Lazarus Group tied to Bybit exploit, laundered over 50% of stolen ETH

Lazarus Group laundered 270K ETH

Lazarus Group laundered 270K ETH

In a dramatic twist in the ongoing saga of cryptocurrency security breaches, authorities have identified the notorious Lazarus Group as the orchestrator behind the recent Bybit exploit.

Reports indicate that the group has laundered approximately 270,000 ETH—valued at about $605 million—accounting for 54% of the stolen funds, while still holding an additional 229,395 ETH worth roughly $514 million. This revelation has deepened concerns over the security of crypto exchanges and the sophisticated methods employed by cybercriminals.

Key takeaways

- Stolen Funds and Laundering: The hackers laundered 270K ETH ($605M) through THORChain, holding another 229K ETH ($514M).

- According to several blockchain analytics companies, including Arkham Intelligence, Lazarus Group is suspected of being involved in the Bybit hack.

- Regulatory and Security Implications: The incident underscores the urgent need for robust cybersecurity measures and regulatory oversight in the crypto industry.

The exploit and response

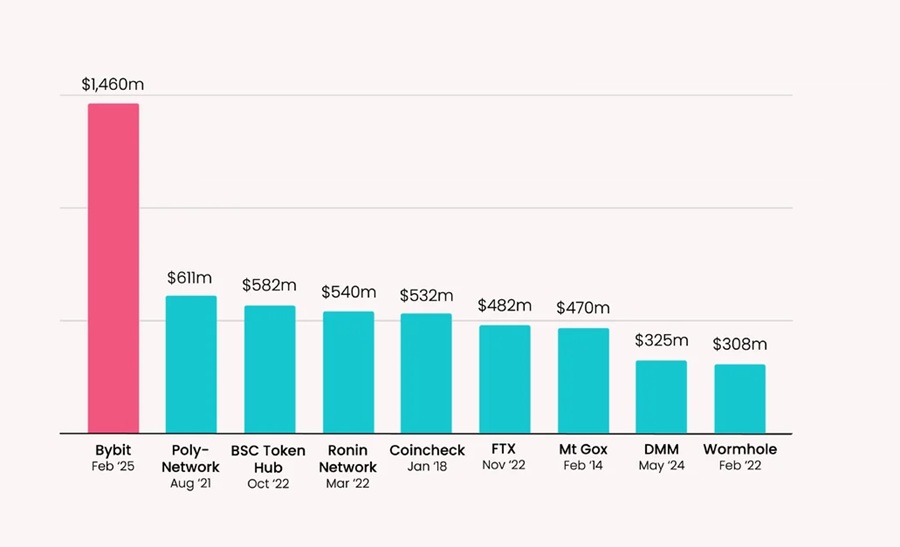

Bybit, a leading cryptocurrency exchange, recently suffered a severe security breach when hackers exploited vulnerabilities in its ETH cold wallet. This hack was the biggest hack of all time.

Largest crypto heist. Source: Elliptic

On the same day, CEO Ben Zhou confirmed the incident, assuring that the situation was quickly contained and that withdrawals had been restored.

The breach, however, left a lasting impact on the market, as a substantial amount of ETH was siphoned off during the exploit.

According to Lookonchain, hackers have laundered $270,000 $ETH ($605 million, 54% of stolen funds) and still hold $229,395 $ETH ($514 million).

Loading...

Laundering Via THORChain

Further investigation revealed that the Lazarus Group is using THORChain as a channel to launder the stolen funds. The group’s strategy allowed them to convert a significant portion of the misappropriated ETH into liquid assets, complicating efforts to trace the illicit gains.

Analysts warn that such sophisticated techniques not only highlight the evolving threat landscape but also challenge regulatory bodies to keep pace with emerging digital asset laundering methods.

Conclusion

As the crypto industry grapples with increasingly complex security challenges, the Lazarus Group’s actions serve as a stark reminder of the persistent risks.

Moving forward, exchanges like Bybit will likely bolster their security protocols, while regulators may intensify efforts to clamp down on illicit activities in the digital asset space.

We also wrote that Bybit launched $140M Lazarus Bounty to track stolen crypto funds.