Trump's 90-day tariff pause boosts U.S. markets

Trump’s 90-day tariff pause sparks market rallies

Trump’s 90-day tariff pause sparks market rallies

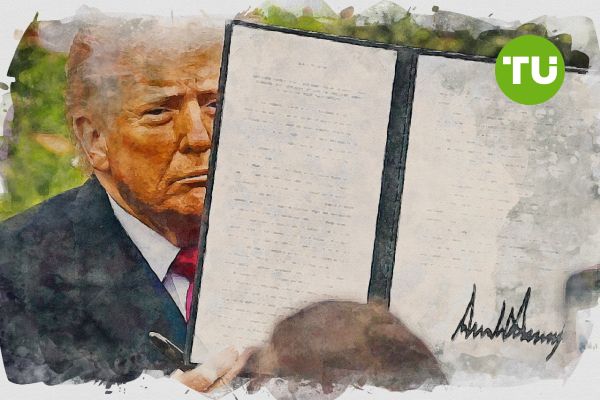

On April 9, President Donald Trump announced a significant shift in U.S. trade policy by imposing a 90-day pause on reciprocal tariffs.

Speaking on Truth Social, Trump outlined that the U.S. would lower the tariff rate to 10% on imports from countries that refrain from enacting counter-tariffs. However, in a stark contrast, he declared that the reciprocal tariff rate on China would be increased to 125% as a response to Beijing’s countermeasures. This move is designed to ease tensions with trading partners that play by the rules while signaling a tougher stance against those that do not, specifically targeting China’s aggressive tariff practices.

Market reaction and future implications

The announcement immediately influenced the financial markets. Data from TradingView shows that the S&P 500 index rallied nearly 7%, while the Nasdaq surged about 8%. This robust response underlines how sensitive global markets are to trade policy shifts amid prevailing macroeconomic uncertainty. Investors welcomed the pause as a temporary alleviation from escalating trade conflicts and retaliatory measures that have weighed on market confidence. Despite the relief provided by the lower tariffs for compliant nations, the planned steep increase for Chinese imports underscores that the U.S. remains resolute in using tariff policy as a strategic tool to counter unfair trade practices.

Looking ahead, industry analysts expect this temporary pause to open a window for renewed negotiations with key international partners. However, with the U.S. setting tougher standards for China, market participants and policy watchers will continue monitoring for further adjustments that may impact global trade dynamics and economic stability.

Read also: Maxine Waters claims Trump doubled wealth through fraudulent crypto projects