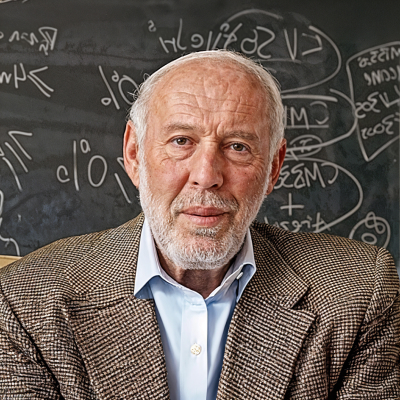

James Harris Simons Biography, Career, Net Worth, and Key Insight

James Harris Simons’s Profile Summary

|

Company

|

Renaissance Technologies |

|---|---|

|

Position

|

Founder and former CEO of Renaissance Technologies. |

|

Source of wealth

|

Management and performance fees from Renaissance Technologies' Medallion Fund.. |

|

Also known as

|

The "Quant King," a mathematician and founder of Renaissance Technologies, famous for revolutionizing algorithmic trading. |

|

Years of life

|

25.04.1938 - 10.05.2024 |

|

Education

|

Massachusetts Institute of Technology – Bachelor’s degree in Mathematics, University of California, Berkeley – PhD in Mathematics. |

|

Citizenship

|

United States |

|

Residence

|

East Setauket, New York, USA |

|

Family

|

James Harris Simons is married to Marilyn Simons, and they have three children: Nat Simons, Audrey Simons, and Paul Simons (deceased). |

|

Website, Social Media

|

https://www.rentec.com/Home.action?index=true |

James Harris Simons’s biography

James Harris Simons (April 25, 1938 – May 10, 2024) was a highly respected American mathematician, billionaire hedge fund manager, and philanthropist. He earned his PhD in mathematics from the University of California, Berkeley, and went on to make significant contributions in the field of differential geometry and theoretical physics. Simons also served as chair of the mathematics department at Stony Brook University, where he was widely recognized for his academic leadership and scholarly work.In 1982, Simons founded Renaissance Technologies, a quantitative hedge fund based in New York that revolutionized finance through the use of sophisticated mathematical models and algorithmic trading. The firm’s flagship Medallion Fund, known for its secrecy and remarkable returns, remains one of the most successful investment vehicles in history. Simons officially retired as CEO in 2009 but remained active in the company and provided ongoing strategic insight.

Beyond finance, Simons became one of the most prominent philanthropists in science and education through the Simons Foundation, supporting research in mathematics, physics, life sciences, autism, and public education. His legacy endures not only through his groundbreaking financial achievements but also in the advancement of global scientific understanding and educational opportunities. He passed away on May 10, 2024, leaving behind a profound impact on multiple disciplines.

-

How did James Harris Simons make money?

James Harris Simons makes money in the following areas:

Management and performance fees from Renaissance Technologies' Medallion Fund..

-

What is James Harris Simons net worth?

As of 2025, James Harris Simons’s net worth is estimated to be $29B.

What is James Harris Simons also known as?

Despite being one of the most successful hedge fund managers in history, James Simons maintained a remarkably low public profile and was deeply committed to scientific philanthropy. Through the Simons Foundation, he directed billions of dollars toward advancing research in mathematics, theoretical physics, and autism, making a lasting impact on science and education far beyond Wall Street.Interestingly, Simons did not enter the financial world until his 40s. Prior to founding Renaissance Technologies, he worked as a codebreaker for the U.S. Department of Defense and later led the mathematics department at Stony Brook University. His hedge fund became legendary for its secrecy and unparalleled returns, employing mostly scientists, mathematicians, and physicists instead of traditional finance professionals—an unconventional approach that helped preserve its unique competitive advantage.

Prominent achievements of James Harris Simons

James Harris Simons was awarded the Oswald Veblen Prize in Geometry, recognized for his contributions to Chern-Simons theory, founded Renaissance Technologies and led its Medallion Fund to achieve some of the highest returns in hedge fund history, named to Time's list of 100 most influential people in the world, his net worth surpassed $29 billion in 2024, through the Simons Foundation, he has donated over $3 billion to scientific research and education.What are James Harris Simons’s key insights?

James Harris Simons is known for his belief in the power of quantitative analysis and mathematics to solve complex problems, not only in finance but across various disciplines. He emphasizes the importance of scientific rigor, long-term vision, and collaboration. Simons has stated that intellectual curiosity drives success and that failure should be viewed as a learning opportunity. His approach blends patience with risk management, focusing on constant improvement through innovation and data-driven decisions.

James Harris Simons’s personal life

James Simons is married to Marilyn Simons, who is also a philanthropist and president of the Simons Foundation. They have three children. Their son Nat Simons is a hedge fund manager and environmental philanthropist, their daughter Audrey Simons is known for her low-profile lifestyle, and their son Paul Simons tragically passed away in a bicycle accident in 1996. The family is deeply involved in philanthropic efforts, especially through the Simons Foundation, focusing on science, education, and autism research.

Useful insights

Leading with purpose and integrity

To achieve long-lasting success, leading with integrity and purpose is crucial. Mary Barra, CEO of General Motors, demonstrates how strong leadership can propel you forward in your career or business.

-

Define your purpose and align it with your goals

Mary Barra emphasizes the importance of having a clear purpose. Identify your core values and ensure that your actions align with these values. This will give you the clarity and motivation needed to succeed, especially in challenging times.

-

Adapt to innovation and stay flexible

Barra's success is tied to her ability to guide GM through a transition toward electric vehicles. Always be open to innovation and stay flexible when markets or industries change. Adaptability is a key trait for anyone aiming to succeed.

-

Empower those around you

Successful leaders know how to empower their teams. By trusting and supporting the people around you, you create a culture of accountability and innovation. Help others succeed, and you’ll find that success naturally follows you as well.

Other profiles in category

Popular Financial Guides

Latest Financial News

South Africa invests R710 million to expand free Internet access

WTI crude oil price slips near $66 as trendline rejection and tariff risk dampen outlook