Is Swing Trading Halal In Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Swing trading may be allowed in Islam if it steers clear of interest-based trades, avoids speculation, and stays true to ethical investing values. Scholars have varying opinions depending on how it’s done. If it involves borrowed funds, overnight interest charges, or high uncertainty, it might be considered haram. But when done responsibly and in line with Shariah values, swing trading can be seen as permissible.

Swing trading appeals to investors who prefer holding positions for several days or even weeks, aiming to benefit from short-term shifts in market prices. It offers more breathing room than day trading and doesn’t demand full-time screen attention. For Muslim investors, the important issue is whether this approach fits within the boundaries of Islamic financial ethics. This article takes a closer look at swing trading through the lens of Islamic teachings. It discusses what this strategy involves, how scholars view it, and ways Muslims can approach it in a halal manner. It also highlights concerns that make swing trading halal or haram a matter of scholarly debate, and offers practical tips to help keep your trades aligned with Shariah principles.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

Understanding swing trading in the financial markets

Swing trading is a strategy where traders aim to profit from short to medium-term price moves, typically holding positions for a few days to a few weeks. It sits between day trading and long-term investing. Instead of reacting to every tick or waiting months for results, swing traders try to catch meaningful price shifts within larger trends. The goal is to enter when momentum is building and exit before it fades, using both technical analysis and timing rather than just luck.

Many new traders think swing trading is just about holding a position for a bit longer than a day. But the real skill lies in knowing where you are in the market cycle. Entering too late into a move or too early into a reversal can ruin an otherwise good setup. Smart swing traders study volume, failed breakouts, and price structure to find entries with real edge, not just textbook signals. For Muslim investors, technical skill is only part of the equation — ethical structure matters too, which is why many ask whether swing trading is halal or haram. To understand this issue, it's essential to learn the key principles of Islamic finance and trading ethics.

Key principles of Islamic finance and trading ethics

Islamic finance is guided by religious values drawn from the Quran and the teachings of the Prophet. It strictly avoids riba (interest), gharar (uncertainty), and maysir (speculation or gambling). Every financial deal should reflect honesty, clarity, and a connection to real economic value.

Islam does not discourage profit, but it places strong emphasis on how that profit is made. Income should be generated through honest trade, ethical investing, or real economic work, not through speculation or interest-driven contracts. This is why some mainstream trading practices may go against Islamic ethics.

In financial markets, integrity matters just as much as compliance. Misleading others, using inside information, or tampering with market prices is completely unacceptable. Traders must stick to halal investments and avoid stocks or firms involved in activities like alcohol, betting, pork products, or interest-based banking.

Is swing trading halal according to Islamic scholars?

Many scholars in Islamic finance generally consider swing trading permissible when it doesn’t involve interest-based borrowing, avoids excessive speculation, and is limited to assets that are Shariah-compliant. But if the method includes leverage, short-selling, or links to companies involved in non-permissible sectors, it may no longer meet Islamic standards.

To evaluate swing trading, scholars look at how it is actually practiced. If the trader buys shares with their own funds and deals with businesses that provide lawful products or services, the activity is usually seen as acceptable. Opinions from organizations such as the Islamic Fiqh Academy and AAOIFI often reflect this understanding.

However, if swing trading uses margin accounts that add interest or involves tools like derivatives or options that resemble betting, it conflicts with Islamic principles. The issue is not with swing trading itself but with how the trades are carried out, which must align with Shariah rules.

Common reasons why swing trading may be considered haram

Swing trading may seem like a balanced strategy for many retail investors, but from a Shariah perspective, its structure raises serious concerns. Two major issues often flagged by scholars are related to how trades are funded and what’s actually being traded.

Use of margin and leverage

Many brokers let traders hold overnight positions using borrowed funds, which often involve interest. Even when interest isn’t directly charged, it may be hidden in spreads or disguised as rollover fees.Lack of true ownership

In Islam, selling what you don’t own is considered gharar (excessive uncertainty). Most swing trades — especially through CFDs — do not involve actual possession of the asset.

Before applying swing trading strategies, Muslim investors are advised to examine the structure carefully — how it’s financed, settled, and whether there’s genuine asset ownership. These aren’t just technical details; they determine whether the trade aligns with Islamic values.

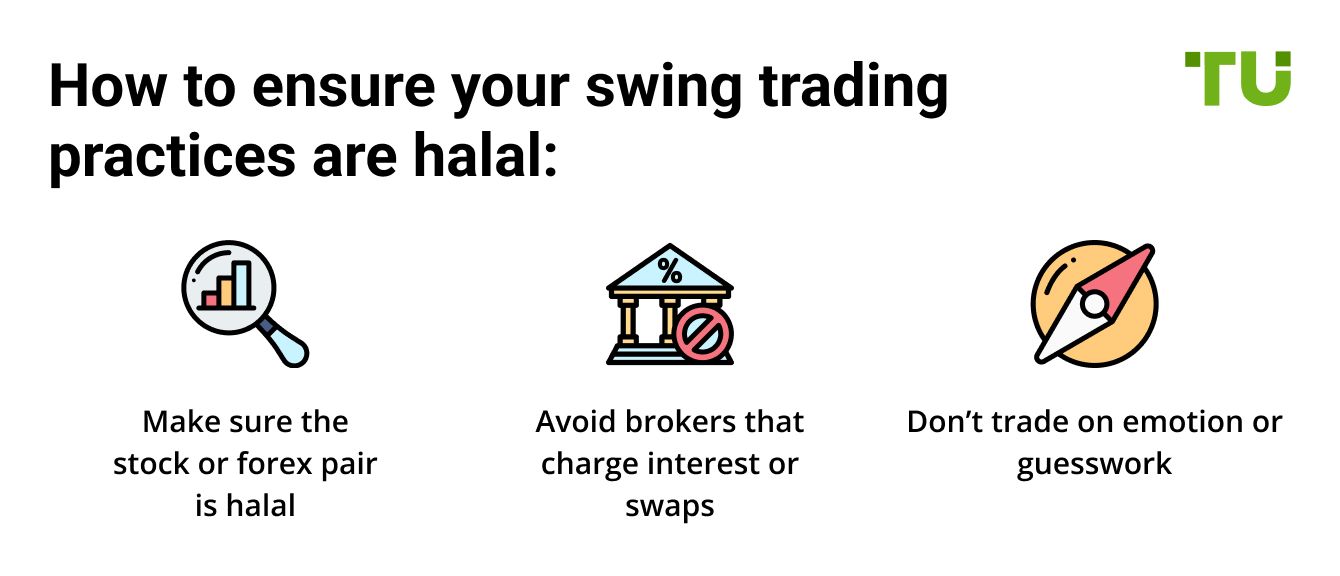

Before you even think about timing or setups, look at what you’re trading. Swing trading only stays halal if the asset itself is clean. A lot of traders jump into Forex or stocks from interest-based companies and assume that holding it for a short time makes it okay. It doesn’t. You’ve got to screen every stock for things like debt levels, business model, and income sources. Tools like Zoya or Islamicly can help, and checking your watchlist for compliance should just be part of your daily routine.

The next thing is your trading account. It’s just as important as what you’re trading. If you’re getting charged overnight interest or swap fees, that already makes the trade haram. Even Islamic accounts from brokers can sometimes disguise interest under weird terms or service charges. You need to ask hard questions and only use brokers who clearly explain how they avoid riba in every part of the process.

Finally, how you trade matters just as much as what you trade. Even if your stock is halal and your broker is clean, your strategy can still go off the rails if it’s built on guesswork or reckless leverage. Swing trading turns problematic when it feels more like gambling than planning. Islam allows risk, but only when it comes with ownership and responsibility. Every trade should be based on research, structure, and clear intention. That’s what actually keeps your trading clean and in line with your faith.

The Quran explicitly prohibits riba (interest) in Surah Al-Baqarah 2:275:

“Those who consume interest cannot stand [on the Day of Resurrection] except as one who is being beaten by Satan into insanity. That is because they say, ‘Trade is [just] like interest.’ But Allah has permitted trade and forbidden interest.”

Additionally, the Quran warns against unjust transactions in Surah Al-Baqarah 2:188:

“Do not consume one another’s wealth unjustly or send it [in bribery] to the rulers in order that [they might aid] you to consume a portion of the wealth of others while you know [it is unlawful].”

These verses underscore the importance of ensuring that all aspects of trading — what you trade, how you trade, and the accounts you use — align with Islamic principles to maintain ethical and lawful financial practices.

How does swing trading compare to other trading strategies in Islamic finance?

Swing trading often stands out as a balanced approach for Muslim traders. It avoids the ultra-fast pace of intraday trades while still offering more flexibility than long-term investing. But how does it stack up against other popular trading strategies when it comes to Shariah compliance?

Take spot trading, for example. It’s considered one of the most halal-friendly methods when done properly, trades are settled immediately, ownership transfers on the spot, and there’s no interest involved. Swing trading, on the other hand, may involve overnight holds, which could trigger swap charges unless you're using an Islamic account. So while both methods can be halal, spot trading is often viewed as the gold standard for simplicity.

Now compare it with copy trading. This approach lets users mirror another trader's activity automatically. While it sounds convenient, many scholars are cautious about it, especially if there's no clarity on risk-sharing or if profits come from speculative trades. Swing trading avoids this concern by putting full control, and responsibility, in the trader’s hands.

Proprietary trading and scalping also raise unique questions. Prop trading often involves using firm capital, sometimes with leverage or unclear risk terms, while scalping depends on extremely fast trades that may resemble gambling due to their repetitive and speculative nature. Swing trading, by contrast, allows time for analysis, discipline, and Shariah screening before making moves.

If you wish to invest in financial assets (stock, crypto, etc), we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Islamic rulings shift when swing trading uses margin or delay in settlement

If you’re starting out and trying to keep your swing trades halal, one key point to know is that even trades without interest can become questionable if there's a delay in actually owning the asset. In Islamic finance, you need more than just a trade confirmation — the asset must come under your full control without delay. If your broker settles trades a couple of days later (like in T+2 systems), that gap might raise the question: is swing trading haram even if the intention was Shariah-compliant?

Another detail that often gets overlooked is how your broker actually processes the trade. Most platforms don’t transfer ownership of shares or currencies to you — they just mirror the price using something called CFDs, which are more like bets than actual ownership. For those aiming to ensure that swing trading is halal, it’s crucial to choose brokers that offer Shariah-compliant accounts and guarantee real-time transfer of real assets. Whether a trade is halal or not can come down to how it’s settled and structured, not just how long you hold it.

Conclusion

To sum up, swing trading can be halal in Islam if it avoids interest-based accounts, speculative behavior, and unethical investments. Its permissibility largely depends on how the trades are structured and whether the trader adheres to Islamic principles. For Muslim traders, it's important to understand that the process matters just as much as the outcome. Trading in a halal way is possible when you stay informed, avoid shortcuts, and focus on ethical investing. If you're unsure, consult with a scholar or certified Islamic finance expert to review your trading practices.

FAQs

Can delayed settlement (like T+2) make a halal swing trade invalid?

Yes, if the asset isn’t in your full possession right after the trade, it may violate Shariah principles. Even though T+2 is standard in many markets, it creates a delay in ownership. Islam requires constructive possession at the time of sale, so this delay can be problematic, even if there’s no interest or leverage involved.

Is it halal to swing trade foreign currencies (Forex)?

Forex swing trading is often considered haram unless done spot-on with immediate settlement and without interest. Many brokers offer leverage or rollover swaps in Forex, which involve riba. Unless the trade is executed using your own money, settled instantly, and through an Islamic forex broker, it likely doesn’t meet halal standards.

Do referral bonuses from brokers affect the halal status of a trade?

They might. If a broker offers bonuses that encourage excessive trading or involve trades in haram assets, it can compromise your ethical intent. Islam values transparency and intention, so if the bonus creates indirect pressure to speculate or trade unethically, it’s best to avoid it.

Can a Muslim follow swing trade signals from YouTube or influencers?

Only if those signals align with Islamic values. Many influencers push trades without screening for halal assets or ethical methods. Following such signals blindly may lead you into haram trades. Always verify the underlying asset and strategy before acting on third-party advice.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Proprietary trading (prop trading) is a financial trading strategy where a financial firm or institution uses its own capital to trade in various financial markets, such as stocks, bonds, commodities, or derivatives, with the aim of generating profits for the company itself. Prop traders typically do not trade on behalf of clients but instead trade with the firm's money, taking on the associated risks and rewards.