Trading platform:

- FastSpring Wallet

- GDPR

FastSpring (Fast Spring) review in 2024

- 200

- 8.9% or 5.9% +95 cents per transaction

Currencies:

- 20

cryptocurrencies:

- No

Summary of FastSpring

The FastSpring payment system is one of the leading payment services in the digital products segment. It was originally developed for online stores that sell software. However, today FastSpring has several discrete solutions for the B2B division, allowing it to accept most payments, process them promptly, and systematize them. There are functions to automate accounting, tax reporting, supply chain, and personnel management. All financial flows are aggregated in an account that can be accessed via a mobile app. Given all these advantages, many experts argue that the service has no full-featured alternative.

| 💼 Main types of accounts: | One type of account, customizable individually |

|---|---|

| 💱 Multi-currency account: | Yes, many choices |

| ☂ Deposit insurance: | 8.9% or 5.9% + 95 cents per transaction |

| 👛️ Savings options: | Data aggregation, monitoring, reporting, conversion tools, accounting, and taxation automation |

| ➕ Additional features: | B2B solutions, risk management options, fraud protection |

👍 Advantages of trading with FastSpring:

- It is simple to set up and manage, and the service integrates easily into the system regardless of its technology stack.

- High-speed operation with instant or almost instant transactions of all types.

- FastSpring solutions are available in 200 regions globally and support 15 languages (with full localization).

- Service allows you to accept and make payments in 20 currencies without restrictions or limits.

- The universal application aggregates financial flows, providing absolute control and complete transparency.

- Built-in options and modules to increase the conversion rate of the online store.

- The function of recurring and regular payments (for example, if users subscribe).

👎 Disadvantages of FastSpring:

- The service is only suitable for digital distribution stores.

- The system offers two pricing plans where the business owner pays 8.9% or 5.9% +95 cents on the transaction value, which is quite a lot.

- Some functions are adapted to specific services. For example, communicating with clients by email implies Mailchimp; you can also set up other email services, but this is more complicated.

Analysis of the main features of FastSpring

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest FastSpring News

- Analysis of FastSpring

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Detailed review

- Banking features

- Social programs

- How to open an account?

- Technical Support

- User Reviews of FastSpring

- FAQs

- TU Recommends

Geographic Distribution of FastSpring

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of FastSpring

The Canadian company FastSpring provides a comprehensive solution for digital B2B transactions. First, it is an electronic payment service that allows receiving and making transfers in the most available ways. For example, customers of an online store that is connected to this platform can pay through an electronic system (say, PayPal) as well as by debit or credit card. Payments through systems like Klarna are also possible.

There are no geographic restrictions, the service is represented in 200 regions, and the platform is fully localized in 15 languages, including English, German, and French. This allows businesses in different countries to use FastSpring.com effectively. Transactions are instantaneous or almost instantaneous, which is the standard of modern internet banking, so we cannot consider this point as an advantage.

FastSpring is implemented in the cloud using the SaaS format. That is, the system has a high level of automation and third-party centralized control. This doesn’t pose a threat to business, but it can be a sticking point for large companies that need a deep elaboration of business processes with the ability to individually adapt each component. In the case of FastSpring, this is possible but difficult.

It is common to note the high transaction fee as a disadvantage, but people forget that for this fee the company provides a full list of services and options for managing digital distribution. The service even allows you to create promotional pages with relevant payment forms, for example, for promotions. Nevertheless, FastSpring.com's transfer fees are indeed higher than the market average.

Dynamics of FastSpring’s popularity among

Traders Union’s traders, according to 2023 data

Investment programs, available markets, and products of FastSpring

FastSpring is an electronic payment system with an extensive list of features designed for stores that sell software and digital goods via the internet. The system doesn’t work with individuals and doesn’t provide investment or other capital-growth solutions, excluding features to increase conversions.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FastSpring Money Transfer Terms & Conditions

FastSpring.com provides the customer with all of its current features. The service has one type of user account, but you can connect different rates for transaction fees. Note that some features will require additional fees. Third-party commissions and fees cannot be calculated in advance, they are provided by support at the request of the client or will be displayed in the user’s account.

A comprehensive FastSpring review shows that the service is highly stable regardless of the load. It integrates with any technical stack and, if everything is OK on the side of the services used, there will be no failures. The system has the proper level of adaptability, and it can be connected to different solutions, including CRM. At the same time, FastSpring doesn’t load the technical capacities of the organization because it operates in the cloud.

Another important point is the dashboard in the mobile app, which accumulates data from all financial and communication channels. FastSpring has a built-in system of interaction between businesses and clients. You don't have to use it specifically, but it's a customized, ready-to-use solution that's proven to be practical in thousands of successful implementations. The review by experts of the Traders Union highlighted FastSpring’s excellent scalability, but also its dependence on business architecture. As a consequence, large organizations built on a monolithic infrastructure may have difficulty implementing some tasks.

| 💼 Main types of accounts: | One type of account, customizable individually |

|---|---|

| 💱 Multi-currency account: | Yes, many choices |

| Deposit terms and conditions: | All remote |

| Loan terms and conditions: | By transaction fee |

| ☂ Deposit insurance: | 8.9% or 5.9% + 95 cents per transaction |

| 👛️ Savings options: | Data aggregation, monitoring, reporting, conversion tools, accounting, and taxation automation |

| Types of payment: | Electronic payments and transfers, Visa/MC cards |

| ➕ Additional features: | B2B solutions, risk management options, fraud protection |

Comparison of FastSpring with other e-payment systems

| FastSpring | Advcash | Payeer | Skrill | Payoneer | 2Checkout | |

| Supported Countries | 200 | 150 countries | 127 countries | 200 countries | All countries | Over 200 countries |

| Supported Currencies | 20 | 9 currencies (USD, EUR, GBP, RUB, BRL, TRY, UAH, KZT, VND) | 3 fiat currencies (USD, EUR, and RUB) and most cryptocurrencies | 40 currencies | 7 currencies – USD, CAD, EUR, GBP, MXN, AUD, JPY | All currencies |

| Support for cryptocurrencies | No | Yes | Yes | Yes (deposit) | No | No |

| Subscription fee | 8.9% or 5.9% +95 cents per transaction | No, only transaction fees | No, transaction fees only | No, only transaction fees | No, only transaction fees | 3.5% + 0.35$, 4.5% + 0.45$ or 6% + 0.60$ per transaction |

| Payment acceptance equipment | No, only software in the form of SaaS | No, only software | No, online only | No, only online | No, only online | No, only online |

FastSpring Commissions & Fees

FastSpring charges a commission for each transaction, similar to those charged by other electronic payment systems. FastSpring charges 8.9% or 5.9% + 95 cents per transaction, depending on the transaction. It's higher than the market average, and most competing systems offer a better price. However, FastSpring fees are reasonable for what it offers.

Fees are not charged for many of the additional services this system provides. For example, the user can connect to a company cash register to receive payments, and this is free. Subscription management, billing, connection to regional and global taxation systems, risk management, and compliance are all included in the standard stack, for which there is no extra charge. Whereas, many FastSpring competitors have similar options that are fully or partially chargeable.

The service may charge other fees, but only for the connection of specialized functions. Full access to these features is available to the user after registration and differs by region. Contact support to find out the price of a particular service or the full stack. For some options, the data is provided in the Personal Account of the user.

The Traders Union also compared FastSpring’s fees with similar types of fees on other e-payment systems.

| FastSpring | Skrill | 2Checkout | |

| Payment commission | 5.9% + $0.95 | Depend on the transaction type and region | 3.5% + 0.35$, 4.5% + 0.45$ or 6% + 0.60$ per transaction |

| Deposit commission | 2% (max $20) | Depend on the transaction type and region | Depending on the payment method |

| Withdrawal commission | $5 | Depend on the transaction type and region | Depending on the payment method |

| Commission for international transfers | 8.9% | Depend on the transaction type and region | Depending on the payment method |

FastSpring.com offers a full range of payment services for businesses involved in the distribution of software and other digital goods. The service is based on the universal payment acceptance system, which operates in 200 countries and accepts payments in 20 currencies. Transfers from electronic systems and debit and credit cards are available. Besides the integration of the payment system, FastSpring customers get solutions for various automated business processes including tax reporting. All data is aggregated in a dashboard mobile application, which is installed on Android and iOS gadgets for free. The system works as a SaaS and is easily scalable.

Detailed review of FastSpring

The convenience of FastSpring for businesses is that the system has some built-in features that solve problems both technically and in terms of digital marketing. For example, FastSpring has provided a regular and recurring payment feature so that customers are invoiced automatically on set terms. A paid subscription is a simple example. A more complicated example is the pattern of a flexible solution, where the customer first gets free software as a demonstration, then chooses a plan with several price ranges.

The automatic notification function is enabled. Notifications can be sent to clients by email, SMS, or in the form of "pushes". At the same time, the system will check the relevance of contacts at specified intervals and update them if necessary. FastSpring Review shows that with this system it's possible to set up a self-service portal with an archive of orders for each account and personalized settings in a few minutes. Few payment services offer such capabilities.

FastSpring.com makes it easy to scale your business and protect yourself from fraudsters. For example, the system implements a 15-factor monitoring algorithm to detect suspicious activity. There's a built-in system for managing chargebacks, which typically involve a tremendous amount of bureaucracy (including digital). The service is General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS) [GDPR and PCI DSS] compliant, with PCI Level 1 in the DSS. This is the highest level for a system to protect user data and ensure privacy.

FastSpring's success by the numbers:

-

0 – the cost of connecting a payment system for business;

-

200% – the possible increase in revenues for companies that use FastSpring;

-

40% – the average increase in conversion when the system is connected;

-

200 – the number of regions in which a business operates through FastSpring;

-

7 million – the number of transactions conducted by the system per year.

FastSpring.com presents real cases of companies that have seen their conversion rates increase to 66% and their annual growth rate increase to 50+% after joining the system.

Useful features of FastSpring:

-

Acceptance of most types of payments via the internet. The system operates in 200 countries and accepts payments from electronic systems and plastic cards of most banks.

-

Automatic invoicing, including regular invoices (e.g., subscriptions). The system allows you to set a template for generating payments and automate each execution.

-

On-site individualized multicurrency terminal. The client can customize the payment system at the front and back to meet most business requirements.

-

The system is highly adaptable and scalable. No matter the size of the business or where it is registered, FastSpring connects to any electronic stack.

-

The system can be integrated with custom solutions. For example, FastSpring is easy to connect to CRM, so you can get end-to-end statistics and aggregate data.

-

The system’s client service is connectable and adaptable in minimal time to any platform. Plus, there is a built-in service for sending mass and personal notifications.

-

The designer module allows you to make an online store with no development experience. Also, there are hundreds of customizable templates and intelligent product displays.

-

Built-in function for testing the system and its components before implementation. There is support for different types of online cash registers. The Popup Checkout is the most universally used option.

The fact that Adobe, Akai, Sketch, MailBird, and some other world-renowned software companies use the system speaks loudly about its effectiveness.

Advantages of FastSpring’s payment system:

If you have a small business, you plug in a ready stack and accept payments from all over the world in 20 currencies.

Medium and large businesses can deeply customize every aspect of the system, down to the communication channels.

FastSpring provides related solutions like a user support system.

In the account, you can choose additional features and options, and control transactions through your user account on the site or in the application.

The application aggregates data from the payment system and related business processes and displays them graphically in the dashboard.

Built-in anti-fraud protection ensures that user data and funds are secure.

The system works quickly and steadily, and transactions are implemented quickly.

Integration with any electronic stacks and third-party systems, including CRM, is available.

The client receives a branded cash register, which can simply build on a template or be customized by the software.

FastSpring even has a website builder that allows you to create an online sales outlet in minutes.

As a reminder, the system is designed for those who sell software and digital products. It cannot be used in other areas. For example, if you have an online store of clothes and accessories, or if you own a cafe or a delivery service, this solution will not work for you.

Banking features

Users are offered not just a payment system, but a comprehensive solution that includes some internet banking functions. Technically, international transfers and the ability to aggregate data about them in a mobile application can be attributed to internet banking, as well as functions to automate the issuance/production of payments, accounting, and tax reporting. All these features are an integral part of a modern banking system. With the proliferation of mobile banks, e-payment services have also begun to provide their clients with an expanded list of services to stay at the forefront of technological advances. FastSpring is the benchmark system for such services.

Social programs of FastSpring

The company has no social programs. It is aimed at providing comprehensive services in the field of e-payments, including related solutions for businesses that implement software.

How to open an account at FastSpring

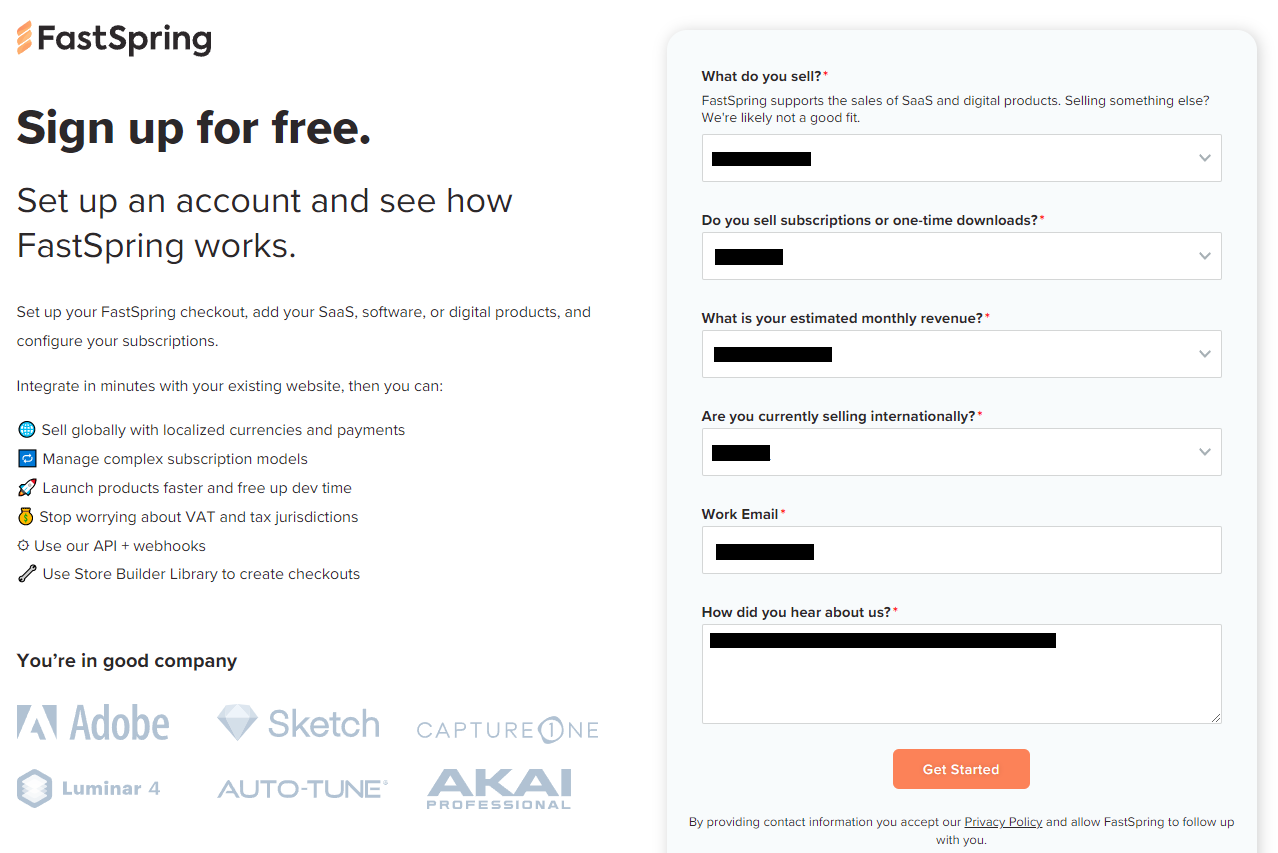

Go to FastSpring.com. Click the "Get Started" button in the upper right corner of the screen. The system will offer you two options – get a demo version or do a full registration. To get the demo version, you'll need to provide your contact information and business details. After that, a manager will contact you using the specified contacts, specify some points and instruct you on how to use the system. The demo allows you to evaluate all the features of the service for free but does not give you full access to it.

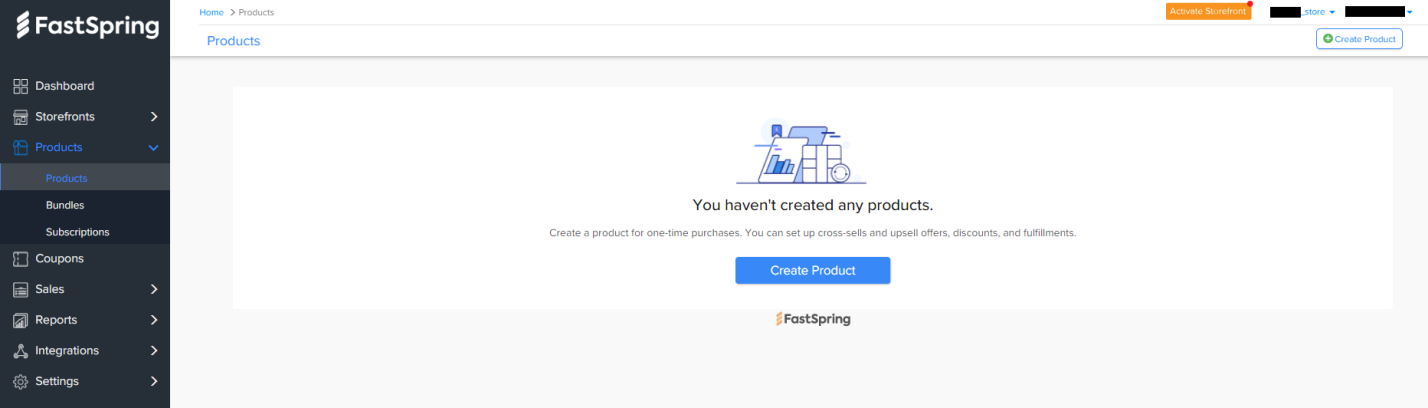

If you don't need a demonstration or are already familiar with the service, click the "Sign Up" button after the "Get Started" button. The left side of the screen will show you the basic FastSpring features, and the right side will show you the form to fill out. Describe your business and select the appropriate categories in the fields provided. After that, enter your organization's official email address, its name, your first and last name, and your phone number. In the final field, tell how you found out about the service (if this field is not filled in, you won't be able to register). After that, click on the "Start" button.

Follow the instructions on the screen. The system will ask you to enter the official information about your organization, including its identifier. Then create an account subdomain and password, and click the "Continue" button. Wait for the system to verify that the information you entered is correct. After that, you can immediately log in to your account or use the automatic configuration system for your technical stack. It is recommended to choose the automatic configuration.

Technical support

If you want to know more about FastSpring features or have any questions while using the service, you can contact the chat room. Chat is available on the site and in the app. The bot answers first and may redirect the client to the help center. If the problem is not solved, a manager joins the issue, to whom the system provides detailed statistics on the account. The company has a call center and email, which are available only after registration. Contacting the call center may allow you to solve the issue more quickly.

FAQs

Does the FastSpring payment system work officially?

Yes. The payment system is officially registered and licensed for financial activities.

Is it possible to withdraw money to a bank card from a FastSpring account?

FastSpring customers can withdraw money to debit and credit cards of any bank.

Can I buy cryptocurrency through FastSpring?

By means of the FastSpring wallet, you can replenish your account on a cryptocurrency exchange and buy cryptocurrency.

Does FastSpring have a mobile app?

Yes. The FastSpring payment system offers a convenient mobile application for money transfers.

Traders Union Recommends: Choose the Best!

Via Advcash's secure website.

Via Payeer's secure website.

Via Skrill's secure website.