Trading platform:

- Square Wallet

- FCA

Square review in 2024

- Most countries (including 8 countries for hardware solutions)

- 2.9% + 30 cents for accounts

Currencies:

- All currencies (for hardware solutions, when paying offline, only the currency of the country where the solution is registered)

cryptocurrencies:

- No

Summary of Square

The Square company develops software for online and physical points of sale and also produces hardware solutions, including payment terminals of various types. The Square Payment System (Square Payment) allows accepting most types of payments in almost every country in the world. In addition to the standard software, the company has several optional developments to facilitate the management of business processes, and automation of reporting, accounting, and taxation. All data is aggregated in the business owner's mobile device (or on his PC), on which the free Square App is installed. Clients of a business using the capabilities of Square receive benefits in the form of loyalty points, which they can then spend to make purchases.

| 💼 Main types of accounts: | One type of account, configured individually |

|---|---|

| 💱 Multi-currency account: | Yes, all currencies |

| ☂ Deposit insurance: | Depends on the type of service or transaction, 2.9% + 30 cents for accepting most payment |

| 👛️ Savings options: | End-to-end reporting, business process automation, conversion enhancement tools |

| ➕ Additional features: | Provides hardware solutions for accepting offline payments, gift cards, and bonus points for customers |

👍 Advantages of trading with Square:

- Its powerful technology stack is designed to accept payments online and offline.

- The company offers hardware solutions for managing payments at points of sale.

- The Square app aggregates payment data and related business processes.

- The app can be used in most countries (hardware solutions – in eight countries).

- An extensive list of optional functions to facilitate and automate business.

- A competitive loyalty program with bonus points that clients can use when shopping.

- Advanced cryptographic protection protocols eliminate the potential of hacking the system.

👎 Disadvantages of Square:

- The software does not involve the use of third-party internet banking options (such as loans, flexes, etc.).

- Hardware solutions are tied to a specific point of sale, they cannot be used elsewhere.

- The tariff for the virtual terminal function is 3.5% + 15 cents per payment, which is higher than the market average.

Analysis of the main features of Square

Table of Contents

Geographic Distribution of Square

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Square

The Square Payment System is designed as a universal solution for online businesses, regardless of the electronic stack and the specific features of its architecture. The solution has a high level of adaptability due to a variety of options and additional modules from the Square digital store. The system allows accepting digital transfers, debit and credit card payments, and payments via online banks. There are no regional restrictions for online payments.

Square also develops and implements hardware products for physical points of sale. These are terminals for accepting payments of various formats, and some have advanced functions that allow increasing conversion. Terminals are ordered for a specific country and cannot be used within the territory of other countries. Currently, this option is only available in the USA, Canada, Australia, Japan, Great Britain, Ireland, France, and Spain. Square does not offer hardware support for other regions.

Internet banking functions are represented by a basic set of features for accepting online and offline payments, invoicing, and payment of invoices. There is a possibility of aggregation and systematization of related business processes. The software allows managing a team in an organization of any size and automating routine processes for tax reporting and accounting. The Square app displays all financial data in a convenient format.

The company's price list corresponds to the average market figures. Some functions are cheaper than most competitors, and options such as fraud protection are offered for free. Other options are slightly more expensive than the market averages. For example, the virtual terminal function. The Traders Union recommends Square because of its high adaptability and reliability of the proposed solutions.

Dynamics of Square’s popularity among

Traders Union’s traders, according to 2023 data

Investment programs, available markets, and products of Square

Square does not offer investment programs, savings accounts, loans, or other investment options to increase capital. The system is focused on meeting the needs of businesses regarding organizing the acceptance and payments online and offline.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Square Money Transfer Terms & Conditions

Square payments are performed as quickly as technically possible, even if paying online to/from another country. Some payment delays may be due solely to the specifics of interbank interactions or regional laws. At the moment, Square works with most electronic payment systems, as well as debit and credit cards issued by major banks of leading countries.

The advantage of the company's software solutions is that they are complete stacks. Square offers software for online stores, private clinics, cafes and restaurants, and beauty salons. In addition to the payment system itself, there are complete programs for registering and following-up users (for example, appointments and notifications). Payment by QR codes and generation of payment links are also available.

On the other hand, the business owner can minimize or expand the stack at will, it is adaptive, and all settings are set in the Square app. The use of the app and the configuration of basic functions are provided free of charge. A standard fee is charged for transactions and additional services, for example, if a businessman needs gift cards or a virtual terminal. The microservice approach to businesses is practical and has proven itself with hundreds of thousands of successfully implemented projects, including online businesses.

| 💼 Main types of accounts: | One type of account, configured individually |

|---|---|

| 💱 Multi-currency account: | Yes, all currencies |

| Deposit terms and conditions: | Almost all |

| Loan terms and conditions: | Per transaction, one-time payment or subscription fee for individual services |

| ☂ Deposit insurance: | Depends on the type of service or transaction, 2.9% + 30 cents for accepting most payment |

| 👛️ Savings options: | End-to-end reporting, business process automation, conversion enhancement tools |

| Types of payment: | Electronic payments and transfers, NFC, Visa/Mastercard cards |

| ➕ Additional features: | Provides hardware solutions for accepting offline payments, gift cards, and bonus points for customers |

Comparison of Square with other e-payment systems

| Square | Advcash | Payeer | Skrill | Paysend | Stripe | |

| Supported Countries | Most countries (including 8 countries for hardware solutions) | 150 countries | 127 countries | 200 countries | 170 countries | 48 |

| Supported Currencies | All currencies (for hardware solutions, when paying offline, only the currency of the country where the solution is registered) | 9 currencies (USD, EUR, GBP, RUB, BRL, TRY, UAH, KZT, VND) | 3 fiat currencies (USD, EUR, and RUB) and most cryptocurrencies | 40 currencies | Most currencies | 135 |

| Support for cryptocurrencies | No | Yes | Yes | Yes (deposit) | No | No |

| Subscription fee | 2.9% + 30 cents for accounts | No, only transaction fees | No, transaction fees only | No, only transaction fees | No | 2.9% + 30 cents per account |

| Payment acceptance equipment | Yes, own devices | No, only software | No, online only | No, only online | EUR 1.5, GBP 1, USD 2 or CAD 3 | No, just the software |

Square Commissions & Fees

The exact cost of using the Square Payment System depends on the connected functions. For the basic version, the price is 2.6% + 10 cents per payment. If the Card on File function is enabled, which allows saving card data and automating repetitive payments, the commission will be higher – 3.5% + 15 cents per account. Payment via a connected virtual terminal costs the same amount.

An alternative payment option for standard payment transactions is a subscription fee. It is $20 per month + an additional fixed payment, which depends on the payment processing speed. Standard fraud protection is provided free of charge, and the connection of an advanced function with intelligent risk management costs 6 cents per transaction (online only).

There are many solutions in the digital marketplace (available on the website and through the Square app), some are free, and others are paid on a one-time basis or require a subscription fee. If the business owner wants to connect responsible employees to the account, the connection of each specialist will cost $35. If one point of offline payments is not paid, and in the case of a large-scale business, depending on the number of points, it is possible to connect the Plus or Premium tariff for $29 and $69, respectively.

Traders Union also compared Square’s fees with similar types of fees on other e-payment systems.

| FastSpring | 2Checkout | Square | |

| Payment commission | 5.9% + $0.95 | 3.5% + 0.35$, 4.5% + 0.45$ or 6% + 0.60$ per transaction | 2.6% + 10 cents |

| Deposit commission | 2% (max $20) | Depending on the payment method | 1.5% |

| Withdrawal commission | $5 | Depending on the payment method | No fees |

| Commission for international transfers | 8.9% | Depending on the payment method | 2.6% + 10 cents |

This is one of the most popular payment systems, the convenience of working with it for businesses is due to a high level of optimization, adaptability, and stability of work. Square app aggregates all flows related to payments and displays transparent statistics on them. Other business processes can also be connected to the aggregator, up to delegation of authority to team members.

An important difference between Square and its analogs is that in addition to dedicated software, the company offers proprietary hardware solutions for offline payment acceptance points. Square does not impose the use of devices on its clients. After all, if the client does not have physical stores, then he often does not need these solutions.

Detailed review of Square

Square payments can be made from anywhere in the world. The system works with most world currencies and almost all payment systems, including electronic payments and Visa/Mastercard cards. The functional and optional Square stack offers a full range of software solutions for businesses. The system is convenient for online stores, HoReCa organizations, as well as private companies providing services in the field of healthcare, cosmetology, and insurance. Square has complete solutions for each sector.

Like some other payment systems, Square is built on the microservices architecture. That is, it is not a solid app with specified functions, but a conglomerate of independent programs that the client can connect and disconnect at will. Many of the standard functions are free (for example, checking for fraudulent actions), others will require a subscription fee (in particular, you have to pay $35 for connecting each employee), or one-time payments (for example, 3.5% + 15 cents for the account when processing transfers with a virtual terminal).

Square's hardware solutions stand apart, as no payment system offers analogs. These are the latest generation payment terminals with convenient touch screens, an intuitive interface, and excellent functionality. They are characterized by simplicity of scalability and high speed of operation. However, these terminals are designed to synchronize with the developer's software, it will not be possible to flash them or connect them to third-party payment systems.

Square Payment by the numbers:

-

2009 – year the company was founded and launched the platform;

-

Square terminals are available in 8 countries;

-

$0 – fee for software installation;

-

2.9% + 30 cents – business commission for each transaction;

-

0 – number of competing companies providing payment terminals to businesses.

Note that Square Payment’s acceptance devices are designed based on the iPod. This determines their impeccable optimization, intuitiveness, and usability.

Useful features of Square:

-

Invoices. A standard function that allows accepting all types of payments on an online resource or through a terminal.

-

Dashboard. An analytical panel in the app (can be accessed through the website or terminal) with detailed statistics on transfers.

-

Card on File. This function allows saving the payment details and their source for automating payments without re-entering data.

-

Risk manager. Automatic payment verification to detect fraudulent activities (provided free of charge in the standard version).

-

Gift cards. A function for creating and distributing gift cards customized for a specific business.

-

Virtual terminal. A complete analog of a physical terminal, but installed on a conventional PC with an internet connection.

-

Customer prepayment. This function allows charging the client an advance payment for the provision of services.

-

Manage multiple locations. A free function that connects several points of online and offline sales, displaying data on the dashboard of the aggregator app.

-

Manage devices by location. Allows full control over a remote point of online or offline sales.

-

Team management. A service for delegating authority to specialists with the possibility of centralized coordination.

-

Square appointments. Appointment, reminder, and follow-up tool for businesses that is fully customizable.

-

Payroll. The service provides an opportunity to generate and send payroll data per local tax laws.

-

Marketing and pricing. A small service for interacting with customers through an advertising newsletter to increase conversion.

-

Loyalty overview. Allows proprietary client loyalty program based on preset settings.

-

Square for Retail. A service for Square hardware devices that allows managing retail businesses.

The cost of a standard Square payment terminal is $299 or $27 per month until the full payment of the amount. Square Reader for contactless payment costs $49. A magnetic stripe reader is provided free of charge. An independent point of sale with two screens (for the manager and the client) will cost $799 or $39 per month until the full payment of the amount. Square offers other hardware solutions as well.

Advantages of Square’s payment system:

-

Versatility. The company's software and hardware solutions are suitable for all types of online and offline payment acceptance points.

-

Adaptability. Complete stacks and templates of microservices can be quickly assembled and customized to meet the requirements of a particular business.

-

Simplicity. No special education or special skills are required to connect to the system and configure it in depth.

-

Responsiveness. All transactions are performed as quickly as technically possible and per regional laws.

-

Transparency. The Square app aggregates for tracking all financial flows and business processes.

-

Flexibility. The company offers complete service stacks, stack templates, and recommendations for individual assembly.

-

Loyalty. The cost of using the system corresponds to the average price on the market, for some functions it is even lower.

-

Originality. Many solutions from the Square marketplace have no analogs in other services.

-

Terminals. In addition to the software for Square Payment System, the company offers terminals of its own design.

-

Safety. Square guarantees the confidentiality of data, and it operates under the license of authorized regulators.

Types of accounts in the Square payment system

The Square Payment System provides only one type of account, which is a business account. All functions are immediately available on it, and access to the software solutions marketplace is open. The account has no restrictions, and its owner can order any services from the company, purchase devices in any quantity, and receive competent advice. When a large business orders services in bulk, it receives individual terms of cooperation.

Some services may be provided under variable tariff plans. For example, the cost of connecting offline payment points depends on the selected tariff. The Standard tariff allows activating one point for free. Plus and Premium tariffs cost $29 and $69, respectively, and they differ in the number of points available for opening (check details on the website).

There are separate tariffs for the Square Invoices service, which allows accepting payments. On the Standard tariff, the transaction costs 2.9% + 30 cents. The Plus tariff enables a business owner to pay $20 per month with no need to pay for transactions separately, but additional fees are charged depending on the speed of transactions (calculated regionally). A flexible approach to choosing a tariff provides an opportunity to choose the most comfortable terms for cooperation following the specifics of a particular business.

Banking features

Square is not a mobile bank, but it has some internet banking functions that are peculiar to neobanks. This applies to making payments and the possibility of aggregating business processes. The business owner manages all financial flows and even his team from a mobile device, and almost all types of payments are available at his payment acceptance points (both online and offline). The service does not provide banking services of a private nature (for example, overdrafts or flexes). It does not have personal accounts at all (although you can register on the platform not as a company, but as the company owner).

Social programs of Square

The company does not implement social programs. This is a FinTech organization that provides a wide range of services for businesses to make payments online and at physical points of sale.

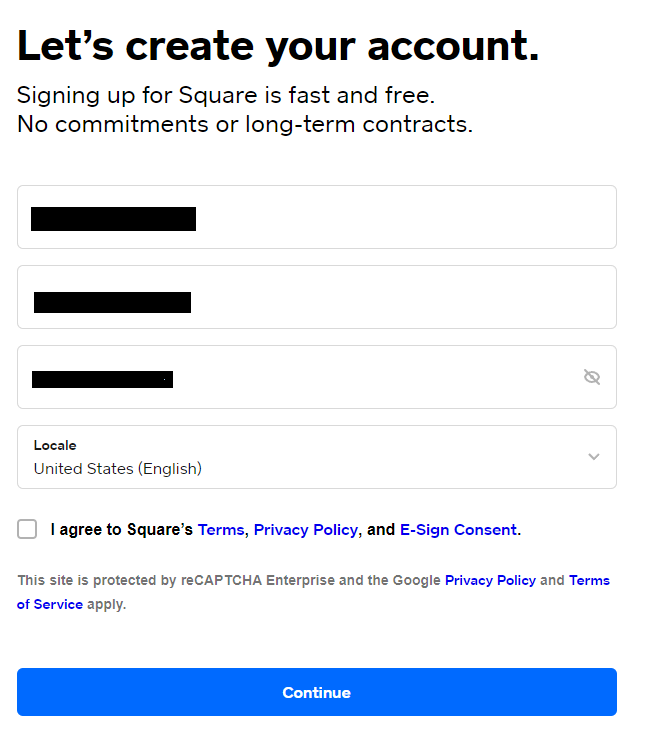

How to open an account at Square

Go to the official website of the company, click on the "Sign in" button in the upper right corner of the main page, and select the "Sign up" line in the window that appears.

Enter your email twice (the second time for confirmation), create a password, and select the region where you do business. Agree to the terms of service by checking the box, and click on the "Continue" button.

In the next window, enter your business details and click "Continue". Then you will need to provide more detailed information about the points of sale (online and/or physical) of your business. After filling in these screens, the system will ask you to confirm your identity by providing personal data, including the SSN or ITIN number.

Confirmation of identity may take some time. Wait for the process to complete, after that, you will be able to fill in additional fields and complete registration in the service. During the registration process, the system will send a link to download the mobile app, and you need to log in using the registration details. Registration can also be done through the app (it can be downloaded directly from the Play Market and App Store digital stores).

At the final stage of registration, you need to link a bank account to your user account, just follow the instructions on the screen to complete this step. The system will also give recommendations on the basic software stack. You can choose the standard option or go to the marketplace and choose the necessary options yourself. The connected services are managed via the website or app.

Technical support

There is a "Support Centre" in the website menu, where detailed information on working with the system is provided. If this is not enough, the client can refer to the "Community" section to contact other users of the service and get advice from them. Chat service is available in the app; but if the bot cannot provide the required answer, it will automatically connect the client with the manager. In the "Contacts" section of the user account and the app, the email and call center number are indicated. Both communication channels work on a 24-hour basis.

FAQs

Does the Square payment system work officially?

Yes. The payment system is officially registered and licensed for financial activities.

Is it possible to withdraw money to a bank card from a Square account?

Square customers can withdraw money to debit and credit cards of any bank.

Can I buy cryptocurrency through Square?

By means of the Square wallet, you can replenish your account on a cryptocurrency exchange and buy cryptocurrency.

Does Square have a mobile app?

Yes. The Square payment system offers a convenient mobile application for money transfers.

Traders Union Recommends: Choose the Best!

Via Advcash's secure website.

Via Payeer's secure website.

Via Skrill's secure website.