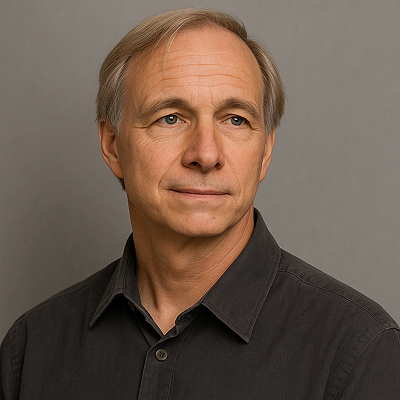

Ray Dalio Net Worth, Biography and Key Insights

Ray Dalio’s Profile Summary

|

Company

|

Bridgewater Associates |

|---|---|

|

Position

|

Hedge fund manager |

|

Source of wealth

|

Management and performance fees from Bridgewater's investment strategies. |

|

Also known as

|

Author of Principles: Life & Work, bloger, financial educator |

|

Age

|

75 |

|

Education

|

Long Island University, Post (BS)) Harvard University (MBA)) |

|

Citizenship

|

United States |

|

Residence

|

Greenwich, Connecticut |

|

Family

|

Wife: Barbara Daio, Children: 4 sons |

|

Website, Social Media

|

Ray Dalio’s biography

Ray Dalio is an American billionaire investor. He is the founder of Bridgewater Associates, the world’s largest hedge fund, which manages approximately $150 billion in assets for institutional clients, including pension funds, governments, and central banks. Dalio established Bridgewater in 1975 from a two-bedroom apartment in New York, and it grew to become a financial giant through innovative investment strategies and a unique company culture based on radical transparency.Over the years, Dalio’s firm has generated billions in profits for its clients and has consistently ranked among the top-performing hedge funds globally. Dalio is also a major philanthropist, having donated over $1 billion through the Dalio Foundation to causes like education, ocean exploration, and social reform. His bestselling book Principles has sold millions of copies worldwide, further extending his influence beyond finance into leadership and personal development.

Dalio’s profound understanding of economic cycles, particularly debt cycles, has made him a trusted voice in financial circles.

-

How did Ray Dalio make money?

Ray Dalio, one of the world’s most successful investors and hedge fund managers, is the founder of Bridgewater Associates, the largest hedge fund globally. His journey to building a financial empire began humbly. Born in 1949 in Queens, New York, Dalio developed an interest in investing as a teenager after buying shares of Northeast Airlines, which tripled in value. This early success sparked his passion for finance.

Dalio founded Bridgewater Associates in 1975 from a small apartment in New York City. The firm initially provided advisory services and corporate risk management before evolving into a hedge fund. Bridgewater’s primary success came from its unique investment philosophy, the "Principles of Radical Transparency and Truth," which Dalio outlined in his best-selling book Principles. This approach enabled the firm to thrive through market cycles, earning billions in profits for its clients, including sovereign wealth funds, pension funds, and central banks. Bridgewater’s flagship strategy, the “Pure Alpha Fund,” delivered consistent returns, further cementing its dominance in the investment world.

Dalio’s net worth, estimated at over $14 billion, largely stems from Bridgewater's success, though his investments in other ventures and philanthropic activities also contribute to his wealth. A key aspect of Dalio’s capital strategy has been reinvesting profits into innovation and expanding Bridgewater’s global influence, solidifying its reputation as a leader in macroeconomic trend analysis.

Dalio’s story is one of entrepreneurial grit and visionary leadership, demonstrating how a clear philosophy and disciplined execution can lead to extraordinary success in the highly competitive world of finance. -

What is Ray Dalio net worth?

As of 2025, Ray Dalio’s net worth is estimated to be $14B.

What is Ray Dalio also known as?

Ray Dalio is the author of Principles: Life & Work, a bestselling book that outlines his unique approach to life and work. The book has gained widespread recognition for its practical insights and comprehensive framework on decision-making and leadership.As a prominent blogger, Dalio regularly shares his views on global financial markets, economic trends, and the evolving geopolitical landscape. His blog is a go-to source for those seeking to understand the bigger picture in the world economy.

As a financial educator, Dalio is known for simplifying complex economic concepts. His famous video, How the Economic Machine Works, breaks down the principles of credit cycles and long-term debt cycles, helping millions understand the fundamental workings of the economy.

Prominent achievements of Ray Dalio

Time’s 100 Most Influential People in the World (2012) – Recognized for his influence on global financial markets and economic thought.Founded Bridgewater Associates, which became the largest hedge fund in the world, managing over $150 billion in assets.

Developed the "Pure Alpha" investment strategy, which has consistently delivered strong returns for over 30 years.

Authored the bestselling book Principles: Life & Work, widely recognized for its influence on leadership and decision-making.

Donated over $1 billion through the Dalio Foundation, supporting causes like education, healthcare, and ocean exploration.

What are Ray Dalio’s key insights?

Ray Dalio's business philosophy is centered around radical transparency and open-mindedness. He advocates for making decisions based on objective data and clear principles, which he outlines in his book Principles. Dalio believes that success comes from learning from mistakes and constantly improving, both individually and as part of a team.

One of Dalio's key insights is the importance of understanding economic cycles, especially long-term debt cycles, to anticipate market changes. He also emphasizes the value of diversification in investments and the need to be prepared for a wide range of economic scenarios. His approach blends both analytical rigor and a deep understanding of human nature, encouraging leaders to create environments where the best ideas rise to the top, regardless of hierarchy.

Ray Dalio’s personal life

Ray Dalio is married to Barbara Dalio, and together they have four sons: Devon, Paul, Matthew, and Mark Dalio. Sadly, their eldest son, Devon Dalio, passed away in 2020. The Dalio family is known for their philanthropic efforts, particularly through the Dalio Foundation, which focuses on education, ocean exploration, and social causes.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

EUR/USD price slips below $1.165 as U.S. tariffs and Fed outlook pressure euro

Ark Invest takes profits as Coinbase market cap tops $100 billion