Justin Sun criticized Coinbase's wrapped Bitcoin

Justin Sun criticized Coinbase's wrapped Bitcoin

Justin Sun criticized Coinbase's wrapped Bitcoin

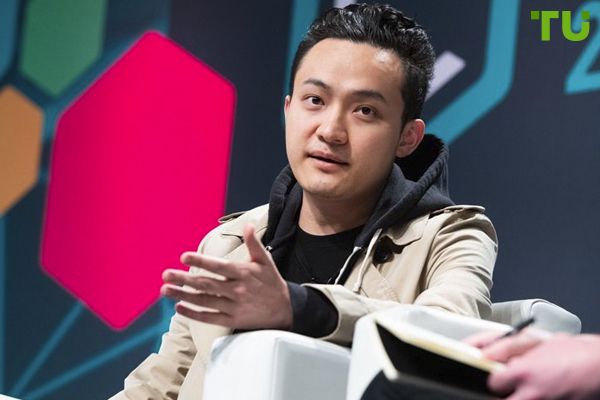

Justin Sun, founder of the TRON blockchain and a prominent figure in the cryptocurrency world, has sharply criticized Coinbase’s latest launch of a new form of wrapped Bitcoin (WBTC), referring to it as “Central Bank Bitcoin.”

The move comes amidst growing debate over the future of WBTC, a key asset in decentralized finance (DeFi), and raises broader concerns about centralization and control within the cryptocurrency space.

Coinbase, a leading U.S.-based cryptocurrency exchange, recently introduced its version of wrapped Bitcoin, a token that allows Bitcoin to be used on Ethereum and Base networks. Wrapped Bitcoin is essentially a 1:1 representation of Bitcoin, but in tokenized form, allowing users to engage in decentralized applications (dApps) and smart contracts. However, Sun has raised alarms about the implications of Coinbase’s new cbBTC product, particularly in relation to the decentralized ethos of cryptocurrency.

Sun's criticism stems from his concerns over the level of control Coinbase will have over this new version of BTC. With Coinbase at the helm, Sun argues that this new token represents a step toward centralization, putting too much power into the hands of one entity. He referred to it as “Central Bank Bitcoin,” alluding to the concerns that it could behave more like a centrally managed asset than a decentralized cryptocurrency.

“By giving Coinbase the reins, we risk turning Bitcoin into something that behaves more like a traditional, centrally managed asset rather than staying true to its decentralized roots,” Sun tweeted, reflecting broader concerns within the crypto community about maintaining decentralization as large companies move into the space.

Loading...

The controversy surrounding wrapped Bitcoin is not new. According to TU Crypto News, DeFi protocol community Sky (MakerDAO) plans to abandon the use of wrapped bitcoin WBTC but Coinbase's entry into this space adds a fresh layer to the debate. WBTC has been a cornerstone of DeFi, enabling users to leverage the value of Bitcoin on platforms like Ethereum, where they can engage in lending, borrowing, and trading. However, WBTC is custodied by a central entity that holds the corresponding Bitcoin, creating concerns about its susceptibility to manipulation or centralized control.

Coinbase’s involvement has only intensified these concerns. Critics like Sun argue that centralization risks go against the very foundation of Bitcoin, which was designed to eliminate reliance on centralized intermediaries. By managing a large portion of wrapped Bitcoin, Coinbase could potentially influence or even control the token’s supply, sparking fears of a concentration of power in the hands of a single institution.

For now, all eyes will be on how Coinbase manages its version of cbBTC and how the community responds. Whether Sun’s warnings about centralization resonate with the broader crypto market remains to be seen, but the controversy has certainly sparked important conversations about the future of Bitcoin and DeFi.

Read also: Robinhood has introduced a new Gold Standard with premium offers