Arthur Hayes bets big on Bitcoin as altcoins slide into accumulation zones

Arthur Hayes bets big on Bitcoin as altcoins slide

Arthur Hayes bets big on Bitcoin as altcoins slide

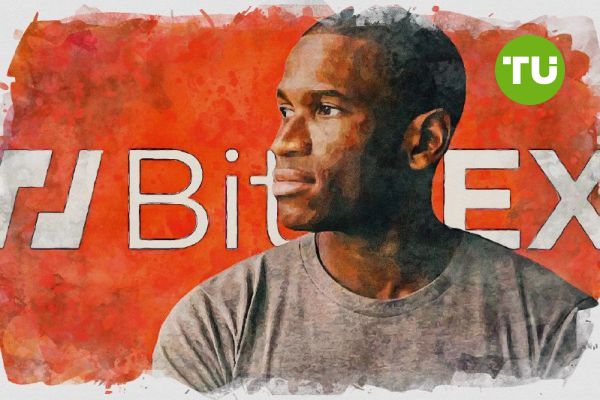

Arthur Hayes, co-founder and former CEO of cryptocurrency exchange BitMEX, is doubling down on Bitcoin amid a turbulent period in the broader crypto market.

In a recent post on social platform X, Hayes said he has been “nibbling on $BTC all day,” signaling a continued belief in the digital asset’s resilience even as altcoins experience sharp declines, according to the Cryptopolitan.

Hayes’s renewed confidence comes as Bitcoin’s dominance in the cryptocurrency market climbs to 62.56%—its highest level since January 2021. He predicts this figure could surge to 70%, reflecting a potential reallocation of capital toward Bitcoin as investors seek safety from the volatility that has rocked smaller cryptocurrencies.

Whales align with Hayes as market recalibrates

On-chain data from Glassnode reveals that high-value investors, known as whales, are echoing Hayes’s strategy. Wallets holding over 10,000 BTC briefly reached an accumulation score of 1.0 earlier this month, marking 15 days of consistent buying. Although that rate has since dropped to 0.65, whales continue to buy, in contrast to mid- and small-scale holders who have been offloading their positions.

Bitcoin has shown greater resilience than other leading cryptocurrencies. While BTC is up 16.95% year-to-date, Ethereum, Solana, and Dogecoin have each posted losses exceeding 45%. According to Hayes, Bitcoin’s strength lies in its perceived role as a hedge against macroeconomic uncertainty. He anticipates a return to quantitative easing by global central banks—an environment in which he expects Bitcoin to thrive.

“Bitcoin is the flight to safety,” Hayes noted, suggesting that current market conditions are creating a new accumulation zone not only for whales but also for those looking to reposition ahead of potential long-term gains.

Meanwhile, the cryptocurrency market may continue to face a short-term downturn due to weakening institutional demand for Bitcoin and Ethereum futures on the Chicago Mercantile Exchange (CME), according to analysts from investment bank JPMorgan.