Is Life Insurance Halal Or Haram In Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Life insurance in Islam is generally viewed as impermissible by many scholars because conventional policies often include riba (interest), gharar (uncertainty), and maysir (gambling). These elements contradict the ethical and financial principles set by Shariah. However, cooperative models like takaful, built on mutual assistance and shared risk, are seen as valid alternatives. Some scholars also permit conventional life insurance in situations where no Shariah-compliant options exist, such as when the law mandates it or when personal circumstances leave no other choice. For Muslims seeking coverage, it's crucial to consult trusted scholars and explore options that align with Shariah guidelines while also understanding whether life insurance is halal or haram in Islam.

As per laws of Islamic finance, standard life insurance is usually considered haram due to its reliance on riba, maysir, and gharar. These factors violate the core Shariah principles of fairness and contractual clarity. Scholarly consensus holds that commercial insurance policies, including those for life coverage, are not compatible with Islamic finance. As a result, the question whether life insurance is haram finds a clear answer when it comes to conventional plans, unless a policy is specifically structured to remove these prohibited elements entirely and meet all ethical requirements outlined by Islamic law.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Is life insurance haram?

In its conventional form, life insurance is halal or haram in Islam depending on how it is structured and practiced. According to the majority of Islamic scholars, it is considered haram. Respected fatwas on life insurance issued by IslamQA.info, Daruliftaa, and AboutIslam describe conventional policies as impermissible because they often contain components not allowed under Sharia. These include riba (interest), gharar (excessive uncertainty), and maysir (gambling), which are incompatible with ethical Islamic finance. As a result, most traditional life insurance products are classified as haram within classical Islamic jurisprudence.

Nonetheless, some modern scholars have offered limited allowances based on necessity. For instance, the question of whether state-sponsored life insurance is halal or haram in Islam can depend on whether the policy is mandatory or voluntarily acquired. When no Sharia-compliant alternative like takaful is available, and the policy is essential for personal or family security, certain scholars may allow that life insurance is permissible in Islam under conditions of hardship and necessity, using legal maxims such as darura (necessity overrides prohibition).

Why is life insurance haram?

The reasoning lies in its structure. Conventional policies involve riba when the insurer pays out more than what the insured contributed, with no justifying asset or service. Gharar appears because the insured cannot know if or when a benefit will be paid out. Maysir is present when a relatively small premium could result in a disproportionate gain, or nothing at all. These features turn the contract into a speculative transaction, not aligned with Islamic principles.

Such terms are embedded into the very framework of these contracts. For example, a guaranteed payout upon death is not always tied to risk-sharing or actual loss, making the arrangement one-sided. This design falls under rulings that say life insurance is halal or haram in Islam based on Sharia-prohibited elements. In comparison, Islamic products like takaful use a cooperative model where risk is shared, uncertainty is minimized, and profits are distributed fairly. This structure avoids the forbidden elements and supports ethical, Sharia-approved protection.

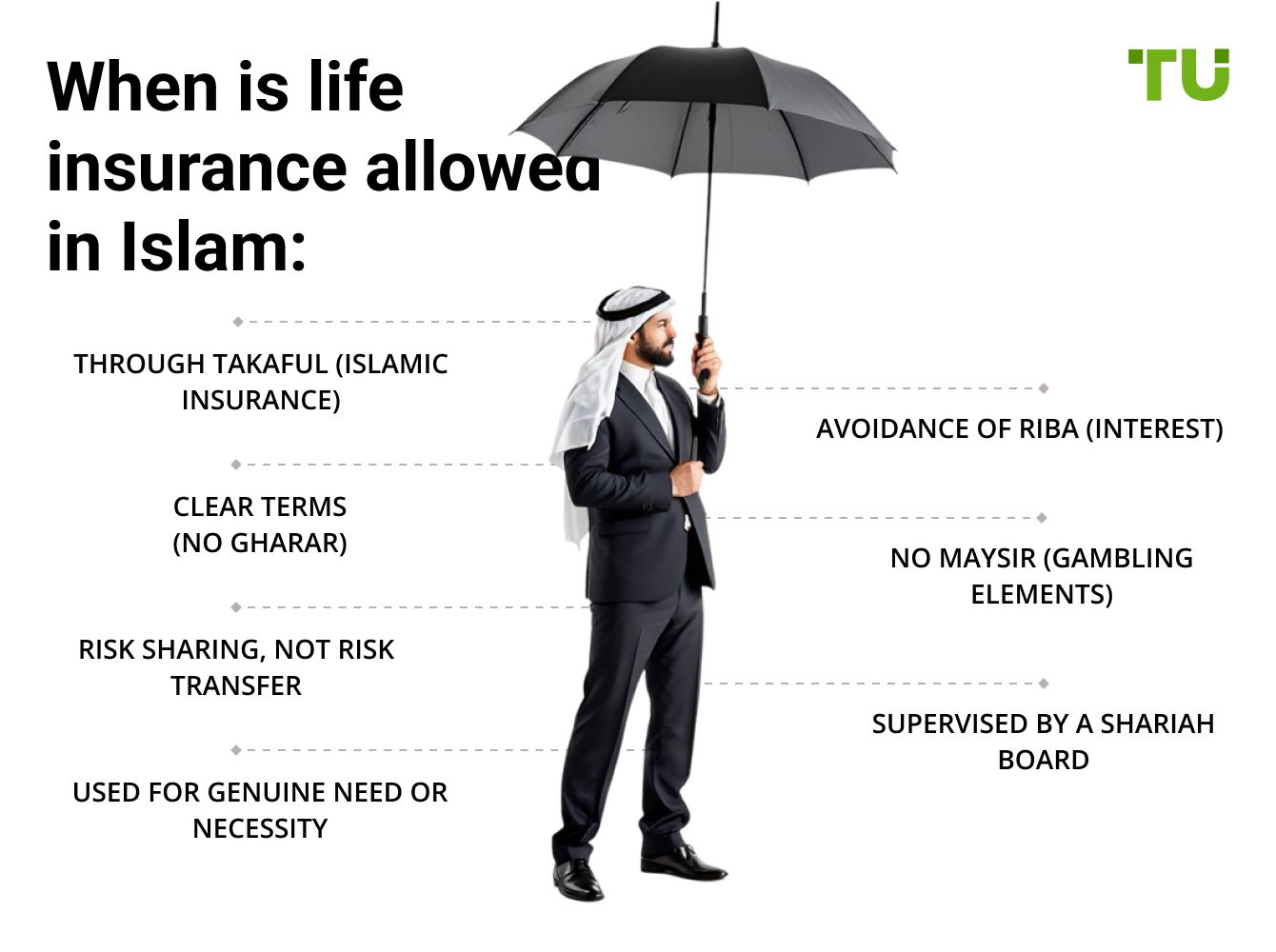

When is life insurance allowed in Islam?

Life insurance may be allowed in Islam under specific conditions, particularly when it aligns with Shariah principles. In such cases, it often takes the form of Shariah compliant life insurance, which ensures that the structure, investment practices, and risk-sharing mechanisms adhere to Islamic guidelines. Here are the key circumstances where life insurance is considered permissible (halal):

Through takaful (Islamic insurance). Life insurance is allowed if structured as a takaful plan — a cooperative model where participants contribute donations to a shared fund used for mutual aid.

Avoidance of riba (interest). The investment component must not involve interest-bearing instruments. Funds should be placed in halal stocks, sukuk bonds, or Islamic ETFs/index funds.

Clear terms (no gharar). The contract must be transparent, with clearly defined payout conditions, timelines, and no hidden uncertainties.

No maysir (gambling elements). The agreement should not rely on speculation or disproportionate payouts that mimic gambling mechanics.

Risk Sharing, not risk transfer. The policy must embody mutual risk sharing, not commercial risk transfer to a profit-driven insurer.

Supervised by a Shariah board. A qualified Islamic authority should oversee the policy structure, ensuring full compliance with Islamic law.

Used for genuine need or necessity. In some opinions, conventional life insurance may be tolerated in cases of darura (necessity), such as when no halal alternative exists — especially in non-Muslim countries.

Is state life insurance halal or haram in Islam?

The ruling on whether state life insurance is halal or haram in Islam depends on whether the policy is mandatory or optional. The main distinction between private and government-administered life insurance lies in compulsion. If enrollment is voluntary, scholars evaluate the policy like any conventional insurance product, often concluding it is haram due to elements of riba, gharar, and maysir. In this context, government-backed plans may fall under the same prohibition as private insurance.

However, if participation is mandatory — as with national pension systems or public employee benefit programs — the ruling shifts. These cases are treated under the principle of necessity (darura). Scholars from IslamQA and Daruliftaa consider such forced enrollment permissible when opting out is not viable.

Further evaluation depends on the structure. If the state plan functions as a redistribution system for social welfare, without profit-based investments or guaranteed bonuses, some scholars consider it outside the scope of commercial insurance.

Fatwa authorities also distinguish between automatic payroll deductions and voluntary participation. When joining is a personal legal choice, the standard prohibitions on life insurance may still apply, especially if the policy terms conflict with Islamic financial principles.

Can Muslims get life insurance?

In jurisdictions where life insurance is legally mandated, Muslims enrolled automatically are not held accountable for any prohibited elements in the policy. In these cases, the question of whether life insurance is haram is addressed through the principle of necessity in Islamic jurisprudence. When the scheme is imposed by law and unavoidable, individual responsibility does not apply.

However, when enrollment is voluntary, the issue becomes more serious. Entering a contract that includes riba, uncertainty, or gambling raises clear concerns. Many scholars deem voluntary participation in such policies impermissible.

In countries where life insurance is optional, Muslims are advised to avoid policies involving interest, unclear terms, or speculative features. If a person has enrolled but can cancel without serious financial harm, scholars generally consider withdrawal an obligation. Many policies include a short window to opt out penalty-free.

Leaving a non-compliant plan requires careful thought and awareness of alternatives. Scholars recommend seeking advice from Islamic finance experts and considering options like takaful, which align with Shariah principles while still offering protection within legal boundaries.

Scholarly opinions, fatwas, Qur'anic verses, hadiths, and expert views

The question of whether life insurance is permissible in Islam has been addressed in detail by leading scholars and major Islamic legal bodies. While modern financial contexts continue to evolve, the foundational Islamic rulings on life insurance remain firm in their stance.

Shaykh Ibn Baz classified life insurance as impermissible, citing its reliance on interest (riba) and speculative uncertainty (gharar), which make it akin to gambling. In a widely referenced fatwa (no. 10805) from IslamQA, he noted that insurance contracts inherently involve prohibited elements, regardless of their structure or purpose.

Mufti Taqi Usmani, one of the foremost scholars in Islamic finance, has long emphasized that the contractual basis of life insurance fails to meet the standards of Shariah-compliant trade. According to him, even if such policies offer societal benefit, their structure built on ambiguity and fixed returns remains incompatible with Islamic commercial ethics. He instead advocates for takaful as a permissible and ethical alternative.

Yusuf al-Qaradawi, in his authoritative works on contemporary Islamic rulings, also critiques conventional life insurance. He highlights that while mutual cooperative models may have merit, most commercial policies involve riba in guaranteed payouts and undefined conditions in claims, both of which violate key Islamic legal principles.

On platforms such as SeekersGuidance and Daruliftaa, jurists from the Hanafi and Shafi’i schools affirm that classical jurisprudence does not support conventional life insurance. For those asking "is life insurance halal Hanafi?", the answer is typically no, except in cases of necessity. Some scholars allow temporary leniency only when legally required by employers or governments. However, this leniency is seen as a necessity-based exception, not a validation of the product itself. IslamQA further reinforces that compulsion does not lift the prohibition from such contracts.

Scriptural backing is also frequently cited. Scholars reference Surah Al-Baqarah (2:275): “Allah has permitted trade and forbidden riba,” to argue against insurance models that guarantee more than what is paid in. The hadith from Sahih Muslim, where the Prophet (peace be upon him) curses all participants in riba-based transactions including those who record or witness them, is applied to the drafting and promotion of interest-linked policies.

In the field of modern Islamic finance, experts like Muaz Akun have reviewed the terms of major life insurance providers and found that even "ethical" or socially responsible packages often breach Islamic rules around risk and compensation. His conclusion, like those of traditional scholars, supports the position that takaful remains the only viable and compliant alternative for Muslims seeking financial protection in line with their faith.

Is it permissible to sell or promote life insurance?

Working in the sale of life insurance is generally not permitted under Islamic law, as it involves promoting contracts considered haram. Fatwas from IslamQA.info and Daruliftaa confirm that this activity constitutes facilitation of prohibited financial transactions. Participating as a sales agent for conventional insurance products is seen as cooperating in a system that violates Shariah principles. This aligns with the Quranic injunction against assisting in sin.

The prohibition is even stronger when compensation is tied to commissions or sales performance. In such cases, most scholars agree that income earned from selling conventional life insurance is haram, due to the presence of riba, gharar, or maysir in these contracts.

Fatwa councils distinguish between selling policies and offering neutral advice. While selling is generally impermissible, advisory roles may be allowed in limited cases, particularly when the goal is to inform, not persuade. If the advisor promotes takaful or Shariah-compliant alternatives without engaging in sales tactics, the work may be considered acceptable.

Still, scholars consistently warn against involvement in cold outreach, marketing funnels, or performance-based roles related to conventional insurance. Where no halal alternative exists, leaving the role and purifying past earnings through charity is strongly advised.

Is working in a life insurance company haram?

Most Muslims who land a job in insurance don’t think twice, but working in a life insurance company raises serious Islamic financial concerns often overlooked in quick online answers. The issue becomes more critical when the role involves contracts that conflict with core Islamic principles.

Conventional life insurance is considered problematic by many scholars due to its links to three key prohibitions: uncertainty (gharar), interest (riba), and gambling (maysir). What’s rarely discussed is how different departments carry different levels of risk. Underwriting and policy sales may involve deeper entanglement with haram elements than admin or tech roles — a distinction that matters.

The halal status of your income also depends on whether your work supports the core riba-based business. Even if you’re not selling policies, scholars caution against roles that contribute directly to prohibited financial systems.

Many professionals are now shifting toward Shariah-compliant options like takaful, which emphasize mutual protection over profit. For those with insurance experience, takaful offers a values-based career path in a growing field.

Surprisingly, some life insurance roles resemble investment banking, involving bundling, portfolio management, and return-chasing structures. So, asking whether the job is haram also means examining whether it supports financial mechanisms Islam seeks to avoid.

Related forms of insurance and their permissibility under Shariah

While life insurance remains the most debated category in Islamic finance, other forms of insurance are no less significant — and often assessed with more nuance.

Essential services such as health insurance are generally approached with greater leniency by scholars, especially when structured through cooperative or takaful models. Since they support critical access to medical treatment and protect life, many jurists from schools like Hanafi consider them permissible under necessity clauses, provided no interest (riba) or uncertainty (gharar) is involved.

For travel insurance and car insurance, the Shariah stance often depends on context. If these policies are legally mandated — such as third-party car insurance in many countries — then conditional permissibility is frequently granted, especially if no halal alternative is available. Where they are optional, the permissibility may hinge on how the contract is written and whether it includes prohibited elements like gambling (maysir).

Bridging these categories is the increasingly popular investment-linked takaful — a hybrid instrument that combines cooperative risk coverage with halal asset growth. Here, a portion of a participant’s contribution funds the takaful risk pool, while another part is invested in Shariah-compliant vehicles like halal stocks, Islamic ETFs/index funds, or sukuk bonds. These products offer both protection and long-term savings, aligning with modern financial goals while respecting Shariah rules.

If you're looking to build wealth without compromising your Islamic values, where you put your money matters just as much as how you manage it. One of the most effective ways to stay Shariah-compliant is by choosing a dedicated Islamic trading account. These accounts are tailored to support halal investing in areas like stocks, Forex, and even crypto. To make your search easier, we’ve assessed the leading platforms offering these services and outlined their standout features. Take a closer look below to find the right fit for your goals.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 50 | 200 | No | 1.95 | Study review | |

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

Takaful as a fiqh-driven structure for risk sharing and surplus ethics

If you're new to the world of Islamic finance, the first thing you must understand is that not all "halal alternatives" are equal in the eyes of Sharia. Takaful isn’t just a substitute for conventional life insurance. It is an embodiment of tabarru’ (voluntary contribution) rooted in mutual risk-sharing, not contractual obligation. What most beginners miss is that opting out of conventional insurance isn't merely about avoiding haram. It’s about actively choosing a structure built on niyyah (intent) and ukhuwah (brotherhood). That shift in mindset, from protecting only yourself to contributing toward others' well-being, is the actual Islamic worldview behind life contingency planning.

Here’s a thought that is rarely discussed. Even within halal frameworks like Takaful, scholars emphasize the structure of the fund and the management contract more than just the label. For instance, if a Takaful operator uses wakala (agency-based) models but embeds a fixed fee that resembles interest-bearing instruments, the permissibility can shift based on how profits are distributed and how surplus is returned. So for beginners, it's not enough to just ask “Is it halal?” Instead, ask: how is surplus shared? Who holds the risk legally? Because in Sharia, it’s not just what you sign but the structure of your trust and risk that determines permissibility.

Conclusion

Life insurance remains one of the most contested financial tools in Islamic jurisprudence. While the conventional model is broadly deemed haram due to elements like riba, gharar, and maysir, exceptions based on necessity continue to generate nuanced debate. Scholars emphasize that permissibility depends heavily on contract structure, personal intention, and available alternatives. For those seeking Shariah-compliant protection, takaful offers a validated cooperative framework. Individuals should assess their specific circumstances, consult qualified advisors, and avoid defaulting into impermissible arrangements. Informed decision-making remains essential in navigating this ethically complex domain.

FAQs

Is it haram to get life insurance?

Yes, conventional life insurance is generally considered haram due to interest and uncertainty, but Shariah-compliant life insurance like takaful is allowed.

Can a life insurance payout be treated as inheritance?

No, the payout is a contractual benefit and not part of the estate. The beneficiary is named in advance and may differ from the Shariah-defined heirs.

What should I do if I can't opt out of a policy and still receive a payout?

If opting out is impossible, the funds may be accepted for basic needs. Any excess should be purified by donating it without the intention of earning religious reward.

Is it haram to sell life insurance?

Yes, selling conventional life insurance is generally considered haram in Islam because it involves elements of riba (interest), gharar (uncertainty), and maysir (gambling). However, selling Shariah-compliant life insurance (such as takaful) is permissible, as it aligns with Islamic ethical and financial principles.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.