How to open a Pepperstone Account

Pepperstone is an Australian broker founded in 2010 with some of the best technological solutions and favorable trading conditions. The company provides professional tools that simplify trading for both novice and experienced traders. The process of opening a Pepperstone account is quite straightforward, and the online application takes roughly 10-15 minutes. The broker has some strict document verification protocols and a suitability test which most traders consider cumbersome. However, these KYC policies are some of the measures put in place by the company to ensure utmost security and compliance with regulations. Here’s all you need to know about opening a Pepperstone account. Take a look!

Pepperstone Account Requirements and Documents

As a highly regulated broker – regulated by seven regulatory authorities, i.e. ASIC, FCA, DFSA, BaFin, CMA, SCB, and CySec – the company considers identity verification a very important step when creating an account. Everyone who opens an account with Pepperstone is first subjected to a suitability test, which is a short questionnaire. This, according to the broker, allows them to assess client suitability to trade derivative products. The process is fast, and applicants receive instant results after answering the seven simple questions.

After passing the suitability test, new account applicants must confirm identification. To do this, you’re required to submit an identification document, and two proof of address documents. You should take a clear photo of the original documents and upload them. Pepperstone doesn’t accept black and white images or scanned copies of the documents. Additionally, you might be required to provide additional information depending on where you’re from.

Although Pepperstone isn't available in the United States, Canada and Japan, it is available in multiple countries and regions. These include Australia, Germany, China, Ireland, India, Malaysia, Hong Kong, Netherlands, Singapore, Kenya, the United Kingdom, South Africa, Nigeria and the United Arab Emirates, among others. The initial $200 minimum deposit is relatively high compared to similar brokers.

Pepperstone Account Types

Pepperstone has two main account types, Standard and Razor. The standard account is the ideal choice for novice traders or for traders who prefer placing long-term trades. For the standard account, the average spread for the EUR/USD pair is between 1.0 - 1.3 pips (with an average of 0.17 pips). In other words, the minimum spread value for the standard account starts from $10. Furthermore, traders are not charged any commission when using a standard account.

The razor account is a great choice for seasoned traders, scalpers, and algorithmic traders. On the razor account, the spread for the EUR/USD pair varies from 0 - 0.3 pips (with an average of 0.17 pips). Traders using the razor account are charged a commission, but the amount charged largely depends on the trading platform you use. The commission charged for opening and closing $100k positions is $7.00 for MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and $6 for cTrader. Regardless of the selected account type, the minimum order size is 0.01 lot and the minimum start-up capital is $200 or the equivalent.

Pepperstone Account Opening Guide

The process of opening a Pepperstone account is simple and involves 4 easy steps.

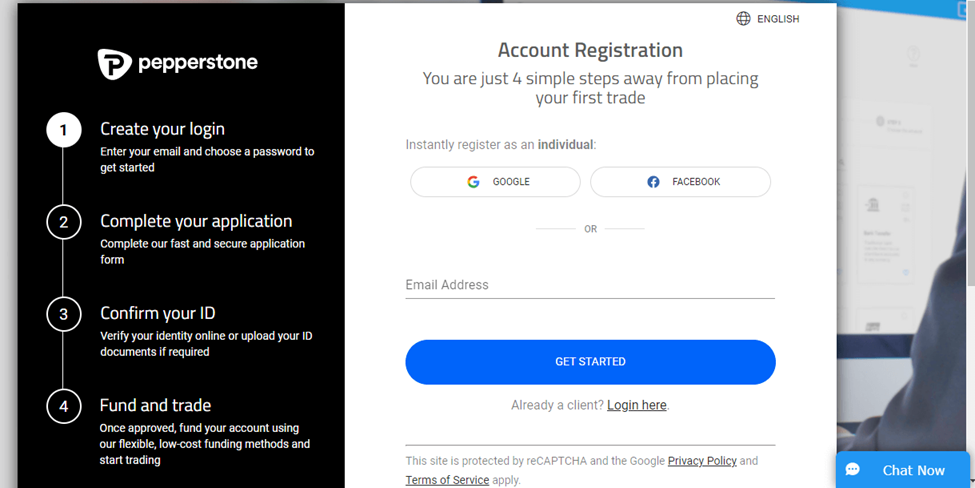

Step 1: Create Your Login

After you open the pepperstone open account page, enter your email address and choose a strong password to get started. You also have the option of registering using Facebook or Google. You'll notice the bar on the left-hand side gives an overview of the four steps required to set up an account.

Pepperstone Account Registration

Step 2: Take Suitability Test

In this next step, you are required to respond to a short questionnaire that is used by the Pepperstone team to assess your suitability to trade derivative products. You receive the results instantly once you answer the seven questions in the form.

Step 3: Confirm Your ID

All regulated brokers are required to verify their client's identities. As a highly regulated broker, Pepperstone requests two identification documents from you, a photo of your ID (either passport, birth certificate, or national identity card), and two proof of address documents (either a tax certificate indicating your address, a copy of the current lease for your primary residence, or a bank statement or utility bill not older than 3 months).

The easiest way is to take a clear photo of the original document showing all four corners and upload them. Black and white images or scanned copies of the documents aren’t acceptable for approval. Additional information may be requested depending on your geographic location. In case of any issues with your application the Pepperstone team contacts you via email with clear instructions on what to do next. You can also live chat with the agents in over 30 languages 24 hours a day 5 days a week to clarify any issues. The support team doesn’t work on weekends.

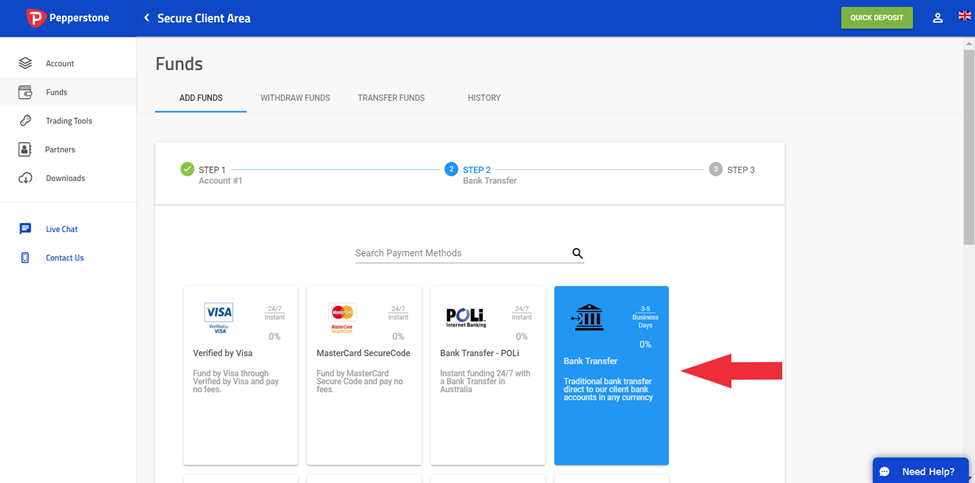

Step 4: Fund the Account and Start Trading

Once your application is approved, you can log in and fund your account. You can deposit using international bank wire transfers, e-payments, Visa, MasterCard, etc. If you’d like to discuss funding options or need any help deciding how much to deposit, get in touch with Pepperstone agents.

Funding the account

How to Close Pepperstone Account

Before you initiate the process of closing your account, ensure that you close all open trading positions and any pending trade orders. Most accounts will require a few days' notices before initiating the process. With Pepperstone, the easiest way is to get in touch with the agents via email at support@pepperstone.com and inform them of your decision to close the account. The representative might ask you a couple of questions about your decision to close the account and probably even try to convince you to keep it open. However, if there are no pending fees and if your account is in good standing, the firm is required to oblige and close the account. Once closed, the company should return all assets in your account.

FAQs

Is Pepperstone good for beginners or experts?

Pepperstone is a great choice for traders of all skill levels. It is highly accessible and simple to learn.

Can traders change account types on Pepperstone?

Yes. You will only need to send an email to the team at support@pepperstone.com.

Does Pepperstone have a demo account?

Yes. Pepperstone offers a free 30-day demo account for traders to train and try out new trading strategies using virtual currency.

Does Pepperstone charge account keeping or inactivity fees?

No. The broker doesn't charge hidden fees for account keeping or inactivity.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.