How To Withdraw From Bybit To Bank Card In Nigeria

How to withdraw from Bybit to bank account in Nigeria:

Bybit, one of the leading platforms for crypto trading, offers a range of withdrawal options, including direct withdrawal to bank cards and accounts. While the process can seem complex, particularly for new traders, it's actually quite straightforward when broken down into clear steps. This guide will walk you through the entire process, offer considerations for traders, and provide expert advice to ensure a smooth withdrawal experience.

How to withdraw from Bybit to a bank account in Nigeria

Step 1. Log into your Bybit account

First, log into your Bybit account using the app or web platform. Once logged in, go to the “Assets” section located in the top-right corner. Here, you will see all your available assets, whether in crypto or fiat currencies. If the funds you wish to withdraw are in your “Spot” or “Funding” account, you’re ready to proceed with the withdrawal.

Log into your Bybit account

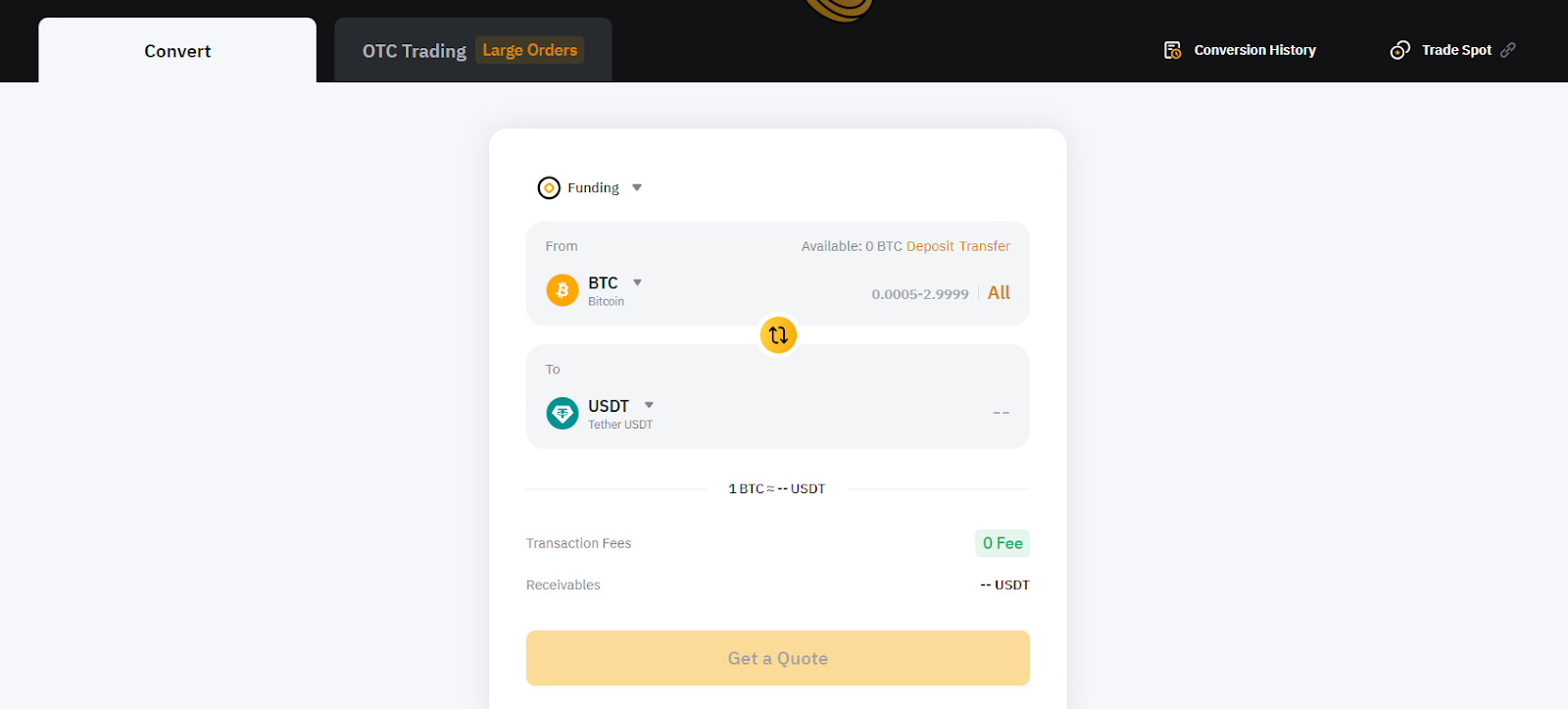

Step 2. Convert your cryptocurrency to fiat or USDT

Bybit doesn’t allow direct withdrawals of certain cryptocurrencies to Nigerian bank cards. Therefore, you may need to convert your chosen cryptocurrency (e.g., Bitcoin or Ethereum) to a more commonly accepted one like USDT. Here’s how:

-

Go to the “Assets” section, then select “Convert”.

Select the trading pair

-

Search for the appropriate trading pair (e.g., BTC/USDT or ETH/USDT).

-

Place a market or limit order to exchange your crypto for USDT.

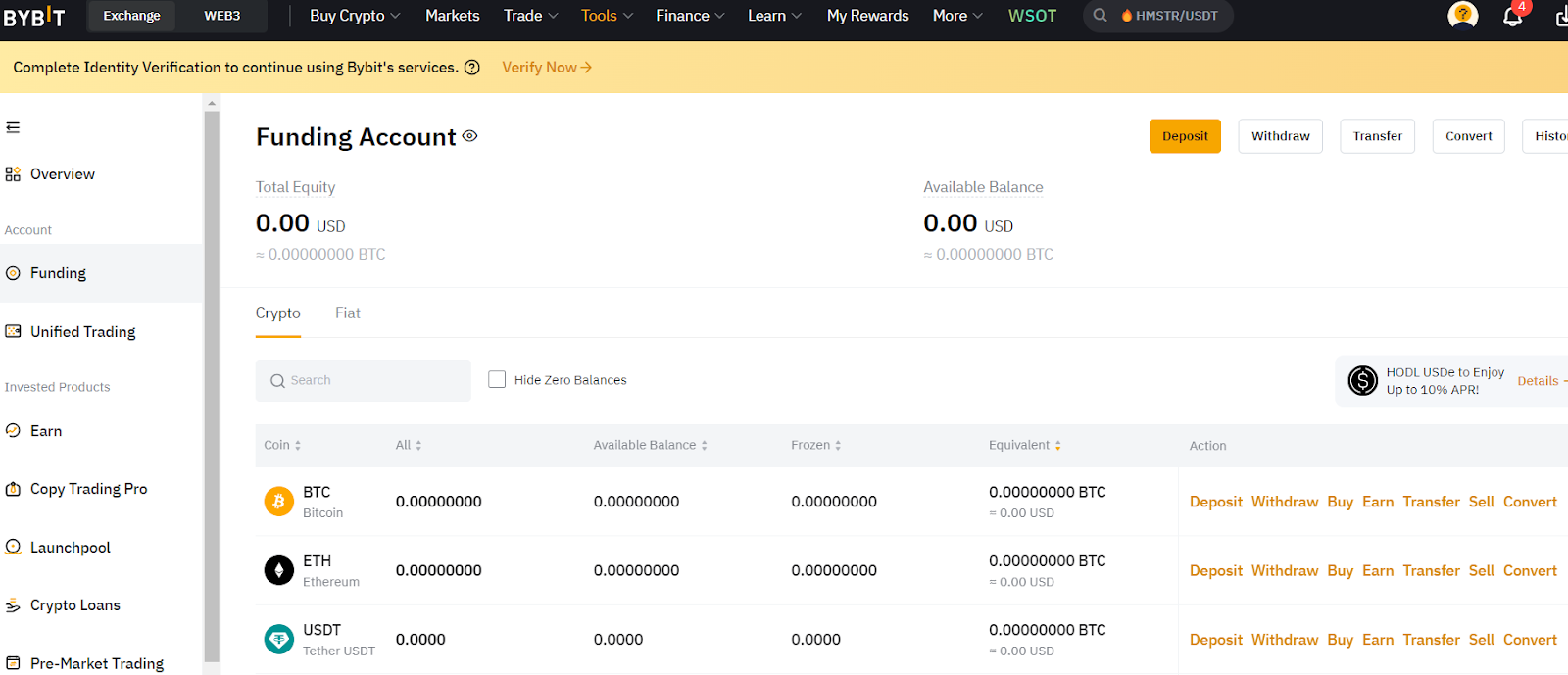

Assets section of Bybit

Step 3. Initiate the withdrawal process

Once your cryptocurrency is converted into USDT or another accepted currency, follow these steps:

-

Go to the “Assets” section and select “Withdraw”.

-

Choose the currency (e.g., USDT) that you want to withdraw.

-

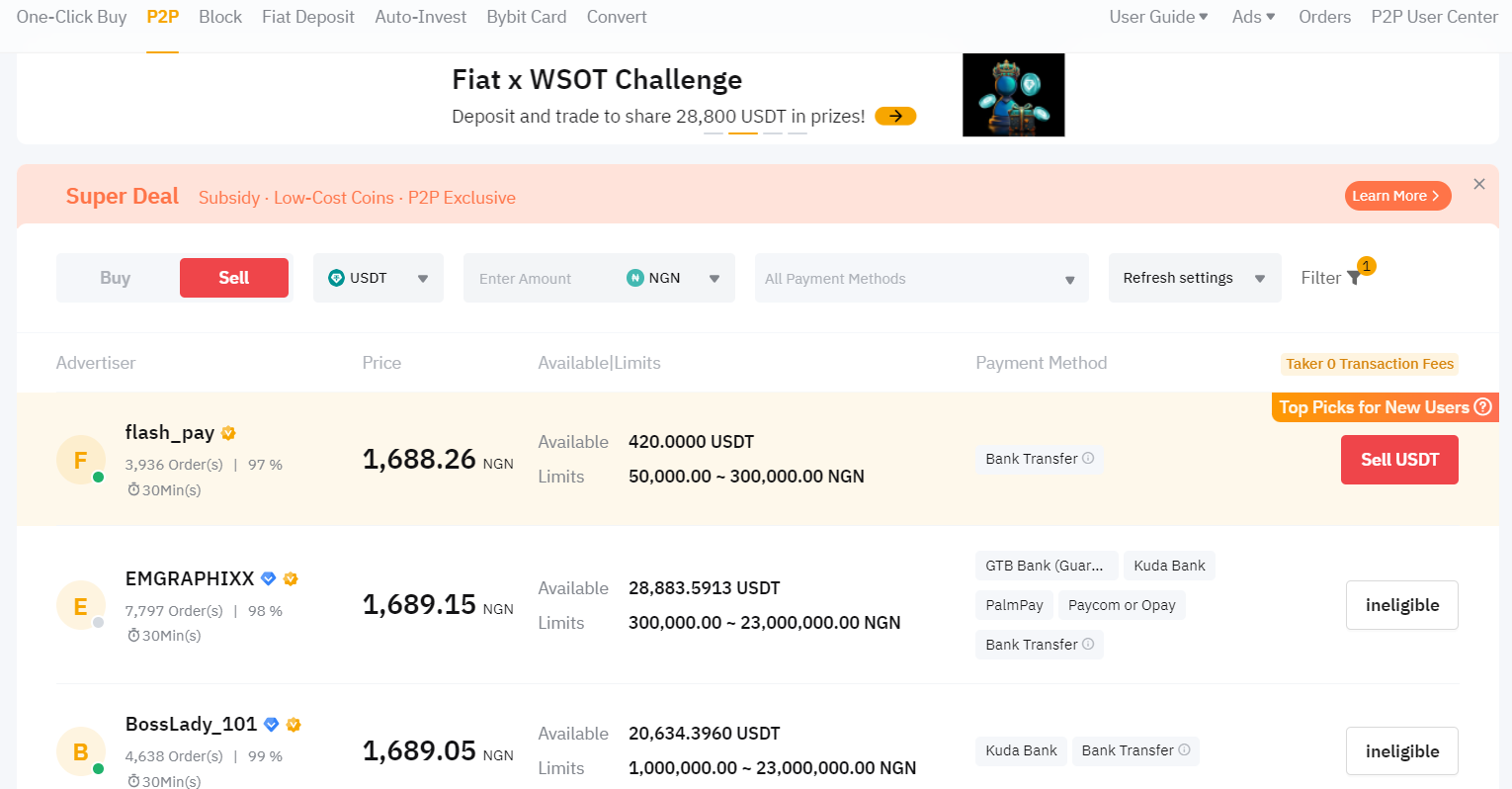

For Nigerian users, it’s recommended to use third-party payment providers such as Advcash or P2P (peer-to-peer) trading options, which allow for converting your funds into Naira (NGN) and then sending it to your bank card.

Bybit P2P

-

Input the details of your Nigerian bank card or account.

-

Verify all details, including the chosen blockchain network and bank details, and confirm the transaction.

Go to the Assets section and select Withdraw

Step 4: Monitor your withdrawal

After submitting your request, monitor the withdrawal status in the “History” tab under the "Assets" section. Most withdrawals are processed within 30 minutes to an hour, but delays can occur due to network congestion or platform maintenance. You can also use blockchain explorers like Etherscan to track your transaction if needed.

Monitor the withdrawal status

In what cases do you need to withdraw funds from Bybit to bank account in Nigeria?

Withdrawal of funds to a bank account is a standard procedure that all traders face. It may be necessary, for example, if you withdraw profits from short-term transactions. Also, withdrawal of funds may be required by long-term investors who work with capital on the principle of “Buy and hold” or use Bybit Earn.

Also in 2024, another reason why you may need to withdraw to a bank account became relevant. This is the withdrawal of profits from Tap-2-Earn games. For example, Bybit allows you to withdraw profits from the following games:

These games allow you to earn cryptocurrency, and accordingly, it can be withdrawn through Bybit, converted into a more liquid coin (for example, USDT) and cashed out.

Considerations for beginners

Familiarize yourself with Nigerian bank regulations

Some Nigerian banks may block or restrict transactions related to cryptocurrency due to the Central Bank of Nigeria's regulatory policies. If you encounter issues, consider using Bybit's P2P platform to convert your funds to Naira and then withdraw to your bank card via a third-party service.

Complete KYC for higher withdrawal limits

For first-time users, Bybit imposes withdrawal limits based on your KYC (Know Your Customer) verification level. Completing KYC not only increases your withdrawal limit but also speeds up the process by reducing potential restrictions.

Be Aware of fees and conversion rates

Understand that there are fees associated with converting crypto to fiat. Additionally, exchange rates can fluctuate, impacting the amount you eventually receive in Naira. Bybit offers competitive fees, but it’s always good to check them before completing a transaction.

Risks and warnings

-

Regulatory risks

Due to Nigeria's regulatory stance on cryptocurrencies, direct transfers may be blocked by some banks. Stay informed of any policy changes that might impact your ability to withdraw funds from Bybit to your Nigerian bank card. -

Exchange rate volatility

Crypto markets are notoriously volatile. It’s essential to withdraw when exchange rates are favorable to get the best conversion into Naira. Monitor rates and convert your funds at the right time to avoid losses. -

Delayed transactions

Occasionally, withdrawals can be delayed due to network congestion or platform maintenance. If delays occur, use Bybit’s tracking tools or consult customer support.

Pros and cons of withdrawing from Bybit in Nigeria

👍 Advantages of Broker:

•Fast transaction times for verified users.

•Multiple withdrawal methods, including P2P trading, for greater flexibility.

•Secure platform with strong encryption and 2FA options.

👎 Disadvantages of Broker:

•High fees for converting crypto to fiat currencies.

•Possible delays due to network congestion.

•Direct withdrawals to Nigerian bank cards may be restricted by banks.

Tips for a smooth withdrawal experience

Withdrawing from Bybit to a Nigerian bank account can be tricky, especially with all the changes in regulations. One smart way to do this is by first moving your funds to a wallet before sending them to your bank. Because of the Central Bank’s rules, sending crypto directly to your account might raise red flags. By moving the funds to a wallet, you can change them into something like a stablecoin and use peer-to-peer platforms to swap it for Naira — this helps you avoid issues like your account being blocked or getting bad rates.

Another useful tip is to withdraw your money early in the morning on weekdays. Nigerian banks tend to process transactions quicker at this time, and some traders have seen their withdrawals go through in just a few hours. If you do it on weekends or evenings, you’ll likely face delays because banks don’t move as fast overnight. Just knowing the best time to make your transfer could get you your money faster!

Conclusion

Withdrawing from Bybit to a bank card in Nigeria doesn’t have to be difficult. Whether you’re new to P2P trades or handling larger transactions, you can make the process smoother by using smart strategies like timing your withdrawals and using decentralized wallets to avoid account issues. Stay aware of the latest regulations and take advantage of the secure tools Bybit provides to keep your funds safe.

FAQs

Is there a minimum withdrawal amount from Bybit?

Yes, Bybit has a minimum withdrawal limit depending on the cryptocurrency. For example, the minimum for Bitcoin is typically 0.001 BTC. Make sure your withdrawal amount meets the minimum threshold for the asset you're using.

Can I cancel a withdrawal request on Bybit after it’s been submitted?

Once a withdrawal request has been processed, it cannot be canceled. If the transaction is pending, you can contact Bybit support to see if they can intervene before it’s completed, but this isn’t always possible.

How long does it take for Bybit to process a withdrawal?

Withdrawals typically take 30 minutes to an hour to process, but delays can occur due to network congestion or platform maintenance. If your transaction takes longer, you can check its status on a blockchain explorer or contact Bybit support.

Are there fees for withdrawing from Bybit to a Nigerian bank card?

Yes, there are fees for withdrawing from Bybit, and these vary depending on the cryptocurrency and withdrawal method. For example, withdrawing Bitcoin may incur a fee of 0.0005 BTC, while third-party services for fiat withdrawals may also charge conversion fees.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).