The Opposite Of FOMO: How JOMO Builds Stronger Decisions

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

FOMO (Fear of Missing Out) is the uneasy feeling that others are enjoying experiences or gains without you, often worsened by what we see on social media. On the other hand, JOMO (Joy of Missing Out) is the peace that comes from intentionally choosing stillness and stepping back from constant online stimulation. Choosing JOMO can be healthy for the mind, as it lowers stress and encourages a more thoughtful, grounded mindset. The contrast between FOMO vs JOMO highlights two opposing emotional responses to the same environment.

FOMO shows up in trading when someone feels pushed to act quickly, afraid that missing out might mean losing money. This pressure usually comes from outside sources like news headlines, price swings, or watching what others are doing. In contrast, JOMO represents a conscious mindset, where skipping a trade is a decision made through planning, not panic. It means staying disciplined and sticking to clear personal strategies. The key difference in JOMO vs FOMO isn't just about doing something or not, but about whether your choice comes from outside pressure or from calm, inner control.

What is JOMO and what’s the opposite of FOMO?

JOMO represents an intentional mindset rooted in choosing not to act when outside influences clash with personal goals. In trading, it reflects the ability to stay out of the market when a setup doesn't meet your criteria. Unlike passive detachment, JOMO involves clear thinking, personal discipline, and sticking to a planned approach. This turns staying still into a thoughtful decision, not hesitation or avoidance. The FOMO vs JOMO meaning captures this shift from impulsive reaction to purposeful inaction.

The opposite of FOMO isn’t about apathy or not caring. It’s about staying focused and making calm decisions even when the market is noisy and tempting. This mindset is not about retreating from action, but about having the clarity to know what fits your plan and what doesn’t. Traders who think this way don’t feel left out. They know what to ignore and why it doesn’t serve them.

From a psychological angle, JOMO helps protect against reacting too quickly to outside triggers. While FOMO can push people to jump in out of fear, JOMO gives space to slow down and think. It takes mental effort to pause and stick to what’s proven, but doing so builds patience and lowers the need for external validation. Many people ask what is the opposite of FOMO, and the answer lies in learning to choose action only when it aligns with your values and system.

The opposite of fearing missed chances is recognizing that not every opportunity is worth chasing, and being okay with letting some go. In trading, this shows up as confidence in your method rather than chasing every new trend. When someone wonders, what’s the opposite of FOMO, they are really looking for a way to act on their own terms. It’s not about doing less. It’s about choosing when and why you engage, with full control and a calm mind.

FOMO vs JOMO: behavioral structure and outcomes

The opposite of FOMO, or Fear of Missing Out, is usually called JOMO, the Joy of Missing Out. It means someone feels good about not jumping into every event, group chat, or trend. But this isn’t just about staying home and chilling. This way of thinking is actually very intentional. People who experience JOMO aren’t avoiding life, they’re choosing what matters most to them.

When it comes to the brain, FOMO lights up parts tied to anxiety and chasing quick rewards. JOMO, on the other hand, is connected to future planning and personal goals. A study from the University of Zurich in 2022 found that people who leaned into JOMO scored much higher on tests that measure decision-making and focus. Basically, FOMO runs on emotion while JOMO runs on purpose.

Here’s the twist. JOMO isn’t about being antisocial. It’s about pulling back from noise to think better. People who value their time and attention often shut out mental distractions not because they’re hiding, but because they want to get their best work done. That’s why we should stop the either-or thinking. Instead of seeing FOMO’s opposite as passive, we should see it as a more thoughtful way of living that shows real mental growth.

| Component | FOMO | JOMO |

|---|---|---|

| Cognition | External urgency, scarcity response | Internal filters, criteria-based evaluation |

| Emotion | Anxiety, loss sensitivity, stimulation | Calm, measured engagement, mental neutrality |

| Behavior | Impulsive entry, trend-chasing | Deliberate pause, alignment with pre-set logic |

| Consequence | Erratic results, strategic drift | Consistency, structural decision pattern |

This FOMO vs JOMO infographic / table shows the thinking patterns that drive each mindset. It goes beyond just comparing them and explains how they work through different ways people think and feel. The infographic serves as a tool to better understand behavior, clearly illustrating the difference between reacting and staying in control.

Signs of FOMO in the moment: how to detect and interrupt it

Recognizing what happens in the mind when you move away from the fear of missing out starts with paying attention to small mental shifts. The first sign is usually a drop in clear focus, replaced by a sudden urgency to act and a need to look outside for answers. Thoughts start racing, and personal judgment becomes more easily influenced. Instead of calmly analyzing a situation, people react quickly and emotionally to pressure. This is very different from the mindset associated with what's the opposite of FOMO, which values calm, control, and thoughtful action.

Physically, this state feels far from the steady energy behind the opposite of FOMO. Many traders notice tense shoulders, shallow breathing, and restlessness. They keep jumping between charts, watching what others are doing, and feeling like they’re being left behind. These actions aren’t really about reading the market. They’re driven by the fear of exclusion, which creates more stress and less clarity.

To reset this pattern, it helps to use a simple routine. When those feelings show up, the person can ground themselves, maybe by touching the desk, focusing their gaze, and asking two clear questions: why am I entering, and how will I exit? If there’s no solid answer to either, they stop. This helps bring back control and shifts the mindset to something more thoughtful, like what’s described when people ask what is JOMO, a space where choices are made with confidence, not panic.

How JOMO shapes strategy: from discipline to conviction

Many leaders today are thinking differently about why skipping the hype can actually help. That mindset is known as FOMO and JOMO, where JOMO stands for the joy of missing out. But JOMO isn’t about just logging off or avoiding news. It’s a focused strategy. Great investors and founders use JOMO to ignore trends and instead stick with what they deeply understand. This kind of clear thinking and real focus is hard to come by in decisions driven by fear of missing out. Naval Ravikant, for example, stayed away from early Web3 hype and focused on long-term infrastructure plays.

JOMO helps founders say “no,” and that’s often what shapes a business in ways that truly matter. In the early days of a startup, offers and opportunities fly in constantly. The instinct that comes from FOMO is to say yes to everything. But those who understand the opposite of fear of missing out choose to slow down. They hold off on short-term wins and skip trends. Basecamp’s founders took this route. While others kept stacking on features to compete, they chose to stay simple, and their approach stood the test of time.

There’s also a deeper personal shift. Founders who embrace JOMO learn to tune out the buzz and move with calm. Saying no becomes a strength. It allows them to stay clear and steady when markets are noisy. Shopify followed this principle. While others copied Amazon’s marketplace model, Shopify stayed focused on its core tools and kept improving them, which paid off long-term.

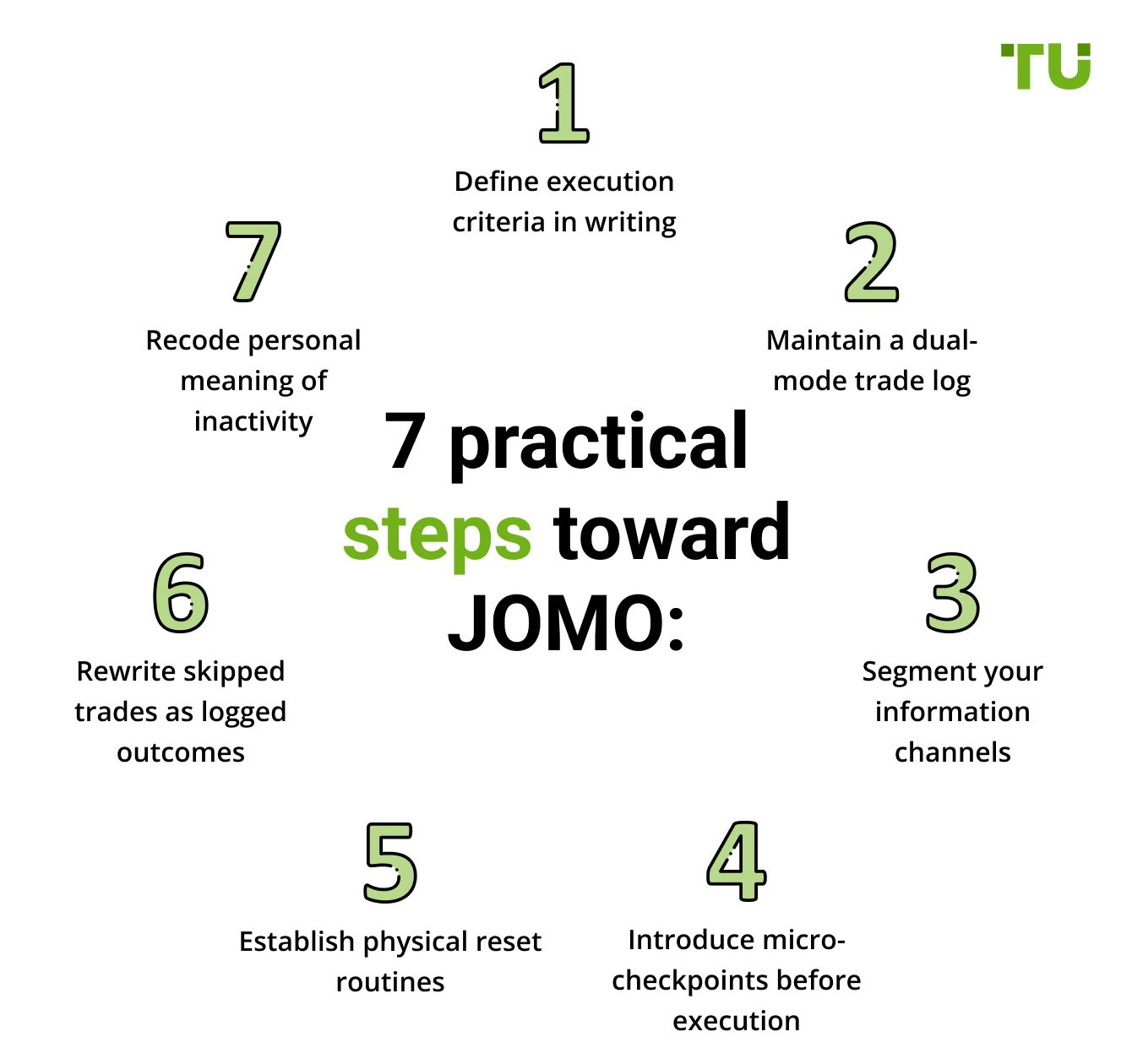

7 practical steps toward JOMO

Transitioning toward the opposite of fear of missing out requires an applied process that consolidates attention, filters interference, and stabilizes internal responses. Each of the following seven steps anchors distinct aspects of this transition.

Define execution criteria in writing

Write down your trade entry rules in clear, testable terms. This keeps you from jumping impulsively from planning to acting. When your rules are solid, skipping a trade feels like a smart decision, not second-guessing. This is where the opposite of FOMO starts to take shape.

Maintain a dual-mode trade log

Track both the trades you took and the ones you skipped. Add notes on what was happening around you, how you felt, and why you acted or didn’t. Over time, this becomes a personal reference that reinforces control, an important distinction within FOMO vs JOMO thinking.

Segment your information channels

Sort your inputs into clear categories: real signals, opinions, and noise. Decide in advance which ones will guide your trading. This improves the quality of your decisions and helps you resist reacting to things that don’t deserve your attention, a key point in the FOMO and JOMO mindset shift.

Introduce micro-checkpoints before execution

Add small pauses before placing a trade: say the setup out loud, freeze your screen for 10 seconds, or tick off a checklist. These quick steps create a moment to think before acting and help shift your habit from reacting to responding.

Establish physical reset routines

Use consistent physical cues, deep breaths, steady eye contact, hand pressure, to ground yourself. These routines calm emotional overload and bring back control. Without them, what's the opposite of FOMO is a question that stays theoretical and never becomes part of how you actually behave.

Rewrite skipped trades as logged outcomes

Treat trades you didn’t take as full entries in your journal. Note why you passed and what might have happened if you’d entered. This turns “not trading” into useful data, and keeps regret from messing with your future decisions.

Recode personal meaning of inactivity

Change the way you talk to yourself: don’t say “missed opportunity,” say “right call not to act.” In this shift, restraint becomes a strength. With practice, this view becomes natural — and it supports a healthier, more structured approach to FOMO vs JOMO.

Each of these steps embeds intention into operations. Together, they shift the focus from reaction to structural logic, confirming that what is the opposite of fomo is not about doing less, but about acting within a governed frame.

Daily micro-practices

Everyday strategies for managing FOMO (Fear of Missing Out) versus JOMO (Joy of Missing Out) rely on intentional, time-bound actions that disrupt automatic behavior. One such step is a mindful pause before opening the trading platform: the trader assumes a fixed posture, sets a one-minute timer, and focuses on breathing. This breaks reactivity and reinforces conscious decision-making.

Another key practice is documenting moments of non-participation. After each session, the trader notes a skipped trade, the reason behind it, and hypothetical outcomes. This reframes inaction as structured discipline rather than indecision.

With consistency, these actions shift the trader’s identity from a reactive entry-seeker to a focused operator managing risk. The transition from FOMO to JOMO becomes behavioral, built through small daily choices that emphasize awareness and control over impulsivity.

To support this mindset, it's also wise to trade with beginner-friendly brokers that reduce cognitive pressure. The table below highlights top brokers ideal for new traders.

| Currency pairs | Crypto | Stocks | Min. deposit, $ | Max. leverage | Demo | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| 60 | Yes | Yes | 100 | 1:300 | Yes | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| 90 | Yes | Yes | No | 1:500 | Yes | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| 68 | Yes | Yes | No | 1:200 | Yes | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| 80 | Yes | Yes | 100 | 1:50 | Yes | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| 100 | Yes | Yes | No | 1:30 | Yes | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA | 6.9 | Open an account Your capital is at risk. |

Train your attention to shift from urgency to alignment and unlock the joy of missing out

Getting over FOMO isn’t just about turning off your phone or disappearing for a weekend. That’s just noise-cancelling. The actual shift happens when you start noticing what constantly pulls your attention away. When you feel that nudge to check your phone or jump into something fast, jot down what made you feel that way. After a few days, you’ll notice it’s usually tied to feeling behind or not good enough. Spotting that in real time gives you a second to breathe, and that second is everything.

And here’s what most folks don’t realise: JOMO isn’t about being a recluse. It’s about knowing what you don’t need to care about. You start feeling better not because you’re avoiding stuff, but because you’re finally saying yes to things that matter to you. Try making a short list of your top three priorities for the week. Suddenly, all those invites and updates don’t feel urgent, they just feel optional. That kind of confidence is where real calm begins.

Conclusion

Behavior aligned with jomo vs fomo is shaped through precise definitions of when engagement is appropriate. A skipped trade is recorded as a decision consistent with internal structure. Repeated actions establish discipline as a functional process with clear parameters. Each step, from pause to non-execution, is treated as an operational element that affects outcomes. Within this structure, the opposite of fear of missing out is reflected in consistent responses and controlled execution. JOMO operates as a system for managing attention and pacing decisions.

FAQs

How can I tell if I'm using JOMO as avoidance rather than strategy?

If non-participation is followed by anxiety, second-guessing, or internal justification, it's likely avoidance. In a strategic JOMO approach, the decision to stay out is calm, predefined, and aligned with clear criteria.

Can JOMO apply to high-frequency or aggressive trading systems?

Yes, if the trader uses entry filters and confirmation procedures. Even in fast-paced systems, JOMO operates through structured selectivity and controlled trade filtering.

What should I do if FOMO returns after several successful trade skips?

Write down the specific fear, what you think you’re missing. Compare it to your trading plan. If the setup doesn’t match your rules, the emotion doesn’t require action.

Is there a way to train response to information overload?

Yes, limit market news to scheduled windows and apply a daily filter: three data-backed facts and three opinion-based inputs. This sharpens your ability to separate actionable signals from noise.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

FOMO in trading refers to the fear that traders or investors experience when they worry about missing out on a potentially profitable trading opportunity in the financial markets.

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.