How To Withdraw From Binance To Bank Account In Pakistan

How to withdraw from Binance to bank account in Pakistan:

Withdrawing funds from Binance to a bank account in Pakistan involves a few straightforward steps. Users should log in to their Binance account, select the fiat currency to withdraw, and specify the account to which the funds will be transferred. Depending on available payment options, users in Pakistan may also find it easier to withdraw via JazzCash, EasyPaisa, or other third-party services if direct transfers aren’t supported. After choosing a method, users enter their details, complete a security check, and confirm the transaction. This guide breaks down each step for a smooth transaction.

How to withdraw from Binance to bank account in Pakistan

Before withdrawing funds from Binance to a bank account in Pakistan, you must meet the following requirements:

-

Account verification. Binance requires all users to complete the KYC (Know Your Customer) process before allowing fiat withdrawals. This ensures user identity verification and aligns with local compliance, especially in regions with stringent regulations like Pakistan.

-

Withdrawal amount limits. Binance sets a minimum withdrawal amount, typically around 10 EUR or equivalent for fiat withdrawals. The Instant Withdrawal feature via Visa Direct generally charges around 1-1.5% for instant transfers. Processing time is typically a few minutes, but delays can occasionally occur based on the payment processor’s policies.

Step 1: Log into Binance

Go to the Binance website and log in to your account.You’ll need to have your verification completed, so make sure that’s done.

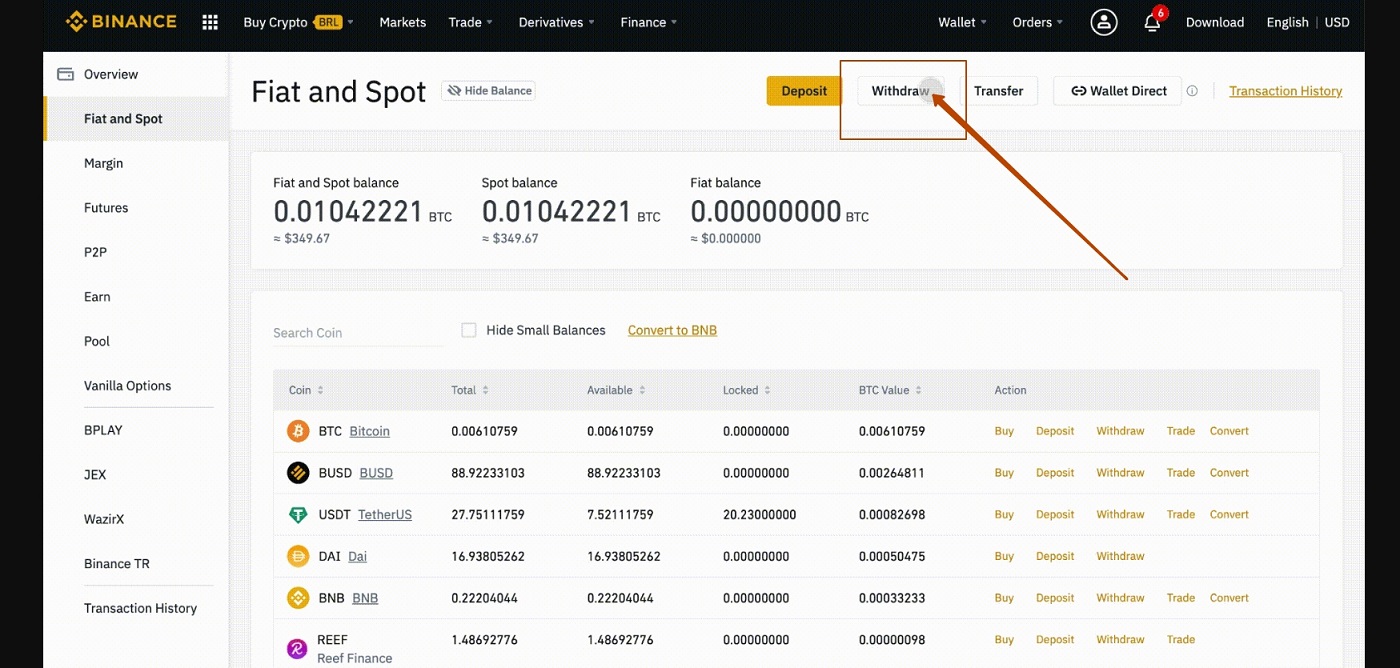

Step 2: Go to wallet > fiat and spot

From the top menu, select "Wallet" and go to the "Fiat and Spot" section. This will allow you to see the balance of available fiat currencies and cryptocurrencies on the platform.

Go to "Wallet" and select "Fiat and Spot" section

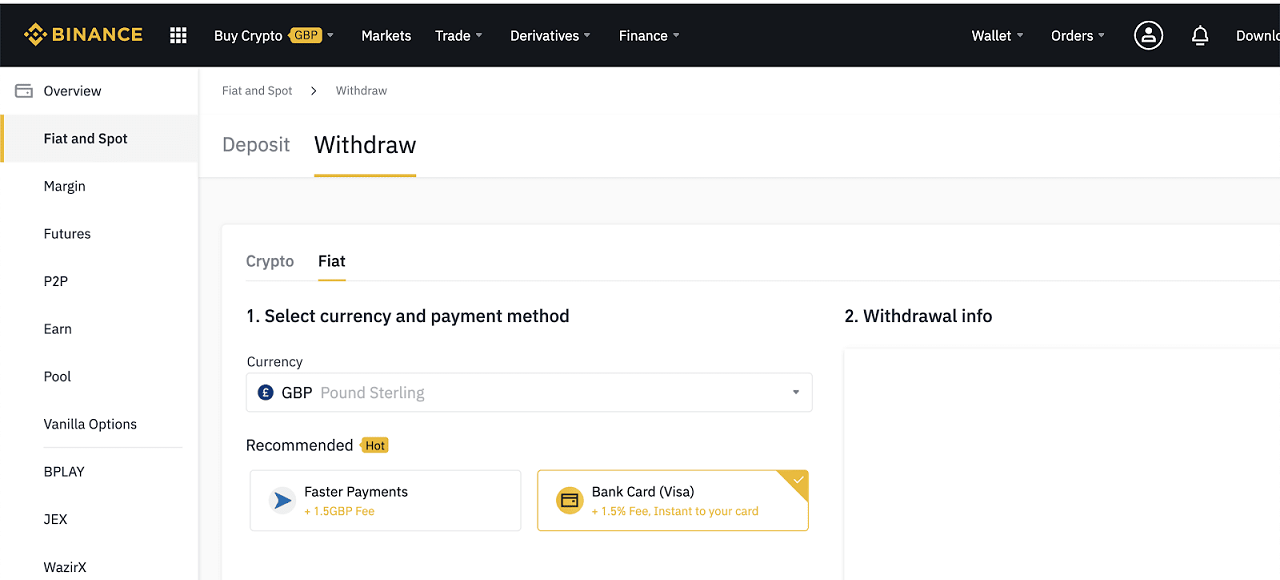

Step 3: Select a currency to withdraw

On the "Fiat and Spot" page, click the "Withdraw" button and select the currency you wish to cash out. Available withdrawal options may vary depending on the region and the currency you select. In Pakistan, some currencies may not be supported for direct withdrawal.

Select a currency to withdraw

Step 4: Set up a payment method

Select a withdrawal method, such as a bank account. If this is your first withdrawal, you will need to add information. Once it has been added, it will be available for future withdrawals.

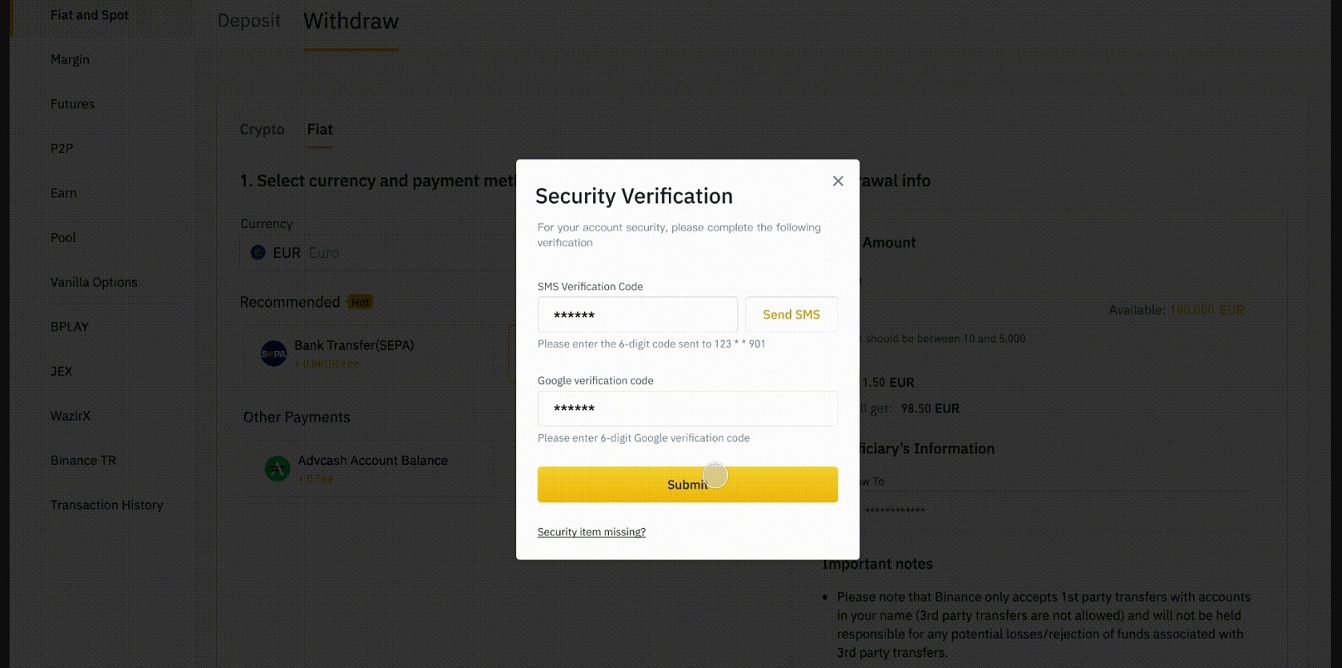

Step 5: Complete security verification

To secure the transaction, complete two-factor authentication (2FA). Enter the code sent to your registered phone number and,may need to enter the code from the Google Authenticator app. This will help confirm the security of the transaction.

Complete security verification

Step 6. Confirm and complete the withdrawal

Double-check the entered data, including the withdrawal amount and selected payment method, and confirm the transaction. Once confirmed, the request will be processed. Keep in mind that depending on the bank and the selected method, the funds may take a few minutes to five business days.

Binance withdrawal processing times and fees

The time for funds to reach your bank card depends on the withdrawal method you choose. Instant transfers via Visa Direct are processed within minutes, but in rare cases can take up to 24 hours to settle a transaction due to bank checks. For bank transfers such as SEPA or SWIFT, processing can take from 1 to 5 business days depending on the country and the receiving bank.

Fiat withdrawal fees depend on the method you choose

-

In Pakistan, Binance offers Visa Direct as one of the primary fiat withdrawal options. The fee for Visa Direct withdrawals is typically 1.5% of the withdrawn amount, with a minimum starting fee around 0.5 USD. This may vary slightly based on bank partnerships or currency settings.

-

For SWIFT transfers, Binance charges 0.1% of the total withdrawal amount. This fee ranges between $15 (minimum) and $135 (maximum), which remains consistent globally.

Users should note that fee structures can also vary based on the region and their Binance account level. VIP users may enjoy reduced fees depending on their trading volume and Binance status, offering some savings on frequent withdrawals.

Common errors and how to fix them

-

Unverified or insufficiently verified account. If your account has incomplete KYC verification, you may be limited to smaller withdrawal amounts or may not be able to withdraw to certain payment methods. Completing all necessary verifications allows higher limits and greater payment flexibility.

-

Insufficient funds. If your account balance is below the required minimum withdrawal amount, your transaction will be declined. Check the specific minimum for the method you’re using, as this varies.

-

Exceeding the withdrawal limit. Depending on your verification level, there may be daily caps. For example, users with a basic KYC level can withdraw a maximum of $50,000 per day. Exceeding the limit will result in your request being declined. Check your current limit on Binance.

-

Recent account changes. Recently changed your password or two-factor authentication? Binance might temporarily block your withdrawal for 24-48 hours for security purposes.

-

Technical issues or scheduled maintenance. When wallets are undergoing maintenance, withdrawals are temporarily suspended. The system may show an error or reject the request.

Enjoy instant transfers and avoid withdrawals during periods of high network congestion

When withdrawing funds from Binance to a bank account or card in Pakistan, it is recommended to consider some tips to improve efficiency.

Withdraw faster and save on fees. If you're cashing out to a bank card or account in Pakistan, picking the right time and method can really make a difference. Opt for the Visa Direct option if it's available for Pakistan, which can get money to you fast — sometimes in just a few minutes. Plus, if you’re not in a rush, try timing your withdrawals for late evening or early morning when fees and network traffic are lower. Quick tip: Binance ’s fee estimates give a heads-up on costs before you confirm, so check them to pick the least expensive timing.

Keep your account steady for easier withdrawals. When you’re set to make a withdrawal, avoid tweaking your account settings, like passwords or security settings, right before. Binance has a habit of putting holds on accounts with recent changes in security settings, which means a delay you probably don’t want. It’s an easy thing to miss, but if you leave your account steady for a day or two before a withdrawal, it can often save you some hassle.

Conclusion

Withdrawing funds from Binance to a bank account is a convenient way to access fiat funds if you take into account all the necessary steps and requirements. Selecting the appropriate method, such as Visa Direct , can lead to faster withdrawals, often within minutes. Make sure your account information is up-to-date and limits are met to avoid possible transaction errors. To speed up the process, consider the network load and choose the most suitable withdrawal methods. If difficulties arise, Binance support is available to promptly resolve issues.

FAQs

Are there any fees for withdrawing to my bank account?

Yes, Binance usually charges a withdrawal fee that can vary based on the currency and withdrawal method. It’s advisable to check the latest fee schedule on their website.

Can I withdraw in different currencies or only in PKR?

While you can withdraw in different fiat currencies, you need to check if your bank account accepts those currencies. For PKR, ensure that your bank supports receiving PKR transactions.

What if my withdrawal is marked as pending for a long time?

If your withdrawal is pending for too long, you should contact Binance support for assistance. Provide them with your transaction ID for quicker resolution.

Can I withdraw to a bank account that is not in my name?

Generally, Binance requires that the bank account name matches the name on your Binance account to comply with regulatory requirements and prevent fraud.

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).