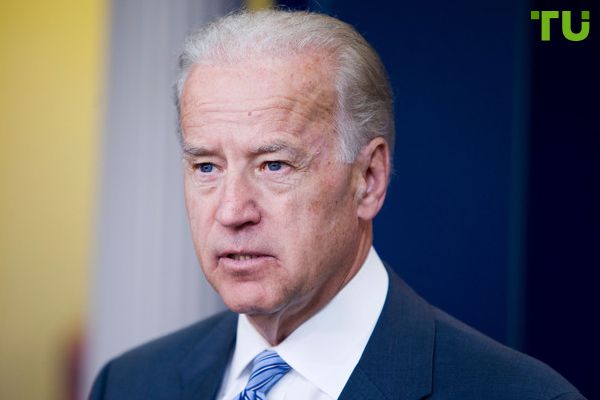

Biden faces pressure over veto of crypto accounting policy repeal

Biden faces pressure over veto of crypto accounting policy repeal

Biden faces pressure over veto of crypto accounting policy repeal

The bulletin, jointly promoted by the House of Representatives, requires financial institutions holding crypto-assets on behalf of clients to include those assets on their balance sheets, has faced a major backlash from both lawmakers and the cryptocurrency industry.

Congress Moves to Overturn SAB 121. In a notable bipartisan effort, the U.S. Senate recently voted 60-38 to pass H.J. Res 109, a resolution aimed at overturning SAB 121. This follows a similar approval from the House of Representatives, where 21 Democrats joined Republicans in opposing the SEC’s policy.

Critics of SAB 121 argue that it imposes onerous operational and financial burdens on firms, potentially exposing customers' assets to risks in bankruptcy situations. Senator Cynthia Lummis, a prominent advocate for the resolution, highlighted that placing customers’ assets on institutional balance sheets could jeopardize those assets during bankruptcies, thereby failing to protect consumers, informs Coindesk.

Despite Congress passing the resolution, President Biden decided to veto the measure. The administration argues that SAB 121 is essential for maintaining investor protection and financial system stability. According to Cointelegraph, president Biden's position is backed by the SEC, which defends the bulletin as a necessary response to technological, legal, and regulatory risks associated with crypto assets.

The potential veto has sparked significant debate within the political and financial communities. Proponents of the resolution, including several banking associations, argue that SAB 121 deviates from traditional accounting practices and imposes unfair burdens on banks compared to non-bank digital asset platforms.

Loading...

Conversely, progressive Democrats like Rep. Maxine Waters contend that the policy ensures transparency and proper accounting for custodial assets, which are critical for preventing fraud and protecting investors, reports Coingape.

If President Biden vetoes the resolution, Congress could attempt to override the veto, though this would require a two-thirds majority in both chambers. The outcome of this legislative battle will have far-reaching implications for the regulation of digital assets and the broader financial industry. As the debate continues, stakeholders on all sides will be closely monitoring the administration’s next moves and their potential impact on the evolving landscape of cryptocurrency regulation.