Halal-Compliant Stocks In Singapore: Full Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The best halal stocks in Singapore are:

Singapore Exchange (SGX: S68). A central, FTSE‑SGX Shariah‑approved financial exchange, key for Islamic market infrastructure.

SATS Ltd (SGX: S58). Halal-certified airport catering & support services provider with solid cash flow and ethical operations.

SembCorp Industries (SGX: U96). Diversified industrial group advancing green energy, aligned with halal environmental stewardship values.

Mapletree Industrial Trust (SGX: ME8U). One of few Shariah-screened industrial/data centre REITs, offering stable compliant rental income.

Keppel DC REIT (SGX: AJBU). Shariah‑approved data‑centre trust with compliant, tech-driven income streams across Asia and Europe.

In Singapore, several companies listed on the stock market seem aligned with Islamic investing principles but don’t have formal Shariah compliant stocks in Singapore status. Investors have to appeal to halal indices lists, third-party screeners or certifications from global Shariah boards. Some firms share detailed reports, while others lack clarity on income sources or debt. This makes research essential to avoid non-compliant picks.

To identify halal stocks in Singapore, investors can do individual case-by-case research using verified screening platforms. Alternatively, another option is to follow halal stock indexes or halal index funds’ and ETFs’ portfolios, which are already screened for Shariah compliance. This guide offers practical tools, compliance checks, and reliable sources to help make informed, Shariah-aligned investment decisions. You will also get details on other halal investment options apart from just stocks.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Best halal stocks in Singapore

Halal stock market implies shares that follow Shariah rules by avoiding businesses tied to interest, alcohol, gambling, pork, and other forbidden sectors. A neat thing is regular companies like UMS Holdings and First Resources regularly tweak their debt to stay under the 33 percent debt-to-equity limit, something big global indexes don’t watch as closely.

Singapore provides special benchmarks like the FTSE SGX Asia Shariah 100 and the S&P Singapore BMI Shariah index. These track a carefully chosen group of firms across the region. Rising names like NetLink NBN Trust and ComfortDelGro are in the mix, offering Asia growth without breaking any Shariah rules.

On the tech side, new platforms are letting people invest directly in Islamic stocks in Singapore with instant compliance checks. Services like CGS‑CIMB iCASH give you real-time info on whether your shares still qualify. With proper Shariah oversight from groups like MUIS behind the scenes, this creates a solid setup for Muslim investors and anyone wanting ethical exposure.

The table below highlights a curated list of Singaporean stocks operating in permissible industries, featuring strong financial fundamentals and potential for long-term growth. Key metrics such as sector, year-to-date (YTD) return, market capitalization, price-to-earnings (P/E) ratio, and dividend yield are provided to support informed investment decisions.

| Company | Sector | YTD Return | Market Cap (SGD bn) | P/E (TTM) | Dividend Yield |

|---|---|---|---|---|---|

| Singapore Exchange (SGX: S68) | Financial Exchange | ~+2.5% | 14.8 | ~23 | ~2.6 % |

| SATS Ltd (SGX: S58) | Food & Services | ~+5.8% | 6.1 | ~15.8 | ~2.8 % |

| SembCorp Industries (SGX: U96) | Industrials | ~+1.2% | 8.4 | ~18.6 | ~4.1 % |

| Mapletree Industrial Trust (SGX: ME8U) | Industrial REIT | 4.50% | 7.2 | ~12.1 | ~6.9 % |

| Keppel DC REIT (SGX: AJBU) | Data Centre REIT | 3.30% | 4.8 | ~10.9 | ~5.6 % |

Singapore Exchange (SGX: S68)

A central hub for halal markets, licensed under FTSE‑SGX Shariah indices, SGX oversees Islamic trading standards and serves as the backbone of Shariah-compliant investing.SATS Ltd (SGX: S58)

Leading provider of halal-certified catering and airport services, SATS maintains strong cash flows and adheres to ethical standards, making it a trusted halal investment.SembCorp Industries (SGX: U96)

A diversified industrial firm with growing green-energy initiatives, aligning with halal values in environmental stewardship and ethical operations.Mapletree Industrial Trust (SGX: ME8U)

One of the few REITs included in FTSE‑SGX Shariah indices, it owns industrial and data centre assets offering stable, compliant rental income.Keppel DC REIT (SGX: AJBU)

Shariah-screened for data centre investments across Asia and Europe, this REIT delivers tech-aligned, compliant income streams.

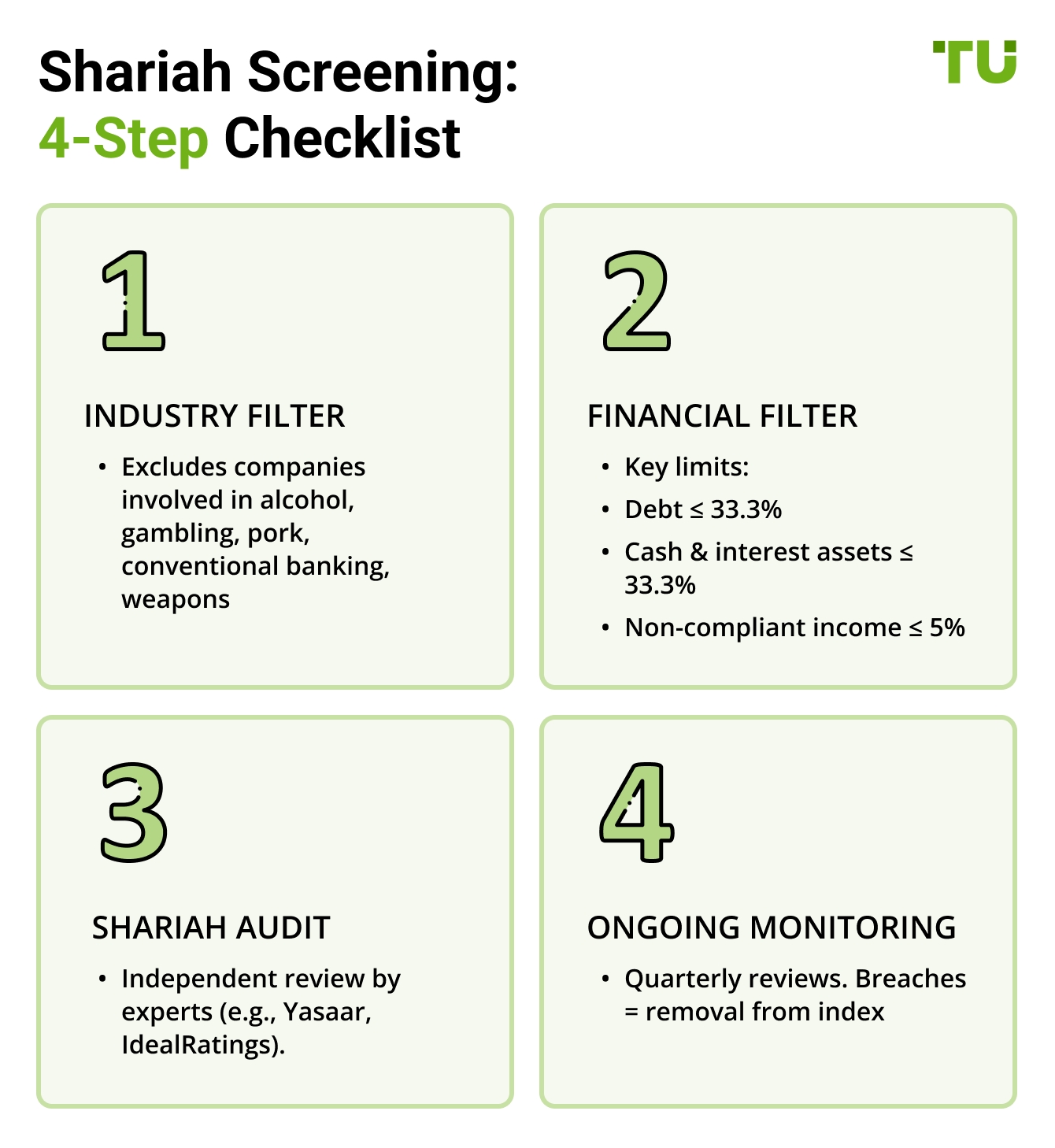

How Singapore stocks undergo Shariah screening

The screening methodology for Islamic equity selection follows a structured set of independent stages that include industry classification and financial health evaluation. These layers form the foundation for identifying stocks suitable for inclusion in Shariah-compliant indices focused exclusively on halal stocks in Singapore, allowing faith-based investors to access ethically screened companies with greater confidence.

1. Industry filter

The first step involves eliminating companies operating in sectors that are not permissible under Islamic principles. This includes businesses linked to conventional banking, alcohol, gambling, tobacco, pork-based products, weapons, and mainstream entertainment. These exclusions are clearly outlined based on standards issued by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and other Shariah supervisory guidelines.

2. Financial ratio filter

Companies that pass the industry screen are then subject to strict financial checks based on criteria set by the FTSE SGX Shariah Index. The main thresholds include:

Total debt must not exceed 33.333% of total assets.

Cash and interest-bearing instruments must not exceed 33.333% of total assets.

Combined accounts receivable and cash must stay within 50% of total assets.

Non-permissible income, such as interest, must remain under 5% of total revenue.

These financial indicators are assessed using the most recent audited statements, and data is considered over a trailing twelve-month period to provide a stable and accurate view, avoiding temporary distortions.

3. Independent Shariah review

An external panel of experts conducts an independent review to determine eligibility. Renowned advisory firms such as Yasaar Ltd. and IdealRatings are responsible for applying the Shariah screening standards, issuing necessary rulings (fatwas), and giving the final approval on compliance. Based on their decisions, FTSE Russell compiles the index components.

4. Ongoing monitoring and rebalancing

Index components are reviewed on a quarterly basis. If a company’s financial ratios cross the set limits due to shifts in operations or market events, it may be flagged or even removed. Firms that consistently breach the criteria for two consecutive reviews are mandatorily excluded. However, a temporary buffer of up to 5% above the limit is permitted under special circumstances, helping to minimize unnecessary disruptions.

This comprehensive process ensures that investors gain exposure to Shariah compliant stocks in Singapore that continue to meet both ethical sector criteria and financial safeguards, without requiring personal Shariah audits or complex verification on their part.

What Islamic investment options are available in Singapore

Singapore offers more than just basic halal investments. If you know where to look, there are smart, lesser-known opportunities that align with Shariah principles and modern financial tools.

Look for Islamic ETFs listed abroad but available locally. While Singapore doesn’t yet offer a wide selection of domestic Shariah-compliant ETFs, local brokers provide seamless access to a variety of international halal funds. Platforms such as IBKR and FSMOne allow investors to buy into options like the iShares MSCI World Islamic ETF or the Wahed FTSE USA Shariah ETF — both offering globally diversified exposure within Islamic investment principles. At the same time, investors seeking local guidance can explore structured halal options more deeply. For example, our dedicated articles on Shariah-compliant ETFs and index funds and halal mutual funds in Singapore explain which platforms offer the best access, what criteria to consider, and how to ensure Shariah compliance in practice. These mutual funds, while often overlooked, are also a popular choice for long-term halal investing in the region.

Use i-Trust accounts for sukuk in Singapore. Some banks in Singapore give access to Islamic trust accounts that are structured to hold sukuk, or Islamic bonds, without triggering riba (interest). These accounts are built to mirror profit-based contracts, where returns come from asset-backed income rather than interest payments. For someone looking to avoid fixed-income products but still earn regular returns, this is a solid starting point that’s often underutilized.

Tap into Shariah robo-advisors. A few robo-advisory platforms in Singapore quietly include Shariah-compliant options under broader ethical or ESG categories. These portfolios automatically screen out stocks tied to alcohol, gambling, conventional banks, and high-interest debt. They also adjust the holdings over time using AI, keeping your investments aligned with Islamic guidelines without manual rechecking. Many Muslims miss these features because they’re not directly labeled as “Islamic.”

Explore halal REITs tied to WAQF properties. Real Estate Investment Trusts (REITs) based on Waqf, Islamic charitable endowments, are gaining traction in Singapore and nearby regions. These REITs lease out Shariah-approved commercial properties and distribute rental income screened by Islamic scholars. Since real estate is a tangible asset and rental income is halal, this model offers both stability and religious compliance.

Invest in co-operative peer-to-peer platforms. Singapore is home to innovative fintech startups that use Shariah contracts like mudarabah (profit-sharing) and musharakah (joint venture) to power ethical lending and business finance. Instead of charging fixed interest, profits are shared between investors and entrepreneurs. These platforms are especially attractive to Muslims who want to support real businesses without engaging in conventional debt.

Participate in Shariah venture funding networks. Some private equity circles in Singapore, especially among Malay-Muslim business communities, are now offering halal angel investment deals using compliant contracts. These opportunities aren’t publicized on mainstream platforms, but they operate through word of mouth or Islamic business groups. They follow risk-sharing models and are typically backed by Islamic scholars or imams who verify contract terms. For investors with a bit more capital, this is a powerful, hands-on way to support ethical startups.

How to get started with halal stocks in Singapore: step-by-step guide

1. Find stock lists

To begin selecting investments, explore platforms that offer curated lists of halal stocks in Singapore. These tools help investors identify Shariah compliant stocks in Singapore by screening SGX-listed companies based on financial ratios and business activity criteria. For broader insights, refer to established Shariah indices such as the FTSE SGX Shariah Index, which is constructed using widely recognized screening methodologies.

2. Verify status

Once you’ve shortlisted companies, use verification tools to check their compliance. Platforms like Islamicly give a full breakdown of a stock’s Shariah status, including specific reasons for exclusion if applicable. The FTSE SGX Shariah website also shares the list of screened constituents along with its review criteria. These resources are especially helpful in keeping track of active Islamic stocks in Singapore and their current status.

3. How to buy

To invest, use brokers that provide access to SGX or international exchanges. Some investors opt for ETFs and REITs that are already classified under Shariah compliant stocks in Singapore, reducing the need for additional checks. Platforms like Wahed offer curated, pre-filtered portfolios, while Syfe allows users to build their own but leaves the screening responsibility to the investor.

If you're already exploring halal investment options in Singapore and are curious about expanding your portfolio globally, there’s a growing ecosystem of Shariah-compliant platforms to consider. Beyond local halal Singaporean stocks, investors can now access international markets through global halal stocks, Islamic Forex accounts, and even halal-friendly crypto assets. These platforms are designed to align with Islamic financial principles by steering clear of interest, speculation, and non-compliant sectors. For those seeking a faith-aligned global investing experience, the following list offers reliable platforms that can help you take the next step.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review |

Spot undervalued halal stocks in Singapore through sector cycles and financial purity filters

New investors often stop at whether a stock is labeled halal or not, but there's a deeper layer worth exploring. Some sectors in Singapore, like logistics, healthcare, or utilities, naturally meet Shariah criteria more often because their core business avoids interest-heavy activities. The real edge is knowing when these sectors are underperforming in the market. When timing lines up, you’re not just buying a compliant stock, you’re buying it cheap, during a period when it’s most likely to bounce back.

Even among Shariah-compliant stocks, there are different levels of quality. Don’t just go by the label. Take a closer look at their numbers, especially how much debt they carry and how much cash they keep. The cleaner the financials, the more stable the compliance. Some stocks sit right on the edge and risk falling off the list after the next financial update. Avoid those by checking the core financial health yourself. You’ll end up with investments that are not just halal, but also solid long-term bets.

Conclusion

Investing in Islamic stocks in Singapore is based on adherence to Islamic legal principles and the exclusion of prohibited sources of income. These guidelines establish a consistent ethical framework for building an investment portfolio. The market offers verified instruments, including shariah-screened ETFs, sukuk funds, halal REITs and many more, selected through defined methodologies. Access is available through both local and international platforms with built-in compliance filters. Investors must account for the limited number of eligible securities and the need for regular compliance checks. Market fluctuations and periodic reclassifications require a structured approach to monitoring and portfolio maintenance.

FAQs

What types of income are considered permissible in Islamic investing?

Permissible income comes from real economic activity such as manufacturing, trade, leasing, and equity participation in lawful businesses. Income derived from interest, speculation, or ambiguous contracts is excluded.

How often should an Islamic investment portfolio be reviewed?

It is recommended to review the portfolio at least quarterly, especially after companies release new financial reports or when shariah-compliant indexes are updated.

Can temporarily non-compliant stocks be held in an Islamic portfolio?

Only if the platform provides an automatic exclusion mechanism and a clear process for resolving non-compliance. Otherwise, the asset should be replaced immediately.

How is risk assessed in Islamic investing?

Risk is evaluated based on liquidity, volatility, and asset transparency. Speculative instruments and high-risk derivatives are not permitted.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).