Chamath Palihapitiya, a prominent venture capitalist and entrepreneur, addresses a critical challenge facing the United States in the evolving ...

Investment and Market Perspectives from Chamath Palihapitiya

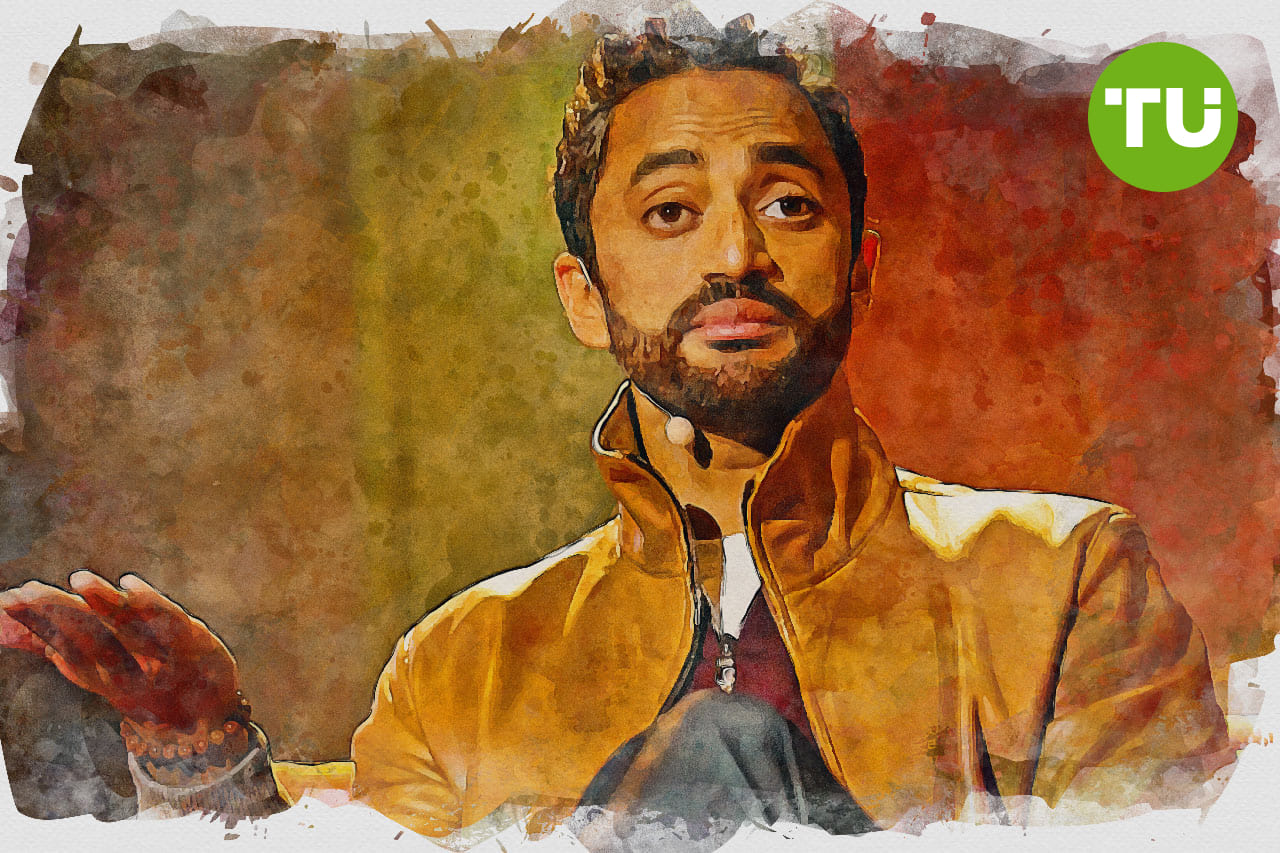

Chamath Palihapitiya has carved out a reputation for doing things differently. He rose to prominence at Facebook, where he played a key role in driving user growth and building the company’s ad business. That success helped him launch Social Capital, a venture firm that backs early-stage companies with big ideas, especially in sectors like AI, blockchain, and healthcare. As of 2025, the firm manages over $10 billion, and Chamath remains known for calling out problems in traditional finance while pushing for a more open system.

His net worth is estimated at $2.1 billion, thanks to early investments in tech giants like Facebook and Slack, as well as his high-profile SPAC deals. In 2024, he launched a blockchain-powered investment fund and a decentralized venture model through an investment DAO. Chamath is a regular voice on finance podcasts and investor panels, often sharing blunt takes that stir debate. Love him or not, he has a knack for seeing where markets are headed and betting on it before others do. His work sits at the crossroads of old-school capital and future-facing tech, and he shows no sign of slowing down.

Chamath Palihapitiya, the founder of Social Capital, has announced a significant interest in Software Factory, a new productOS, as thousands have ...

Chamath Palihapitiya, a prominent investor and venture capitalist, has observed a notable change in the presence of Tesla vehicles in Milan over the ...

Chamath Palihapitiya, a noted investor and venture capitalist, stated that Groq has positioned itself as a leader in the AI inference market by ...

Chamath Palihapitiya, a prominent venture capitalist and entrepreneur, has announced the development of a new platform called Software Factory. This ...

Chamath Palihapitiya has highlighted a critical issue in the corporate adoption of Artificial Intelligence. In a recent tweet, Palihapitiya, the ...

Chamath Palihapitiya, a prominent venture capitalist and CEO of Social Capital, emphasizes China's ambitious drive into solar energy. According to ...

Chamath Palihapitiya, a prominent venture capitalist and former executive at Facebook, poses an intriguing question in a recent tweet regarding ...

Investors are taking notice as Chamath Palihapitiya points out the impending refinancing of over $3 trillion in maturing federal debt by the U.S. ...

Chamath Palihapitiya, a prominent venture capitalist and founder of Social Capital, has highlighted a potential shift in New York's real estate market. ...

In a recent tweet, Chamath Palihapitiya highlighted the crucial role of vertical integration in the success of artificial intelligence. He stressed ...

Chamath Palihapitiya, a well-known venture capitalist, suggests a favorable shift in market disclosures underway. Palihapitiya, a significant figure ...

Chamath Palihapitiya, a prominent investor and founder of Social Capital, is advocating for a rate cut by the Federal Reserve. In a recent tweet, ...

Chamath Palihapitiya, a prominent venture capitalist and social capital CEO, has voiced his view that ''stablecoins are the grand unifying theory of ...

Chamath Palihapitiya, a prominent venture capitalist, raises concerns about the current state of the venture capital industry.In a recent tweet, ...

Chamath Palihapitiya, well-known investor and founder of Social Capital, has shared his personal experiences with financial leverage during the years ...

Chamath Palihapitiya, a prominent venture capitalist, recently suggested that Ripple or Coinbase could benefit from acquiring Circle. In a tweet, ...

Chamath Palihapitiya, a prominent venture capitalist and former Facebook executive, has taken to social media to express his disdain for what he ...

Venture capitalist Chamath Palihapitiya has publicly criticized American Express, labeling its marketing department as one of the laziest among large ...

Investor Chamath Palihapitiya has indicated a shift towards hard assets as potential safe trades, amidst growing uncertainties in the global economic ...