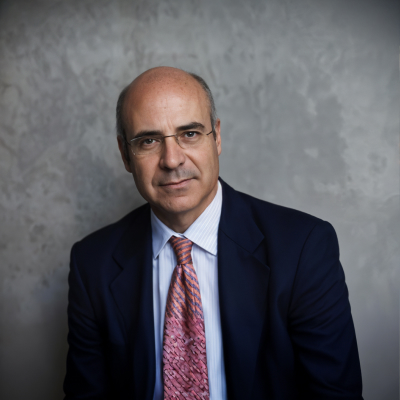

Bill Browder Biography, Career, Net Worth, and Key Insight

Bill Browder’s Profile Summary

|

Company

|

Hermitage Capital |

|---|---|

|

Position

|

CEO and co-founder of Hermitage Capital Management. |

|

Source of wealth

|

Management and performance fees from Hermitage Capital's investment strategies, early investments in Russian privatization, authoring of Red Notice and related speaking engagements. |

|

Also known as

|

Author, human rights activist, public speaker. |

|

Age

|

61 |

|

Education

|

University of Chicago – Bachelor’s degree in Economics, Stanford University – MBA |

|

Citizenship

|

British (previously American, renounced U.S. citizenship in 1998) |

|

Residence

|

London, United Kingdom |

|

Family

|

Bill Browder is married to Elena Browder, and they have two children. |

|

Website, Social Media

|

Bill Browder’s biography

Bill Browder is an American-born British financier and political activist, best known as the co-founder and CEO of Hermitage Capital Management, once the largest foreign investor in Russia. Born in 1964, Browder earned a degree in Economics from the University of Chicago and an MBA from Stanford Business School. Early in his career, Browder worked in finance at companies such as Salomon Brothers before co-founding Hermitage Capital in 1996. Through Hermitage, Browder initially gained significant profits by investing in undervalued Russian assets during the post-Soviet privatization wave. However, his stance against corporate corruption in Russia led to tensions with the government, resulting in him being barred from the country in 2005. Browder’s work took a significant turn after the death of his lawyer, Sergei Magnitsky, in a Russian prison in 2009. Since then, Browder has become a prominent human rights advocate, pushing for the passage of the Magnitsky Act, which imposes sanctions on Russian officials involved in human rights abuses. His activism has made him a controversial figure, especially in Russia, where he has faced numerous legal challenges. Browder has authored the book Red Notice, which chronicles his experiences in Russia and his fight for justice.-

How did Bill Browder make money?

Bill Browder makes money in the following areas:

Management and performance fees from Hermitage Capital's investment strategies, early investments in Russian privatization, authoring of Red Notice and related speaking engagements.

-

What is Bill Browder net worth?

As of 2025, Bill Browder’s net worth is estimated to be $100M.

What is Bill Browder also known as?

Bill Browder is widely recognized as the author of the bestselling book Red Notice, which provides a detailed account of his experiences in Russia and his fight for justice following the death of Sergei Magnitsky. His advocacy for human rights and anti-corruption efforts, particularly through his work in promoting the Magnitsky Act, has garnered international attention. Browder is also a sought-after public speaker, frequently delivering talks at global forums, including major conferences and universities, where he discusses financial transparency, Russian politics, and human rights.Prominent achievements of Bill Browder

Bill Browder is known for his successful investments in Russian markets during the 1990s, having managed Hermitage Capital to become the largest foreign investment fund in Russia. He was instrumental in promoting the passage of the Magnitsky Act in the U.S. and other countries, which targets human rights violators. His book Red Notice became a bestseller and has been translated into multiple languages. Browder has received numerous accolades for his human rights activism, including being named as one of Foreign Policy's Global Thinkers and receiving awards from organizations dedicated to justice and anti-corruption efforts.What are Bill Browder’s key insights?

Bill Browder’s business philosophy centers on transparency, accountability, and fighting corruption. He believes in exposing unethical business practices, especially in the financial sector, as a way to drive both economic and social change. His experiences in Russia have shaped his belief that businesses should operate with integrity, and he has become a fierce advocate for using financial tools, like sanctions, to address human rights abuses. Browder often emphasizes the importance of resilience in business, especially when confronting powerful adversaries.

Bill Browder’s personal life

Bill Browder is married to Elena Browder, who has been a supportive partner throughout his career and activism. The couple has two sons, Joshua and David Browder. His family resides with him in London, and while Browder’s professional life has often been in the spotlight, he tends to keep his family life private.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa unveils digital visas to attract film and events

South Africa invests R710 million to expand free Internet access