Kraken expands in EU with new MiCA license

Kraken gains EU-wide crypto license

Kraken gains EU-wide crypto license

Kraken, a leading U.S.-based cryptocurrency exchange, has secured a Markets in Crypto-Assets (MiCA) license from the Central Bank of Ireland, enabling it to offer regulated crypto services across all 30 countries in the European Economic Area (EEA).

Key Takeaways

- Pan-European Access: The MiCA license allows Kraken to provide crypto services throughout the EEA under a unified regulatory framework. beincrypto.com

- Enhanced Compliance: Kraken's MiCA license complements its existing regulatory approvals, including Virtual Asset Service Provider (VASP) registrations in France, Italy, Spain, and the Netherlands, as well as an E-Money Institution (EMI) license in Ireland.

- Strategic Expansion: The license positions Kraken to expand its product offerings and client base across Europe, aligning with its goal to build a robust crypto ecosystem in the region.

Kraken is expanding into the EU

Kraken's acquisition of the MiCA license from the Central Bank of Ireland marks a significant milestone in its European expansion strategy. This license permits Kraken to offer a range of regulated crypto services, including trading, derivatives, and payment solutions, across the entire EEA.

Loading...

Arjun Sethi, Kraken's co-CEO, emphasized the importance of this development, stating that the license reflects the company's commitment to building trust and delivering secure, accessible crypto services to a broader audience in Europe.

The MiCA framework, effective from December 2024, aims to harmonize crypto regulations across the EU, providing a clear and consistent regulatory environment for crypto-asset service providers. Kraken's compliance with MiCA positions it favorably to meet the growing demand for regulated crypto services in Europe.

With the euro accounting for 17.5% of global fiat spot crypto trading volume—a figure that has more than doubled over the past year—Kraken's enhanced regulatory standing is expected to attract both retail and institutional clients seeking reliable and compliant crypto platforms.

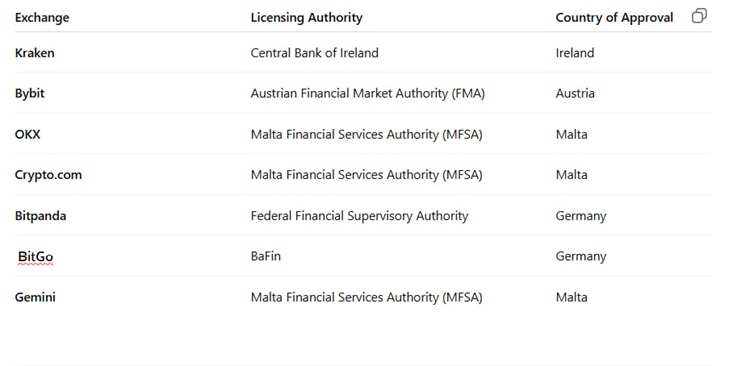

As of June 2025, several major cryptocurrency exchanges have secured licenses under the European Union's Markets in Crypto-Assets (MiCA) regulation. This framework allows licensed entities to offer crypto services across all 30 European Economic Area (EEA) countries.

Conclusion

Kraken's MiCA license from the Central Bank of Ireland signifies a pivotal advancement in its efforts to expand within the European crypto market.

By aligning with the EU's comprehensive regulatory framework, Kraken is well-positioned to offer a wide array of crypto services across the EEA, catering to the increasing demand for regulated digital asset platforms.

Recently we wrote Kraken launches regulated crypto derivatives trading in Europe.