Overall Score

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- Minimum deposit $1

- EUR/USD spread 0.3

- Supported assets 3,000,000

- Regulation FCA, FINMA, DFSA, MFSA, MAS

users picked this broker in 3 months

Brief Look at Swissquote Bank SA

Swissquote Bank SA is a Swiss-based online broker known for its strong regulation, security, and wide range of trading instruments. Regulated by FINMA, it offers access to stocks, ETFs, forex, cryptocurrencies, and more across global markets. Swissquote is ideal for both retail and professional traders, providing advanced platforms, competitive spreads, and integrated banking services. It stands out for its reliability, multilingual support, and access to over 60 global exchanges. While fees are higher than average, the broker is a trusted choice for those prioritizing safety and comprehensive investment options.

- Advantages

- Disadvantages

-

Regulated by FINMA (Switzerland) and FCA UK

-

Access to 60+ global exchanges

-

Supports crypto, forex, stocks, ETFs

-

High security and banking integration

-

Advanced platforms (e.g., MetaTrader, eTrading)

-

Higher fees compared to low-cost brokers

-

Platform interface may feel complex for beginners

Swissquote Bank SA Key Parameters Evaluation

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Why trust us

Traders Union has analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we recommend that users perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Top Forex brokers vs Swissquote Bank SA

| Swissquote Bank SA | FBS | FxPro | |

|---|---|---|---|

| TU overall score | 6.93/10 | 8.39/10 | 8.98/10 |

|

Max. Regulation Level

Tier-1 regulation represents the most stringent oversight by top financial authorities, ensuring the highest level of security and compliance. Tier-2 and Tier-3 regulations indicate moderate to lower levels of oversight, with varying degrees of investor protection.

|

Tier-1 | Tier-1 | Tier-1 |

| ECN Spread EUR/USD | 0.3 | 0.1 | 0.2 |

| ECN Commission | 2.5 | 3 | 3 |

| Withdrawal fee, % | No | No | No |

Commissions and Fees

The trading and non-trading commissions of broker Swissquote Bank SA have been analyzed and rated as Medium with a fees score of 5/10. Additionally, these commissions were compared with those of the top two competitors, RoboForex and FxPro, to provide the most comprehensive information.

- Advantages

- Disadvantages

-

Tight EUR/USD market spread

-

No withdrawal fee

-

Above-average Forex trading fees

-

Inactivity fee applies

-

Deposit fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Swissquote Bank SA with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Swissquote Bank SA’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

| Swissquote Bank SA | RoboForex | FxPro | |

|---|---|---|---|

| EUR/USD min, pips | 1.1 | 0.5 | 0.9 |

| EUR/USD max, pips | 1.7 | 1.5 | 1.7 |

| GPB/USD min, pips | 1.1 | 0.5 | 1.2 |

| GPB/USD max, pips | 2.0 | 1.5 | 1.4 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

| Swissquote Bank SA | RoboForex | FxPro | |

|---|---|---|---|

|

Commission ($ per lot)

The commission is the fee charged by the broker for trading one standard forex lot (100,000 units of the base currency).

|

2.5 | 2 | 3 |

| EUR/USD avg spread | 0.3 | 0.2 | 0.2 |

| GBP/USD avg spread | 0.3 | 0.4 | 0.2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Swissquote Bank SA. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

| Swissquote Bank SA | RoboForex | FxPro | |

|---|---|---|---|

| Deposit fee, %

The indicated amount does not include possible fees from payment systems and banks.

|

0-1.9 | 0 | 0 |

| Withdrawal fee, %

The indicated amount does not include possible fees from payment systems and banks.

|

0 | 0-4 | 0 |

| Withdrawal fee, USD, %

The indicated amount does not include possible fees from payment systems and banks.

|

0 | 0-1.3 | 0 |

| Inactivity fee ($, per month) | 10 | 0 | 15 |

Regulation and Safety

Swissquote Bank SA has a safety score of 10/10, which corresponds to a High level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Advantages

- Disadvantages

-

Tier-1 regulated

-

Negative balance protection

-

Regulated in the UK

-

Track record over 29 years

-

Strict requirements and extensive documentation to open an account

| Abbreviation | Full Name | Country | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

MFSA MFSA |

Malta Financial Services Authority | Malta | Up to €20,000 | Tier-2 |

DFSA DFSA |

Dubai Financial Services Authority | Dubai | No specific fund | Tier-2 |

FINMA FINMA |

Swiss Financial Market Supervisory Authority | Switzerland | CHF 100,000 | Tier-1 |

MSA MSA |

Monetary Authority of Singapore | Singapore | No specific fund | Tier-1 |

SFC HK SFC HK |

Securities and Futures Commission of Hong Kong | Hong Kong | No specific fund | Tier-1 |

| Foundation date | 1996 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Deposit and Withdrawal

Swissquote Bank SA received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Swissquote Bank SA provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Advantages

- Disadvantages

-

Supports 5+ base account currencies

-

No withdrawal fee

-

Bank card deposits and withdrawals

-

Limited deposit and withdrawal flexibility, leading to higher costs

-

BTC payments not accepted

-

Deposit fee applies

What are Swissquote Bank SA deposit and withdrawal options?

Swissquote Bank SA provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire.

| Swissquote Bank SA | RoboForex | FxPro | |

|---|---|---|---|

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | No | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Swissquote Bank SA base account currencies? Base account currencies are the primary currencies in which trading accounts are denominated. They determine the currency used for deposits, withdrawals, and calculating account balances.Using a base currency that matches a trader's local currency can help avoid unnecessary conversion fees.

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Swissquote Bank SA supports the following base account currencies:

What Are Swissquote Bank SA's Minimum Deposit and Withdrawal Amounts?

The minimum deposit on Swissquote Bank SA is $0, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Swissquote Bank SA’s support team.

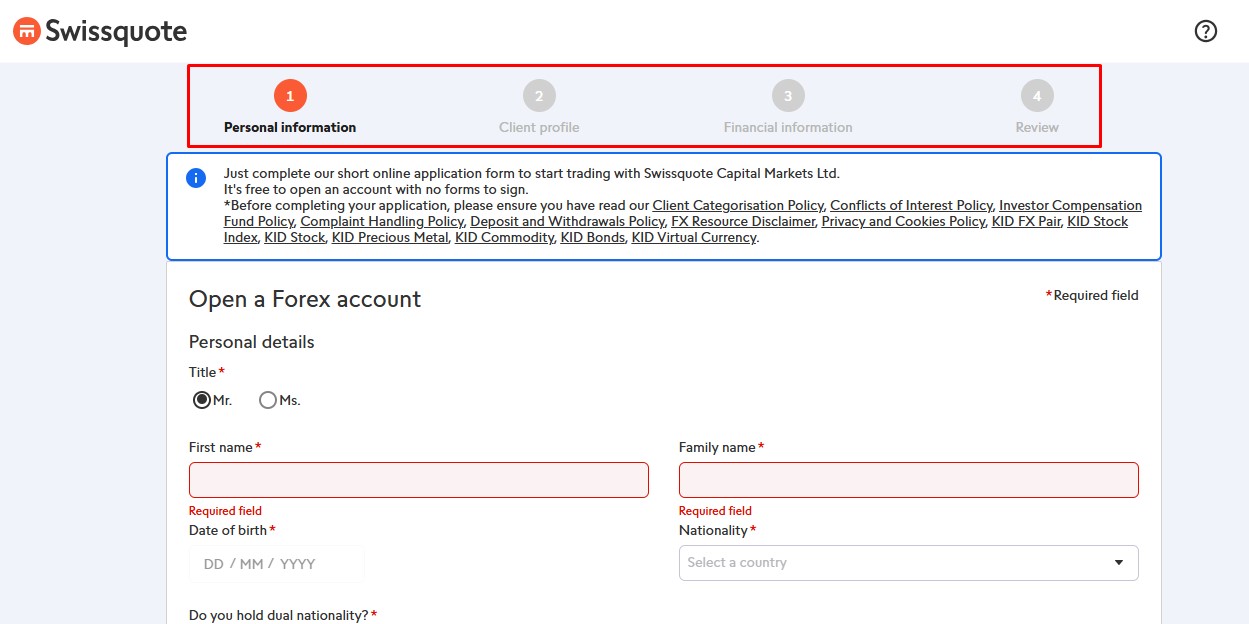

Trading Account Opening

We successfully registered an account with Swissquote Bank SA, which took 30 minutes. The minimum deposit amount at Swissquote Bank SA is $1.

We successfully registered an account with Swissquote Bank SA, which took only 10 minutes. The minimum deposit amount at Swissquote Bank SA is only $10.

- Advantages

- Disadvantages

-

Fully online

-

Multiple account types available (Individual, Joint, Corporate)

-

Supports a wide range of base currencies

-

Complex form with detailed financial and ID verification

-

Not available to residents of some countries

| Minimum deposit | $51 |

| Is it fully online? | Yes |

| Registration time | 30 minutes |

| KYC time | 3 working day |

| Account currencies |

USD

EUR

GBP

JPY

AUD

CAD

CHF

TRY

PLN

SEK

NOK

SGD

XGD

HUF

CZK

|

| Funding options | Bank Cards, Bank Transfers |

Required documents

Identity document (passport, ID card).

Proof of residence: In some cases, the broker may request a document confirming your place of residence with the exact registered address. Accepted documents include gas, water, electricity, or landline phone bills (issued no more than 6 months ago). Documents are only accepted in German, French, English, or Italian.

For online verification, digital authentication with a camera is required.

Account types

Swissquote Bank SA provides several account types to suit different trading needs, including Standard and ECN accounts with competitive spreads and fast execution. Muslim traders can opt for a Swap-Free (Islamic) account. The broker also offers Managed accounts for hands-off investing and a Demo account for practice. However, Cent, Micro, and VIP accounts are not available.

|

Standard

A general trading account suitable for most traders, offering access to a variety of markets with standard spreads and conditions.

|

Yes |

|

ECN

Provides direct market access with raw spreads and low latency execution. Typically requires a commission per trade instead of a spread markup. Suitable for high-frequency and professional traders.

|

Yes |

|

Swap Free

Designed for traders who follow Islamic finance principles, eliminating overnight interest (swap) charges.

|

Yes |

| Corporate | Yes |

|

Micro

Allows trading with micro-lots (0.01 lot = 1,000 units), reducing capital requirements and risk. Ideal for beginners and strategy testing. Availability and conditions vary by broker.

|

No |

|

Cent

Operates with cent-denominated balances (1 USD = 100 cents), allowing trades with micro-lot sizes (0.01 lot = 1,000 units). Suitable for beginners and low-risk strategies.

|

No |

|

Demo

Enables risk-free trading with virtual funds. Conditions may vary by broker.

|

Yes |

|

VIP

Offers premium services, lower fees, and dedicated support. Requirements vary by broker.

|

Yes |

|

Managed

A professional handles trading on behalf of the investor. Risks and fees depend on the provider.

|

Yes |

How to open Swissquote Bank SA account

Complete the extended registration form in several steps:

Provide your full address and phone number.

Enter details about your workplace and organization name.

Specify information about your income sources and level of income.

-

Provide details about your education and level of knowledge.

Swissquote Bank registration form

If the broker determines that the provided information is inaccurate or that you lack sufficient knowledge, experience, or understanding of risk levels, further verification will be denied. Any additional questions must be addressed with the Support Service.

10

- Advantages

- Disadvantages

-

Access to 60+ global stock exchanges

-

Managed thematic portfolios

-

Crypto trading

-

80 currency pairs

-

Limited CFD offering compared to specialized CFD brokers

Swissquote Bank SA supported markets vs top competitors

Swissquote Bank SA offers access to a broad range of global markets and products from a single multi-asset trading account. Traders can choose from over 80 Forex pairs, 60+ stock exchanges, CFDs, ETFs, commodities like gold and oil, popular cryptocurrencies, and professionally managed investment portfolios. This makes Swissquote a comprehensive platform for both active traders and long-term investors.

| Swissquote Bank SA | RoboForex | FxPro | |

|---|---|---|---|

| Currency pairs | 80 | 74 | 70 |

|

Tradable assets

The total tradable assets listed include all available instruments, including CFDs. Due to regional restrictions, certain CFDs may not be offered in some countries. For example, cryptocurrency CFDs are banned in the UK, and the U.S. has restrictions imposed on CFDs.

|

3000000 | 600 | 2100 |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

|

Crypto

Cryptocurrency CFDs are restricted or prohibited in certain regions due to regulatory limitations. These include the United Kingdom, China, Egypt, the United States and Canada.

|

Yes | Yes | Yes |

| Bonds | Yes | No | No |

| Indices | Yes | Yes | Yes |

Trading Platforms and Tools

Swissquote Bank SA provides several powerful trading platforms tailored to different types of traders, from beginners to professionals. Users can choose between the intuitive eTrading web platform, the advanced MetaTrader 4 and 5 for algorithmic and forex trading, and the mobile app for trading on the go. Each platform is designed to offer fast execution, robust charting tools, and seamless access to Swissquote’s full range of markets.

- Advantages

- Disadvantages

-

Multiple platforms: eTrading, MetaTrader 4 & 5, mobile app

-

Advanced charting and technical analysis tools

-

Supports algorithmic and automated trading (MT4/MT5)

-

Stable and reliable execution

-

eTrading lacks some customization compared to MT5

-

Limited third-party integrations beyond MetaTrader

| Alerts | Yes |

| 2FA | Yes |

| EAs | Yes |

| Indicators | 80+ |

MetaTrader 5 (MT5) is an enhanced, more versatile version of MT4, designed for trading CFDs and stocks in addition to Forex. It overcomes the limitations of MT4 by supporting more asset classes and providing greater functionality. Swissquote’s standard MT5 package includes around 80 built-in indicators, which users can customize by adding their own indicators, scripts, or expert advisors through the "File / Open Data Folder" option. MT5 supports a wider range of order types, including Buy Stop Limit and Sell Stop Limit, and offers non-standard timeframes such as 2 minutes, 6 minutes, and 12 hours for greater flexibility.

Main Interface Components:

Top Menu: Quick access to key functions like timeframes, chart type, and order windows.

Price Chart: Visualizes price movements, order levels, and indicators, with zoom and auto-scroll features.

Market Watch: Displays real-time quotes of selected instruments; customizable via the “Symbols” menu

Data Window: Shows price and indicator values for the candle under the cursor.

Navigator: Quick access to accounts, indicators, scripts, and EAs.

Toolbox: Displays trade activity, account history, alerts, news, and more

MT5 is available in desktop, web, and mobile versions, ensuring seamless trading across devices.

Additional trading tools

Swissquote Bank SA offers a variety of additional features aimed at enhancing the overall trading experience, including advanced market analysis tools, improved automation capabilities, and optimized trade execution.

| Swissquote Bank SA | RoboForex | FxPro | |

|---|---|---|---|

| Trading bots (EAs) | Yes | Yes | Yes |

|

Trading Central

Trading Central is a leading provider of investment research and financial market commentary. Integration with Trading Central offers traders advanced analytics, trading signals, and expert market insights, aiding in more informed decision-making.

|

Yes | No | Yes |

|

API

An Application Programming Interface (API) allows traders to connect their trading accounts to custom applications, algorithms, or third-party software. This flexibility enables advanced trading strategies and automated trading solutions tailored to individual needs.

|

Yes | Yes | No |

|

Free VPS

A Virtual Private Server (VPS) provides a dedicated and reliable server environment for running trading platforms and EAs without downtime. Free VPS ensures that trading operations continue uninterrupted, even when the trader's personal device is off.

|

No | Yes | No |

|

Signals (alerts)

Trading signals or alerts are notifications that provide buy or sell recommendations based on market analysis. These signals help traders make timely decisions by highlighting potential trading opportunities.

|

Yes | Yes | Yes |

|

One-click trading

One-click trading simplifies the trading process by allowing traders to open or close positions with a single click. This feature is particularly useful for scalpers and day traders who need to act quickly in fast-moving markets.

|

Yes | Yes | No |

|

Strategy (EA) builder

A Strategy or EA builder is a tool that allows traders to create and test their own automated trading strategies without needing to write code. This empowers traders to customize their trading approaches and backtest them for effectiveness.

|

No | Yes | No |

|

Autochartist

Autochartist is a market scanning tool that identifies trading opportunities by analyzing chart patterns and key levels. It provides traders with real-time alerts and actionable insights, helping to improve trading accuracy and efficiency.

|

Yes | No | No |

| TradingView | No | Yes | No |

TU Expert Advice: Is Swissquote Bank SA Worth the Try?

Swissquote Bank SA offers a comprehensive range of trading instruments, including currencies, CFDs, precious metals, and cryptocurrencies. Traders can choose between MetaTrader 4, MetaTrader 5, and Advanced Trader platforms. The broker provides Standard, Premium, Professional, and Prime accounts, with leverage up to 1:400. Swissquote's regulation by FINMA adds a layer of security, and its diverse selection of base account currencies helps minimize conversion costs.

However, Swissquote's high minimum deposit and limited account offerings for beginners may deter novice traders. Its higher-than-average trading fees and complex registration process are notable drawbacks. Consequently, Swissquote may be more suitable for experienced and large-scale investors rather than novice traders or those with limited capital.

Video Review of Swissquote Bank SA

FAQs

The minimum deposit at Swissquote Bank SA depends on the account type and platform. For the eTrading account, it starts from CHF 1,000 (or currency equivalent), while for MetaTrader accounts, the minimum can be CHF 1,000–5,000. Some advanced services may require higher deposits. Full details are available on Swissquote Bank SA’s official website.

Swissquote Bank SA is a fully regulated and reputable broker. It is licensed by FINMA (Swiss Financial Market Supervisory Authority) and listed on the SIX Swiss Exchange. The broker also operates regulated entities in the EU, UAE, and Asia, ensuring strict compliance and client fund protection.

Spreads at Swissquote Bank SA vary depending on the account type and platform. On MetaTrader accounts, EUR/USD spreads start from around 1.1 pips. Spreads may be wider on eTrading and during low-liquidity periods. Commission-free pricing is applied to most retail accounts.

Swissquote Bank SA supports bank transfers, credit/debit cards, and e-payment methods depending on the account type and region. Deposits and withdrawals are generally processed securely and efficiently, though fees may apply depending on the method and currency.

Swissquote Bank SA serves clients in over 120 countries. However, it does not provide services to residents of certain jurisdictions, such as the United States. Availability depends on local regulations, so it’s recommended to check directly with Swissquote Bank SA.

Swissquote Bank SA provides access to 80 Forex pairs and thousands of trading instruments, including stocks, ETFs, indices, commodities, bonds, options, and 35+ cryptocurrencies. All assets are available through a single multi-asset account across platforms like eTrading, MT4, and MT5.

Articles that may help you

Our reviews of other companies as well

Latest Swissquote Bank SA News

Swissquote, a leading provider of online financial and trading services in Switzerland, has officially partnered with TradingView, combining the power

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).