Palantir Technologies stock climbs to $92 on trade relief and enterprise demand

Palantir also benefited from a flurry of company-specific announcements.

Palantir also benefited from a flurry of company-specific announcements.

As of April 10, 2025, Palantir Technologies Inc. (NYSE: PLTR) is trading at $92.01, following a sharp rally of nearly 19% the previous day.

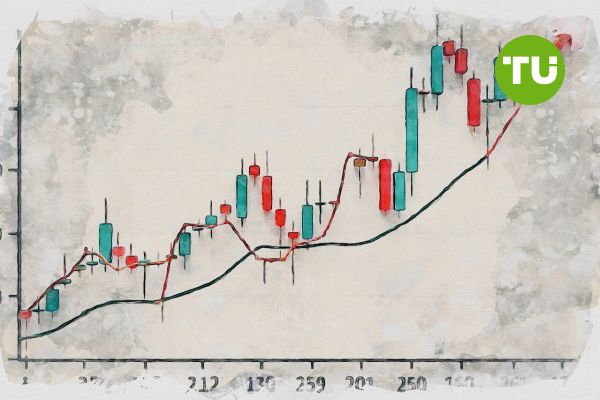

The stock is now testing its 50-day moving average, a key short-term technical threshold that often acts as resistance. PLTR has struggled in recent weeks, trading below both its 50-day and 200-day moving averages, but the sudden surge has brought it back into bullish contention.

From a chart perspective, the stock appears to be forming a double-bottom pattern, with lows near $66 and a potential breakout level at $98.17. This formation is generally interpreted as a bullish reversal indicator, especially if confirmed with strong volume. Current RSI (Relative Strength Index) levels are approaching 65, not yet overbought, suggesting room for further upside if momentum continues.

PLTR stock price dynamics (February 2025 - April 2025). Source: TradingView.

Support is visible at $85, which coincides with a short-term consolidation range seen in March. A failure to hold above this level in the coming sessions may lead to a retest of the $75 zone, which served as interim support during previous pullbacks. On the upside, if PLTR can close above $98.17, the next resistance lies near $105, a level not seen since early 2024.

Market context and recent developments

PLTR’s recent price action is occurring within a broader market recovery. On April 9, the U.S. equity markets surged after President Donald Trump announced a 90-day temporary rollback of tariffs on a wide array of imported goods. This news triggered a massive relief rally, with the Nasdaq Composite climbing more than 12%, its best day in over a year. Tech stocks, particularly those with high beta like Palantir, led the charge as investors rotated back into growth-oriented names.

Palantir also benefited from a flurry of company-specific announcements. The company disclosed that it had signed six new high-value enterprise clients in Q2, including government and Fortune 500 contracts. Additionally, the firm deepened its collaboration with Databricks, a leading AI platform backed by Nvidia, to integrate AI-driven analytics into federal agency operations. These moves have significantly improved sentiment around Palantir’s growth prospects and have helped reverse a multi-week downtrend in the stock.

The company has also hinted at an upcoming product launch that leverages its Foundry platform with generative AI enhancements. Though details remain scarce, investors have interpreted this as a potential revenue catalyst, particularly in the public sector where PLTR already maintains a strong presence.

PLTR price scenarios

In the immediate term, PLTR’s technical setup suggests a bullish continuation is possible, but not guaranteed. A confirmed breakout above the $98.17 level would validate the double-bottom formation and could propel the stock toward $105–$110, assuming macro conditions remain supportive. This would mark a roughly 15% upside from current levels.

However, risks remain. If the recent rally proves to be a relief bounce rather than a sustainable reversal, the stock may fall back below $85. In a more bearish scenario, PLTR could revisit the $75–$78 support band or even retest the recent $66 low if broader market sentiment deteriorates.

Meanwhile, Nvidia (NVDA) is trading at $114.33, up over 9% from the prior session. The stock saw heavy volatility and massive volume, with over 612 million shares traded, indicating strong institutional interest.