Is Shared Ownership Halal In Islamic Finance?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Shared ownership is considered halal in Islam if it meets Sharia requirements. These include avoiding interest (riba), eliminating excessive uncertainty (gharar), and ensuring fairness by preventing injustice (zulm). It should be structured around clear contractual agreements and transparent profit-and-loss sharing, without any hidden conditions that could compromise its ethical basis.

Within Islamic finance, a key question is whether shared ownership is halal or not, especially among Muslims exploring ethical alternatives to conventional investments. Shared ownership involves partial control or equity in a property or asset, commonly seen in real estate and business partnerships. It may qualify as halal shared ownership, but only when it strictly follows Islamic guidelines and avoids elements that contradict foundational financial ethics in Islam.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is shared ownership and why is it important for Muslims?

Shared ownership isn't just a financial tool. For Muslims, it rarely gets the attention it deserves as a powerful way to build assets while staying true to faith. Beyond affordability, Islamic shared ownership lets you co-own homes or businesses without needing a loan, dodging interest traps. What most people overlook is how this mirrors old Islamic methods like musharakah and mudarabah, where you split profit and risk based on your actual contribution. That setup makes it more stable and faith-aligned than most modern systems.

More importantly, shared ownership is halal when done right, because you’re investing in something real, not just juggling loans. Take the example of diminishing musharakah, where you slowly buy out a co-owned property while paying rent on the rest. Unlike rent-to-own deals that sneak in interest or inflate rents, this method keeps everything open and fair. It’s not just about dodging riba, it’s about growing wealth in a clean, ethical way that reflects the heart of Islamic finance.

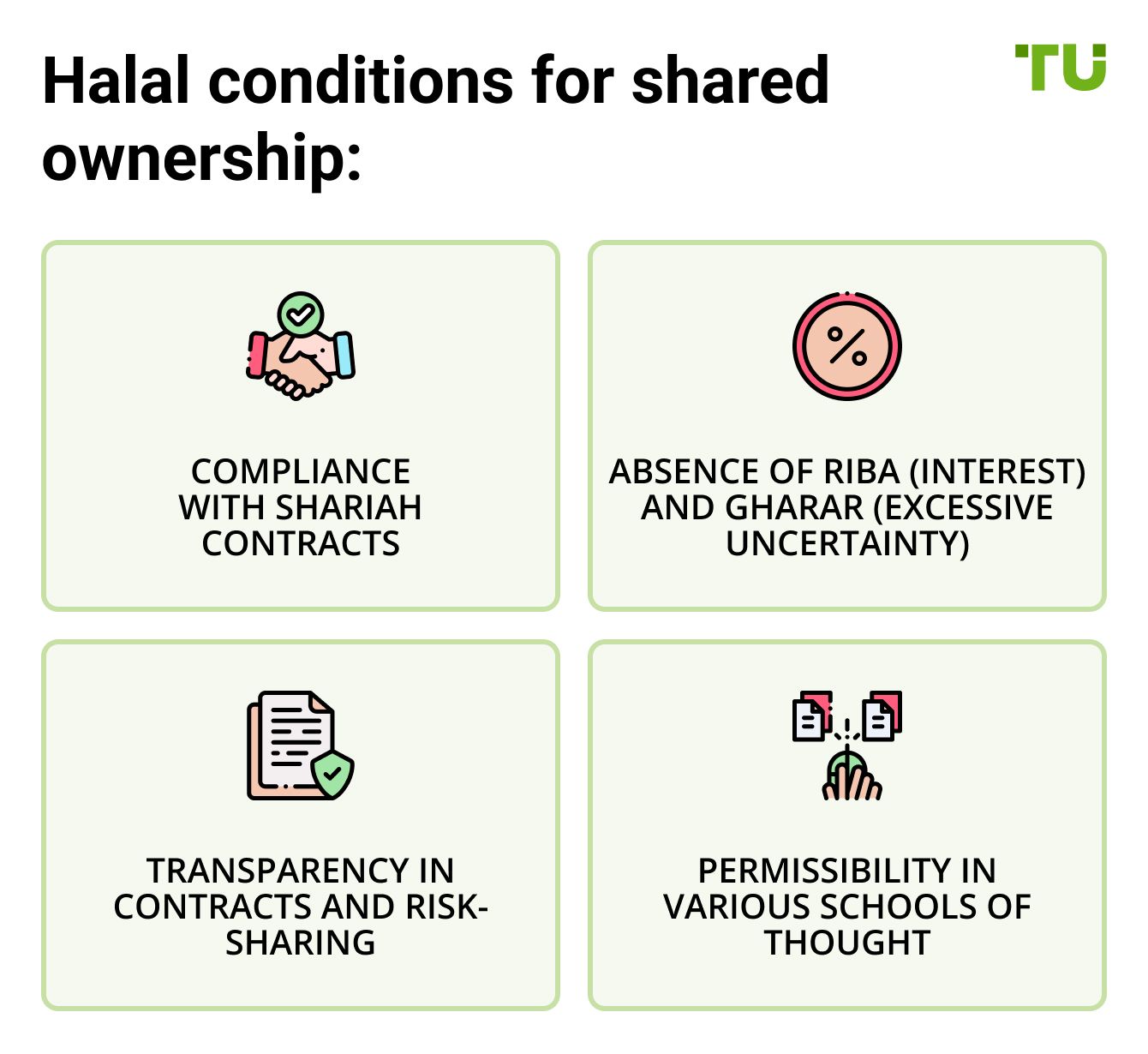

For shared ownership to be halal, the following conditions must be met:

Compliance with Shariah contracts (Musharakah, Mudarabah)

Islamic finance encourages models like Musharakah (joint partnership) and Mudarabah (profit-sharing with a silent partner). These agreements form a key part of halal shared ownership and reflect the spirit of mutual responsibility.

Absence of riba (interest) and gharar (excessive uncertainty)

Any arrangement involving interest automatically disqualifies it from being Shariah-compliant. Similarly, agreements should be free from ambiguity or misleading terms, avoiding what Islamic law defines as gharar.

Transparency in contracts and risk-sharing

Each participant must have full clarity about the agreement. Profit and risk should be shared fairly, reflecting each individual’s contribution, this is central to the concept of shared ownership, if done in a halal manner.

Permissibility in various schools of thought

Though interpretations may vary, most Sunni and Shia scholars accept well-structured Islamic shared ownership models as valid within Islamic jurisprudence.

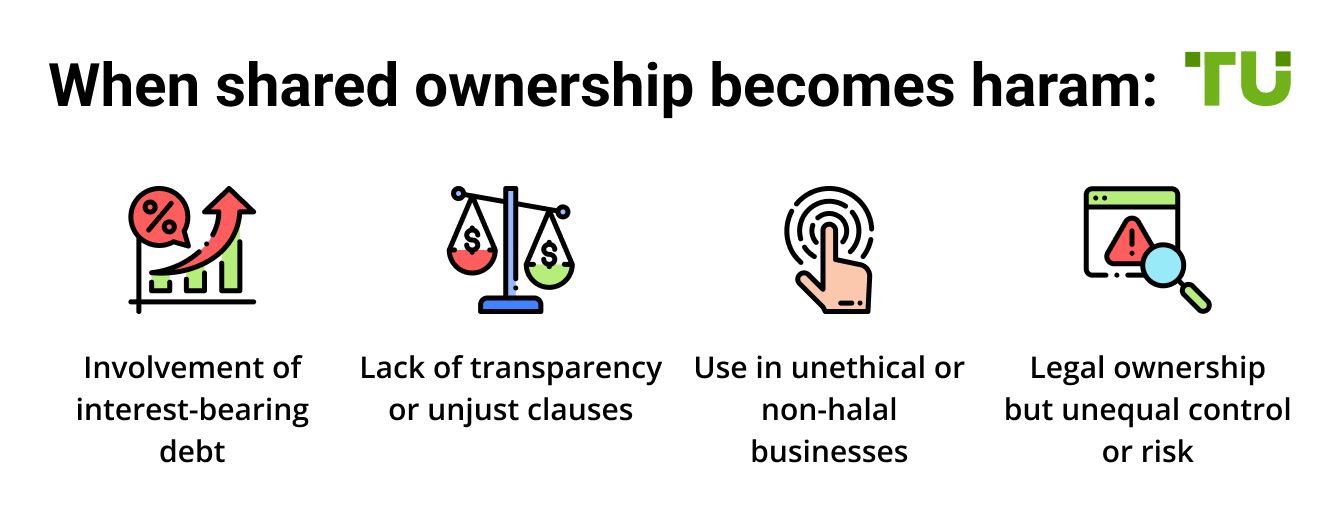

Shared ownership becomes haram based on the following conditions:

Involvement of interest-bearing debt

If shared ownership is financed through loans that charge interest, it goes against the core values of Sharia law. This is a strong reason to question whether shared ownership is haram, especially when the financing structure relies heavily on conventional banking.

Lack of transparency or unjust clauses

When agreements contain hidden fees, give one party disproportionate power, or shift risks unfairly, the deal moves away from ethical standards in Islam. These situations often lead to contracts that fall under the category of shared ownership that is haram, as they undermine fairness and mutual trust.

Use in unethical or non-halal businesses

If the shared ownership model is used to invest in businesses related to alcohol, gambling, or pork, the income generated is not permissible. Profits from such ventures are not just discouraged but considered haram under Islamic teachings.

Legal ownership but unequal control or risk

Even if both parties legally own a share, problems arise when one side faces more risk than their financial stake justifies. This imbalance breaks the principle of fairness (adl) that Islamic finance is built on and can lead to serious ethical concerns.

Practical examples and rulings from scholars

Islamic authorities like the Islamic Finance Council UK and scholars such as Mufti Menk and Mufti Taqi Usmani have issued fatwas supporting shared ownership when structured under Islamic contracts:

"Shared equity is permissible if structured under Musharakah and free from riba." — Dr. Taqi Usmani

"Avoidance of interest is key. Shared ownership can empower halal home acquisition." — Islamic Finance Guru

Quran reference: "O you who have believed, do not consume one another’s wealth unjustly." (Surah An-Nisa 4:29)

Halal shared ownership options in modern banking

Shared ownership might sound simple, but under Islamic finance, it opens up some fascinating options when done the right way.

Use diminishing musharakah for property deals. This model lets you slowly buy a house with the bank as a co-owner and is one of the most trusted halal ways to do it in halal shared ownership systems.

Watch for hidden rental markups. In some deals, the bank charges rent on their part of the house. Double check that the rent isn’t inflated beyond what’s normal.

Always ask clearly who takes the hit if things go wrong. If you’re stuck with the losses but the bank still makes a profit, that raises red flags and makes you question “is this form of shared ownership even halal?”.

Choose institutions with transparent exit clauses. Some banks charge you big if you want out early, so go with setups that are designed to be fair and let you exit when needed.

| Criteria | Halal shared ownership | Conventional shared ownership |

|---|---|---|

| Involves interest (riba)? | No | Often yes |

| Transparency of agreement | Required | Varies |

| Gharar or risk uncertainty? | Minimized by Sharia rules | Often present |

| Profit/loss sharing? | Yes (Musharakah/Mudarabah-based) | Not guaranteed |

| Common in Islamic banks? | Yes | No |

Related rulings on Islamic banking and halal financial products

Understanding whether shared ownership is halal requires looking at the broader landscape of Islamic finance. For example, many wonder, is working in a bank halal or haram, especially when it involves interest-bearing operations. Similarly, student loans in Islam raise questions around riba, making them a useful comparison point for those assessing financing terms in shared ownership deals.

For savings and investment products, Muslims must consider whether tools like savings accounts, Islamic savings models, or CDs align with their values. Even income from cashback programs needs scrutiny under Shariah law, since not all rewards are considered ethically earned.

Complex fields like investment banking and newer instruments like ISAs also test the boundaries of halal finance. The principles that determine if credit cards are halal directly relate to shared ownership too — especially when financing terms mimic interest-bearing debt.

To get a full understanding of how Islamic finance compares with the conventional model, it's worth reading this foundational overview on Islamic vs conventional banking, which outlines the ethical, legal, and practical differences that shape rulings like whether shared ownership is halal or haram.

Another key issue is not just what you invest in, but how you go about it. To ensure your investments remain halal, it's best to use an Islamic trading account specifically designed to follow Shariah principles. These accounts are structured to avoid interest and other non-compliant practices. We reviewed several leading brokers for halal stock, Forex and crypto trading that offer such accounts and outlined their main features below for your reference.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Unequal risk and vague exits make shared ownership haram

Here’s something people rarely notice in shared ownership setups: just because both sides put in the same money doesn’t mean the risk is actually shared. In real-world cases, especially with homes or cars, one person often ends up handling all the repairs, paperwork, or extra fees while the other just watches the profits. That’s not fair by Islamic standards. If one partner takes on more of the risk or responsibility, even quietly, then the deal loses its balance. In Islam, that imbalance can quietly tip a halal setup into something that’s not permissible.

There’s also the issue of how people leave these agreements. A lot of shared ownership contracts are written in a way that makes it hard to walk away, with penalties, vague buyback terms, or confusing rules that only one side benefits from. That’s a red flag in Islam. Every contract should be clear and give both sides a fair way out. If it doesn’t, then one person ends up stuck in a bad situation, and that’s not in line with what Shariah teaches about mutual respect and fairness.

Conclusion

Shared ownership balances modern finance needs with Islamic values. The key question many Muslims ask is, "is shared ownership haram?" The answer depends not on shared ownership itself, but on how the arrangement is structured. If based on Shariah principles — avoiding riba, minimizing gharar, and ensuring fairness — it can be permissible. Contracts like Musharakah and Mudarabah support transparent, fair partnerships.

However, some models, especially in real estate or investments, may involve hidden interest or unequal risk-sharing, making them haram. Therefore, addressing the question "is shared ownership haram?" requires careful analysis and consultation with scholars to ensure compliance with Islamic finance principles.

FAQs

Can shared ownership apply to non-property assets like startups or equipment?

Yes. Shared ownership isn’t limited to homes, it can apply to startups, vehicles, or equipment leasing too. As long as contracts are clear, risks and profits are fairly split, and no interest is charged, it can still be halal.

Does the intention behind the contract matter in Islamic finance?

Absolutely. Even if the structure is halal on paper, if the intent is to mimic interest-based outcomes or deceive the other party, it undermines the ethical foundation of Islamic finance.

Are buyback agreements in shared ownership always halal?

Not necessarily. If the buyback guarantees a fixed profit or return regardless of asset performance, it resembles riba. Shariah-compliant models must base returns on actual asset value and shared risk.

What role do scholars play in validating shared ownership contracts?

Qualified scholars review and certify contracts to ensure they meet Shariah standards. Without their validation, even well-intended deals can unintentionally include haram elements like hidden interest or unfair clauses.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.