq-100 price movements without owning the underlying assets. It's a contract between the trader and the CFD provider. Traders can go long (buy) or short (sell), without buying the asset. CFDs are often used for short-term trading. Like futures, Nasdaq-100 CFDs can be traded Sunday to Friday, from 4:00PM (Sunday) to 4:15PM, 4:30PM to 5:00PM, then 6PM the next day at 4:15PM.

QQQ (ETF) : QQQ is an exchange-traded fund that tracks the Nasdaq-100 index’s performance. It holds a portfolio of stocks similar to those in the index. Buying shares of QQQ means owning a part of the ETF, providing exposure to Nasdaq-100. QQQ trades on stock exchanges, providing liquidity and ease of trading. QQQ can be traded during the market hours of Nasdaq-100, and during pre-market hours from 4:00AM to 9:30AM EST, and in the after hours market from 4:00PM to 8:00PM EST.

What are the best hours to trade the Nasdaq-100 index?

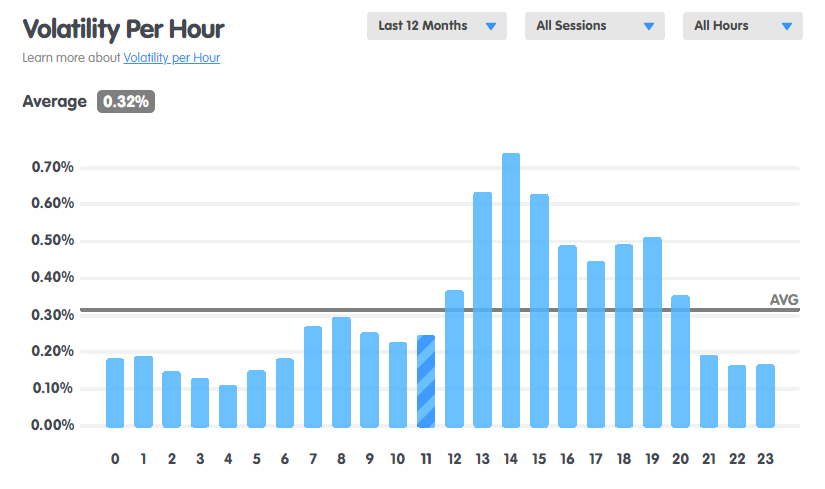

Depending on your strategy and chosen instrument, the time that suits you best will vary. However, times of increased volatility often present the best opportunities for profit. The average volatility for trading the Nasdaq-100 index is 0.32%. Due to the US market hours of the Nasdaq, volatility sharply increases and stays above average from 12PM to 9PM GMT, or 7AM to 4PM EST. This can be seen in the chart below.

Volatility of Nasdaq-100 Index by hour (Source:babypips.com)

Volatility of Nasdaq-100 Index by hour (Source:babypips.com)What is the most volatile day for the Nasdaq100?

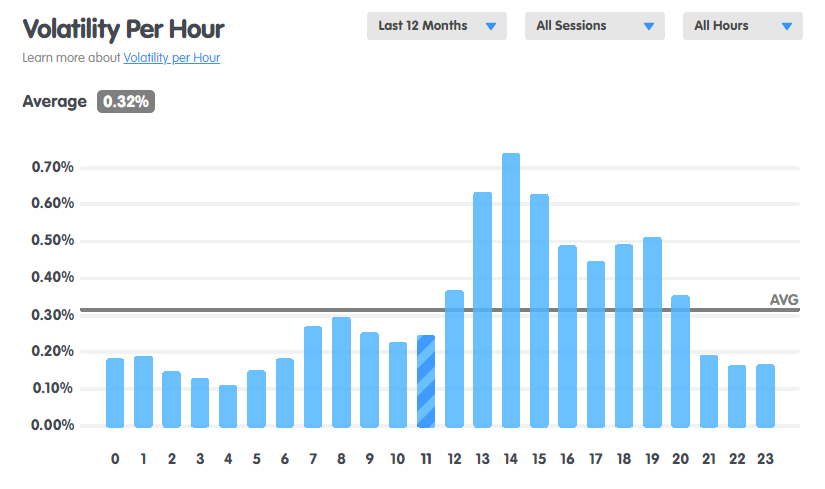

Volatility differs throughout the trading week, so depending on your trading strategy, days should also be taken into account. Higher volatility leads to increased opportunities, potential for higher profits due to rapidly changing prices, and higher liquidity for increased ease of trading. The most volatile day to trade the Nasdaq-100 index is Thursday, as can be seen in the chart below.

Volatility of Nasdaq-100 Index by hour (Source:babypips.com)

Volatility of Nasdaq-100 Index by hour (Source:babypips.com)Best stock brokers

Tips for trading NASDAQ100

The Nasdaq-100 index (INDEXNASDAQ: NDX) is one of the most famous indices in trading, and can be traded in different ways. Let’s look at some tips for trading the NASDAQ index.

Active Hours : The NASDAQ100 market is most active during the morning and afternoon sessions of the American market hours. In Eastern Standard Time (New York), this is from 9:30AM to 4:00PM EST, or 2:30PM to 9PM GMT. It does not close for lunch.

Morning Volatility : The morning session of the Nasdaq-100 market hours is typically more volatile. During this time, traders react to news that may have occurred the previous evening, over the weekend, or before the market opened. Many companies choose to release economic data such as earnings calls before market hours. Others release economic data after market hours, so the market reacts the following morning.

Afternoon Stability : The afternoon hours of the Nasdaq-100 market hours are typically more subdued compared to the morning. During this time, traders tend to digest market news from the morning and position themselves for the next day.

24/5 Trading : Outside of directly trading the Nasdaq-100 index, traders can also trade CFDs and ETFs derived from the Nasdaq-100, or trade futures and options to speculate on its performance. This can be done almost 24 hours a day, Sunday to Friday.

Understand Time Zones : Traders who are interested in trading the Nasdaq 100 should familiarize themselves with its market hours and the trading patterns that typically occur during those hours. Be sure to take location and time zones into consideration when calculating this.

Conclusion

The Nasdaq 100 is a popular and liquid stock market index that offers a variety of trading opportunities. By understanding the different trading sessions and using sound trading strategies, you can increase your chances of success when trading the Nasdaq 100.

FAQs

What hours can you trade NAS100?

The NAS100 ETF can be traded 6:00PM Sunday to 4:59PM Friday (EST) with trading breaks between 4:15PM to 4:30PM and 4:59PM to 6:00PM.

Does NASDAQ trade 24 hours a day?

No, they trade 9:30AM to 4PM each day, though financial instruments based on the NASDAQ can be traded almost 24/5

What are the best trading hours for NASDAQ?

If trading directly in the NASDAQ, market hours are from 9:30AM to 4PM Eastern Standard Time, pre-market hours are 8AM to 9:30AM, and after-market hours 4PM to 8PM. Options, futures and CFDs for the NASDAQ can be traded almost 24-5, though volatility is highest during market hours.

Are NAS100 and US100 the same?

No, though they are both financial instruments derived from the Nasdaq-100 index. However, the US100 is typically offered as a CFD or futures contract, allowing traders to take long or short positions using leverage. The NAS100 is an ETF that tracks the Nasdaq-100’s performance, allowing traders to buy shares and trade it like a stock, without leverage.

Related Articles

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.