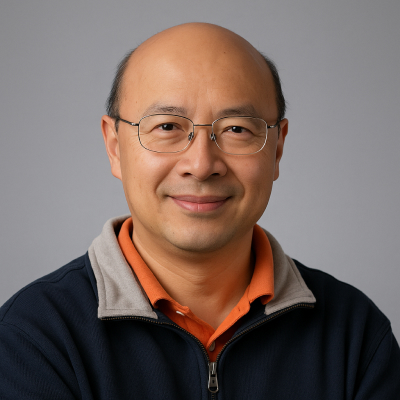

Andrew Lo Biography, Career, Net Worth, and Key Insight

Andrew Lo’s Profile Summary

|

Company

|

QLS Advisors |

|---|---|

|

Position

|

Co-Founder and Principal at QLS Advisors, in addition to his academic roles |

|

Source of wealth

|

Consulting and advisory roles in biotech startups, management fees from QLS Advisors, academic research and book publications |

|

Also known as

|

Finance author, quantitative finance expert, risk management specialist. |

|

Age

|

64 |

|

Education

|

Yale University - Bachelor of Arts in Economics, Harvard University - Ph.D. in Economics |

|

Citizenship

|

United States |

|

Residence

|

Cambridge, Massachusetts, USA |

|

Family

|

Not publicly available. |

|

Website, Social Media

|

https://qlsadvisors.com/ |

Andrew Lo’s biography

Andrew W. Lo is a distinguished academic and thought leader in the field of finance, known for his pioneering work on the "Adaptive Markets Hypothesis." He is the Charles E. and Susan T. Harris Professor of Finance at MIT Sloan School of Management and Director of the MIT Laboratory for Financial Engineering. Lo's academic background includes a B.A. in economics from Yale University and a Ph.D. in economics from Harvard University. He began his academic career at the Wharton School before moving to MIT in 1988. Throughout his career, Lo has made significant contributions to quantitative finance, risk management, and financial regulation, with notable work in healthcare finance and machine learning applications in finance. He has authored several influential books, including Adaptive Markets: Financial Evolution at the Speed of Thought. Beyond academia, Lo co-founded QLS Advisors, a biotech investment firm, and serves on multiple corporate boards. His research has earned him numerous awards, and he is recognized as one of TIME magazine's "100 Most Influential People"-

How did Andrew Lo make money?

Andrew Lo makes money in the following areas:

Consulting and advisory roles in biotech startups, management fees from QLS Advisors, academic research and book publications

-

What is Andrew Lo net worth?

As of 2025, there is no publicly available and reliable information regarding Andrew Lo’s net worth.

What is Andrew Lo also known as?

Andrew Lo is not only a finance professor but also a prolific author and thought leader in quantitative finance. His book Adaptive Markets explores how financial markets evolve, blending traditional financial theory with evolutionary biology. He has applied his expertise to healthcare finance and artificial intelligence, influencing risk management practices globally. Lo also advises biotech firms and sits on the boards of several health and finance-related startupsProminent achievements of Andrew Lo

Named one of TIME's "100 Most Influential People," winner of the Harry M. Markowitz Award, honored as the 2017 Risk Manager of the Year by GARP, recognized with the Pinnacle Achievement Award by CME Group and BarclayHedge, and recipient of the Paul A. Samuelson Award for his contributions to financial economicsWhat are Andrew Lo’s key insights?

Andrew Lo believes in the "Adaptive Markets Hypothesis," where markets evolve similarly to biological systems. His philosophy emphasizes flexibility, innovation, and the blending of classical economic theories with modern scientific insights, particularly from evolutionary biology and machine learning

Andrew Lo’s personal life

Andrew Lo maintains a private life, and no detailed public information is available about his family.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

EUR/USD price slips below $1.165 as U.S. tariffs and Fed outlook pressure euro

Ark Invest takes profits as Coinbase market cap tops $100 billion