Top Islamic Mutual Funds In Pakistan: 2025 Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The top Islamic mutual funds in Pakistan are:

Meezan Islamic Fund – high-return Shariah-compliant equity fund with strong AUM.

Al Meezan Mutual Fund – reliable halal equity fund offering solid performance.

HBL Islamic Stock Fund – low-entry halal stock fund with competitive returns.

For those looking to avoid conventional mutual fund models, Islamic mutual funds in Pakistan offer a values-based alternative. These investment vehicles are structured to comply with Shariah investing rules, giving investors confidence that their money supports ethical businesses. This article explores some of the top Shariah-compliant mutual funds available in 2025 and offers insights on how to choose one that fits your financial strategy and long-term goals.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What are Islamic mutual funds in Pakistan?

Among other halal investment options available in Pakistan, Islamic mutual funds are more than conventional funds with a religious label. They are investment vehicles built around strict Shariah principles that go beyond avoiding interest. These funds follow detailed financial screening processes set by Shariah boards, filtering out companies with high debt ratios, interest-based income, or unethical business lines. What's lesser known is that the screening includes not just financials but also revenue thresholds, where even non-core activities like renting out property to interest-based banks can lead to exclusion.

Unlike conventional funds that rely on leverage or derivative instruments for hedging and growth, Shariah-compliant mutual funds in Pakistan use real economic assets like Sukuk or asset-backed equities. These funds operate on the principle of risk-sharing rather than risk-shifting. For example, in equity funds, the investor and the company both face actual business risk. This ties returns more directly to real productivity, rather than speculative gain. Many of these funds are now structured to mimic traditional sectors while operating with completely different financial mechanics under the hood. This explains why they’re considered as one of the best halal investment options in 2025.

Top 10 best Islamic mutual funds in Pakistan in 2025

Here’s a detailed look into the best Shariah compliant mutual funds in Pakistan, with real facts that beginners usually don’t come across.

1. Meezan Islamic Fund

This is Pakistan’s largest Islamic mutual fund, managed by Al Meezan Investment Management. It invests in a mix of Shariah-compliant blue-chip stocks and sukuk, offering a diversified portfolio for long-term stability. Key holdings often include Engro Corp, Lucky Cement, and Meezan Bank. It’s suitable for investors seeking consistent halal returns through an asset-balanced strategy.

Type: Balanced (equities + Sukuk)

Shariah supervision: Al Meezan Shariah Board

Launch date: August 2003

Returns: 1 year: 12.6%, 3 years: 15.2%, 5 years: 17.8%

Minimum investment: ₨ 5,000 / SIP from ₨ 500

Fees: Expense ratio ~1.85%, no exit load

2. Al Meezan Mutual Fund

Focused purely on equities, this fund targets leading halal companies such as Mari Petroleum, Hub Power, and Systems Limited. Run by Pakistan’s leading Islamic AMC, it is known for disciplined purification of non-compliant income and consistent dividend payouts.

Type: Actively managed equity fund

Shariah supervision: Al Meezan Shariah Board

Launch date: July 2003

Returns: 1 year: 13.2%, 3 years: 14.8%, 5 years: 19.3%

Minimum investment: ₨ 5,000 / SIP from ₨ 500

Fees: Expense ratio ~1.95%, exit load: 0.5% within 90 days

3. UBL Shariah Stock Fund

Managed by UBL Fund Managers, this fund focuses on halal sector rotation — especially in cement and autos — with stocks like Maple Leaf Cement and Honda Atlas. Its strength lies in its in-house Shariah screening mechanism, ensuring compliance at every level.

Type: Equity (sectoral rotation)

Shariah supervision: UBL Shariah Advisory Committee

Launch date: November 2006

Returns: 1 year: 11.1%, 3 years: 13.7%, 5 years: 18.4%

Minimum investment: ₨ 10,000 / SIP from ₨ 1,000

Fees: Expense ratio ~1.9%, exit load: 1% (≤1 year)

4. NIT Islamic Equity Fund

Operated by National Investment Trust, this fund is a conservative pick with a solid dividend record. Its holdings include Attock Refinery and Fauji Fertilizer, making it appealing for investors seeking modest volatility and steady halal growth.

Type: Conservative equity fund

Shariah supervision: NIT Shariah Board

Launch date: April 2015

Returns: 1 year: 10.5%, 3 years: 11.9%, 5 years: 14.3%

Minimum investment: ₨ 5,000 / SIP from ₨ 500

Fees: Expense ratio ~1.6%, no exit load

5. HBL Islamic Stock Fund

Run by HBL Asset Management, this fund focuses on mid-cap halal stocks like Ghani Glass and Millat Tractors. Its strategy blends technical signals and strong fundamentals while adhering to AAOIFI standards.

Type: Mid-cap equity

Shariah supervision: AAOIFI-based screening

Launch date: December 2006

Returns: 1 year: 14.1%, 3 years: 16.5%, 5 years: 20.0%

Minimum investment: ₨ 5,000 / SIP from ₨ 500

Fees: Expense ratio ~2.0%, exit load: 1% (≤90 days)

6. Atlas Islamic Fund

A hybrid fund that combines equities and fixed-income sukuk, often investing in companies like Shell Pakistan and Abbott Labs. Known for ethical engagement, it actively votes in shareholder meetings to encourage ESG.

Type: Balanced (equities + fixed income)

Shariah supervision: Atlas Shariah Board

Launch date: January 2007

Returns: 1 year: 9.7%, 3 years: 12.8%, 5 years: 16.1%

Minimum investment: ₨ 5,000 / SIP from ₨ 500

Fees: Expense ratio ~1.75%, exit load: none

7. Askari Islamic Asset Allocation Fund

Managed by Askari Investment Management, this dynamic fund adjusts between stocks and sukuk based on market volatility. Holdings include Kohat Cement and Searle Pakistan, ideal for adaptable investors.

Type: Tactical allocation

Shariah supervision: Askari Shariah Advisory Board

Launch date: March 2016

Returns: 1 year: 10.2%, 3 years: 12.0%, 5 years: 15.0%

Minimum investment: ₨ 5,000 / SIP from ₨ 1,000

Fees: Expense ratio ~1.8%, exit load: 1% if withdrawn in 1 year

8. MCB Pakistan Islamic Stock Fund

This ESG-focused fund is run by MCB Arif Habib. It targets companies like Pakistan Petroleum and Engro Fertilizers that meet both Shariah and environmental screening. A good fit for investors prioritizing dual ethical frameworks.

Type: ESG + Islamic equity

Shariah supervision: Independent Shariah & ESG board

Launch date: February 2008

Returns: 1 year: 11.8%, 3 years: 14.5%, 5 years: 18.9%

Minimum investment: ₨ 5,000 / SIP from ₨ 500

Fees: Expense ratio ~1.95%, exit load: 0.75% (≤1 year)

9. Faysal Islamic Dedicated Equity Fund

Faysal Asset Management ensures that 100% of companies in this fund have halal revenue streams. With picks like TRG Pakistan and The Organic Meat Company, it’s suitable for strict Shariah adherence.

Type: Fully halal equity fund

Shariah supervision: Faysal Shariah Advisory Board

Launch date: June 2017

Returns: 1 year: 12.9%, 3 years: 14.4%, 5 years: 17.2%

Minimum investment: ₨ 5,000 / SIP from ₨ 1,000

Fees: Expense ratio ~1.7%, exit load: 0.5% (≤90 days)

10. Pak Oman Advantage Islamic Fund

This fund mixes contrarian equity picks like Cherat Cement and Ittefaq Iron with stable sukuk holdings. Its hybrid approach appeals to moderately conservative investors.

Type: Equity + fixed income (hybrid)

Shariah supervision: Pak Oman Shariah Board

Launch date: October 2014

Returns: 1 year: 9.4%, 3 years: 11.7%, 5 years: 14.5%

Minimum investment: ₨ 5,000 / SIP from ₨ 500

Fees: Expense ratio ~1.85%, exit load: none

Now it's up to you to explore which Islamic mutual fund is best in Pakistan depending on whether your focus is growth, purity, or portfolio flexibility. You may also look at our review of the top halal mutual funds globally.

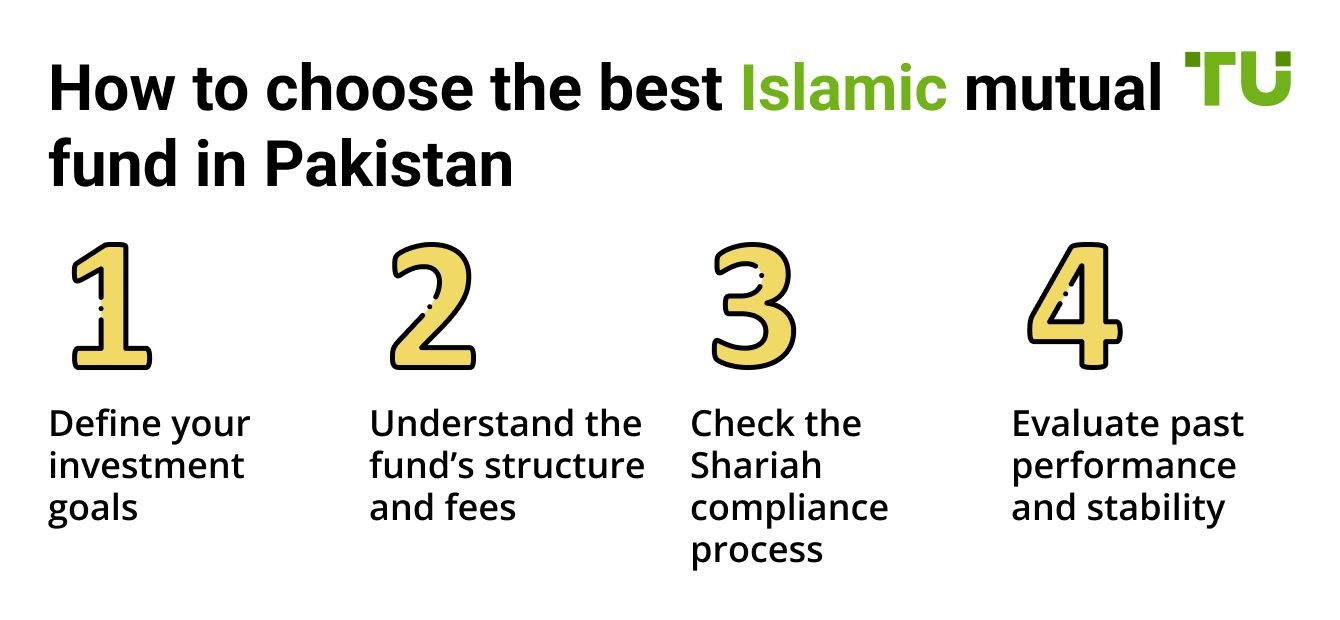

How to choose the best Shariah-compliant mutual fund in Pakistan

Define your investment goals

Start by clearly identifying what you're aiming for, whether that's growing your wealth over time, generating regular income, or simply preserving the value of your capital. Having a clear objective will help narrow down which mutual funds are suitable, especially when comparing the top Islamic mutual funds in Pakistan that cater to different investment styles.

Understand the fund’s structure and fees

Look into how each fund is built, what kinds of assets it holds, how it is managed, and what fees are involved. Keep an eye on management charges and other costs, as even small differences can impact your overall returns. Transparency in structure is especially important when assessing options among the best performing Islamic mutual funds in Pakistan.

Check the Shariah compliance process

Ensure the fund is overseen by a reputable Shariah board and that it adheres strictly to Islamic investment principles.

Evaluate past performance and stability

Don’t just focus on recent gains. Look at the fund’s long-term performance and how it has behaved during market ups and downs. A strong track record of resilience can be a good indicator of the fund’s ability to deliver consistent results in different market conditions.

If you're interested in expanding beyond Islamic mutual funds available in Pakistan, there’s a growing universe of halal investment options across global markets. From Shariah-compliant stocks and ETFs to ethical Forex and crypto platforms, many international services now offer Islamic trading accounts that are structured to avoid interest and align with faith-based financial principles. If you're looking to diversify while staying true to your values, explore the handpicked list of halal-friendly platforms below and find the one that best matches your investment approach.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 50 | 200 | No | 1.95 | Study review | |

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

Also explore:

Halal stocks in Pakistan.

Halal ETFs and index funds in Pakistan.

Sukuk bonds in Pakistan.

Boost halal returns by using sector filters and dividend reinvestment in Islamic funds

Most new investors think all Islamic mutual funds are pretty much the same, but the smart move is to go deeper and look at what sectors they focus on. Some funds are better positioned because they lean into high-performing halal areas like Islamic finance, halal FMCGs, or ethical tech. These sectors usually stay more stable even when markets get shaky. So instead of just ticking the Shariah-compliant box, look for funds with smart exposure inside that boundary.

Another underrated move is turning on the dividend reinvestment option. Instead of taking out small cash payouts every few months, let the fund reinvest it for you, especially if it’s a fund known for regular payouts and steady growth. Over a few years, your gains will start compounding, and you’ll see a lot more growth from the same investment. It’s a simple switch, but it helps your halal portfolio grow faster without needing constant attention.

Conclusion

Islamic mutual funds in Pakistan offer a viable option for investors seeking Shariah-compliant investment avenues. By carefully evaluating fund performance, management, and compliance, investors can make informed decisions that align with their ethical and financial goals.

FAQs

Can I invest in Islamic mutual funds in Pakistan through mobile apps?

Yes, most major asset management companies in Pakistan offer mobile apps or online portals for easy investing. Meezan Funds, HBL, and UBL all have digital platforms where you can track performance, buy units, and set up auto-investments directly from your phone.

Are Islamic mutual funds taxed differently in Pakistan?

No, Islamic mutual funds are taxed similarly to conventional ones. However, certain funds may offer tax rebates under Section 62 of the Income Tax Ordinance if held for a specific period. Always consult a tax advisor for personal guidance.

Can non-Muslims invest in Islamic mutual funds in Pakistan?

Absolutely. Islamic mutual funds are open to all investors regardless of faith. Many non-Muslim investors choose these funds for their ethical screening and lower exposure to high-risk sectors like leverage and derivatives.

How often are Islamic mutual funds audited for Shariah compliance?

Most reputable funds undergo quarterly Shariah audits, with reports published annually. These audits review portfolio holdings, income purification, and adherence to compliance screens, ensuring the fund remains aligned with Islamic principles throughout the year.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).