Top Tips To Reduce Forex Trading Taxes

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

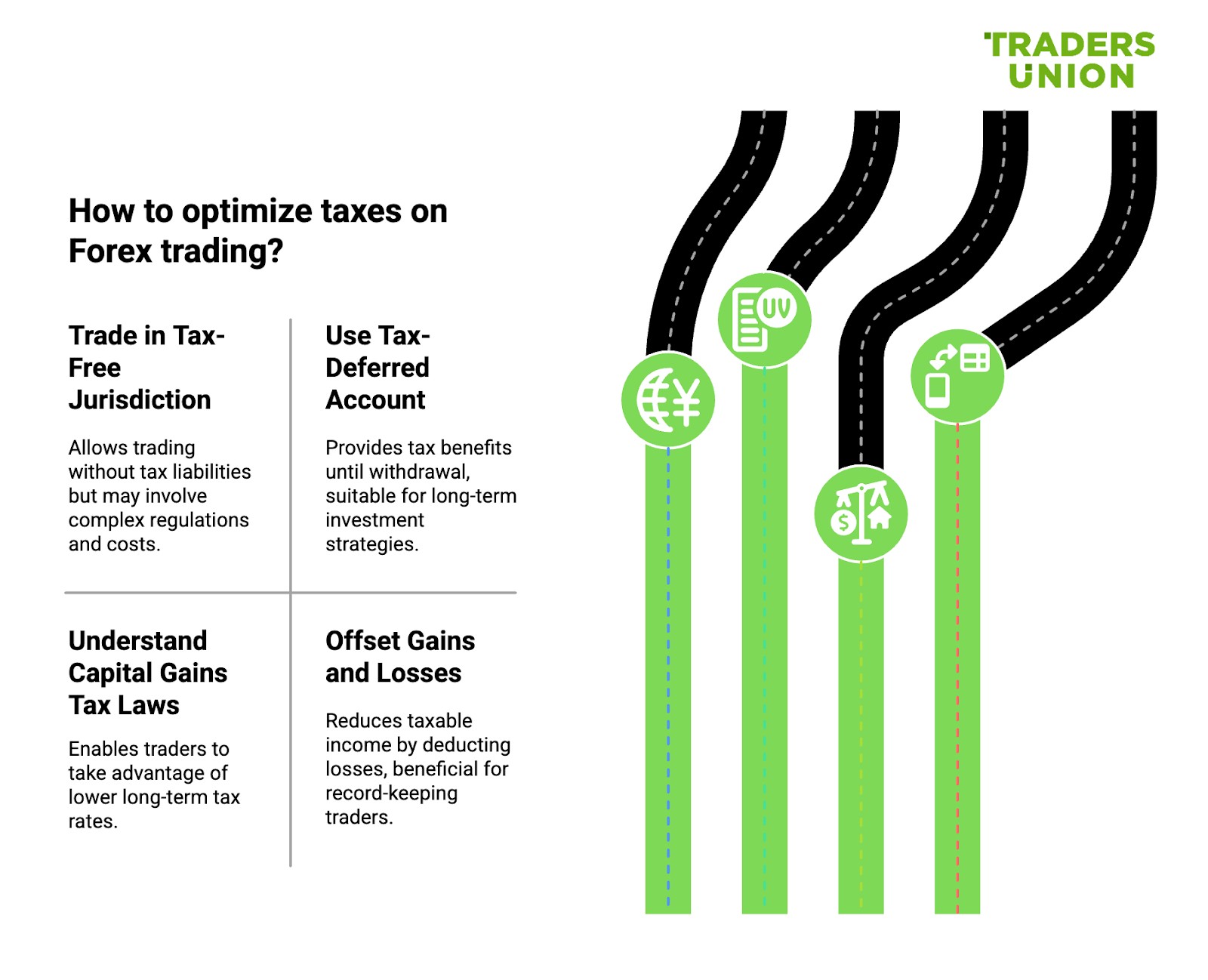

Trading in tax-free jurisdictions like the Bahamas or Bermuda can eliminate Forex taxes, but it requires an offshore account and may not be allowed by your home country. Using tax-deferred accounts such as IRAs or TFSAs lets you delay taxes until withdrawal, potentially lowering your tax burden. Understanding capital gains tax laws can help — holding trades for over a year may qualify for lower tax rates. Offsetting losses against gains also reduces taxable income.

Just like any other trading, Forex trading is also subject to taxes. But with the right approach, you can lower your tax burden and avoid unnecessary payments. Some ways to do this include trading through tax-exempt accounts, claiming losses on your tax return, and choosing currency pairs that aren’t subject to U.S. tax laws.

Put simply, there are ways to save on trading taxes, and this blog covers key strategies to help you do it. However, keeping detailed records of all your trades — like dates, currency pairs, amounts, and profit or loss — is crucial for accurate tax reporting.

Do remember though, that It’s always a good idea to check with a tax advisor for personalized advice before making any tax-related decisions.

Tax optimization techniques for traders

As an investor, it's normal to look for ways to help you avoid tax liabilities. Following are some proven strategies that can be useful.

Trade in a tax-free jurisdiction

In the U.K. and U.S., tax laws require Forex traders to pay taxes on their profits. However, you can trade in tax-free places like the Bahamas, Bermuda, or the Cayman Islands, where Forex trading isn’t taxed. This is a simple way to avoid Forex taxes.

But there are a few key things to consider. Trading in a tax-free country isn’t always easy — you’ll need to open an offshore account, which can be costly and take time.

Also, your home country might not allow trading in tax-free jurisdictions. Talking to a tax expert is the best way to get clarity before making any moves.

Using a tax-deferred account

A way to lower your tax bill on Forex trades is by using a tax-deferred account. Special accounts with tax benefits, like Individual Retirement Accounts (IRAs) or Tax-Free Savings Accounts (TFSAs), let you trade Forex without paying taxes on profits until you withdraw the money. This helps you pay less tax in the long run. Taking money out of these accounts means you’ll owe taxes on the withdrawn amount. But if you withdraw after retirement, you might be in a lower tax bracket, so you end up paying less in taxes overall.

Understanding capital gains tax laws

A smart way to lower taxes on Forex trading is knowing how capital gains tax works. In many countries, this tax applies to the profits you make when selling an asset. If you hold a Forex trade for over a year, you could qualify for a lower tax rate.

In the U.S., this rule is especially useful. Long-term capital gains tax rates are lower than short-term rates, meaning you can reduce the taxes you owe by keeping trades open for more than a year.

Offsetting gains and loses

Another smart way to reduce taxes on Forex trades is by deducting your trading losses. Many traders overlook this, but it can be a big help. By writing off your losses, you can offset your gains and lower the amount of tax you owe.

Keeping track of your trades is key to making this work. Besides deducting losses on your tax return, you can also roll them into future years to reduce taxes on upcoming profits.

Structuring trades for tax efficiency

How you set up trades, group assets, and decide how long to hold them can help lower taxes on profits. Grouping assets by type, purpose, risk level, and regulations makes it easier to manage your portfolio, understand potential risks, and follow regulations.

The common ways assets are categorized in trades are:

Asset type. Assets can be categorized into different types, such as equities (stocks), fixed income (bonds), commodities, currencies, real estate, and derivatives.

Risk profile. They can be classified based on their risk characteristics, ranging from low-risk. This categorization helps you balance risk and return in your portfolios.

Liquidity. Another category is their liquidity, with some being extensively liquid and others less liquid (e.g., real estate or private equity). These considerations are significant for trade execution and portfolio management.

Market capitalization. In equity markets, assets are often categorized by market capitalization, like large-cap, mid-cap, and small-cap stocks. Every category has different growth and volatility characteristics.

Geographic location. Assets can be categorized by location, which is important in international trade and investment. You may allocate assets to particular regions or countries based on economic conditions and opportunities.

Industry sector. Stocks and bonds can be categorized by the industry sector they are in, like technology, healthcare, or energy. Sector-specific categorization helps you assess sector-specific risks and opportunities.

In trading, "period holding" refers to the span for which you hold a particular investment or asset in your portfolio. The holding period length can vary, ranging from seconds or minutes for day traders to years for long-term investors.

It's an essential consideration in trading, as the length of time you hold an asset can influence the potential for profit or loss and may have tax implications.

Now that we know what asset categorisation and holding periods are let's check out the significant benefits of trade structuring.

Tax efficiency. Trade structuring includes planning and arranging financial transactions to reduce tax liabilities. Properly structuring trades can minimize the tax burden legally and efficiently.

Income tax planning. If you're running a business, trade structuring can optimize income tax liabilities. It will include selecting the right business structure, e.g., sole proprietorship, LLC, or corporation, to decrease taxes. It can also have timing income recognition for lower tax rates in particular years.

International trade. If you're engaged in international trade, structuring trade transactions can help minimize customs duties and tariffs and navigate complex international tax regulations.

Avoiding tax traps. One noted benefit of trade structuring is that it helps avoid tax traps and pitfalls. This includes ensuring compliance with tax laws and regulations to prevent expensive penalties and audits.

Risk management. Trade structuring can also help manage tax-related risks. It involves assessing potential tax consequences before executing a trade and executing methods to battle adverse tax results.

Compliance and reporting. Proper trade structuring also takes care of accurate and complete tax reporting, reducing the error chances, omissions, or inconsistencies in tax filings.

Tax laws and regulations can change over time, and the effectiveness of trade structuring strategies may vary depending on individual circumstances and jurisdiction. Therefore, we again advise you to consult with tax professionals or financial advisors.

Leveraging tax-advantaged accounts

Tax-advantaged accounts aren’t just about saving on taxes — they’re a strategic tool that can multiply your wealth if you know how to use them right.

Use multiple accounts to stack benefits. Don’t just rely on one tax-advantaged account. Pair a Roth IRA with an HSA or a 401(k) with a taxable brokerage to control when and how you pay taxes, giving you more flexibility when you withdraw.

Time your contributions based on tax brackets. If you expect your income to rise in the future, prioritize Roth contributions now while you're in a lower tax bracket. If you're earning more today but expect lower income later, max out pre-tax accounts like a traditional IRA to lower your current taxable income.

Withdraw strategically to minimize lifetime taxes. Instead of blindly withdrawing from one account, pull from different sources in a way that keeps you in the lowest tax bracket possible. Start with taxable accounts, then move to tax-deferred accounts, and let Roth money grow tax-free for as long as possible.

Use an HSA as a stealth retirement account. Most people think of HSAs as medical savings, but they double as a retirement powerhouse. Pay medical bills out of pocket, save your receipts, and let the HSA grow. Later, you can withdraw tax-free for any past medical expense, or after 65, you can use it like a traditional IRA.

Convert traditional accounts to Roth in down years. If you have a low-income year due to a job change, sabbatical, or market downturn, it’s the perfect time to convert part of a traditional IRA into a Roth. You’ll pay taxes at a lower rate and lock in future tax-free growth.

Tax planning for Forex traders

Most traders only think about taxes at the end of the year, but smart traders structure their trades and accounts from day one to keep more of what they earn.

Use the right tax classification. The way you file your Forex income can change how much tax you pay. Some traders benefit from being classified as investors, while others save more by electing trader tax status. Picking the wrong one could mean paying thousands more than necessary.

Track unrealized losses for tax benefits. Most traders only report realized profits and losses, but tracking your unrealized losses can help you offset future gains. Some tax codes let you "carry forward" losses to reduce taxable income in high-earning years.

Separate trading from personal expenses. If you trade from home, you may be eligible for deductions on internet, software, and even a portion of your rent or mortgage. But mixing personal and business expenses without proper documentation can get you flagged for an audit.

Consider forming an LLC or entity. Depending on where you live, trading under a legal entity can reduce self-employment taxes and provide liability protection. It also helps establish a clear distinction between your personal and trading finances, making tax filing easier.

Take advantage of tax-friendly jurisdictions. Some countries and states have lower capital gains taxes or even no tax on Forex profits at all. If you're a full-time trader, relocating or structuring your trading business in a tax-friendly jurisdiction could save you a fortune.

Seeking professional advice

With that, we conclude our discussions on the possible ways to reduce tax on trade. Forex taxation and everything related to tax documentation is a complex process. Hence, we strongly recommend consulting a professional with detailed knowledge of intricate concepts.

It will help you gain detailed insights into the tax accounts, possible reasons for minimizing liable taxes, and every little concern.

Also, choosing the right Forex broker can help you save other costs apart from taxes that can already be saved from the ways mentioned above. We have researched the market and shortlisted the best options in the table below for you to make a choice:

| Demo | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Investor protection | Max. Regulation Level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | 0,5 | 0,9 | €20,000 £85,000 SGD 75,000 | Tier-1 | 6.83 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | 0,5 | 1,5 | £85,000 €20,000 €100,000 (DE) | Tier-1 | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | 0,1 | 0,5 | £85,000 SGD 75,000 $500,000 | Tier-1 | 6.8 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | 0,7 | 1,2 | £85,000 | Tier-1 | 6.95 | Study review | |

| Yes | No | 1:30 | 0,2 | 0,8 | $500,000 £85,000 | Tier-1 | 6.9 | Open an account Your capital is at risk. |

Trader tax status and business structures can lower your Forex tax bill

Most traders think cutting taxes is just about tracking expenses, but smart traders plan ahead. A big way to keep more of your profits is by choosing the right tax setup — investor or trader. Investors pay capital gains tax, while traders with "trader tax status" can write off things like software, data feeds, and even part of their home office. If you trade full-time, choosing MTM accounting can be a huge advantage. It lets you write off all your losses for the year instead of getting stuck with limits on writing off losses.

Another smart move is trading under a business setup like an LLC or S-corp. This can give you extra tax perks like retirement contributions, healthcare deductions, and lower self-employment taxes. Some traders even move to places with lower taxes where Forex gains aren’t taxed at all. It’s not just about paying less tax — it’s about making sure every dollar you keep works harder for you.

Conclusion

Reducing your Forex trading taxes isn’t just about tracking expenses — it’s about structuring your trading life in a way that legally keeps more money in your pocket. The biggest mistake traders make is waiting until tax season to think about this. Instead, set up the right tax classification early, choose strategies like MTM accounting if they fit your style, and consider trading under an LLC or S-corp for extra tax perks. If you’re serious about maximizing profits, even where you live can make a difference — some locations have little to no tax on Forex gains. The bottom line? Plan ahead, structure wisely, and make tax efficiency a key part of your trading strategy, not an afterthought.

FAQs

What is leverage in Forex trading?

Leverage helps you to control larger positions with less capital. While it can increase profits, it also increases the chances for significant losses. You need to use leverage cautiously.

Is Forex trading risky?

Yes, Forex trading can be hazardous due to market volatility. It's possible to lose more than your initial investment. You should have a well-thought-out trading plan and risk management strategy.

Do I need much money to start Forex trading?

You can go ahead with Forex trading with a small amount of capital due to leverage. However, it's essential to trade with money you can afford to lose.

Are there risks of Forex scams?

Yes, the Forex market can attract scams and fraudulent brokers. It's essential to choose a reputable and regulated broker and be cautious of any tempting offers.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

A Roth IRA (Individual Retirement Account) is a tax-advantaged retirement savings account available in the United States. It allows individuals to contribute after-tax income to the account, and the contributions grow tax-free. When qualified withdrawals are made in retirement, including both contributions and earnings, they are typically tax-free as well.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Trade execution is knowing how to place and close trades at the right price. This is the key to turning your trading plans into real action and has a direct impact on your profits.

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.