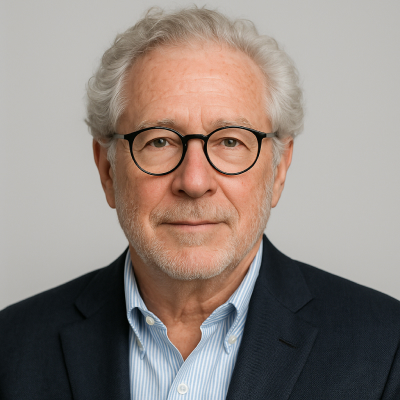

Douglas A. Kass Biography, Career, Net Worth, and Key Insight

Douglas A. Kass’s Profile Summary

|

Company

|

Seabreeze Partners Management |

|---|---|

|

Position

|

President and Founder of Seabreeze Partners Management, Inc., a hedge fund management firm specializing in U.S. equities. |

|

Source of wealth

|

Management and performance fees from Seabreeze Partners Management, media appearances, contributions to Real Money Pro and TheStreet.com |

|

Also known as

|

Author, Media Contributor, Financial Analyst. |

|

Age

|

76 |

|

Education

|

Alfred University - Bachelor's degree, Wharton School, University of Pennsylvania - MBA in Finance |

|

Citizenship

|

United States |

|

Residence

|

Palm Beach, Florida, USA |

|

Family

|

Details about his family are not widely available in public sources. |

|

Website, Social Media

|

https://seabreezepartnerslp.com/ |

Douglas A. Kass’s biography

Douglas A. Kass is a seasoned investor and the founder of Seabreeze Partners Management, a hedge fund that focuses on investments in large-cap companies. Kass began his career in finance in 1972 as a Housing Analyst at Kidder, Peabody & Co. Over the years, he gained extensive experience across various firms, including serving as a General Partner at Glickenhaus & Co. and later DAK Securities. Kass has also been an influential voice in the financial media, regularly appearing on CNBC's Squawk Box and Mad Money with Jim Cramer. His contrarian investment strategies have earned him widespread recognition, including being selected by Warren Buffett to present a bearish case on Berkshire Hathaway. Additionally, Kass is a prolific writer, contributing to TheStreet.com's Real Money Pro, where he shares his insights on market trends and investment strategies. He has also co-authored a report with Ralph Nader and lectured at prestigious institutions like Yale University. With over 45 years of experience, Kass is highly regarded for his market insights and his ability to navigate market volatility

-

How did Douglas A. Kass make money?

Douglas A. Kass makes money in the following areas:

Management and performance fees from Seabreeze Partners Management, media appearances, contributions to Real Money Pro and TheStreet.com

-

What is Douglas A. Kass net worth?

As of 2025, Douglas A. Kass’s net worth is estimated to be $92,979.

What is Douglas A. Kass also known as?

Douglas Kass is well-known for his contributions as an author and financial commentator. He has co-authored the book Citibank: The Ralph Nader Report and is a principal writer for TheStreet.com’s Real Money Pro. His market analysis has been featured in various financial media outlets, including CNBC, Bloomberg TV, and Barron's. Kass regularly shares his insights on television, appearing as a guest host on Squawk Box and Mad Money

Prominent achievements of Douglas A. Kass

Founder of Seabreeze Partners Management, selected by Warren Buffett to argue a bearish case at a Berkshire Hathaway meeting, frequent guest on CNBC’s Squawk Box and Mad Money, co-author of Citibank: The Ralph Nader Report, contributor to TheStreet.com, recognized for his contrarian investment strategies

What are Douglas A. Kass’s key insights?

Douglas Kass is known for his contrarian investment philosophy, often betting against market consensus. He emphasizes the importance of being adaptable, learning from mistakes, and maintaining a long-term perspective. He is also known for his candidness about his investment missteps, which sets him apart in a field often marked by overconfidence

Douglas A. Kass’s personal life

There is limited information about Kass's family, as he maintains a relatively private personal life

Useful insights

Fundamental principles of investing

As someone deeply immersed in the world of finance, I firmly believe that learning the fundamental principles of investing is the cornerstone of financial literacy. The books I recommend here have shaped modern investment strategies, offering timeless wisdom that can benefit both beginners and seasoned investors. These are not just texts, but essential tools to help you navigate the complexities of the financial markets with confidence and insight.

-

Benjamin Graham – "The Intelligent Investor"

-

Summary:

Written by one of the most influential investment thinkers, this book outlines the principles of value investing. Graham emphasizes the importance of analyzing a company’s intrinsic value, long-term investment strategies, and avoiding emotional decisions driven by market fluctuations. The book also discusses defensive investing, focusing on preservation of capital and minimizing risk.

-

Why read it:

This is a must-read for anyone looking to understand the core philosophy behind successful long-term investing. Graham’s principles influenced generations of investors, including Warren Buffett, making it an essential guide to navigating stock market risks with a focus on minimizing losses.

-

-

Ray Dalio – "Principles"

-

Summary:

Ray Dalio, founder of one of the world’s largest hedge funds, shares the life and work principles that led to his immense success. The book covers Dalio’s unique management and investment strategies, focusing on radical transparency, truth-seeking, and the importance of learning from mistakes. It also provides practical insights into organizational behavior and personal growth, making it valuable beyond just investing.

-

Why read it:

Dalio's "Principles" is a treasure trove of wisdom for investors and business leaders who wish to improve their decision-making. It’s a guide on how to align personal and professional life through well-defined, actionable rules.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

Weekly forecast: Nvidia overtakes Apple, ready to join the $4T market club

Weekly forecast: Tesla shares remain 31.8% below 52-week high