What Is The Best Type Of Stop-Loss Order?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

A stop-loss order is an instruction to buy or sell an asset once it reaches a certain price, aimed at limiting an investor's loss on a position. There are three main types of stop-loss orders:

- Market stop-loss: Executes at the best available price once the stop level is hit

- Limit stop-loss: Executes at a specified price or better once the stop level is hit

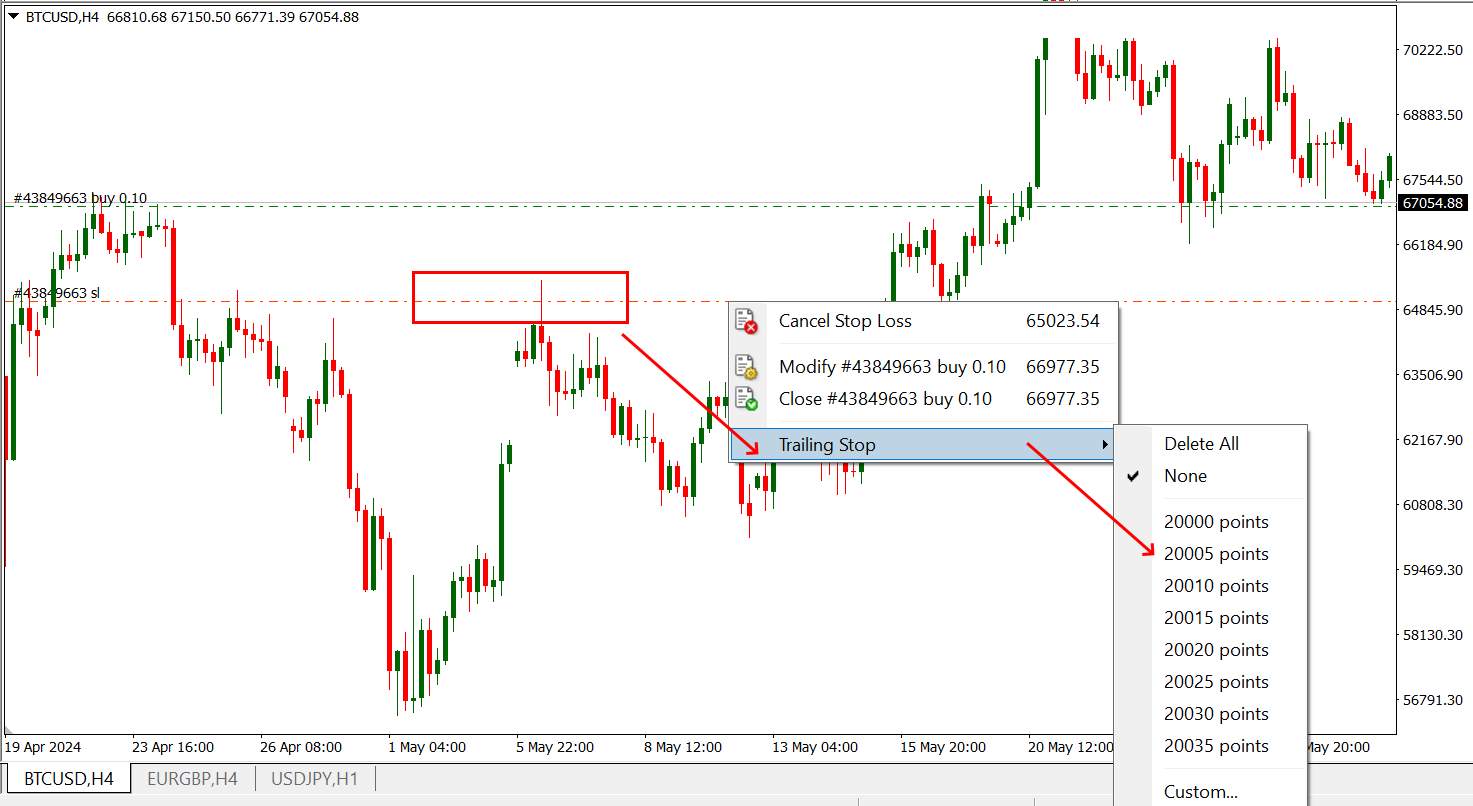

- Trailing stop-loss: Moves with the price fluctuations, maintaining a set distance from the current price

From this article you will learn the types of stop-loss orders and which one is better. We will also tell you how to set stop-loss orders and combine them with other tools to minimize risks.

What is the best type of stop-loss order?

Choosing the best stop-loss order depends on several factors, including the trading context, your risk tolerance, and current market conditions. Let's walk through each type to understand their mechanisms, advantages, and drawbacks.

Market stop-loss

A market stop-loss order is a straightforward tool used by traders to limit potential losses. When the price hits a predetermined stop level, the order triggers an immediate sale at the best available price. This ensures that the position is closed quickly to prevent further losses.

Benefits: Simple and guarantees execution.Once the stop level is reached, the order will be executed.

Drawbacks: In highly volatile markets, the price at which the order is executed may be significantly lower than the stop level, resulting in unexpected losses.

Limit stop-loss

A limit stop-loss order ensures that the stock will only be sold at the specified price or better once the stop level is hit.

Benefits: You have control over the minimum price at which the stock can be sold, preventing unexpected slippage.

Drawbacks: If the market price falls rapidly and doesn’t hit the specified limit price, the order may not be executed, leaving you with the stock at an even lower price.

Trailing stop-loss

A trailing stop-loss order adjusts the stop level as the stock price moves in your favor, maintaining a set distance below the market price.

Benefits: As the stock price rises, the trailing stop-loss follows, helping to lock in profits.

Drawbacks: More complex and requires active management.

Step-by-step guide how to set up stop-loss orders

Identify your stop-loss level: Determine the price at which you want to exit the trade to prevent further losses.

Choose the type of stop-loss order: Decide between a market stop-loss, limit stop-loss, or trailing stop-loss order based on your trading strategy.

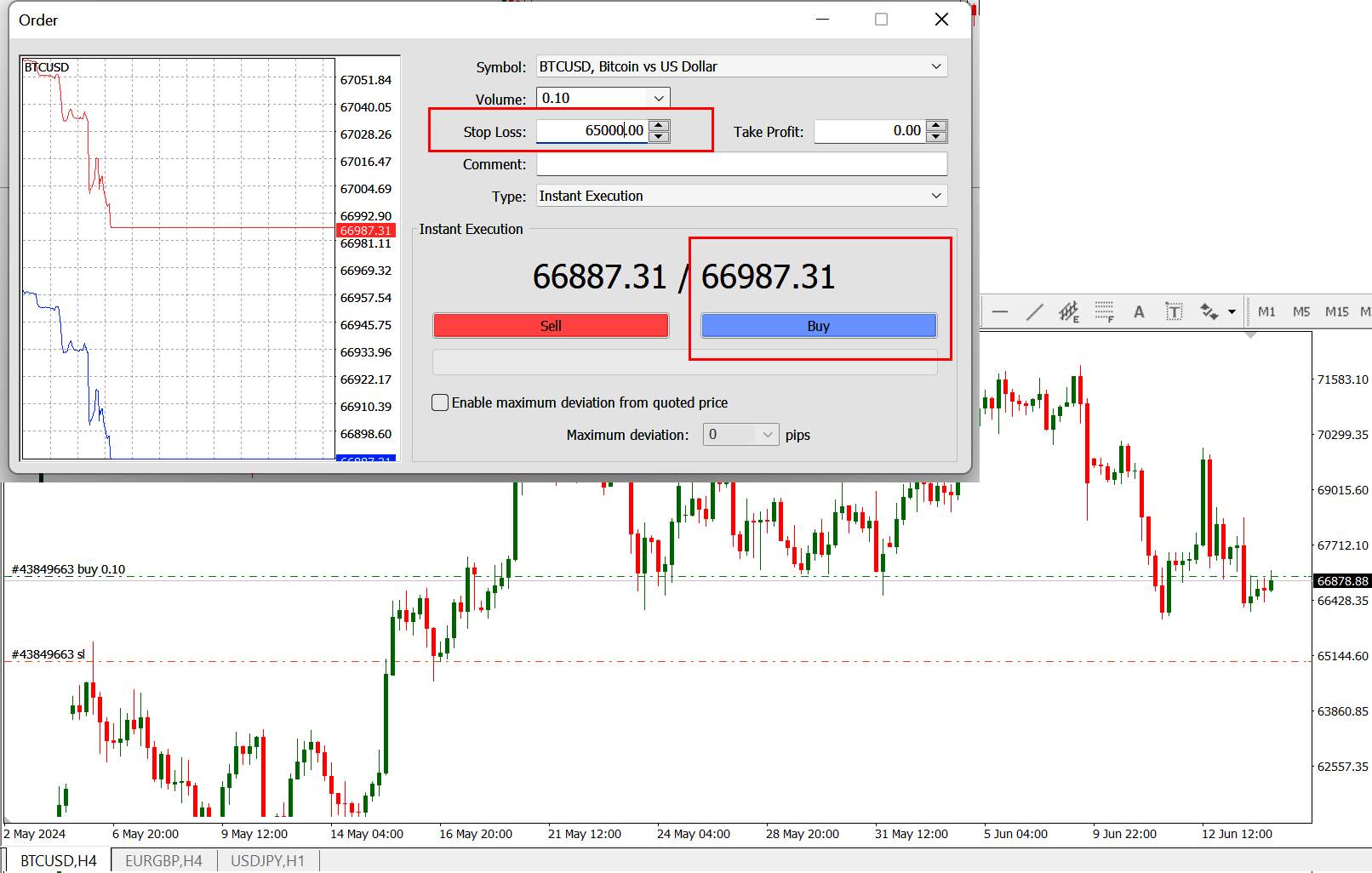

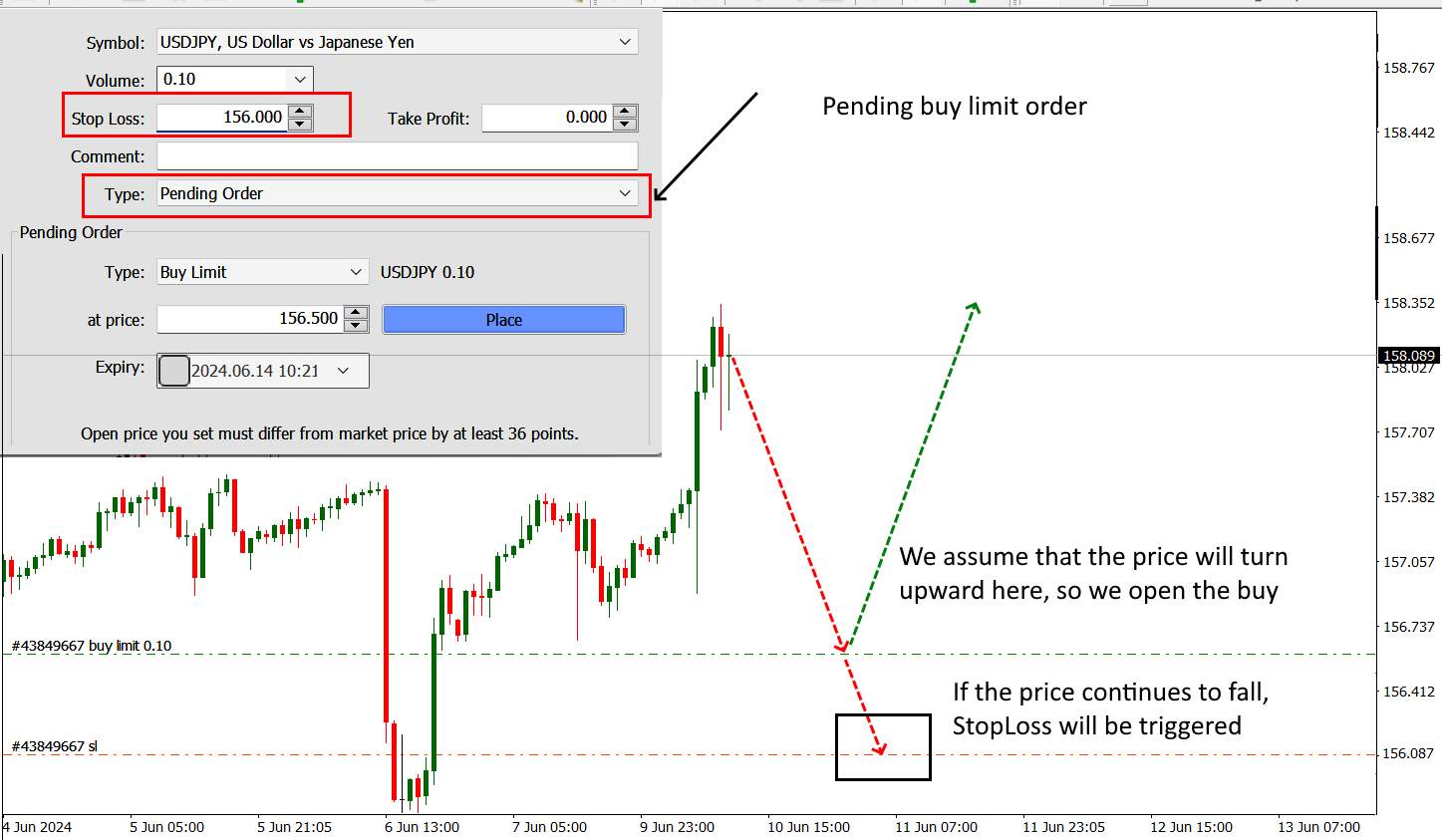

Enter the order on your trading platform:

Market stop-loss: Set the stop price. Once this price is reached, the order executes at the current market price;

Limit stop-loss: Set the stop price and the limit price. The order will execute at the limit price or better;

Trailing stop-loss: Set the trailing amount or percentage. The stop price will adjust as the market price moves in your favor.

How do you use stop-loss orders?

Adjusting your stop-loss strategy based on market conditions and integrating it with other risk management tools will help you navigate the complexities of trading with greater confidence and security.

How to determine the right stop-loss level

Setting an appropriate stop-loss level can help you manage risk effectively and protect your investments from significant losses. Here’s a step-by-step guide to help you set an optimal stop-loss level:

Understand Your Risk Tolerance

Assess Your Financial Situation: Consider how much capital you can afford to lose on a single trade without affecting your overall portfolio.

Determine Your Risk-Reward Ratio: A common ratio is 1:3, meaning you are willing to risk $1 for every potential $3 of profit. This helps in setting realistic stop-loss levels.

Analyze Market Conditions

Study Volatility: Understand the typical price fluctuations of the asset you are trading. In volatile markets, set wider stop-loss levels to avoid premature triggers.

Consider Market Trends: In trending markets, a trailing stop-loss might be more appropriate to lock in profits as prices move favorably.

Technical Analysis

Support and Resistance Levels: Place stop-loss orders just below support levels or just above resistance levels. This ensures that your stop-loss is placed at a point where a reversal is less likely.

Moving Averages: Use moving averages (e.g., 50-day or 200-day) as dynamic stop-loss levels. Prices that dip below these averages may indicate a reversal.

Indicators and Oscillators: Tools like the Relative Strength Index (RSI) can help identify overbought or oversold conditions, providing clues for setting stop-loss levels.

Calculate Based on Percentage or Dollar Amount

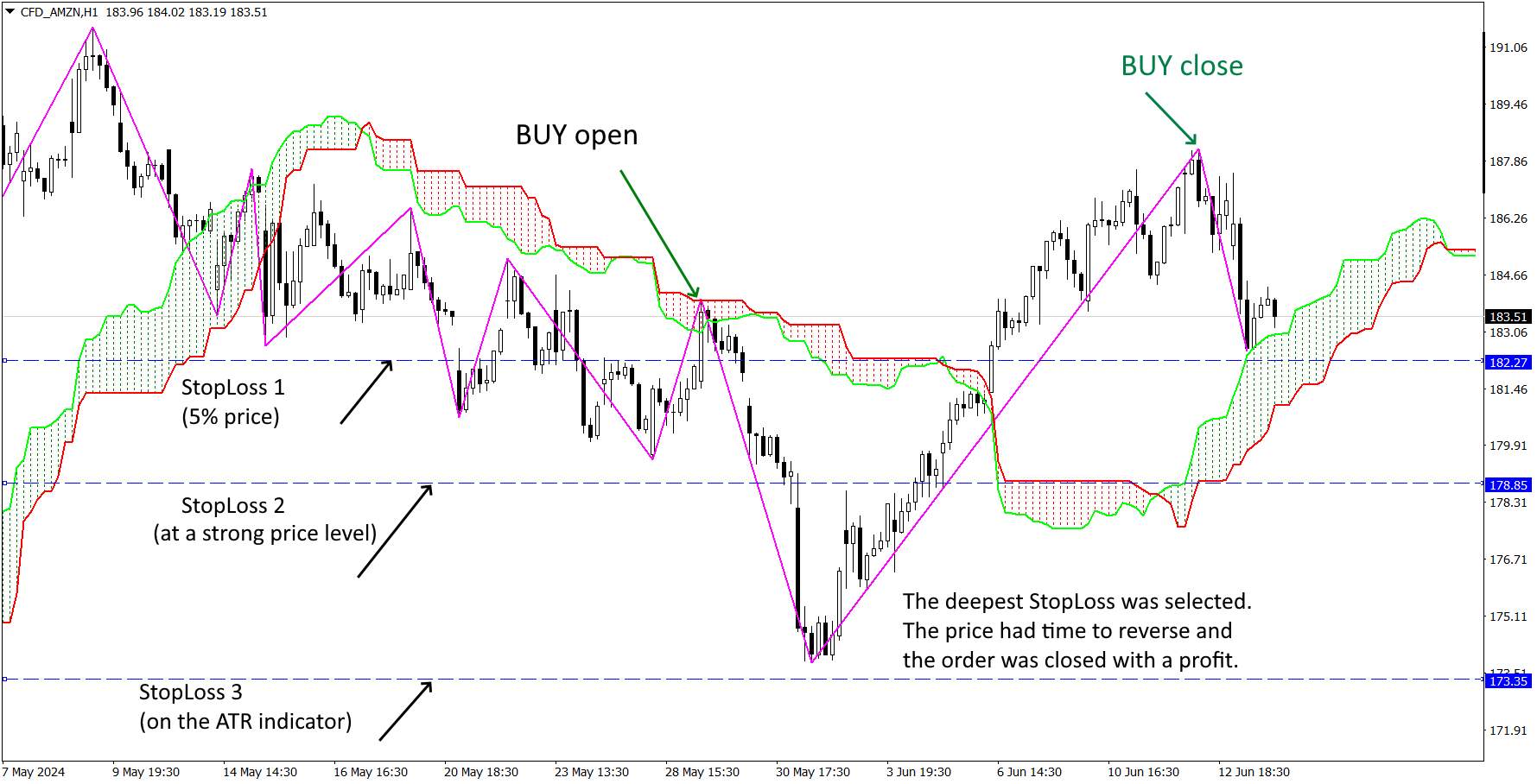

Percentage Method: Decide what percentage of your entry price you are willing to lose. For instance, setting a stop-loss at 5% below your purchase price.

Fixed Dollar Amount: Choose a specific dollar amount you are willing to risk. This method is straightforward and aligns with your overall risk management strategy.

Use ATR (Average True Range)

ATR Indicator: The ATR measures market volatility. Setting a stop-loss level at 1.5 to 2 times the ATR can provide a buffer against normal market fluctuations while protecting against significant losses.

Adjust Based on Position Size

Smaller Positions: For smaller trades, you might set tighter stop-loss levels to minimize exposure.

Larger Positions: For larger trades, consider wider stop-loss levels to accommodate greater market movements.

How to adjust stop-loss orders

By monitoring market conditions and re-evaluating your position, you can make informed adjustments to your stop-loss levels, optimizing your risk management strategy.

Monitor market conditions: Regularly review your stop-loss levels and adjust them based on market trends and movements.

Re-evaluate your position: If your trade moves in your favor, consider adjusting your stop-loss to lock in profits.

How to combine stop-loss orders with other tools

Adjusting your stop-loss strategy based on market conditions and integrating it with other risk management tools will help you enhance your trading strategy with greater confidence and security.

Use in conjunction with take-profit orders: Pair stop-loss orders with take-profit orders to manage both ends of the trade.

Integrate with technical indicators: Use moving averages, support and resistance levels, and other technical indicators to set more precise stop-loss levels.

How to avoid risks using stop-loss orders

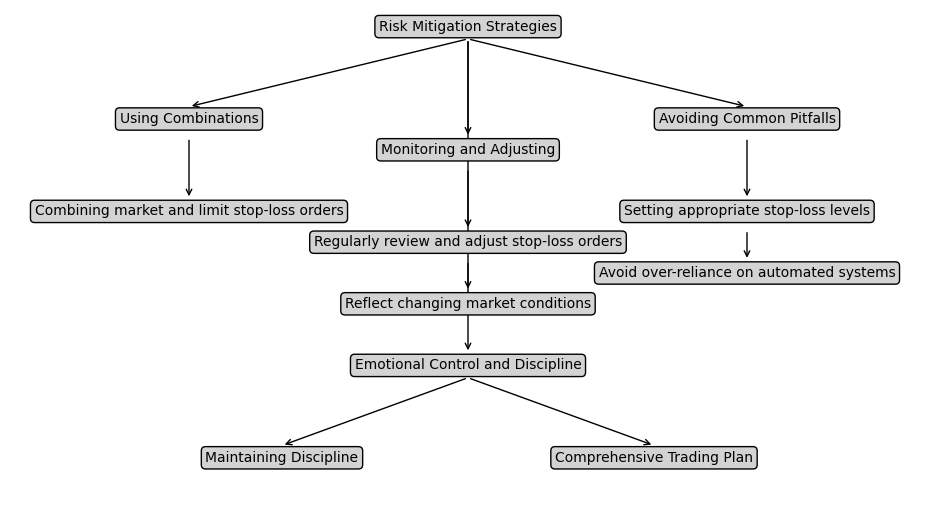

By implementing these risk mitigation strategies and maintaining emotional control, traders can use stop-loss orders more effectively and safeguard their investments against potential market risks.

Risk mitigation strategies

Using combinations. Combining different types of stop-loss orders for optimal risk management.

Avoiding common pitfalls. Tips on setting appropriate stop-loss levels and avoiding over-reliance on automated systems.

Monitoring and adjusting. Regularly reviewing and adjusting stop-loss orders to reflect changing market conditions.

Emotional control and discipline

Maintaining discipline: Sticking to your trading plan and avoiding emotional reactions.

Comprehensive trading plan: Integrating stop-loss orders into a well-thought-out trading strategy.

Determine how much risk you are willing to take on each trade

There is no one-size-fits-all answer to the best type of stop-loss order. It largely depends on your trading strategy, market conditions, and personal risk tolerance. Based on my experience, here’s how you can choose the best type of stop-loss order for your trading strategy:

Assess your trading style and goals;

Determine how much risk you are willing to take on each trade;

Regularly review and adjust your stop-loss levels based on market conditions;

Don’t hesitate to combine different types of stop-loss orders.

By understanding the unique advantages and disadvantages of each type, you can make informed decisions that enhance your trading performance and risk management.

Conclusion

Implementing stop-loss orders effectively requires not only technical knowledge but also emotional discipline. Regularly monitoring market conditions, adjusting stop-loss levels as needed, and maintaining a comprehensive trading plan are essential practices for minimizing risks and maximizing returns. Combining different types of stop-loss orders, setting appropriate levels, and staying educated on trading techniques are all part of a robust risk management approach. Ultimately, the best type of stop-loss order depends on your specific trading needs and objectives.

FAQs

What is a stop-loss order?

A stop-loss order is an instruction to buy or sell a security when it reaches a certain price, limiting an investor's loss on a position.

How does a market stop-loss differ from a limit stop-loss?

A market stop-loss executes immediately at the best available price once the stop level is reached, while a limit stop-loss executes only at a specified price or better.

What are the advantages of a trailing stop-loss order?

A trailing stop-loss adjusts the stop level as the market price moves in your favor, locking in profits while limiting losses.

Can stop-loss orders be used in all market conditions?

Stop-loss orders are versatile but may vary in effectiveness. Market stop-losses can suffer from slippage in volatile markets, while limit stop-losses might not execute if prices move quickly.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

ATR (Average True Range) is a volatility indicator that helps traders assess the potential price range or volatility of a financial instrument. It calculates the average of true price ranges over a specified period, providing insight into the level of price fluctuations within that timeframe.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.