- 64 countries

- Individual

Currencies:

- Most currencies

cryptocurrencies:

- Yes

Summary of TransferGo

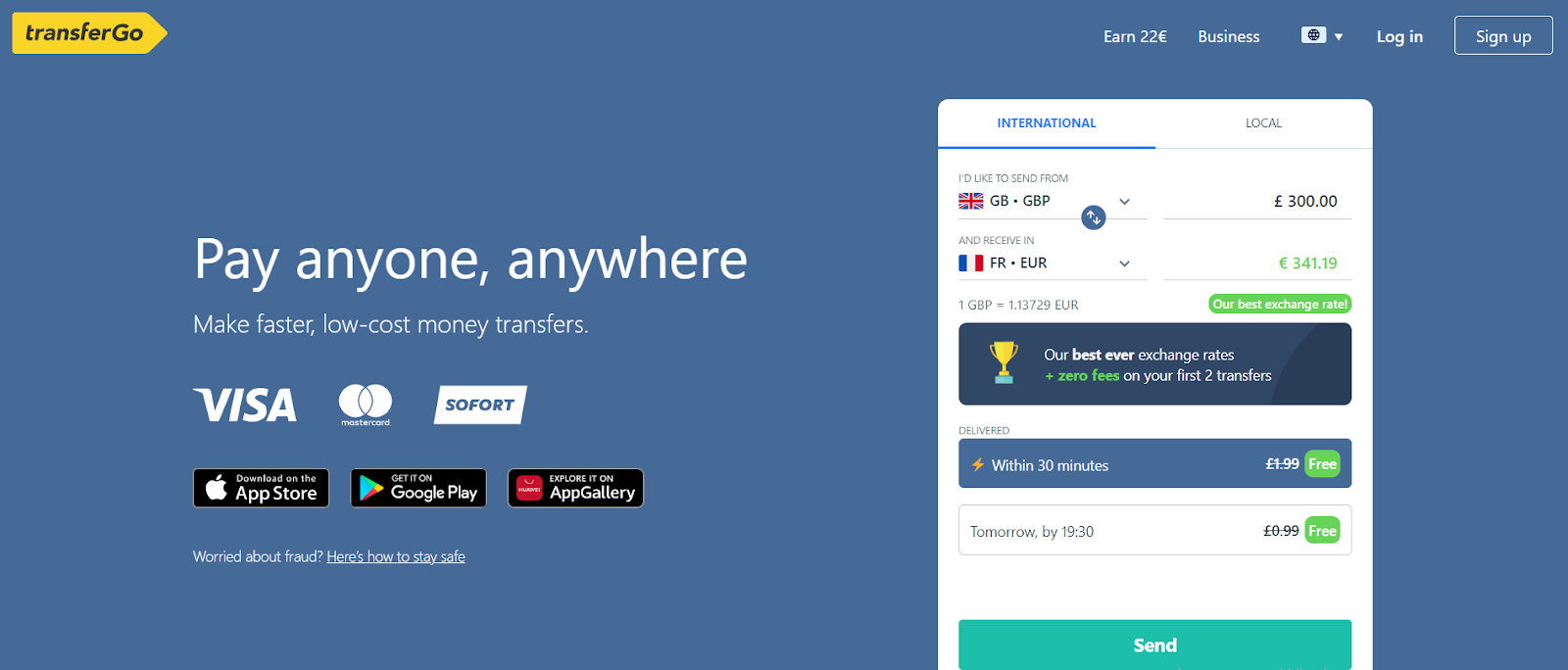

The money transfer service was launched in 2012, and at the time, it was working with 30 of the world’s largest banks. Today, ten years later, the platform works with nearly all major banks in 64 countries, including the United States, Australia, Europe, Asia, and Africa. This is a universal system that allows you to make personal transfers to individuals as well as deal with corporate financial matters (for example, to settle accounts with foreign partners). The integrated TransferGo currency converter uses the current market rate, allowing you to instantly convert one currency to another. At the same time, the service charges fairly low fees when compared with its competitors. The payment transfer fee ranges from 0 to 0.99 euros, depending on the country of the sender and recipient. The conversion fee varies from 0 to 2.2%. You can request a fast transfer with a transfer time of fewer than 30 minutes, but the fee will be higher.

| 💼 Main types of accounts: | Personal and Business |

|---|---|

| 💱 Multi-currency account: | Most currencies |

| ☂ Deposit insurance: | 0-0.99 euros transfer fee, and 0-2.2% conversion fee |

| 👛️ Savings options: | Automatic, optional, at the current market rate |

| ➕ Additional features: | Account for corporate clients, referral program, 8 languages |

👍 Advantages of trading with TransferGo:

- TransferGo money transfer service works with most currencies and banks of many developed countries;

- Fees are lower than the market average, and some types of transfers have no fees.

- Most transfers are made within the same day, but it is possible to request a fast transfer so that the money comes in half an hour;

- Because the service is available 24 hours a day, including weekends and holidays, you can make a transfer at any time of day.

- There are no "pitfalls" or hidden fees, and the work of the TransferGo money transfer service is 100% transparent;

- The currency is converted at the market rate, and TransferGo converts the funds when transferring with a zero fee;

- The service has a mobile app for iOS and Android devices.

👎 Disadvantages of TransferGo:

- Although the platform is active in 64 countries, services and transfers are not available in some regions, and there are no transfers in some countries, though payments are accepted.

- There is no call center, so communication with tech support is done via email or chat in the app, which isn’t always convenient.

- A standard transfer takes one day, but a transfer with currency conversion at the TransferGo exchange rate can take up to three days or more in some countries.

Analysis of the main features of TransferGo

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest TransferGo News

- Analysis of TransferGo

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Detailed review

- Banking features

- Social programs

- How to open an account?

- Technical Support

- User Reviews of TransferGo

- FAQs

- TU Recommends

Geographic Distribution of TransferGo

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of TransferGo

Transfergo Ltd is registered with HMRC, operates under Regulation No. 12667079, and is regulated by the FCA (license no. 600886). The company has been operating since 2012, and its activities comply with local and international legislation. There have been no situations where the TransferGo money transfer service has failed to meet its obligations to its clients. A retrospective evaluation showed that there are no unresolved conflict situations with customers.

Thus, there is no doubt about the service’s reliability and trustworthiness. TransferGo is a money transfer platform with an integrated currency converter. It operates in 64 countries. However, users should first read the Terms and Conditions before using the service, because some regions only allow receiving funds, while others only allow transferring funds. It is important to note that TransferGo uses the current market rate, not the daily rate.

Many users emphasize how fast the transfers are. This is true. In practice, international transfers usually take no more than one business day. Due to the peculiarities of the banking system and the legislation of the country where the recipient resides, the term can sometimes be extended to three days or even more. A fast transfer in half an hour costs 2.99 euros, which is cheaper than most of its competitors. In general, the financial policy of the service is beneficial for the client. In many cases, a transfer fee is not charged at all. On average, it is in the range of 0-0.99 euros.

Also, there were no design flaws. Some experts and TransferGo clients have noted that the company doesn’t have a call center. However, this is not a significant problem as it is possible to communicate with tech support via live chat. There are no other common complaints among service users. According to the sum of the factors, TransferGo can be recommended for use by both private clients and businesses.

Dynamics of TransferGo’s popularity among

Traders Union’s traders, according to 2023 data

Investment programs, available markets, and products of TransferGo

The TransferGo money transfer service doesn’t offer investment solutions. After all, its users have the opportunity to increase their capital. The first option is to use a unique invitation code. It is provided to each new client. The code can be sent to friends via messengers or posted on social media platforms. Anyone who signs up using an invitation code will bring 22 euros to the code owner. However, the invited user must make at least one transfer.

The second option is to participate in the referral program. To do this, you need to register in a special section of the service. TransferGo will provide ready-made promotional materials for publishing on blogs, forums, etc. Users who sign up for the service by clicking on the link in the promotion will bring its owner a one-time bonus. The amount of each payment is determined individually, and the service withholds a fee. With the increase in the volume of payments, the fee also increases.

The referral program member receives detailed statistics on all promotional materials that they post on the internet. The advantage of registering through the promotion is that you will receive discounts on international transfer fees.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

TransferGo Money Transfer Terms & Conditions

This TU review of TransferGo emphasizes the service’s versatility. It allows you to send funds in most currencies with automatic conversion at the current market rate. In many cases, the fee is either zero or close to zero. Under regular conditions, the maximum transfer fee is 0.99 euros. If the client requires a fast transfer (within 30 minutes), the fee will be set at 2.99 euros.

The transferred funds don’t need to be converted. If you activate this function, the conversion will be carried out at the time of transfer (not at the time of receipt). TransferGo’s integrated currency conversion feature significantly simplifies the transfer process and relieves the client of extra actions.

It should be noted that the TransferGo website and app are both free to use. A new client doesn’t need to pay a one-time or subscription fee. The only types of expenses are transfer and conversion fees. However, other services that participate in the transfer process, such as electronic wallets, may charge additional fees. TransferGo is not liable for the actions of third parties. You can be 100% confident in the company because it follows UK financial legislation and is regulated by the FCA.

| 💼 Main types of accounts: | Personal and Business |

|---|---|

| 💱 Multi-currency account: | Most currencies |

| Deposit terms and conditions: | Card, electronic wallet |

| Loan terms and conditions: | Bank cards and accounts, electronic wallets |

| ☂ Deposit insurance: | 0-0.99 euros transfer fee, and 0-2.2% conversion fee |

| 👛️ Savings options: | Automatic, optional, at the current market rate |

| Types of payment: | No |

| ➕ Additional features: | Account for corporate clients, referral program, 8 languages |

Comparison of TransferGo with other e-payment systems

| TransferGo | Advcash | Payeer | Skrill | PayPal | FastSpring | |

| Supported Countries | 64 countries | 150 countries | 127 countries | 200 countries | All developed countries | 200 |

| Supported Currencies | Most currencies | 9 currencies (USD, EUR, GBP, RUB, BRL, TRY, UAH, KZT, VND) | 3 fiat currencies (USD, EUR, and RUB) and most cryptocurrencies | 40 currencies | USD, EUR, GBP and 22 other currencies | 20 |

| Support for cryptocurrencies | Yes | Yes | Yes | Yes (deposit) | Yes | No |

| Subscription fee | Individual | No, only transaction fees | No, transaction fees only | No, only transaction fees | No | 8.9% or 5.9% +95 cents per transaction |

| Payment acceptance equipment | 0-0.99 euros | No, only software | No, online only | No, only online | Upon receipt of payment/transfer, depend on the region | No, only software in the form of SaaS |

TransferGo Commissions & Fees

A review of TransferGo and a comparison with its competitors revealed an important benefit of this service: it has one of the most simple and transparent fee structures. For many platforms, the fee depends on various factors, including the amount of the transfer, the specific currency, the sender's or receiver’s country of residence, and the bank. As for TransferGo, everything is simple. There are two types of fees charged for transfer and conversion (the latter is optional).

The conversion fee ranges from 0 to 2.2%. It depends only on the currencies involved in the conversion and nothing else. The standard transfer fee can also be zero, while the maximum standard fee is 0.99 euros. It all depends on the currency and the amount of the transfer. Moreover, the user doesn’t need to calculate anything; the system will automatically calculate and indicate the fee amount before the transfer. If you require a fast transfer that will be received by the recipient within 30 minutes, the fee is always fixed at 2.99 euros.

Given the market exchange rate, converting funds through the service is very profitable. Moreover, it is convenient, since you only need to activate the relevant option before the transfer, and the funds will come to the recipient in the selected currency. There are no "pitfalls" or hidden fees, and the service’s operation is completely transparent, with no complaints about convenience, functionality, or legality.

The TransferGo money transfer service completely fulfills the purpose for which it was developed. It has been in operation for ten years and allows for quick transfers between most banks worldwide. Transfers take up to a day and, in some cases, up to three days. A fast transfer in half an hour has a fixed fee of 2.99 euros. Given that some transfer types have no fee and the rest of the non-urgent transfers have a fee of up to 0.99 euros, TransferGo has one of the most favorable financial policies for the client.

The Traders Union also compared Paysend’s fees with similar types of fees on other e-payment systems.

| PayPal | Remitly | TransferGo | |

| Payment commission | $0.49 | $2.99 | €0.99 |

| Deposit commission | No fee | No fee | No fee |

| Withdrawal commission | 1.5% | $2.99 + 0.5% of the amount for Economy or 1.5% of the amount for the Express option | 0-0.99 euros |

| Commission for international transfers | Depend on the transaction type and region | Depends on the transaction type and region | Depends on the transaction type and region |

The built-in TransferGo currency converter allows you to exchange one currency for another during the transfer at transparent rates. Moreover, the exchange is carried out at the current market rate. The conversion fee range is from 0 to 2.2%. Clients of the service benefit from responsive tech support (live chat), guaranteed work stability, and the ability to send and receive funds to and from 64 countries. Socially active users can earn one-time bonuses for inviting new clients, as well as through the referral program. Experts have no complaints about TransferGo.

Detailed review of TransferGo

The above information is more than enough for a comprehensive evaluation of TransferGo. The review of the platform clearly demonstrates all its advantages. As for the drawbacks, they can rather be named as special points that need to be taken into account.

TransferGo, for example, doesn’t support all countries and banks; and you can view the current list on its website. However, there are no money transfer services that work in all regions. Therefore, transfers to some regions will have very unfavorable conditions.

Transfers that take three days or more require such additional time due to regional laws and the peculiarities of the local banking system. TransferGo has no control over this.

Some TransferGo reviews note that you can’t contact tech support by phone because the service doesn’t have a call center. You can contact the support team via the website’s contact form or by email. Live chat is the preferred option: intelligent bots respond immediately, and specialists promptly connect at the client’s request if the bot is unable to assist.

TransferGo by the numbers:

-

Operates in 64 countries;

-

0 euro is the minimum fee;

-

Funds transferred in 30 minutes or less upon request;

-

20 seconds – maximum response time of tech support;

-

5 million active users.

-

Rating of 4.8 points out of 5 according to Trustpilot;

-

22 euros is the bonus for an invited client.

TransferGo allows you to transfer funds from bank accounts, Visa or MasterCard cards, or through Sofort and other systems. You can also accept payments to accounts and bank cards. There are no restrictions or limits. It should be noted that the promotion applies to the first two transfers; the fee will be zero regardless of the conditions.

Functions of the TransferGo money transfer service:

-

Standard transfer. The client can transfer funds within the country and abroad. The source and destination can be bank accounts, bank cards, or electronic wallets.

-

Fast transfer. Allows funds to be transferred within 30 minutes, regardless of the amount or a participating destination. The fee for such a transfer is fixed at 2.99 euros.

-

Currency converter. TransferGo provides an option to convert funds when transferring. Almost all world currencies are available. The conversion is performed at the time of the transfer at the current market exchange rate.

-

Corporate services. Legal entities are provided with additional features, such as the ability to make bulk transfers (for example, when paying for suppliers’ services) and track payments.

-

One-time bonuses. Each valid user of the service can use a personal code to invite a new client. As soon as they make their first payment, the owner of the code will receive 22 euros.

-

Referral program. Socially active users have the opportunity to post promotional materials for the service on web platforms and receive regular payments for new clients who sign up through the promo link.

The TransferGo app and the user account on the website are equivalent in their capabilities. The service has almost no options that are not related to international transfers. Experts see this as a benefit because the platform focuses on its main task, doesn’t split forces, and thus provides advanced, high-quality services.

Pros of the TransferGo money transfer service:

-

The client doesn’t need to worry about calculating fees. There is one type of fee for transfers and another for conversion. The range is fixed, and the fee is calculated automatically before the transfer.

-

If the client needs to make a transfer in one currency, and the payment must be credited in another, this will not be a problem. The TransferGo integrated currency converter allows you to exchange currencies at the current market rate.

-

The use of the service is completely free; there is no subscription fee or one-time payment for a particular function. There is only a transfer fee.

-

Transfers are made from bank cards and electronic wallets to bank cards and accounts at various banks. The service covers 64 countries. There are no transfer limits, and the service accepts all world currencies.

-

In some cases, the transfer fee is not charged, and the conversion fee is 0%. The TransferGo money transfer service has one of the lowest fees in the industry.

-

The client can make a transfer at any time since the service is available around the clock. Tech support is also available at any time, including weekends and holidays.

-

In addition to the user account on the website, the client can use a free mobile app that offers the same functions. It is compatible with iOS and Android devices.

Service fees, currency exchange rates, basic functions, and tech support – every aspect of the platform’s work meets advanced standards. This is a modern money transfer system that allows you to quickly and easily transfer funds in different currencies between even the most remote points of the globe.

Types of accounts in the TransferGo payment system

All accounts of private clients offer equal possibilities. To access the website, you don’t need to pay for a subscription; all functions are provided for free. Because the client is charged a fee for each transfer, different types of accounts are simply unnecessary in this case. The only thing that can be noted in this section is the user account for corporate clients. If you represent a company, you need to specify this when signing up. Corporate user accounts allow you to send money to 50 suppliers at once, make batch payments, and track transfers in stages. These user accounts are equally convenient for small and medium-sized businesses.

You can find out more about business accounts if you click the "Business" button on the website in the upper right corner of the page. The main advantages of using the TransferGo service for corporate clients are savings of up to 90% compared to similar bank services and the ability to make bulk or batch payments. The latter significantly saves time and gives you peace of mind. A business user account is also convenient for freelancers and self-employed persons because it allows you to issue invoices to legal entities and generate reports.

Banking features

Because the TransferGo money transfer service is not a mobile bank, it doesn’t provide appropriate services. Such services, however, can be represented by the functions of international transfers and currency conversion. Clients cannot receive overdrafts, flex, or create spots. Therefore, if you need a full package of banking services, it is recommended that you use a specialized service.

Social programs of TransferGo

The company doesn’t implement any social programs and doesn’t participate in charity or other social activities. However, many TransferGo clients participate in environmental donations, create various kinds of funds, and run fundraising campaigns.

How to open an account at TransferGo

Go to the official TransferGo website. In the upper right corner of the screen, select the language that is most convenient for you. Click the "Register" button.

If necessary, change the user account type to a business user account. Then select your country code and enter your mobile phone number. Click "Confirm number".

Enter the code that will be sent in an SMS to the specified phone number in the appropriate field. Follow the instructions to complete the registration. You don’t need to provide personal information at this step.

In most cases, the first transfer doesn’t require verification. It will be required for the second transfer or if the amount of the first transfer exceeds 900 pounds (or its equivalent in another currency).

To begin the verification process, log in to your user account, click the "Menu" icon, and select "Confirmation". Next, select "Identification" and specify your country and type of ID document. Follow the on-screen instructions. You will be required to provide a scan of your passport or driver’s license.

Now all the features of the TransferGo service are open to you. You can download the mobile app by following the link on the main page of the website. Clicking on the link will take you to a digital store, such as Google Play, the App Gallery, or the App Store. Download and install the TransferGo app on your mobile device for free. For identification, use the registration data.

Many TransferGo clients use the mobile app, but some prefer to make transfers from a PC or laptop. It makes no difference whether you use the website or the app because both versions include all of the service’s functions and have no limitations. The only thing to keep in mind is that registration and verification will have to be done on the website in any case.

Technical support

TransferGo money transfer service offers round-the-clock tech support, with specialists available seven days a week, including holidays. To contact the service specialists, you need to go to the "Help centre" section and fill out a standard request. The response will be sent to the email address specified during registration. Then the client can communicate directly with the support team by email. A faster way of communicating is through live chat, which is available through the app. It should be noted that the company doesn’t have a call center and instead provides a dedicated email address for contact with media representatives (you can find it in the footer of the website, in the "Press" section).

Disclaimer:

Your capital is at risk. Via TransferGo's secure website. Your capital is at risk.

FAQs

Does the TransferGo payment system work officially?

Yes. The payment system is officially registered and licensed for financial activities.

Is it possible to withdraw money to a bank card from a TransferGo account?

TransferGo customers can withdraw money to debit and credit cards of any bank.

Can I buy cryptocurrency through TransferGo?

By means of the TransferGo wallet, you can replenish your account on a cryptocurrency exchange and buy cryptocurrency.

Does TransferGo have a mobile app?

Yes. The TransferGo payment system offers a convenient mobile application for money transfers.

Traders Union Recommends: Choose the Best!

Via Advcash's secure website.

Via Payeer's secure website.

Via Skrill's secure website.