Essential Resources To Help Prop Traders Succeed In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

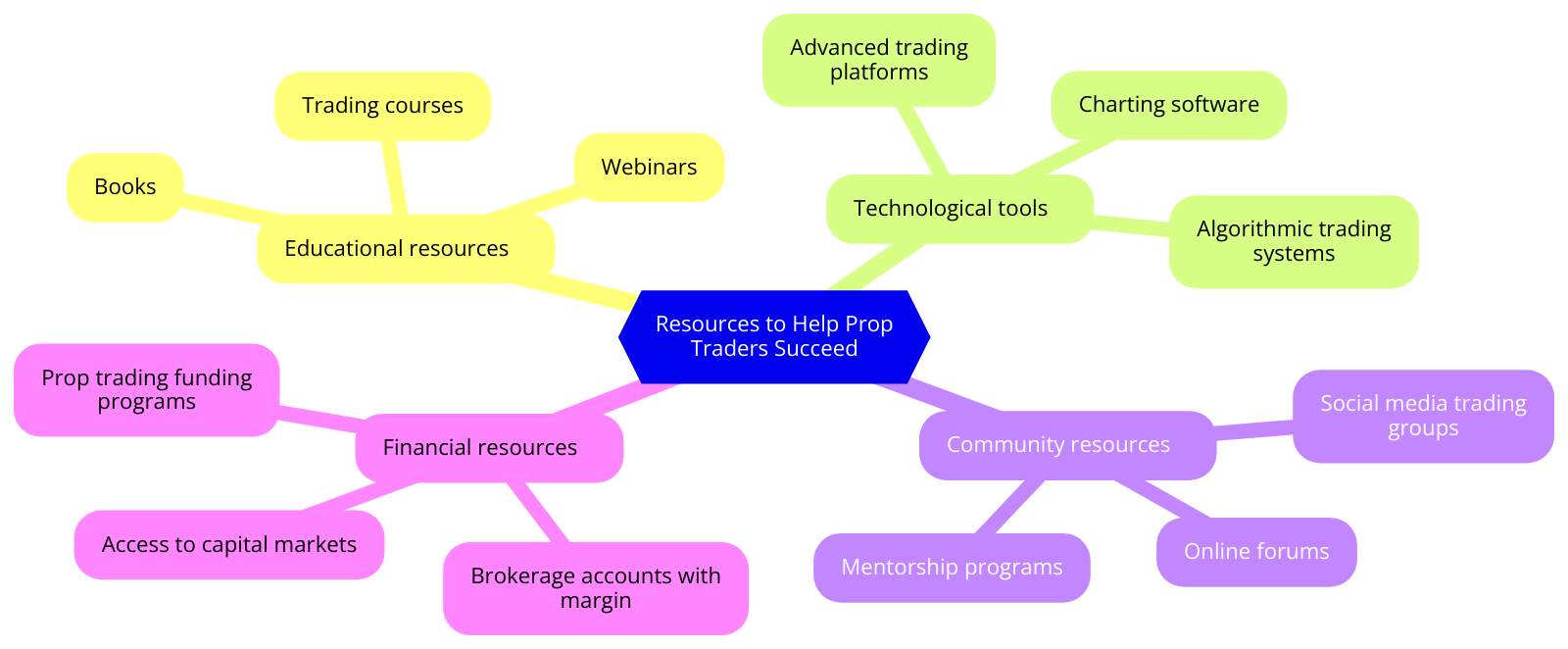

Essential resources for prop traders in 2025 include:

- Educational resources like online courses and tutorials, books, etc

- Technological resources: charting software, risk management tools, etc

- Community resources like online forums and chat rooms, social media groups, etc.

- Financial resources: funding programs

Proprietary (prop) trading offers a unique career path within the financial sector, where traders use a firm's capital to trade various financial instruments, aiming to generate profits for the institution.

Success in this field requires access to a variety of resources, ranging from educational materials to advanced technological tools. This article explores the essential resources prop traders need to enhance their trading strategies and achieve success in the highly competitive world of prop trading.

Resources available to help prop traders succeed

Seasoned prop traders utilize a variety of resources to enhance their trading strategies and stay competitive in the market. These resources fall into four main categories: educational, technological, community, and financial.

Educational resources

Prop traders have access to various educational resources to enhance their skills and improve risk management. These include:

Online courses and tutorials:proprietary trading firms offer online courses and tutorials covering trading fundamentals to advanced strategies, providing comprehensive understanding and effective strategy implementation. For instance, Coursera and Udemy provide courses on algorithmic trading, technical analysis, and risk management, which are crucial for developing a robust trading strategy. A study shows that 73% of traders found online courses crucial in avoiding costly mistakes and gaining a foundational understanding of the market;

Books and articles: traders refer to classic books and articles for insights into trading strategies, technical analysis, and risk management. Books like "The Intelligent Investor" provide timeless insights that are still relevant in today's fast-paced trading environments. According to recent surveys, 68% of successful traders regularly read industry-related books and articles to stay informed about market trends and strategies;

Webinars and seminars: firms organize webinars and seminars where experienced professionals share market insights and strategies, helping traders stay updated with the latest trends;

Mentorship programs: new traders benefit from mentorship programs that provide guidance and support from seasoned traders, offering practical insights and assistance in their early careers.

You will find opportunities for training at trusted prop companies. We studied the conditions of top companies and also checked whether they have additional options that may be useful for successful trading.

| Funding Up To, $ | Profit split up to, % | Demo | Copy trading | Trading bots (EAs) | Open account | |

|---|---|---|---|---|---|---|

| 4 000 000 | 95 | No | No | Yes | Open an account Your capital is at risk.

|

|

| 200 000 | 90 | Yes | No | Yes | Open an account Your capital is at risk.

|

|

| 2 500 000 | 90 | No | No | No | Open an account Your capital is at risk.

|

|

| 2 000 000 | 95 | No | No | Yes | Open an account Your capital is at risk.

|

|

| 400 000 | 80 | No | No | Yes | Open an account Your capital is at risk. |

Technological resources for prop traders

Most prop traders rely on various technological resources, including:

Trading platforms: proprietary trading firms provide cutting-edge trading platforms with advanced functionalities for charting, order management, and trade execution, allowing traders to implement strategies with precision and efficiency. For instance, TradingView has become the most preferred trading platform, used by 35.5% of traders, while Python for algorithmic trading follows closely at 33.3%. These platforms allow traders to implement strategies with precision and efficiency;

Charting software: essential for analyzing market trends, studying historical price movements, and identifying trading opportunities, charting software helps traders gain insights into market dynamics to inform their strategies;

News and market data feeds: access to real-time news and market data feeds keeps traders updated on market developments, enabling timely and informed trading decisions;

Risk management tools: effective risk management is crucial, and firms typically offer tools like stop-loss orders and position sizing calculators to help traders mitigate potential losses and protect their capital.

Community resources for prop traders

Community resources are valuable and accessible, even for beginners. Popular options include:

Online forums and chat rooms: these platforms allow prop traders to connect, interact, and collaborate. Traders can exchange ideas, seek answers to questions, and engage in collective learning, gaining fresh insights and diverse perspectives on trading strategies and market dynamics;

Prop trading firms and networks: these firms and networks provide a vibrant community of seasoned traders, offering access to a wealth of knowledge, insights, and mentorship. They often offer training and educational programs, helping traders continuously expand their skillset and refine their strategies;

Social media groups: social media groups offer another platform for prop traders to connect and collaborate. These groups facilitate discussions, idea sharing, and mutual learning, helping traders stay updated with industry trends and gain insights from their peers' experiences.

Financial resources for prop traders

Prop traders can enhance their trading skills by utilizing various financial resources, including:

Prop trading funding programs: many firms offer funding programs to traders who consistently demonstrate profitability. These programs provide additional capital for trading, allowing successful traders to expand their positions and potentially increase their returns. A study by the Financial Conduct Authority (FCA) shows that traders who receive additional funding can see a 20-30% increase in their trading volume and profitability. This mutually beneficial arrangement ensures traders have the necessary resources to succeed while the firm shares in the profits;

Access to capital markets: proprietary trading firms often have direct access to capital markets, allowing traders to trade a broad spectrum of financial instruments and seize diverse trading opportunities. This access gives traders a competitive edge, enabling them to diversify their portfolios and enhance profit potential by trading across different asset classes. Data from the World Federation of Exchanges indicates that firms with direct market access experience higher trade execution speeds and lower transaction costs, contributing to better overall trading performance.

Starting with foundational knowledge is essential

For beginners, starting with foundational knowledge is essential. Educational websites like Traders Union help build a strong foundation in trading principles, market terminology, and basic strategies in prop trading. Practicing with demo accounts offered by prop firms allows for risk-free trading practice, helping to understand market operations and refine strategies.

Beginners should start by building a strong foundation through educational resources. Familiarizing yourself with professional trading tools, like MetaTrader 4/5, and learning to use their features, including technical analysis tools and automated trading systems, is also crucial. Seeking mentorship or utilizing copy trading platforms to learn from successful traders can provide practical insights and aid in developing your own strategies.

Final thoughts

The role of a prop trader is both challenging and rewarding, offering a unique career path within the financial sector. Prop traders use a firm's capital to trade various financial instruments, aiming to maximize profits and manage risks. They benefit from flexibility, a rich learning environment, access to increased capital, and lower trading fees. However, they also face a steep learning curve, intense competition, potential isolation in digital firms, and additional expenses.

To succeed, seasoned prop traders leverage essential resources, including educational tools like trading courses and books, technological aids such as advanced trading platforms and charting software, community support through online forums and social media groups, and financial resources like funding programs with margin. By effectively utilizing these resources, prop traders can enhance their skills, optimize their trading strategies, and navigate the financial markets with greater confidence and efficiency.

FAQs

How can a new trader determine if proprietary trading is the right career path for them?

New traders should evaluate their risk tolerance, interest in financial markets, and willingness to commit to a steep learning curve. They should also consider participating in internships or training programs offered by proprietary trading firms to gain hands-on experience and better understand the demands of the role.

What is the typical daily routine of a prop trader?

A prop trader's daily routine involves market research, data analysis, strategy implementation, and monitoring trades, often starting early to align with market openings.

What are the common career progression paths for prop traders?

Common career progression paths for prop traders include advancing to senior trading positions, transitioning to risk management roles, or starting their own trading firms.

What are some effective risk management techniques for prop traders?

Effective risk management techniques for prop traders involve setting stop-loss orders to limit potential losses, diversifying their trading portfolios to spread risk, and using position sizing calculators to determine the appropriate capital allocation for each trade. Regularly reviewing and adjusting their strategies based on performance and market conditions is also crucial.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Trade execution is knowing how to place and close trades at the right price. This is the key to turning your trading plans into real action and has a direct impact on your profits.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.