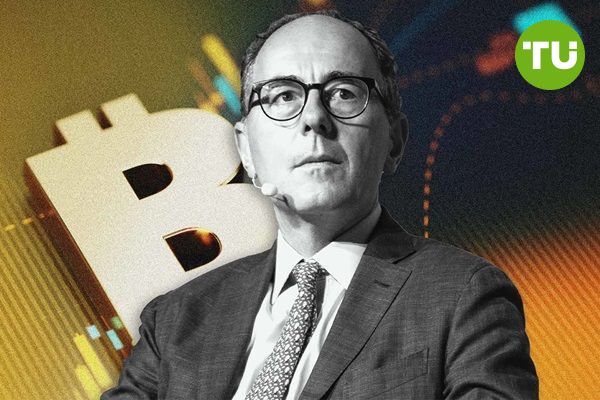

VanEck CEO forecasts Bitcoin to reach $300K, matching half of gold’s market cap

VanEck emphasized Bitcoin's growing adoption

VanEck emphasized Bitcoin's growing adoption

Jan van Eck, CEO of the global investment firm VanEck, has made a bold forecast that Bitcoin could surge to $300,000, positioning it at roughly half of gold’s current market capitalization.

This prediction comes as the crypto market continues to experience heightened interest from institutional investors and a broader acceptance of digital assets as a store of value, Cryptopolitan reported.

Bitcoin’s Rising Appeal Amid Inflation Concerns

During a recent interview, VanEck emphasized that Bitcoin could be the next “digital gold” as a savings asset. Bitcoin's growing adoption and its fixed supply make it an attractive hedge against inflation, comparable to gold. He noted that as more investors seek alternatives to traditional assets, Bitcoin's scarcity and decentralized nature are likely to drive its value even higher. According to VanEck, reaching the $300,000 mark would mean Bitcoin achieving half the market cap of gold, which currently stands at approximately $12 trillion.

Loading...

VanEck's forecast reflects a broader shift among institutional investors who are increasingly viewing Bitcoin as a legitimate store of value. The CEO’s prediction aligns with VanEck’s broader strategy, which has included significant investments in cryptocurrency products, such as Bitcoin exchange-traded funds (ETFs), to cater to the growing demand for digital assets.

Institutional Adoption Could Fuel Bitcoin’s Price Surge

The VanEck CEO highlighted that Bitcoin's trajectory towards $300,000 could be accelerated by the continued entry of institutional players into the market. With major financial institutions and asset managers showing increased interest in digital assets, the stage is set for Bitcoin to potentially rival traditional safe-haven investments like gold.

Reminder, Bitcoin price surges to record $77,000, on-chain metrics support continued growth.