Is Stock Lending Halal? A Shariah-Based Review For Traders

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Stock lending is viewed as haram in Islam because it involves riba (interest), maysir (speculation), and gharar (uncertainty). Scholars such as Mufti Taqi Usmani have clearly stated that lending shares for short selling, which is a frequent practice in conventional finance, is not permissible. At present, there are no broadly recognized Shariah-compliant alternatives being practiced, and most Islamic finance boards strongly caution Muslim investors against entering stock lending deals offered by mainstream brokers.

Stock lending, often referred to as securities lending, plays a regular role in modern financial markets by allowing investors to temporarily transfer their shares, usually for short selling. For Muslims looking to invest in the stock market ethically, the key issue is whether stock lending fits within Islamic guidelines or not. This piece looks at how Islamic law views stock lending, reflects on what scholars have said, highlights specific issues like riba and maysir, and provides guidance to Muslim traders trying to determine if this activity truly fits within the boundaries of halal stock investing.

For a broader overview of Islamic financial principles, see the Islamic Investing hub at our site.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is stock lending?

Stock lending means one party, the lender, hands over shares to another party, the borrower, for a set time, receiving collateral and a fee in return. Borrowers usually take these shares to short the market or to manage risk. Even during this period, the original owner may still receive dividends and retain voting rights, based on the specific agreement.

In traditional finance, lenders earn a fee while eventually getting their shares back. But borrowers may use the stocks for speculative moves like short selling, which raises concerns under Islamic finance due to its link with maysir, or gambling.

This activity also raises issues related to or gambling-like speculation, which is explained in more detail in our article on maysir in Islamic finance.

Is stock lending halal or haram in islam?

Most Islamic scholars view stock lending as haram because it conflicts with fundamental Shariah finance principles. This activity includes aspects of riba (interest), gharar (excessive uncertainty), and maysir (speculation), each of which goes against Islamic teachings.

Key Shariah concerns:

Riba (interest). Charging a fee for lending shares is often interpreted as earning interest from a non-cash asset, which is not acceptable.

Maysir. Stock lending is commonly used for short selling, which many scholars liken to gambling because of its speculative basis.

Gharar. There is ambiguity regarding the value and outcome of the returned shares, especially when markets are highly unstable.

“O you who have believed, do not consume usury, doubled and multiplied, but fear Allah that you may be successful.” — Surah Al-Imran 3:130

To understand why interest-based income is prohibited, refer to our guide on riba in Islam, which outlines the rules, examples, and modern implications.

As a result, most Shariah scholars prohibit participation in stock lending arrangements, especially when it supports activities like naked short selling or margin-based speculation.

Scholarly opinions and regulatory guidance

AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) has not clearly allowed stock lending in its standards. Most Islamic finance scholars generally discourage it because it involves speculative market activity.

Mufti Taqi Usmani and other respected scholars view short selling and share lending for speculation as not permissible under today’s trading systems.

Islamic finance boards in Malaysia and the GCC share the same view, noting that unless the lending process is redesigned using Shariah-based agreements like mudarabah or wakalah, it still doesn’t meet Islamic standards.

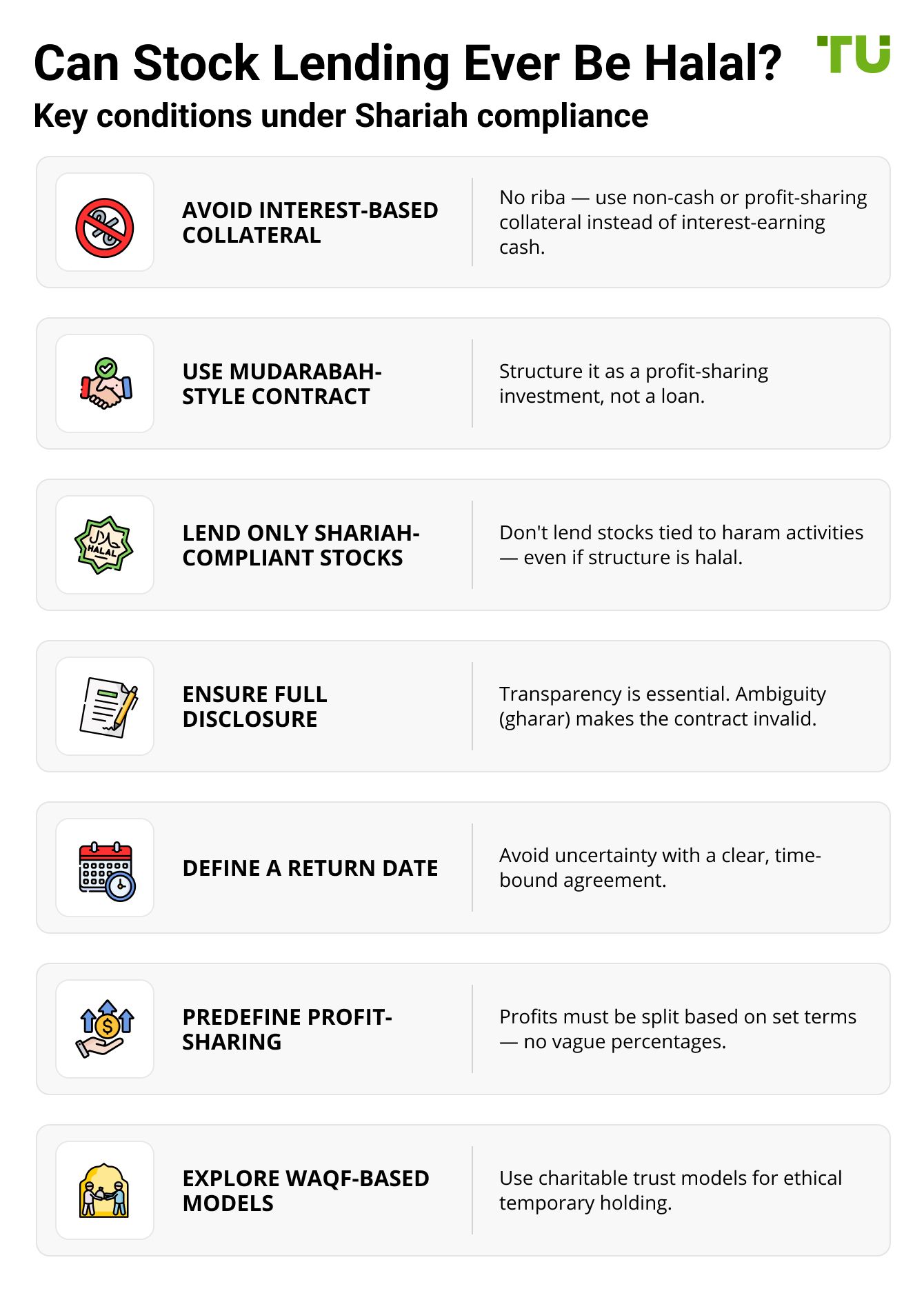

Can stock lending ever be structured to be halal?

Stock lending is typically off-limits in Islamic finance, but under certain conditions, it might be restructured in a way that aligns with Shariah. Here's what you need to know.

Avoid interest-bearing collateral. Most conventional stock lending involves cash collateral earning interest, which is riba. A Shariah-compliant structure would need to use non-cash collateral or a profit-sharing alternative.

Use a mudarabah-style contract. Instead of a loan, structure it as an investment partnership where the borrower uses the shares and shares a portion of the returns.

Only lend Shariah-compliant stocks. Lending shares in companies with haram activity breaks the chain of compliance even if the structure itself is halal. This might also require consideration if penny stocks are involved.

Demand full disclosure on usage. Islamic ethics require clarity on how the shares will be used; lending without transparency turns the contract into an ambiguity (gharar), which invalidates it.

Incorporate a time-bound clause. Open-ended lending creates uncertainty. Shariah-compliant structures must define a clear return date to avoid gharar.

Profit-sharing must be predefined. Any profit from the borrowed stock should be split based on agreed terms, not estimated or discretionary payouts.

Consider waqf-based models. Some scholars suggest creating a charitable trust (waqf) to temporarily hold the stock, allowing usage under Islamic stewardship rules.

How stock lending differs from halal investing

Stock lending goes against the spirit of halal investing because it relies on lending shares in ways that don’t sit right with Islamic finance. In most setups, the lender gets cash as collateral and earns interest on it, which is a non-starter in Shariah.

There’s also the issue of ownership not really changing hands, which brings in a lot of uncertainty and gray areas that Islam tries to avoid. Islamic finance sees things differently, you can’t make money off something unless you take some risk or take real ownership.

Something most people don’t talk about is how stock lending often feeds into short-selling. The borrower usually sells the borrowed shares on the open market, hoping to buy them back cheaper.

That’s pure speculation, and in Islamic terms, it's a problem because you're selling something you don’t fully own. Even if it’s not direct, you’re still part of the process if you lend the shares. Halal investing isn’t just about picking the right company. It asks tough questions about how profits are actually made and whether the process itself is clean.

| Feature | Halal Investing | Stock Lending (Conventional) |

|---|---|---|

| Asset ownership | Direct ownership with full rights | Temporary transfer of title |

| Income source | Profit or dividend | Lending fee (viewed as riba) |

| Risk nature | Investment in real business activity | Often supports short selling/speculation |

| Shariah compliance | Structured to avoid riba and maysir | Involves riba and speculative use |

How stock lending compares to other popular halal investing options

As alternatives, many investors also look into index funds (eg. S&P 500 Index fund) and ETFs, since these options typically offer diversified exposure without the direct complexities of lending shares. However, even within ETFs, not all options qualify, so investors often seek out the best halal ETFs and index funds that are screened for Shariah compliance.

Similarly, some traders explore mutual funds for long-term investing, but these too can contain non-compliant assets or involve interest-based holdings. And while bonds are a popular fixed-income choice globally, most are not halal unless structured specifically as sukuk.

Stock lending, like these instruments, exists in a gray area, it depends on the terms, purpose, and whether ownership rights are transferred in a Shariah-compliant manner. Comparing it with these mainstream investment options helps clarify whether it truly aligns with Islamic principles or not.

Key risks for muslim investors

When building a Shariah-compliant portfolio, Muslim investors face some hidden risks that most beginners don’t even think to watch for.

Income sources change without warning. A stock that looks halal today might earn from interest or non-compliant contracts next quarter, and most retail investors don’t track these shifts.

Islamic labels can be misleading. Just because a fund or stock has “Shariah” in the name doesn’t mean it’s certified or regularly screened by qualified scholars.

Halal ETFs can still hold questionable stocks. Index-based ETFs sometimes include borderline companies that pass filters on paper but violate Islamic ethics in practice.

Purification data is often missing. Many platforms don’t clearly tell you how much of your dividend needs to be purified, leaving you guessing and potentially holding impure gains.

Short selling and margin are quietly included. Some so-called halal platforms offer trading tools like leverage or shorting without flagging them as non-compliant.

Industry practice: How brokers handle stock lending

A large number of well-known brokers across regions like the U.S., Europe, and Asia rely on automated tools to lend shares held in client accounts. While these features are often presented as opportunities for passive earnings, they frequently conflict with halal investing standards.

Some Islamic finance-compliant brokers and robo-advisors avoid offering stock lending services because of this conflict. That’s why choosing a fully Shariah-screened brokerage matters. If you wish to invest in financial assets (stock, crypto, etc), we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.96 | Study review |

Silent stock lending by brokers may unknowingly breach Shariah compliance

Many beginner Muslim investors are surprised to learn that stock lending can occur without their active knowledge. Some brokers, especially in Western markets, include “fully paid securities lending” clauses by default when opening an account. This means your shares can be lent out for short-selling activities, even if you never explicitly agreed to it.

From a Shariah perspective, this passive participation in lending may lead to indirect involvement in interest-based or speculative transactions, putting your investments at risk of being non-compliant without you realizing it.

Here’s the catch most people miss: even if you personally avoid stock lending, the structure of your brokerage account can still cause problems. If a platform mixes client shares with margin lending or rehypothecation practices, it can violate the Islamic principle of asset separation.

That’s why Shariah-sensitive investors need to go beyond just filtering halal stocks. You must also review your brokerage’s back-end custodial agreements and ask whether your shares are ever pooled or reused. Halal investing isn’t only about what you buy, it’s about how your ownership is treated behind the scenes.

Conclusion

Is stock lending halal? In its current conventional form, stock lending is haram under Islamic finance rules. The structure contains prohibited elements such as riba and maysir, and the most common use case — short selling — conflicts with Shariah investing principles.

Muslim investors should avoid platforms that lend out shares by default and ensure their portfolios are managed in line with ethical, halal standards. Until a viable Shariah-compliant lending framework is developed, stock lending should not be part of an Islamic investment strategy.

FAQs

Is stock lending haram even if the borrower is halal-compliant?

Yes, because the structure itself involves lending fees and speculative use that violate Shariah principles.

Does stock lending violate Islamic finance ethics?

Yes. It involves lending for speculative activity, which contradicts principles of risk-sharing and real economic contribution.

Can I earn halal income from stock lending fees?

No. Lending fees are viewed as riba-based income, which is not permissible under Shariah law.

Is stock lending allowed if I receive collateral?

Collateral does not change the ruling. The income structure and usage of borrowed shares remain non-compliant.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

Short selling in trading involves selling an asset the trader doesn't own, anticipating its price will decrease, allowing them to repurchase it at a lower price to profit from the difference.

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.