Review of the Best Forex Position Size Calculators

Forex position size calculators help manage investment risk per trade. The best tools for this purpose include: web-based MyFXbook, MT4 indicators, mobile apps, and Excel calculators.

-

Each tool offers different benefits: user-friendliness, precision, portability, and customization

-

The use of calculators does not preclude a series of losses

-

Essential money management tips: set risk per trade, use stop-losses, manage leverage, diversify trades

One critical challenge traders face in the world of Forex trading is managing risk effectively while striving to maximize returns. This balancing act is fraught with complexities, often leading to the unnerving question: How much should I invest in a single trade? Without a clear answer, traders may either expose themselves to undue risk or hinder their potential for profit.

This article illuminates the path to prudent trading by introducing the concept of the Forex position size calculator, a pivotal tool for gauging the appropriate stake for each trade based on precise risk management strategies.

-

What does position size mean in Forex?

Position size in Forex is the volume of a trade measured in units of currency, which affects the risk and potential profit of an investment.

-

How do I know my position size?

Your position size can be determined by using a position size calculator, which considers your account balance, risk tolerance, and stop-loss level.

-

What is a Forex position size calculator?

A Forex position size calculator is a tool that helps traders to determine the appropriate amount of currency units to buy or sell based on their capital and risk management rules.

-

How do you use position size on a calculator?

You input your account balance, risk percentage, stop-loss in pips, and the currency pair into the calculator, which then outputs the correct position size for your trade.

Understanding Forex position size calculator

At the heart of successful Forex trading lies the concept of risk management, with the position size calculator serving as its linchpin. These calculators enable traders to determine the optimal amount of currency units to buy or sell, ensuring that risk exposure is meticulously calibrated to individual risk tolerance and account size.

This equilibrium is crucial, it not only safeguards traders from devastating losses but also optimizes the growth potential of their portfolio.

Can we do without a position size calculator?

Theoretically, yes. Traders could rely on gut feeling or simplistic percentage-based rules of thumb. However, such approaches lack the precision and personalization essential in the volatile Forex market. Without this tool, traders are essentially navigating a storm without a compass.

The foundational principle of a Forex position size calculator is the input of your risk level (usually a percentage of your account balance), stop-loss in pips, and the currency pair you wish to trade. This information calculates the exact lot size for your trade, tailored to the specific constraints and objectives of your trading strategy.

For example, if a trader's risk management policy allows for a risk of 2% per trade and has a $10,000 account, the calculator aids in determining the precise lot size that aligns with this risk threshold. This use case demonstrates the calculator's role in making informed, disciplined trading decisions.

Myfxbook position size calculator

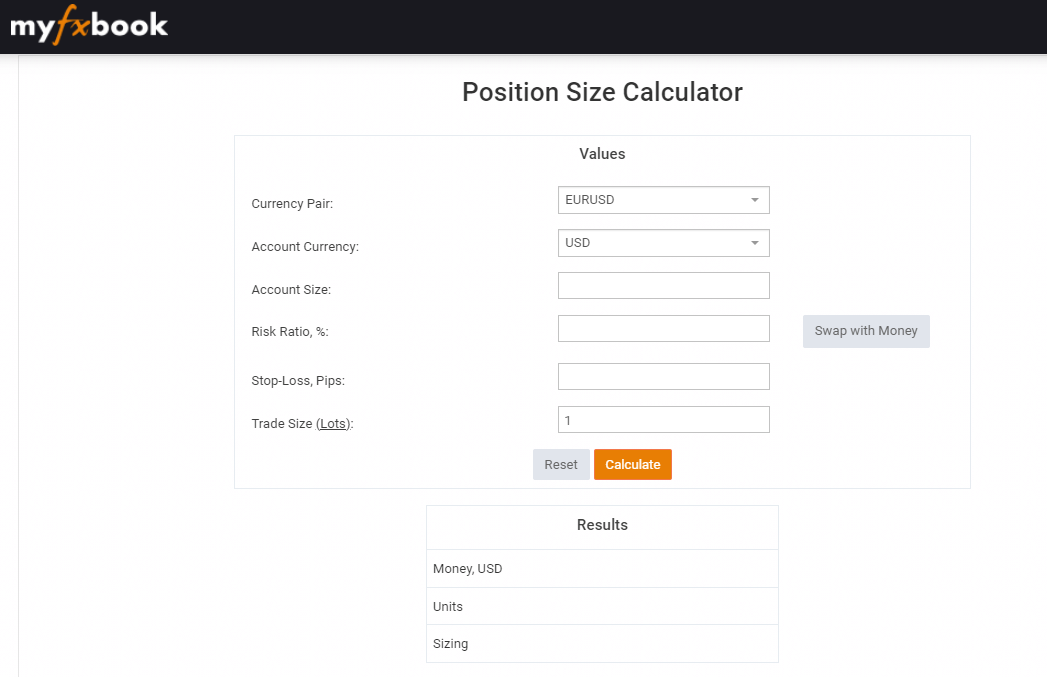

When precision is paramount, the Myfxbook position size calculator stands out as a user-friendly tool that fortifies a trader's decision-making arsenal. This online calculator offers a straightforward interface for calculating the exact size of Forex positions, tailored to one's individual trading account and risk management strategy.

It's designed to take into account various crucial parameters that directly influence risk, including account size, risk ratio, stop-loss, and the specific currency pair being traded.

Myfxbook position size calculator

The Myfxbook position size calculator is remarkably intuitive. To leverage its capabilities, a trader begins by selecting their currency pair of interest, for instance, EUR/USD. Following this, they input the currency of their trading account, which, in many cases, may be USD. The next step involves entering the total equity of the trading account.

The risk ratio percentage is then specified, which represents the fraction of account equity the trader is willing to risk on a single trade.

The final key input is the stop-loss in pips, which safeguards against larger than expected losses. Upon filling in these details, setting the desired trade size in lots is optional. Traders can leave this as the default if they wish the calculator to determine the appropriate trade size based on the other parameters.

With a simple click on “Calculate,” the tool processes these inputs and reveals the precise position size, thus guiding traders to make measured and informed trades.

Indicator for position size calculation

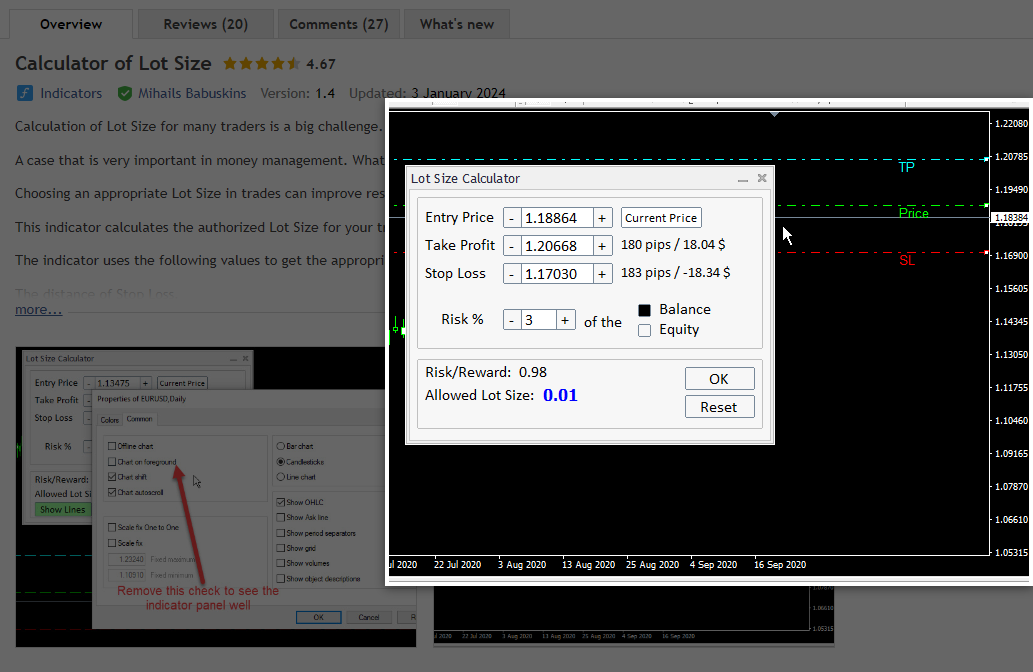

For traders who utilize the MetaTrader 4 (MT4) platform, the challenge of calculating the correct lot size for each trade can be formidable, yet it is a pivotal element in effective money management. Recognizing this essential need, the Indicator for Position Size Calculation emerges as a crucial tool, specifically crafted for MT4, to assist traders in this task.

Lot Size Calculator

This MT4 indicator simplifies the lot size calculation process by incorporating several key trading parameters: Stop Loss distance, Pip Value, Risk Allowed for Each Trade, and Account Balance.

To use this tool, traders input the Entry Price, along with their intended Stop Loss and Take Profit levels for the position they plan to enter. The indicator then calculates the risk percentage of the account's equity that the trader specifies, and as a result, it presents the allowable lot size for the trade.

👍 Pros:

• User-Friendly: The indicator provides a straightforward interface that integrates seamlessly with MT4, making it accessible even for those new to trading

• Precise Money Management: By automating the calculation of lot size based on predefined risk parameters, the tool helps maintain consistent risk management across all trades

• Time-Efficient: It eliminates the need for manual calculations, thereby saving time and reducing the potential for human error

👎 Cons:

• Over-Reliance: Traders may become too dependent on the tool and overlook the importance of developing their own understanding of risk management principles

• Platform-Specific: Its utility is limited to users of the MT4 platform, leaving out traders who prefer other trading platforms

Go over our article 10 Best MT4 Brokers (MetaTrader 4 Forex Platforms) for 2024 for further insights.

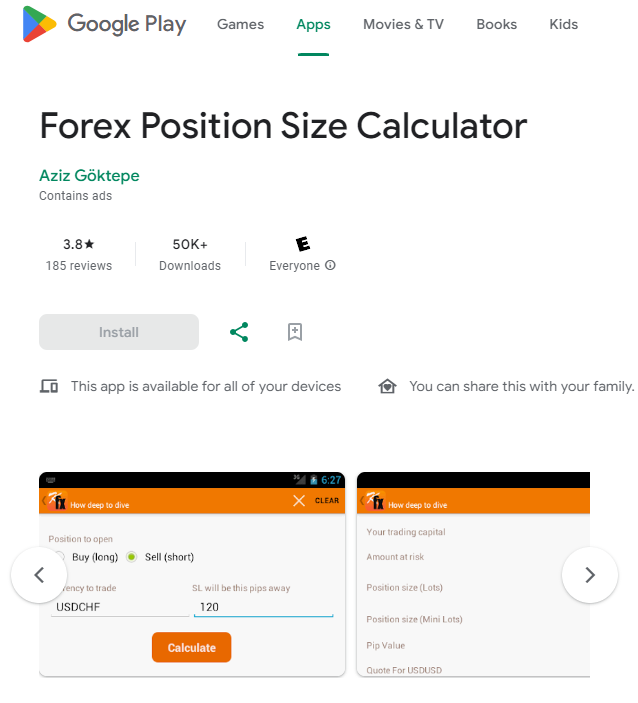

Forex position size calculator app

In the hands of the mobile trader, the Forex Position Size Calculator App is a pivotal tool. Simplifying the trade setup process, it allows for swift calculation of position sizes aligned with risk management tactics.

Forex position size calculator app

Traders specify their trade direction, currency pair, risk amount, and stop-loss in pips. The app computes the suitable lot size, streamlining the risk calculation process.

👍 Pros:

• Portability: Empowers traders to manage risk from anywhere, facilitating dynamic trade adjustments

• Intuitive Design: The straightforward layout minimizes the learning curve

• Efficiency: Provides expedited position size computations for prompt trading decisions

👎 Cons:

• Features: May offer fewer functionalities compared to comprehensive desktop calculators

• Device Dependence: Relies on the user's mobile device capabilities

• Advertisements: Includes ads which may disrupt the user experience

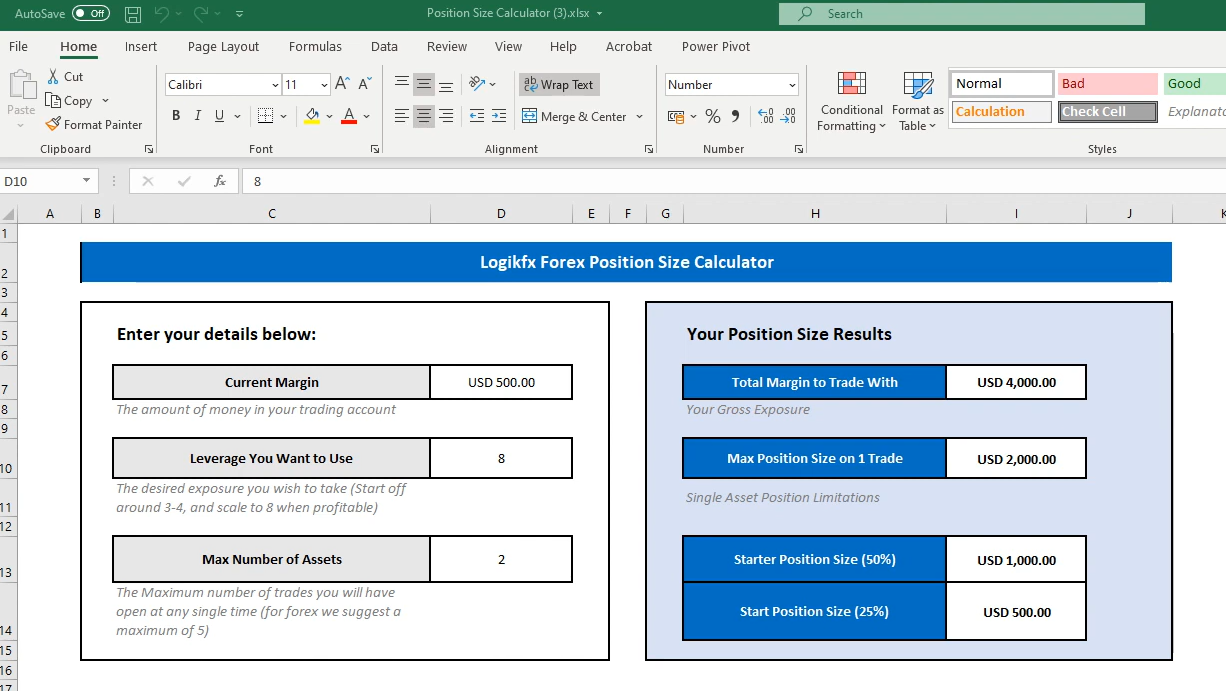

Forex position size calculator in Excel

Another tool for using a calculator in Excel, or Google Sheets. Any Forex trader can create a unique table to calculate a position based on their personal trading strategy.

Forex position size calculator in Excel

One example of such use of spreadsheets is shown above.

Traders input their current margin, desired leverage, and the maximum number of assets they plan to trade. The calculator then crunches these numbers to output a comprehensive risk assessment, including total margin available for trade, gross exposure, and maximum position size per trade. It even breaks down advisable starter position sizes as a percentage of the trader's capital.

👍 Pros:

• Customizability: Excel allows traders to tweak the calculator to their specific needs

• Detail-Oriented: Provides an extensive overview of potential risk and position sizes

• Control: Users maintain full control over their data and how it's processed

👎 Cons:

• Complexity: May be intimidating for Excel novices

• Manual Entry: Requires manual data input, which can be time-consuming and prone to errors

• No Real-Time Data: Unlike apps or MT4 indicators, it doesn’t offer real-time updates without additional programming

Best Forex brokers

Tips on money management in Forex trading

Effective money management is the backbone of any successful trading strategy. Here are key tips to help you maintain control over your financial risk in the Forex market

-

Set a Risk Percentage Per Trade: Decide on a fixed percentage of your account that you're willing to risk on each trade. This helps keep losses manageable. A common threshold is between 1% and 2%

-

Use Stop-Loss Orders: Always set a stop-loss order for every trade. It's a critical tool to limit potential losses if the market moves against you

-

Monitor Leverage Closely: Leverage can amplify gains, but it also increases risk. Use leverage judiciously and never overextend your positions

According to TU’s expert Matthew Du, diversification is also an important way to reduce risk in Forex. He said: Don't put all your capital into a single currency pair or trade. Spread your risk across different instruments to mitigate potential losses.

For more nuanced and detailed information, read our article Forex Trading Profit Calculator: Estimate Your Income.

Summary

The disciplined use of Forex position size calculators is integral to robust risk management. Whether you opt for a web-based tool, an MT4 indicator, a mobile app, or an Excel spreadsheet, each comes with its own set of advantages.

Pairing these tools with solid money management practices - like setting risk percentages, using stop-loss orders, managing leverage, and diversifying trades - can provide a substantial foundation for Forex trading success. Remember, consistent application of these strategies is key to long-term profitability and capital preservation in the ever-changing Forex marketplace.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

4

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

5

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).