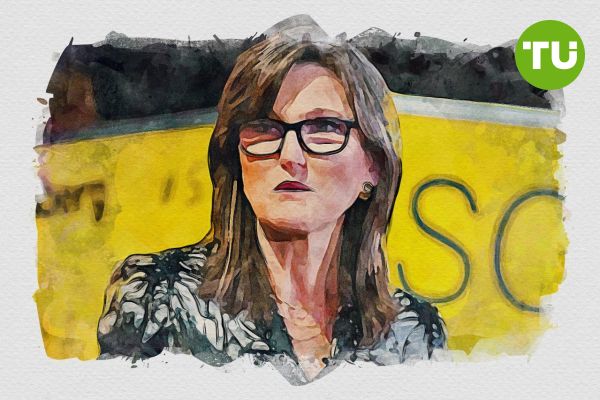

Cathie Wood Ark Invest adjusts Coinbase holdings after price drop

Ark trims Coinbase stake, selling $3.9M after Fed cut

Ark trims Coinbase stake, selling $3.9M after Fed cut

Ark Invest, led by Cathie Wood, has sold 13,780 shares of Coinbase (COIN) worth $3.9 million from its Fintech Innovation exchange-traded fund (ARKF).

The sale took place on Wednesday following a 10% drop in COIN’s price after the Federal Reserve adopted a more hawkish stance, The Block reports.

Federal Reserve implements third rate cut in 2024

The Federal Reserve, under the leadership of Jerome Powell, announced its third interest rate cut of the year, lowering the federal funds rate to a range of 4.25% to 4.5%. Powell emphasized that the risks to achieving employment and inflation targets are now balanced, reflecting a relatively stable U.S. economy.

Powell also stated that the Federal Open Market Committee (FOMC) has no predefined schedule for further adjustments, noting that future decisions will depend on economic data, evolving risks, and the broader outlook.

Crypto market reaction to powell’s remarks

During the FOMC’s final meeting of the year, Powell clarified the central bank’s stance on cryptocurrency. “We are not allowed to own Bitcoin,” he stated, stressing that any legal authority for the Federal Reserve to hold cryptocurrencies would require Congressional approval, a move the Fed does not intend to pursue.

Powell’s comments appeared to unsettle cryptocurrency traders. Bitcoin (BTC) saw a sharp decline, dragging down altcoins such as Ethereum (ETH), XRP, and Solana (SOL), contributing to a broader market downturn.

Ark Invest’s strategy for Coinbase holdings

This recent sale marks one of Ark Invest’s most significant transactions involving Coinbase stock since September 23, when the firm sold $2.8 million worth of COIN shares. Ark’s investment strategy avoids allowing individual holdings to exceed 10% of an ETF portfolio to maintain diversification. As COIN’s value fluctuates, the firm continues to rebalance its portfolio to adhere to this threshold.

According to the latest disclosures, Coinbase remains the second-largest holding in ARKF, accounting for 9.9% of the fund’s portfolio, just behind Spotify. ARKF’s Coinbase holdings are valued at approximately $110 million, with the fund achieving a 54% gain year-to-date.

Coinbase stock performance

Coinbase’s stock closed at $279.86 on Wednesday, reflecting a 10.2% daily drop. Despite this, COIN rose by 3.7% in pre-market trading and has gained over 79.97% year-to-date, according to TradingView. The stock’s performance highlights its volatility and importance within Ark’s portfolio, as the firm continues to monitor and adjust its holdings to align with broader investment goals.

Meanwhile, Cathie Wood has previously expressed enthusiasm for Bitcoin’s rapid growth and its evolving role in the global financial ecosystem.