Michael Saylor celebrates Bitcoin hitting $106,000 with "Moon" tweet

Bitcoin hits $106K ATH, Saylor celebrates with bold vision

Bitcoin hits $106K ATH, Saylor celebrates with bold vision

Bitcoin (BTC), the world’s largest cryptocurrency, surged to a new all-time high, briefly touching $106,488 before retreating to around $104,700.

This milestone sparked enthusiasm across the crypto community, with prominent Bitcoin advocate Michael Saylor sharing his optimistic sentiment on social media.

Michael Saylor’s “Moon” Tweet

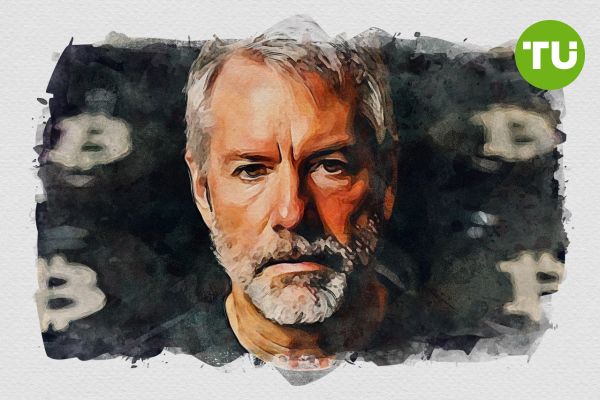

Michael Saylor, cofounder and executive chairman of MicroStrategy, marked the occasion with a tweet featuring an AI-generated image of himself as an astronaut planting an orange flag with the Bitcoin logo on the Moon. Accompanied by the caption “I will see you on the Moon. #Bitcoin,” the tweet captured the celebratory spirit as Bitcoin enthusiasts filled the comments with messages of optimism.

Loading...

Saylor has long been known for his unwavering support of Bitcoin, which has positioned MicroStrategy as one of the largest corporate holders of the cryptocurrency. According to the latest data, MicroStrategy’s BTC reserves amount to approximately 386,000 BTC.

MicroStrategy stock gains momentum

MicroStrategy’s association with BTC has also positively impacted its stock performance. The company’s shares rose 4.2% to $408.67 on the same day Bitcoin achieved its historic high.

The road ahead

Saylor has bold ambitions to transform MicroStrategy into a trillion-dollar enterprise, with BTC serving as the cornerstone of this vision. As MicroStrategy increasingly aligns itself with cryptocurrency, Saylor has suggested that the company could evolve into a “Bitcoin Bank,” leveraging its holdings to become a financial hub for the digital age.

In a recent interview with Yahoo Finance!, Saylor presented a compelling case for why the U.S. should shift its focus from gold to Bitcoin as a strategic reserve asset.

Bitcoin’s record-breaking rally underscores its enduring appeal as a store of value and an investment vehicle, cementing its role in shaping the future.